Good morning.

This year, I’ve been writing about how the CFO role is continuing to evolve, and talking with executives who have shared their vast experience.

Yvonne McGill of Dell Technologies, Anat Ashkenazi of Eli Lilly and Company, and Leeny Oberg of Marriott International are CFOs at Fortune 500 companies leading the finance function across the globe. The leaders have built careers at their companies for more than 20 years.

The women represent different industries—tech, pharmaceutical, and travel and hospitality. However, in my separate conversations with each leader about their journey to the CFO chair, there was a continual theme—an integral part of being an effective finance chief is operational knowledge and strategy. Here’s what the CFOs shared on the topic, and some career advice as well.

Dell Technologies

McGill began at Dell Technologies in 1997. She started her tenure as CFO this past August. Corporate controller and CFO of the Infrastructure Solutions Group, CFO of Asia-Pacific, Japan and China business, and chief accounting officer were some of her previous leadership roles. Her first job at Dell was as finance manager.

As a CFO, you really need to understand the business, McGill said. “Am I a deep, technical engineer? No,” she quipped. “But I love understanding the technology and knowing how we are driving technology on the edge of the future. It gives me energy to understand the operations of the business. As a CFO, I help to allocate investment, and so understanding where I need to invest to drive automation or efficiency is important, as is creating great technology and great products and services for our customers. So how do you do both? We have to understand the whole portfolio.”

“I’ve had so many different opportunities at Dell over the past 26 years,” McGill said. A combination of finding the right mentors, listening a lot, taking feedback from people, and a variety of roles prepared her for the C-suite. However, she also had to step outside of her comfort zone.

Her career advice: There will be different times in your career where you’re given “opportunities, or you could call them risks, however you want to see it,” and you should take them because they will help you grow, McGill said. She is a founding member and current global sponsor of Women in Action, one of Dell’s employee resource groups.

Eli Lilly and Company

Ashkenazi, who joined Eli Lilly and Company in 2001, has been EVP and CFO of the company since 2021. She previously served as a CFO for several of the company’s global business areas.

“One piece of advice I give new hires or people starting their career is to keep a flexible mindset as it comes to your career because you’ll learn things about yourself as you progress,” Ashkenazi said. “And you’ll find that you may have an interest in different areas or places and then pursue that, but don’t change your mind every year over a 20-year period. Learn about yourself and kind of develop that self awareness.”

“If someone had asked me at age 15, I probably would not have said I want to be CFO,” Ashkenazi says. “At 35, maybe.” She started her career in financial services, and thought she’d run an investment firm one day.

“When I joined Lilly, I started on the business development side in venture investing, which is very kind of financially driven,” Ashkenazi explains. “But then I moved into strategy, and it opened my eyes to other areas, and I absolutely loved it. I love the breadth of looking at the entire business, the entire value chain from start to finish. I enjoyed being at the forefront of making really important decisions looking at very challenging and complex problems. And that’s where my career shifted a little bit and got on the CFO track.”

“CFOs need to clearly articulate the vision, how actions we take impact the business, employees, customers, and stakeholders, and guide the organization through change,” Ashkenazi explained. “Whether an organization is going through tremendous success and growth, or challenging times, the CFO should anchor the organization back to its core mission and values and chart the course forward.”

Marriott International

Oberg, the CFO of Marriott International since 2016, was also appointed executive vice president of development in February. Oberg first joined Marriott as part of its Investor Relations group in 1999. One of her previous roles was CFO of Marriott-owned Ritz-Carlton.

“The CFO role at Marriott has always been one that has been very much connected to the business overall,” Oberg said. “My predecessor was Carl Berquist, and his predecessor was Arne Sorenson, who was our former CFO and then CEO. I’ve been fortunate in that regard, as the CFO has always been considered kind of a broad financial partner, in addition to being absolutely responsible for the controls and processes and the financial reporting, particularly of a public company.”

“I knew that as soon as I got to the company, that it was going to be great to be working in a department that the CFO had that broad perspective on for helping with the strategy. When I first joined, we were working on trying to win and close the Starwood deal. And we had to integrate two very large companies, which was a fascinating set of choices and decisions to make to then try to grow faster on the other side of that.”

“I’m in my eighth year, but it feels like yesterday,” Oberg added. “It’s gone by in a flash and has just been incredibly interesting.”

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Keith Murphy was promoted to EVP and CFO at New Gold Inc. (NYSE American: NGD), effective January 2. Murphy will be succeeding Rob Chausse, who will be retiring at the end of 2023, as previously announced this year. Murphy has 15 years of experience in finance, primarily within the mining industry. He joined the company in 2013 and was promoted to VP of finance in April 2023.

Thomas Mayrhofer was named CFO and treasurer at DigitalBridge Group, Inc. (NYSE: DBRG), effective by the second quarter of 2024. He will succeed Jacky Wu, who will continue in his role through the company’s 2023 reporting cycle. Mayrhofer will join DigitalBridge on Jan. 8, and work with Wu and the DigitalBridge team during the first quarter of 2024. Mayrhofer spent almost 18 years at The Carlyle Group in a variety of financial roles across all of the firm's products. He concluded his tenure at Carlyle as a partner and CFO of the firm’s Private Equity business. Following Carlyle, he served as CFO and COO at alternative asset manager EJF Capital.

Big deal

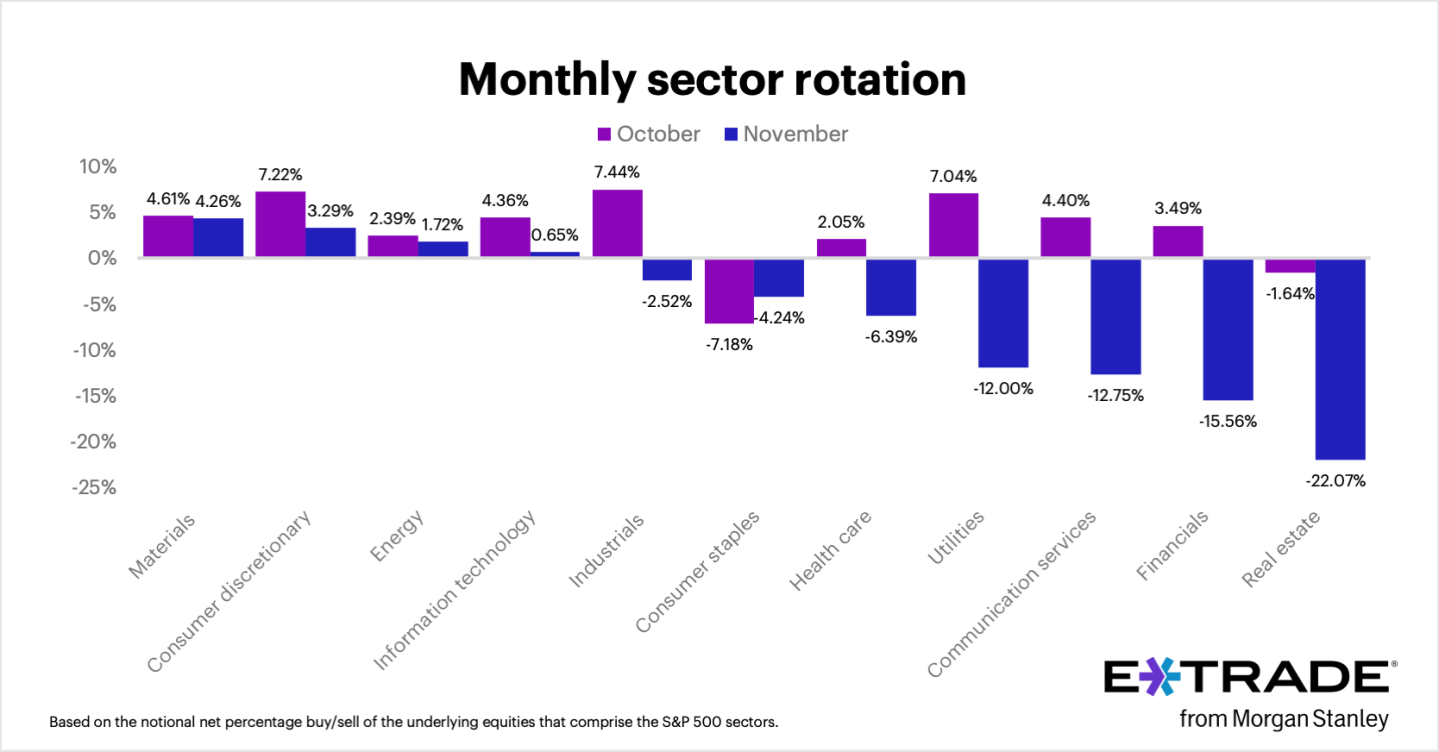

Morgan Stanley’s E-Trade released data from its monthly sector rotation study for November. The results are based on the trading platform’s customer notional net percentage buy/sell behavior for stocks that comprise the S&P 500 sectors.

"As stocks come off of their second-strongest November of the past four decades, traders were profit-taking with selling in seven of the 11 sectors," Chris Larkin, managing director of trading and investing at E-TRADE from Morgan Stanley, said in a statement. "Even the perennial favorite—tech—saw buying cool. Traders were heavy sellers in real estate and financials where the interest rate landscape could have a greater impact and in Communication services where many of Magnificent 7 hang their hats. Materials and consumer discretionary came out on top as we head into the holiday season—meaning increased buying and shipping."

Going deeper

In the latest episode of Wharton's Ripple Effect Podcast, Wharton finance professor Itay Goldstein evaluates the economy and discusses why current indicators make it difficult to predict the future. The episode is part of a series on “Holiday Retail.”

Overheard

"Our two airlines are powered by incredible employees, with 90-plus year legacies and values grounded in caring for the special places and people that we serve."

—Ben Minicucci, CEO, Alaska Airlines, said in a statement on Sunday regarding Alaska Air Group agreeing to to buy rival Hawaiian Airlines in a $1.9 billion deal.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.