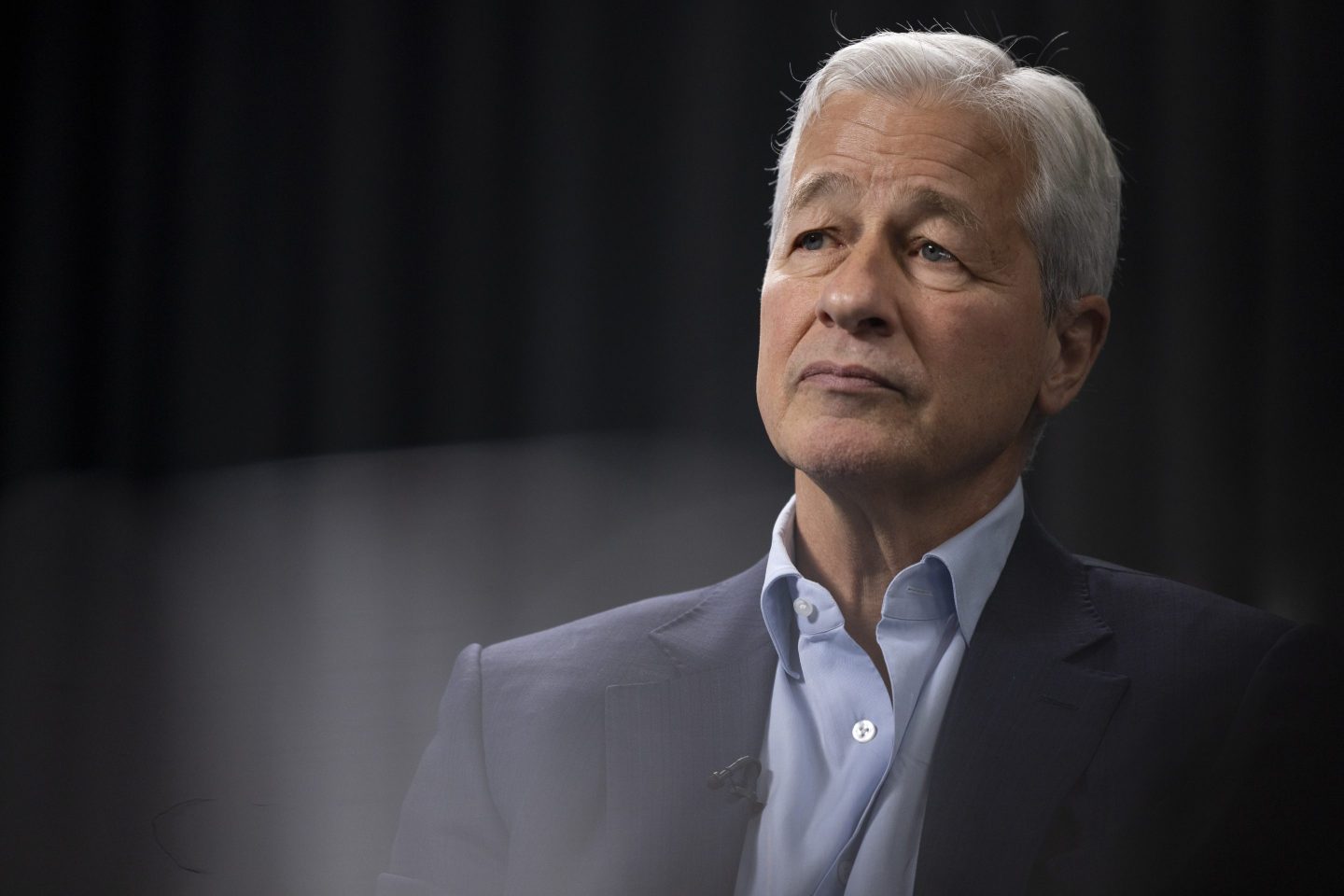

JPMorgan CEO Jamie Dimon lashed out at central banks for being “dead wrong” in their financial forecasts as he weighed in with his outlook for the economy on Tuesday.

During a panel discussion at the Future Investment Initiative summit in Saudi Arabia, the Wall Street veteran said there ought to be a sense of humility around financial forecasting over the next year—and encouraged people to hunker down for the possibility of more rate hikes.

“Central banks, 18 months ago, were 100% dead wrong,” he told an audience at the event in Saudi capital Riyadh. “I would be quite cautious about what might happen next year.”

Dimon noted that his wariness around near-term economic prospects was linked to fiscal spending, which was “more than it’s ever been in peacetime.” He likened the current environment to the 1970s, when the U.S. saw spiraling inflation and huge rate hikes.

However, the JPMorgan boss said he was skeptical about how much of an impact monetary policy could still have on the economy while governments were continuing to spend huge sums, a lot of which Dimon argued is “going to be wasted.”

“There’s this omnipotent feeling that central banks and governments can manage through all this stuff. I am cautious,” he said on Tuesday. “I don’t think it makes a piece of difference whether rates go up 25 basis points or more—zero, none, nada. Whether the whole curve goes up 100 basis points [or not]…I would urge people to be prepared for it. I don’t know if it’s going to happen.”

The U.S. Federal Reserve has been widely criticized by market watchers and economists for failing to use its toolkit to tackle inflation before it was too late, resulting in inflation surging way above the central bank’s 2% target and requiring hawkish policies to help bring costs back down.

Dimon himself has been a vocal critic of the Fed, saying last month that the U.S. Federal Reserve started “a day late and a dollar short” and is just “catching up” when it comes to taming inflation.

In a September interview with the Times of India, Dimon argued that Americans are on an economic “sugar high” because of all the fiscal and monetary stimulus injected into the economy since the pandemic.

He urged people to prepare for interest rates to hit 7%, noting that JPMorgan was “urging our clients to be prepared for that kind of stress.”