The Federal Reserve’s preferred inflation gauge edged higher last month, but the figure may be misleading.

The personal consumption expenditures (PCE) price index, which measures the prices U.S. consumers pay for everything from clothes to medical care, rose to 3.3% in July, from 3% in June, the Bureau of Economic Analysis reported Thursday. And core PCE inflation, which excludes more volatile food and energy prices, hit 4.2% last month, compared with 4.1% in June.

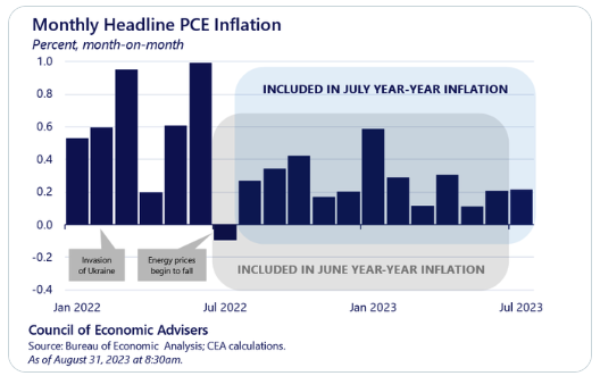

However, the increase was caused by the method of calculating these year-over-year inflation measures, not a rise in underlying price pressures during July. When taking year-over-year measurements, the corresponding “base” or period of comparison in the previous year can have a big impact on calculations. Last month, the year-over-year inflation data included the decline from record-high gasoline prices last summer, but this month’s data doesn’t.

“The key driver of the uptick in yr/yr was NOT faster monthly inflation. It was last July falling out of the calculation!” Jared Bernstein, chair of the White House Council of Economic Advisers, explained in a post Thursday on X, formerly Twitter.

On a month-over-month basis, both PCE and core PCE inflation actually rose just 0.2% in July, matching June’s pace. Combined, this was the smallest back-to-back increase in PCE inflation since 2020.

Still, when it comes to what’s next for the Fed and its inflation fighting campaign, the experts are split—as is often the case.

To raise or not to raise

The Fed’s aggressive interest rate hikes have weighed on the economy and markets since March 2022, leading to a raft of recession predictions from economists and Wall Street titans. But with inflation steadily falling throughout 2023, many investors now believe the Fed is near the end of its rate hiking cycle.

EY-Parthenon’s chief economist, Gregory Daco, argued Thursday that fading consumer demand for goods and services, owing to high interest rates and the resumption of student loan repayments after a pause during the pandemic, will help reduce inflation throughout the year.

Although inflation-adjusted consumer spending increased 0.6% in July after strong gains in June, Americans were forced to dip into their savings to continue spending. The savings rate decreased to 3.5% last month, its lowest since November.

Morning Consult senior economist Kayla Bruun warned Thursday, like Daco, that this means momentum in consumer spending “is likely to fade heading into the fall.” That’s particularly true of spending on nonessential items and services, from plane tickets to big-ticket items like TVs.

“Morning Consult’s data shows that much of the strength in spending recently has been for discretionary categories, which are easiest to trim from budgets when financial pressure picks up. Factors like higher credit card interest rates, slowing wage growth, and the resumption of student loan repayments could increasingly discourage these nonessential purchases, cooling the pace of top-line spending growth,” she said.

Weaker consumer spending, coupled with “softer” housing inflation and slowing wage growth, should lead the Fed’s favorite inflation gauge to sink throughout 2023, Daco argued. The economist expects headline PCE inflation of around 3% by year-end and core PCE inflation of between 3.6% and 3.7%—figures that should enable the Fed to stop raising interest rates.

“The latest evidence of slowing consumer spending, easing labor market tightness, cooling wage growth momentum, and slowing core inflation reinforce our expectation that the Fed’s tightening cycle is over, even if policymakers will keep the door open to further tightening,” he said, arguing a “soft landing” is now “more plausible.”

Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, said he also believes the Fed will likely keep interest rates unchanged at its next meeting in September.

“Not only is the Fed unlikely to raise rates at the next meeting, they are unlikely to raise rates again this year as long as inflation continues to remain contained,” Zaccarelli added, arguing that investors should “cheer” the latest PCE inflation reading.

Before 2000, the Fed relied on the consumer price index (CPI) to measure inflation, but it made the switch to the PCE price index for three main reasons. First, PCE inflation includes a more comprehensive range of goods and services. Second, PCE inflation can be revised after it is reported based on new information. And finally, the weights of the components of the PCE index, from housing to medical care, can change as consumers shift their spending habits, giving a clearer picture of true inflation.

Still, not every economist believes the Fed has tamed inflation. Citi economist Veronica Clark said in a Thursday note that the central bank’s progress in fighting inflation has been “a bit slower than presumed” in recent months. “Fed officials could still see one more rate hike as helpful insurance against upside inflation risks,” she warned.

And Quincy Krosby, chief global strategist at LPL Financial, said that she fears core inflation will remain “sticky.” Although there has been steady disinflation this year, Fed officials will likely require more evidence that stable prices have returned for the long term before ending their interest rate hiking campaign. “The Fed needs the numbers to edge lower before they can declare victory,” she said.

To her point, at the Fed’s annual economic symposium in Jackson Hole, Wyo., last week, Fed Chair Jerome Powell promised to “proceed carefully” with any further interest rate hikes, but reiterated his commitment to taming inflation.

“Two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” he said. “There is substantial further ground to cover.”