Artificial intelligence startups have clearly been all the rage in 2023. But as the summer nears its end, the A.I. hype may be starting to cool for investors in those earliest-stage companies.

A.I. seed companies have “been priced at an extreme premium with multiple term sheets in certain situations, minimal or limited diligence done, and a lot of expectations for what these companies will grow into moving forward,” Meera Clark, a principal at Redpoint Ventures, told me. “I would say over the past couple of months, we’ve seen…the bloom fall off the rose a little bit, in that we’ve begun to see large tech catch up, and at an accelerating pace.”

Clark argues that three or four months ago, VCs believed 75% to 80% of these upstart A.I. companies were investable; “I think that number has perhaps been cut in half as they think about the actual tech moat that these companies have,” she says.

For example, tech titan Adobe recently entered the buzzy image generation space with its launch of Firefly earlier this year. Clark points out that there’s been so much hype around image generation, but Adobe’s “engagement metrics have truly blown folks out of the water.”

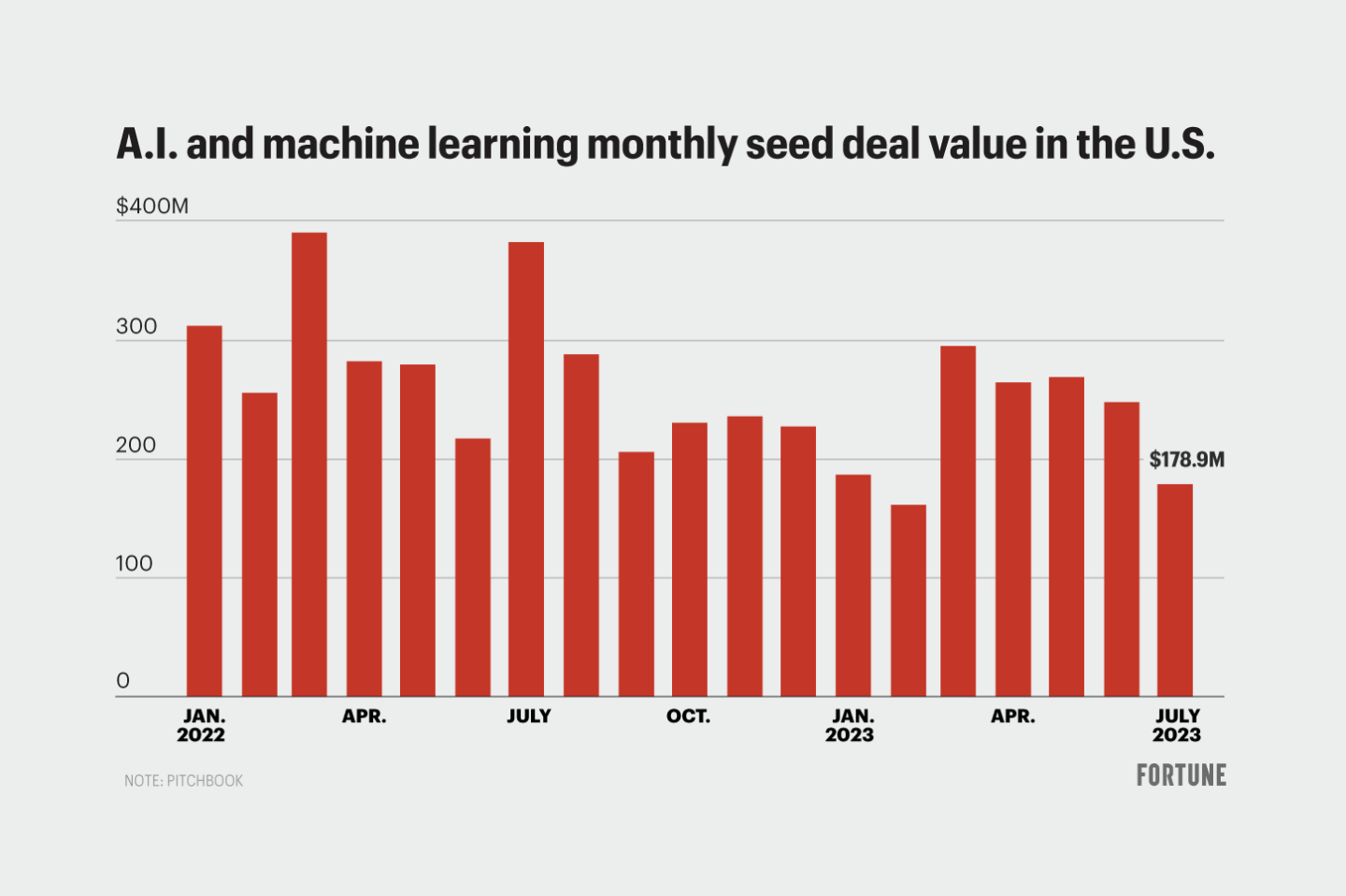

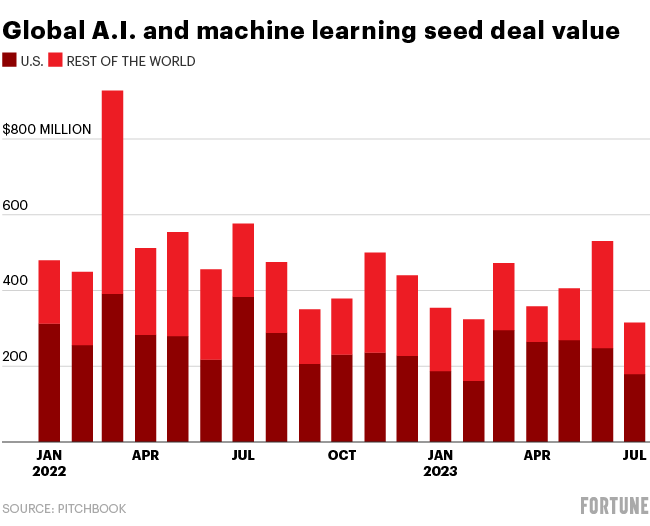

Per PitchBook data provided to Fortune, both deal count and value for U.S. and global A.I./ML seed-stage startups have begun to slump this summer. The value of A.I. seed deals in the U.S. is down from $295 million in March to roughly $179 million in July. (As a caveat, PitchBook senior venture capital analyst Kyle Stanford notes that since there will be some lag in the data, the recent July dip likely won’t look quite so severe in a few months’ time.)

“I think investors are growing a little bit fatigued with the seed investments they made two to six months ago that are almost going to zero overnight due to a single tech release, or what have you…because so many of them are OpenAI wrappers,” Clark believes, referring to companies whose businesses rely on A.I. models like GPT. She thinks we’re going to see continued excitement around A.I. startups, but more scrutiny over whether they have enough differentiation from established tech competitors. “I think it will be harder to fundraise looking into the next several months,” Clark added.

As we head into the fall, seed investors will likely be more judicious with fundings and valuations as Series A rounds are harder to come by. “At the beginning, it was, ‘Hey, as long as it’s A.I., you’re gonna get funding,’” Pegah Ebrahimi, cofounder and managing partner at FPV Ventures, told me. “Now, they might be more likely to get funding, but…people have seen examples of funding A.I. [startups] that have had a harder time getting the traction they need” for the next round.

It all centers around this big discussion of defensibility in A.I.—that is, what competitive advantage one A.I. company has over another when much of the technology is the same or open source. It’s something that I think will remain an outstanding question, and one that those fledgling startups—eager to raise funds with that prized A.I. angle—will need to have a rock solid answer for.

No product + no customers = $81 million? It’s something you’d expect more from an A.I. company than one in the icy-cold crypto space. But crypto startup Auradine announced it had raised $81 million in May—with no product or customers to speak of. My colleague Ben Weiss dug into how they did it, which you can read here.

See you tomorrow,

Anne Sraders

Twitter: @AnneSraders

Email: anne.sraders@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- Caelux, a Pasadena, Calif.-based solar energy company, raised $12 million in Series A3 funding. Temasek led the round and was joined by Reliance New Energy Limited, Khosla Ventures, Mitsui Fudosan, and Fine Structure Ventures.

- Grit, a New York-based technical debt elimination platform, raised $7 million in funding. Founders Fund and Abstract Ventures co-led the round and were joined by Quiet Capital, 8VC, A* Capital, AME Cloud Ventures, SV Angel, Operator Partners, CoFound Partners, and Uncorrelated Ventures.

- Configu, a Tel Aviv-based open source platform and cloud service for application configuration orchestration, raised $3 million in pre-seed funding led by Cardumen Capital.

PRIVATE EQUITY

- Align Capital Partners acquired a majority stake in Global Guardian, a McLean, Va.-based security, medical, and travel-related services provider. Financial terms were not disclosed.

- F&G Annuities & Life acquired a minority stake in Quility, a Swannanoa, N.C.-based life insurance company. Financial terms were not disclosed.

- Haveli Investments acquired a minority stake in Candivore, a Tel Aviv-based mobile gaming studio. Financial terms were not disclosed.

- Sequoia Financial Group agreed to acquire Affinia Financial Group, a Burlington, Mass.-based wealth manager. Financial terms were not disclosed.

OTHER

- Clari agreed to acquire Groove, a San Francisco-based sales engagement platform. Financial terms were not disclosed.

- MSCI agreed to acquire the remaining 66% of The Burgiss Group, a Hoboken, N.J.-based data, analytics, and technology solutions provider for investors in private assets, for $697 million.

PEOPLE

- IVP, a Menlo Park and San Francisco, Calif.-based venture capital firm, hired Alex Lim as general partner.

- Kainos Capital, a Dallas-based private equity firm, hired Catherine Anne Prideaux as a vice president.

- Nuveen, a New York-based asset management firm, hired Ted Maa as managing director, private equity impact investing. Formerly, he was with Pine Brook.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.