Good morning.

As the return-to-work debate continues, WeWork, an office-space leasing company, finds itself in a dire dilemma.

The company, founded by Adam Neumann, released its Q2 2023 earnings report on Tuesday, but management also issued a disturbing “going concern” warning to investors. “Our losses and negative cash flows from operating activities raise substantial doubt about our ability to continue as a going concern,” the company explained in a regulatory filing.

My colleague Will Daniel documents WeWork’s woes in his latest article. “WeWork stock has plummeted roughly 40% this week to just $0.13 per share on the news, leaving it down more than 98% since its $13-per-share peak in October 2021,” Daniel writes. “That’s roughly $9 billion of value washed away in less than two years. But zooming further out to the heady pre-pandemic days of 2019, when WeWork was highly touted on Wall Street, it’s an even steeper drop. Japan’s investment conglomerate SoftBank, which has plowed nearly $20 billion into WeWork to date, tagged the firm with a $47 billion valuation prior to its failed attempt at an initial public offering in 2019.”

And there’s been a steep fall. The company’s market cap is now around $270 million, Daniel explains. “And SoftBank revealed in an SEC filing this week that its cumulative loss on its investment in the company is sitting at $18.6 billion,” he writes. You can read his complete assessment of the state of WeWork, “a fallen giant,” here.

Neumann stepped down from his CEO role at WeWork in September 2019, and the company has experienced a lot of executive turnover since then. Sandeep Mathrani joined the company as chairman and CEO in February 2020 and stepped down from the position this past May. WeWork board member David Tolley was appointed as interim CEO. In May 2022, WeWork named Andre Fernandez as the firm’s third CFO in just over two years. However, Fernandez resigned from his position in June. Kurt Wehner, chief accounting officer, was then appointed CFO and treasurer.

At Fortune Brainstorm Tech in July, Neumann mentioned lessons he learned from WeWork’s crash and implied that his team wasn’t “brave” enough to tell him what they really thought.

“Surround yourself not only with the best people and the smartest people but also the ones that are going to tell you what they think,” he said. However, he said during the interview that he did have at least one person in his circle that would push back: investor Marc Andreessen. “Marc called me after an investor presentation and told me everything he disagreed with,” Neumann said.

Hindsight is 2020. But WeWork is still at a crossroads that could potentially lead to bankruptcy.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

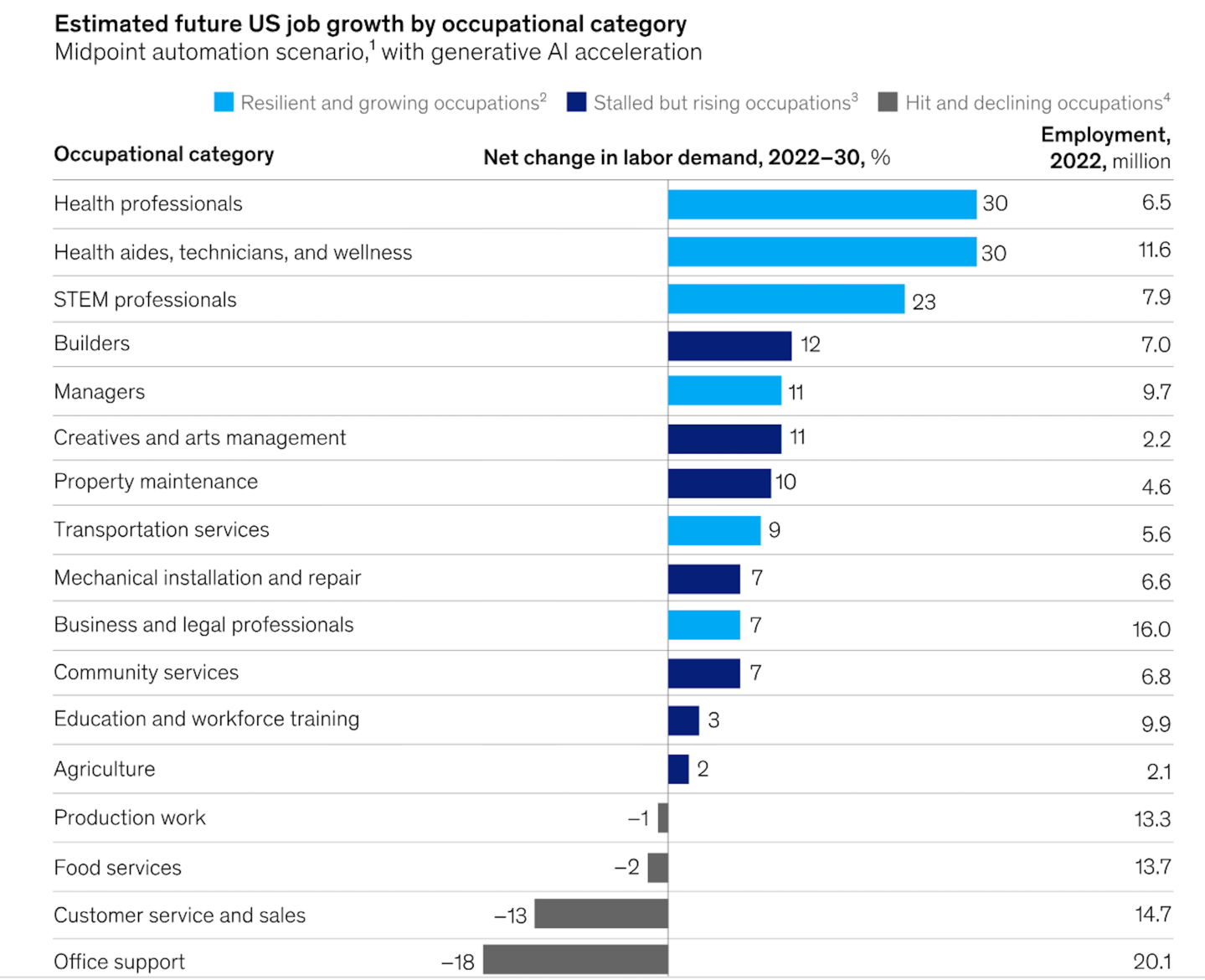

McKinsey Global Institute's recent report, "Generative AI and the future of work in America," explores which jobs will be in demand, will shrink, and which jobs will be hardest to fill. "We see generative A.I. enhancing the way STEM, creative, and business and legal professionals work rather than eliminating a significant number of jobs outright," according to the report. "Automation’s biggest effects are likely to hit other job categories. Office support, customer service, and food service employment could continue to decline."

In the U.S., health care is expected to have the largest future job gains. McKinsey estimates that there could be demand for 3.5 million more jobs for health technicians, wellness workers, and health aides, and an additional two million health care professionals. McKinsey also estimates that by 2030, there will be a 23% increase in the demand for STEM jobs, and the transportation services category is expected to see job growth of 9%. But the biggest future job losses are expected in office support, customer service, and food services.

Going deeper

"Midyear observations on the 2023 board agenda," a new report by KPMG, looks closely at topics including generative A.I. and outlines themes for boards to focus on, such as education and governance. The report also discusses the recent SEC cyber rule and the expected final ESG rule.

Leaderboard

Brian Scott was named EVP and CFO at Jack in the Box Inc. (Nasdaq: JACK) effective Aug. 14. Scott has more than 20 years of experience. Most recently, he served as CFO of ShiftKey. He also served as CFO of TheKey, a private pay provider of home care services. Before that, Scott served for over 10 years as CFO and chief accounting officer of AMN Healthcare. Scott began his career at KPMG LLP in the audit group specializing in technology and health care companies.

Brian DeCenzo was named president and CFO at Inxeption, a technology platform for industrial commerce. DeCenzo joins Inxeption from Goldman Sachs, where he spent close to two decades, primarily in the investment banking division. He held several executive positions during his tenure at Goldman Sachs, most recently as a managing director in the technology investment banking group, covering internet and software companies focused on business enablement. Additionally, DeCenzo served as chief of staff to the president and chief operating officer.

Overheard

"I'd like to say a few words about the ongoing strikes. Nothing is more important to this company than its relationships with the creative community, and that includes actors, writers, animators, directors, and producers. I have deep respect and appreciation for all those who are vital to the extraordinary creative engine that drives this company and our industry. And it is my fervent hope that we quickly find solutions to the issues that have kept us apart these past few months, and I am personally committed to working to achieve this result."

—Bob Iger, CEO of The Walt Disney Company, said on Wednesday during the company's earnings call for the period ending June 30. The Writers Guild of America’s strike against the major media companies began on May 2. SAG-AFTRA, the union that represents about 160,000 actors, went on strike July 14.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.