Fitch downgrading the U.S. credit rating for the second time in America’s history is “ridiculous,” but in the end it “doesn’t really matter,” according to JPMorgan CEO Jamie Dimon.

The agency lowered the U.S. government’s credit rating on Tuesday from the top AAA grade to AA+, citing an “erosion of governance” that it said had manifested as “repeated debt limit standoffs and last-minute resolutions.” It also argued the country’s financial standing was likely to deteriorate over the next three years thanks to tax cuts, increased government spending, economic shocks, and political division.

Back in May, Fitch warned that the U.S. was at risk of a downgrade due to policymakers allowing a solution on raising the country’s debt ceiling to go down to the wire.

The move made Fitch the second major ratings agency to strip the U.S. of its top-tier credit rating, after S&P Global Ratings made the same decision in 2011.

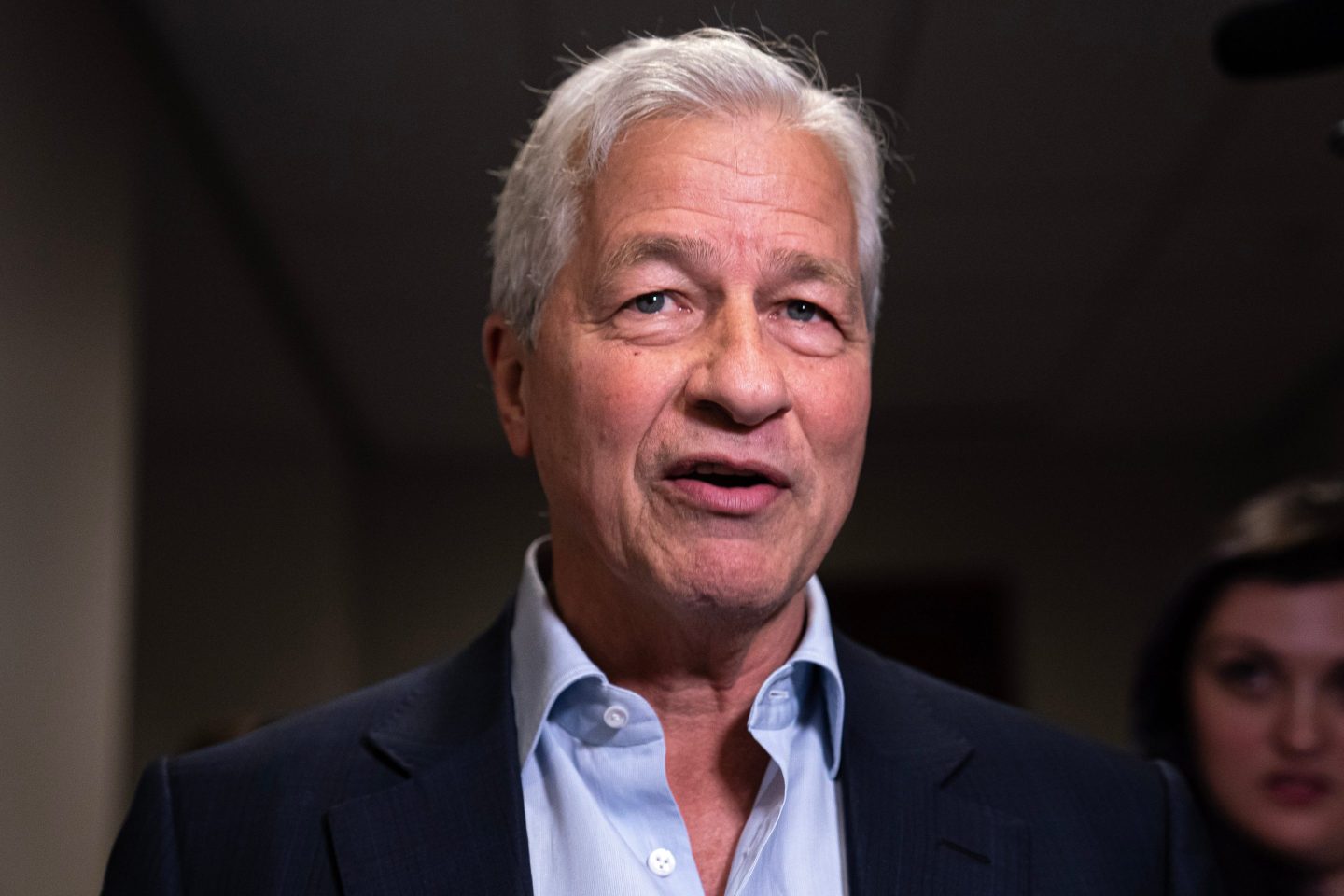

While Tuesday’s downgrade spooked investors, JPMorgan CEO Jamie Dimon appeared unfazed by the change, saying in a CNBC interview that “it doesn’t really matter that much” because it’s markets, not ratings agencies, that set borrowing costs.

Still, he did criticize Fitch’s decision, labeling it “ridiculous” considering several nations that rely on America and its military for stability have better credit ratings than the United States.

“To have them be triple-A and not America is kind of ridiculous,” he told the network. “It’s still the most prosperous nation on the planet, it’s the most secure nation on the planet.”

Countries that still have the highest credit rating at major agencies S&P Global, Fitch and Moody’s Investor Service include Germany, Denmark, Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore, and Australia.

Dimon also told CNBC on Wednesday that the U.S. should “get rid of the debt ceiling”—one of the sources of America’s credit rating troubles—as it was “used by both parties” in ways that created uncertainty and instability for financial markets.

The debt ceiling—the legal limit of the total amount of debt the federal government can borrow—was introduced in 1917. The government technically hit the debt ceiling at the beginning of 2023 for the 79th time since 1960, which resulted in it using “extraordinary measures” to pay its bills and coming incredibly close to defaulting on its debts.

Lawmakers reached a bipartisan deal on raising the debt ceiling just days before a June deadline which, if missed, could have dealt a $12 trillion blow to the U.S. economy.

Chorus of critics

Dimon, who has served as JPMorgan’s chief executive and president for almost two decades and is also the chairman of the banking giant’s board of directors, is not the only economic expert to have expressed bemusement over the Fitch downgrade.

Former Treasury Secretary Larry Summers slammed the downgrade as “bizarre and inept” in a post on X (formerly Twitter), noting that the economy currently looked “stronger than expected.”

“I can’t imagine any serious credit analyst is going to give this weight,” he later told Bloomberg.

The U.S. economy has demonstrated resilience in recent months, with economic data released last week showing that the U.S. economy grew faster than expected in the second quarter of the year, while U.S. inflation cooled for the 12th consecutive month in June, slowing to 3%.

Also weighing in on Fitch’s downgrade was Mohamed El-Erian, president of Queens’ College Cambridge and economic advisor to both Allianz and Gramercy, who said he found the move “surprising.”

“When you look at the reasoning you scratch your head as to the timing of this,” he told Yahoo Finance, explaining that Fitch had not given any evidence since May that should have changed its stance on America’s creditworthiness.

Meanwhile, sitting Treasury Secretary Janet Yellen lashed out at Fitch on Wednesday, calling its removal of America’s triple-A rating “flawed” and “entirely unwarranted.”

“Fitch’s decision is puzzling in light of the economic strength we see in the United States,” she said at an event in McLean, Virginia.

She insisted that the U.S. “remains the world’s largest, most dynamic, and most innovative economy, with the strongest financial system in the world.”