Throughout the course of the Pandemic Housing Boom, homebuyers were jumping at the opportunity to secure mortgages at ultra-low rates of 2% to 3%, creating a whirlwind of housing market transactions. But now a growing frustration is seeping into the industry as those once tantalizingly low rates have given way to a stark reality of higher rates and fewer transactions. The cause of this housing market shift? Enter the “lock-In effect,” a term that has real estate professionals sounding the alarm and grappling with the consequences of the abrupt change.

The idea of the “lock-in effect” is that homeowners are reluctant to sell their properties—and buy something new—due to the financial shock that would come with losing their historically low mortgage rates for something with a 6% or 7% handle.

Sean Dobson, founder and CEO of property powerhouse Amherst, might have summed up the frustration best when he recently tweeted: “Financing these at 3% [mortgage rates] then jumping rates to 6% [rates] is the same as burning them [the homes] down from a supply perspective.”

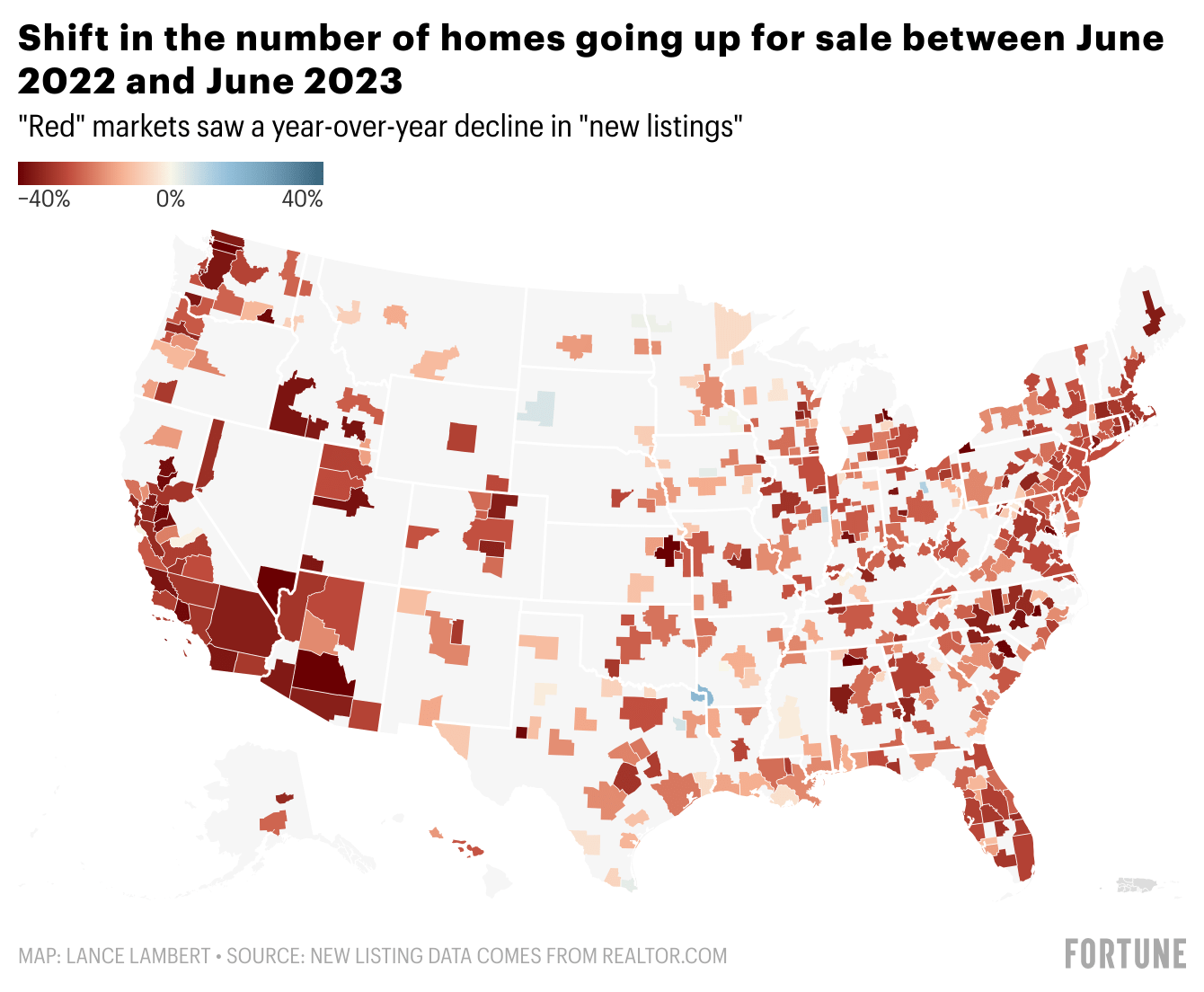

Dobson, who runs one of the largest owners of U.S. single-family homes, was responding to a map produced by Fortune (see below) showing the huge decline in the number of homes for sale across the country.

This so-called “lock-in effect” is happening just about everywhere. Resilient East Coast markets like Richmond, Va., and Philadelphia saw new listings decline 27% and 26%, respectively, on a year-over-year basis. Even Austin, a market still passing through home price correction, saw a 31% year-over-year decline in new listings on realtor.com between June 2022 and June 2023.

According to Realtor.com, there were 26% fewer U.S. homes listed for sale in June 2023 than in June 2022, and 28.9% fewer than in June 2019.

To better understand the lock-in effect, just consider the fact that 91% of mortgage borrowers have an interest rate below 5%, including 70.7% with an interest rate below 4%. For those homeowners, it simply doesn't make a lot of sense to sell and purchase a property right now at a 6% or 7% mortgage rate.

The limited amount of inventory coming onto the market has fueled competition among buyers and caused home prices to rise in the first half of the year—the seasonally strong part of the year—in most markets. Northeast and Midwest markets, in particular, saw stronger than expected home price gains this spring.

However, there are some exceptions.

Just take a glance at Austin's housing market, and you'll see something unusual happening. Despite a sharp 31% decrease in new listings (i.e., homes coming up for a sale in a given month), Austin home prices are still down 13% from the peak, according to Black Knight. The reason behind this intriguing phenomenon lies in the significant increase of overall supply sitting on the market (i.e. active listings) by 47% year over year, even as new listings declined. Austin's housing prices skyrocketed by around 60% in the first two years of the pandemic, resulting in a considerable affordability shock once mortgage rates spiked, causing homes to linger longer on the market. Rather than witnessing a rush of sellers, Austin is experiencing a pileup effect, which is pushing home prices lower there even as most markets inch higher again.

Want to stay updated on the housing market? Follow me on Twitter at @NewsLambert.