Good morning.

Generative A.I. aside, not all CFOs have cracked the code on digitization, Kristof Stouthuysen tells me.

Thirteen years ago, Stouthuysen received his Ph.D. in managerial accounting, and he has continued his research on the finance field and CFOs. As an academic researcher and consultant, he’s studied hundreds of finance chiefs and senior finance leaders from more than 20 industries at global companies with revenues ranging from $250 million to more than $20 billion.

He’s currently a professor of management accounting and digital finance at Vlerick Business School and KU Leuven and director of the Centre for Financial Leadership and Digital Transformation at Vlerick.

In his latest report in the MIT Sloan Management Review, Stouthuysen shares findings from his research for the past six years on digital transformation in the finance function. In the report, he points to seven key capabilities CFOs must develop to become digital leaders: use advanced analytics to meet strategic needs; unpack and explain machine learning outputs; collaborate on data management across functions; embed analytics skills; explore and experiment; manage cultural change; and include everyone on the team in digital efforts.

And Stouthuysen shared with me three top reasons why some CFOs are slow to take full advantage of new technology:

1) How they define themselves. “Many CFOs still act as if their main task is just reporting numbers,” Stouthuysen says. “The traditional bookkeeping type of CFO spends too much time on transactional processes.” Then it becomes a perception issue.

“On the one hand, you have a CFO who doesn’t take the initiative to start investing in digital solutions,” he explains. “And on the other hand, they’re also not perceived by their colleagues as being real business partners.” The digital finance leaders Stouthuysen has spoken with consider technology and advanced analytics to be strategic priorities for protecting company assets and achieving measurably better business outcomes. “If the CFO doesn’t step up, it will be difficult to build a case for the digital transformation of the finance office,” he says.

2) Not understanding the technology. “If you look at one of the major technologies behind advanced analytics—machine learning—it is still an unknown technique for many finance leaders,” Stouthuysen says. “They still do not grasp the basics behind it, what the technology is capable of, and how to get started with it.”

He provides the following example in the report: “The CFO of a global car manufacturer found that explainability and interpretability were among the main challenges of using A.I. and machine learning to detect financial and credit risks. In such a context, it’s critical to understand how a model is making predictions in order to confirm that it’s not employing proxies for any demographic characteristics that would be illegal or unethical to consider when weighing a credit application.”

3) Lack of advanced analytics skills in the finance organization. “Yes, you need a strong CFO that has a vision, that knows the technology,” Stouthuysen says. “But a strong CFO also needs to have strong talent for execution.” Digitally mature finance offices have upskilling programs to provide additional training, he says.

An example from the report: “To develop a team with a stronger orientation toward analytics, the CFO of an international hotel group stopped hiring candidates with traditional finance or accounting backgrounds and instead recruited data scientists, mathematicians, and data engineers. She provided these new hires with on-the-job training in the fundamentals of budgeting, financial analysis, compliance, risk management, and other accounting principles. Senior practitioners were required to spend at least one day a week helping to develop the accounting and finance skills of the new staff members.”

Final thoughts? “A successful CFO realizes that the technology evolutions that we’re currently facing might bring lots of advantages to the finance office,” Stouthuysen says. “That CFO is very much open for change.” He also says a CFO shouldn’t just jump into any new technology solution, “but should have a real strategy on the way forward.”

Sheryl Estrada

sheryl.estrada@fortune.com

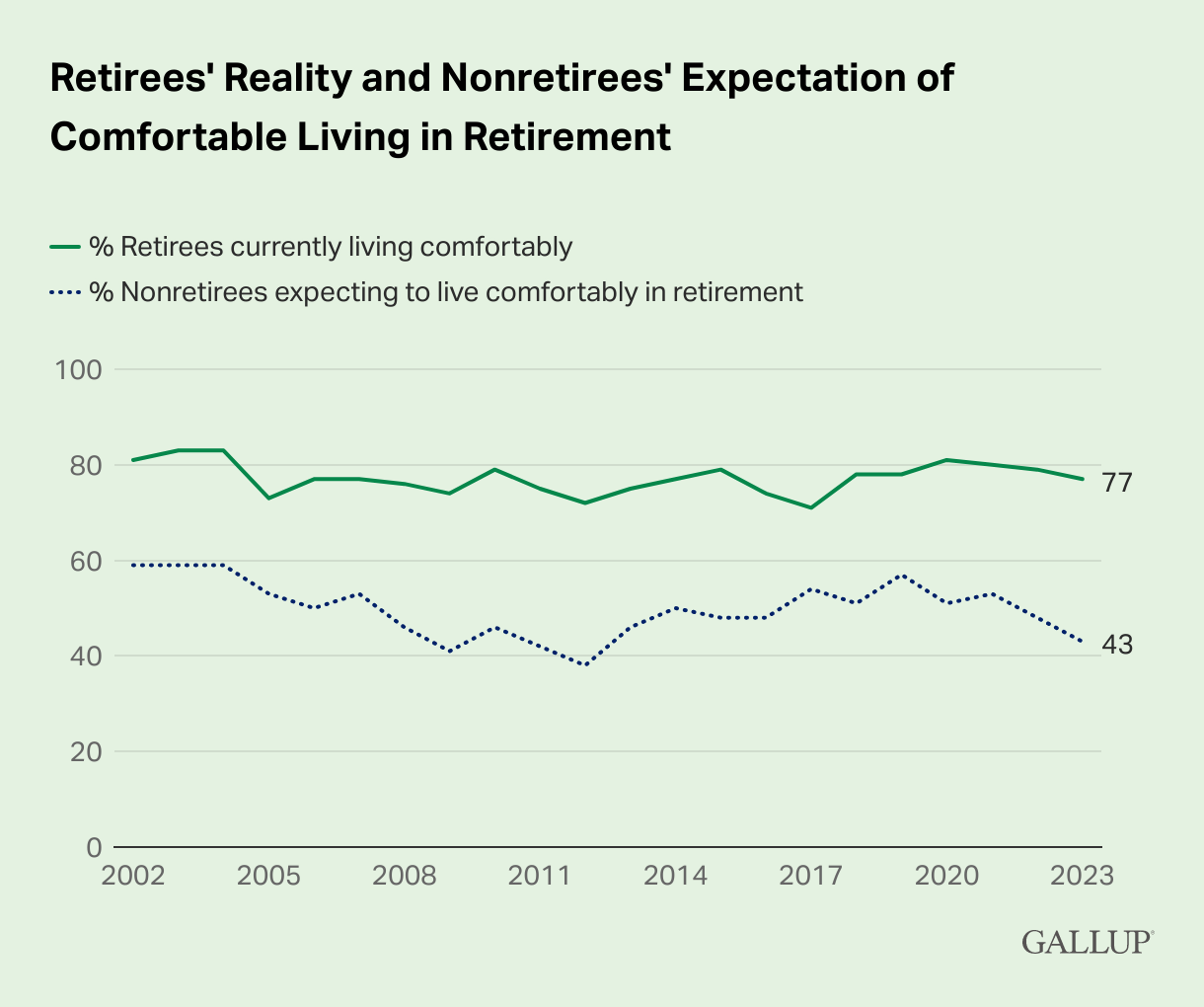

Big deal

The latest findings from Gallup show that Americans are worried about having enough money for retirement. Non-retired Americans are the most pessimistic about having a comfortable retirement since 2012, falling 10 percentage points since 2021, including five points in the past year. However, retirees in the U.S. broadly continue to report that they have enough money to live comfortably, according to Gallup's research. Forty-three percent of non-retirees think they will have enough money to live comfortably, while 77% of retirees say they currently do—unchanged from last year's data. "While retirees’ reports of living comfortably have always been quite high (ranging from 71% to 83%), nonretirees’ outlook has been consistently lower and subject to swings based on the national economic climate," according to the report. The findings are based on an April 3-25 Gallup poll.

Going deeper

"Global Equity Markets: The Near-Term and Mid-Term Outlook Amid Inflation, Rising Rates, Global Conflict and Pandemic Recovery," is a new report by EquitiesFirst, a global equities-based financing firm, in partnership with business-to-business publisher Institutional Investor. The report examines how the global investment community is responding to sweeping shifts in the macroeconomic and geopolitical environment amid heightened uncertainty for equity markets.

Leaderboard

Gerald Laderman, EVP and CFO of United Airlines Holdings, Inc., the parent company of United Airlines, Inc., announced his plans to retire in 2024, after more than three decades of service with the company, according to a Securities and Exchange Commission filing. An external search will be launched to identify the next CFO. Laderman will serve as CFO until the effective date of the company’s appointment of his successor and then will serve as EVP of finance until his expected retirement in September 2024.

James Turner, CFO of China-based Prudential PLC, resigned following an investigation into a "code of conduct issue" relating to a recent recruitment, according to a Hong Kong stock exchange filing. Turner, based in Hong Kong, was named CFO in March 2022. He previously served as the Asia-focused insurer's group chief risk and compliance officer.

Overheard

"This agreement is good news for the American people and the American economy. I urge the Senate to pass it as quickly as possible so I can sign it into law."

—U.S. President Joe Biden said in a statement after the House of Representatives voted yesterday to suspend the debt ceiling for two years, through the next presidential election. The bill also places a cap on some government spending. The bill is now headed to the Senate ahead of Monday’s deadline. In the House's final vote, 149 Republicans and 165 Democrats backed the bill, while 71 Republicans and 46 Democrats opposed it, the New York Times reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.