If you ask a Wall Street analyst about the Federal Reserve’s power to move markets these days you’d better have a soapbox ready. Don’t fight the Fed, they’ll say; the central bank’s ability to stoke or slow the economy through interest rate changes and new policies like quantitative easing and tightening is epic and unprecedented. Even a single line at a press conference from Chair Jerome Powell can impact share prices. That means investors have to be fluent in “Fed speak,” the “turgid dialect” that central bank officials use to describe their views—or risk being caught off guard. Simply put, a Fed speaker can get ahead of the big thing set to move markets.

But it wasn’t always this way. Since its inception, the Fed has been a driving force in the economy that Wall Street has watched closely, but officials’ tone and word choice in public comments wasn’t always so important. JPMorgan Chase economist Joseph Lupton explained in a Wednesday research note that as recently as the 1990s, “silence and obfuscation” by design was the norm.

Fed Chair Alan Greenspan, who served between 1987 and 2006, was known for confusing statements that the press often referred to as “gnomic.” In a 1987 Senate committee meeting he drew laughs from Congress after saying: “If I seem unduly clear to you, you must have misunderstood what I said.” But his goal, according to Lupton, was simply to maintain “maximum flexibility in conducting monetary policy.” Essentially, if he had to, he wanted to shock markets with his actions, not his words.

But in the wake of the Global Financial Crisis of 2008, during Ben Bernanke’s tenure as chair, the Fed took a new approach in order to explain the tools it had created to manage a recession that eventually attained the adjective of “great.” This was an intentional decision by Janet Yellen, a Fed official at the time who would go on to become chair herself, before becoming Joe Biden’s Treasury secretary. Since then, “policymakers have increasingly used statements and speeches to clarify their intentions,” Lupton wrote Wednesday, adding that “in this regard, communications are now almost as important as the policy actions themselves.”

That’s why it’s so important for investment banks to understand exactly what the Fed is trying to say—and they’ve been working to create A.I. tools that can streamline that process for years. But until recently, the models weren’t sophisticated enough to “generate actionable results,” according to Lupton. “Simply put, the technology was not yet ready for primetime.”

Of course, that’s changed over the past year. The development of the latest large language models (LLMs) that can rapidly analyze vast amounts of data means A.I. tech is “ready for successful application” in the world of finance, according to Lupton, who unveiled JPMorgan’s “Hawk-Dove Score” that uses A.I. to assess central bank communications and help determine what the Fed might do next this week. (On Wall Street, Fed officials who support rate hikes are labeled “hawks,” while those that favor low rates are called “doves.”)

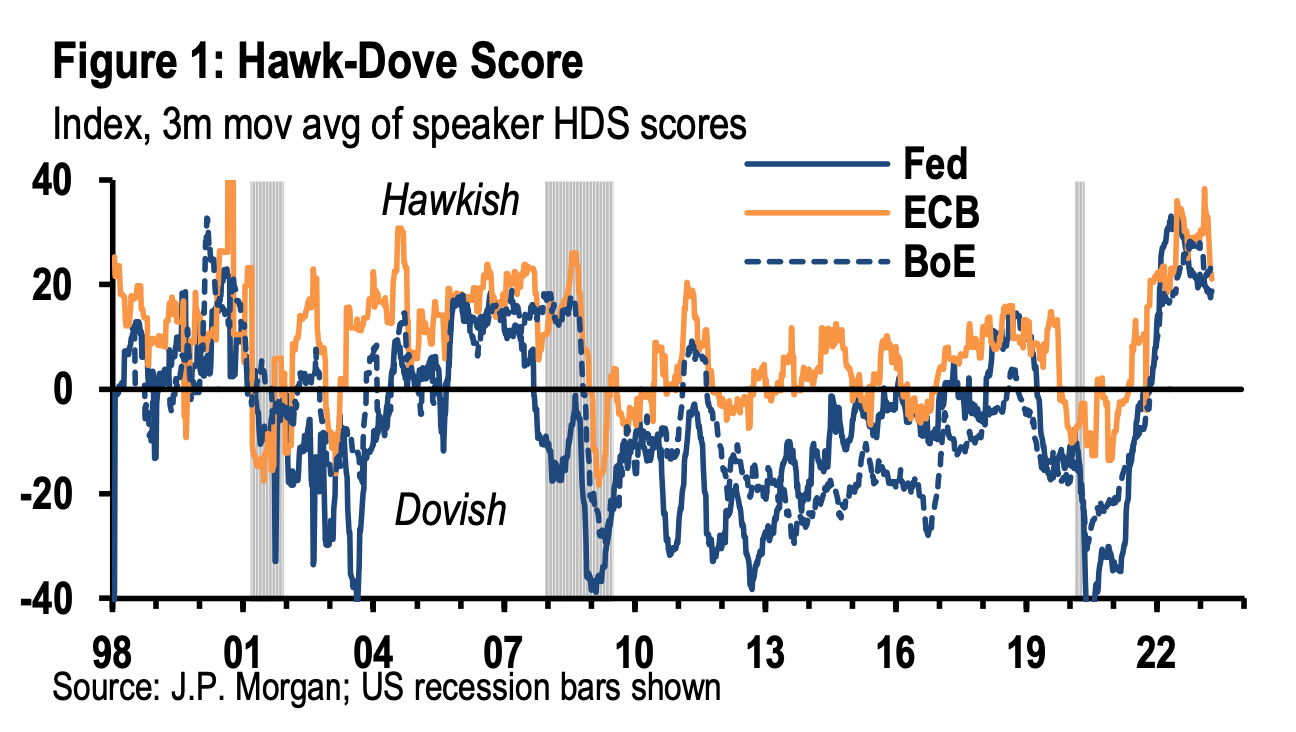

JPMorgan uses a LLM that is trained on central bank speeches and statements going back to 1998 to create a score for the current hawkishness or dovishness of the central bank. The higher the score, the more hawkish. It says it’s “a large language model tuned to central bank speak.” The Fed’s current Hawk-Dove Score, 20, signals more rate hikes are likely on the way.

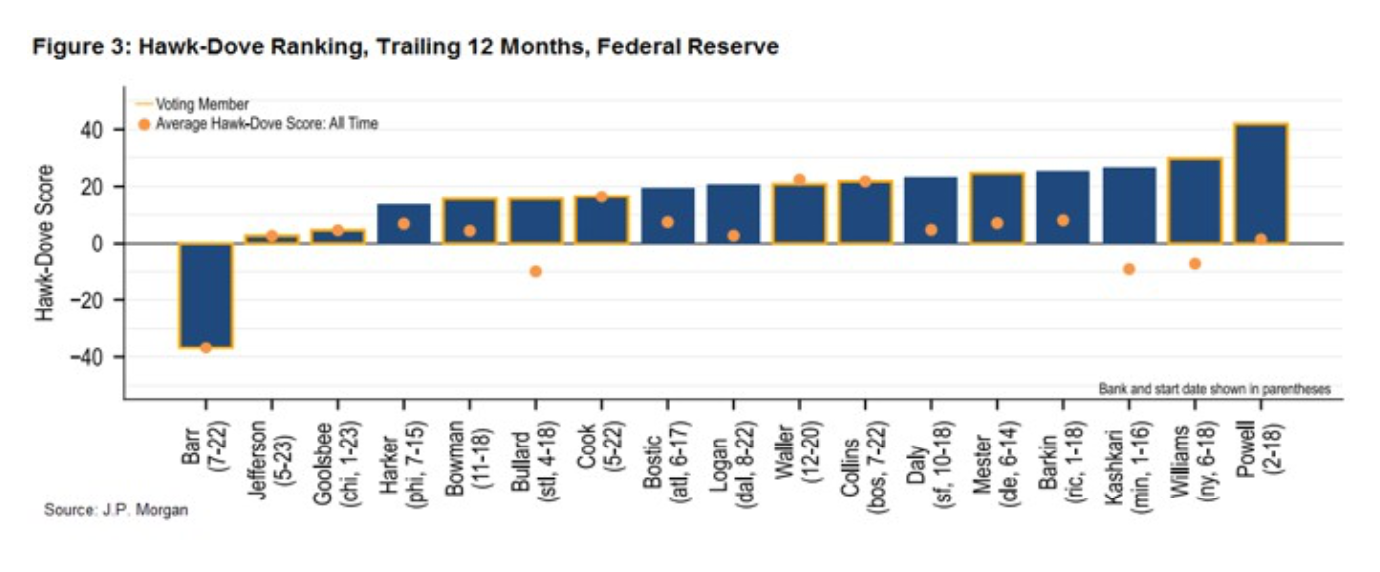

JPMorgan also released the first edition of something they call the Hawk-Dove Ranking Wednesday, a measure of the relative hawkishness or dovishness of 17 members of the Federal Reserve Board. Every official except Michael Barr, the vice chair for supervision, was given a hawkish score by the model. (Barr also oversaw the report on the implosion of Silicon Valley Bank, released on Friday, in which he criticized not only SVB management but also the Fed itself.) Powell took the top spot as the most hawkish member of the Fed, with a score of 41.

After OpenAI’s Microsoft-backed ChatGPT spawned an A.I. boom in markets this year, there have been questions as to how the LLM technology could be used in finance and whether or not OpenAI will have competition. JPMorgan’s latest report may have provided some answers to that question, or at least hints.

Lupton and his team utilized an A.I. model called BERT, or Bidirectional Encoder Representations from Transformers, which was released in 2019 for their Hawk-Dove Score. And while the headline of their report says JPMorgan is preparing its model for the latest “ChatGPT environment,” buried in the findings is something a little more concrete: “The BERT-based model we unveil in this report is already being upgraded to a ChatGPT-based model.”