Climate technologies, which combat climate change through reduced emissions, are critical to company-level decarbonization and reaching global net zero. They also hold enormous potential as new sources of economic opportunity. Low-carbon hydrogen alone is estimated to cut emissions by as much as three to five gigatons per year by 2050 (about 8% of global greenhouse gas emissions), creating a $3 trillion to $4 trillion global market.

With recent legislative changes, the rules of the game have just changed, further unlocking this massive market opportunity. New U.S. legislation in particular is driving major capacity increases and cost reductions with important business implications. The Inflation Reduction Act (IRA), the Infrastructure Investment and Jobs Act (IIJA), and the CHIPS and Science Act are decreasing the cost premium of these technologies through incentives. Global responses to the IRA are under consideration in major jurisdictions such as the European Union (EU).

In the example of the IRA, the levelized cost of solar reduced by 41% from $40 to $24 per megawatt-hour (MWh). Its boost to onshore wind is even more dramatic, slashing the unit cost by 57% from $35 to $15 per MWh, making subsidized renewable energy even more cost-competitive than the fossil fuel alternative.

This fast-changing context is spurring business leaders to reassess opportunities over two time horizons:

- Immediate–term value capture to lower the cost of doing business (e.g., reducing energy costs) while enabling decarbonization

- Mid-term growth opportunities from expanding into new markets or entering new partnerships as a result of new incentives proliferation

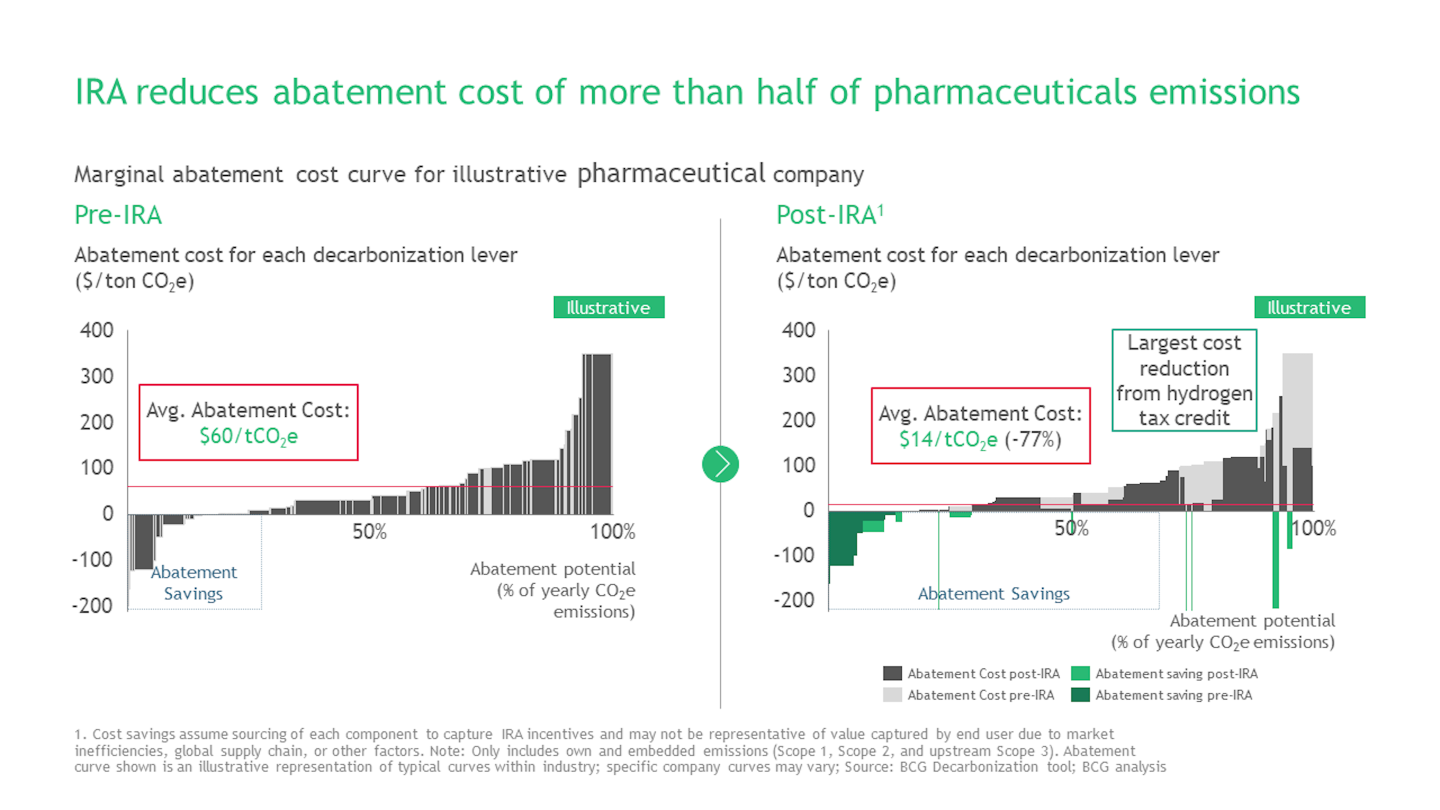

In the immediate term, new policies have fundamentally changed the economics of many critical decarbonization technologies. Companies should start by reassessing their marginal abatement cost curves (MACCs) to surface decarbonization levers made newly attractive by net cost savings. Taking the pharmaceutical industry as an example, the IRA makes 56% of emissions cost saving to abate.

These regulations offer manufacturing incentives to promote domestic production, which can yield additional opportunities for corporates. With CHIPS now directing up to $62 billion to manufacturing and technology hubs through 2026, it may now make sense to locate near-term investment in these favorable geographies. The IRA provides additional domestic manufacturing incentives. First movers are already acting to capture this value. For example, First Solar announced that it will expand its solar manufacturing capacity through a $1 billion investment in new facilities in the U.S. Southeast.

Identify new low-carbon value pools and realize opportunities for mid-term growth

BCG analysis estimates an over $300 trillion market opportunity across a range of core climate technologies through 2050 for climate tech players and their value chain participants. And Canada’s current exploration of a clean hydrogen production tax credit could open up additional market prospects for key players.

Several companies are already shifting or accelerating existing production plans for low-carbon hydrogen to capture mid-term growth opportunities from the legislative changes. For example, Bosch, a German-based manufacturer of powertrain and propulsion technologies, has announced an over $200 million investment in fuel cell stack production in its U.S. facility. In another example, Fusion Fuel and Electus Energy entered an exclusive agreement to develop a 75-megawatt solar-to-hydrogen facility in California; that is enough hydrogen to fuel over 1,000 Class 8 trucks or buses per day.

BCG analysis finds an increase of approximately 15% pp compound annual growth rate (CAGR) on sales growth for “green” products. To take advantage of this opportunity, companies should expand product development and shorten timelines to market for sustainable and low-carbon offerings. For example, the U.S. demand for electric vehicles is already such that the time between new models being available and sold-out is often just a matter of minutes. Similarly, economic policies and business economics will turbocharge electric truck adoption in major markets like the U.S., Europe, and China. A traditional truck manufacturer can enter the electric truck market and expand into services associated with EV charging infrastructure. New product development and expediting speed to delivery can create a lasting first-mover advantage in these new markets.

Critical building blocks to enable success across opportunities

With so many new opportunities surfaced by the legislative changes, what are potential deterrents to progress? Accelerated timelines and growth of climate technologies will put pressure on supply chains, required infrastructure, and resources. In the U.S., raw materials like critical minerals and underlying infrastructure both fall short of IRA requirements. For example, there is predicted to be a gap of over 500,000 public EV charging sites in the U.S. by 2025, leaving the private sector and state governments to fill the gap. Organizations should approach this challenge from several angles. Examples:

- Investing in upstream capabilities and infrastructure, which may previously have been unattractive, can create value and decrease bottlenecks. Organizations must move faster than their peers to secure scarce supplies. For example, Toyota has allocated an additional $2.5 billion to its investment in a North Carolina battery plant.

- Advocating to expedite permitting timelines. In the U.S., permitting times for heavy industrial and power generation projects have doubled since 1970s. Today, almost 50% of clean energy projects are stuck in at this stage of the process. Engaging internal government affairs resources can be a step in the right direction.

- Engaging suppliers earlier on with advanced market commitments, coalitions, and other arrangements can mitigate supply-chain risk. Engagement can include direct investment in critical capabilities to enable future supply, like coinvesting in a new production facility or partnering for long-term procurement. For instance, Tesla secured a long-term supply contract for sustainable nickel with BHP, a multinational mining firm.

- Supporting critical talent development and upskilling. Displaced fossil fuel operations jobs and the surge in demand for clean technology construction create an imperative to develop and source newly needed skills like wind turbine maintenance. Over half of new clean energy jobs in the U.S. will require some form of postsecondary education. Collaborating with suppliers or customers on talent upskilling, reskilling, and knowledge sharing can also be a powerful way to engage and build partnerships across the value chain.

Recent regulatory and macroeconomic shifts are making critical climate technologies vastly more attractive. Corporations should act now to leverage immediate and longer-term opportunities across their operations and supply chains to capture value, meet climate targets, and advance global net zero.

Jim Larson is a BCG managing director and senior partner, and the North America Social Impact practice leader. Thomas Baker, Ph.D., is a managing director and partner, and BCG’s global lead for the Low Carbon Energy and Infrastructure Sector. Bahar Carroll is a project leader in BCG’s Climate and Sustainability practice area.

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.