Despite high inflation, rising interest rates, and consistent recession predictions from Wall Street, Americans have continued spending at near a record pace over the past year, opting to splurge on Disney vacations and DoorDash deliveries.

Rising wages and a “cash buffer” of savings that was built up during the pandemic—when spending slowed and benefits like stimulus checks and enhanced unemployment boosted incomes—have provided consumers with “unprecedented spending power,” according to Liz Young, head of investment strategy at SoFi, an online bank. But data shows many Americans have begun financing their new spending habits with credit cards and draining their savings in recent months, as the cost of living soars. Some experts fear that means a spending slowdown—or even a recession—could be on the horizon.

“My intuition and common sense says there’s not a bottomless pit of savings to support this level of spending, and there’s not a bottomless pit of wage growth to keep it elevated enough to drive GDP indefinitely,” Young wrote in a Thursday article. “Time will tell, but I still believe something’s gotta give.”

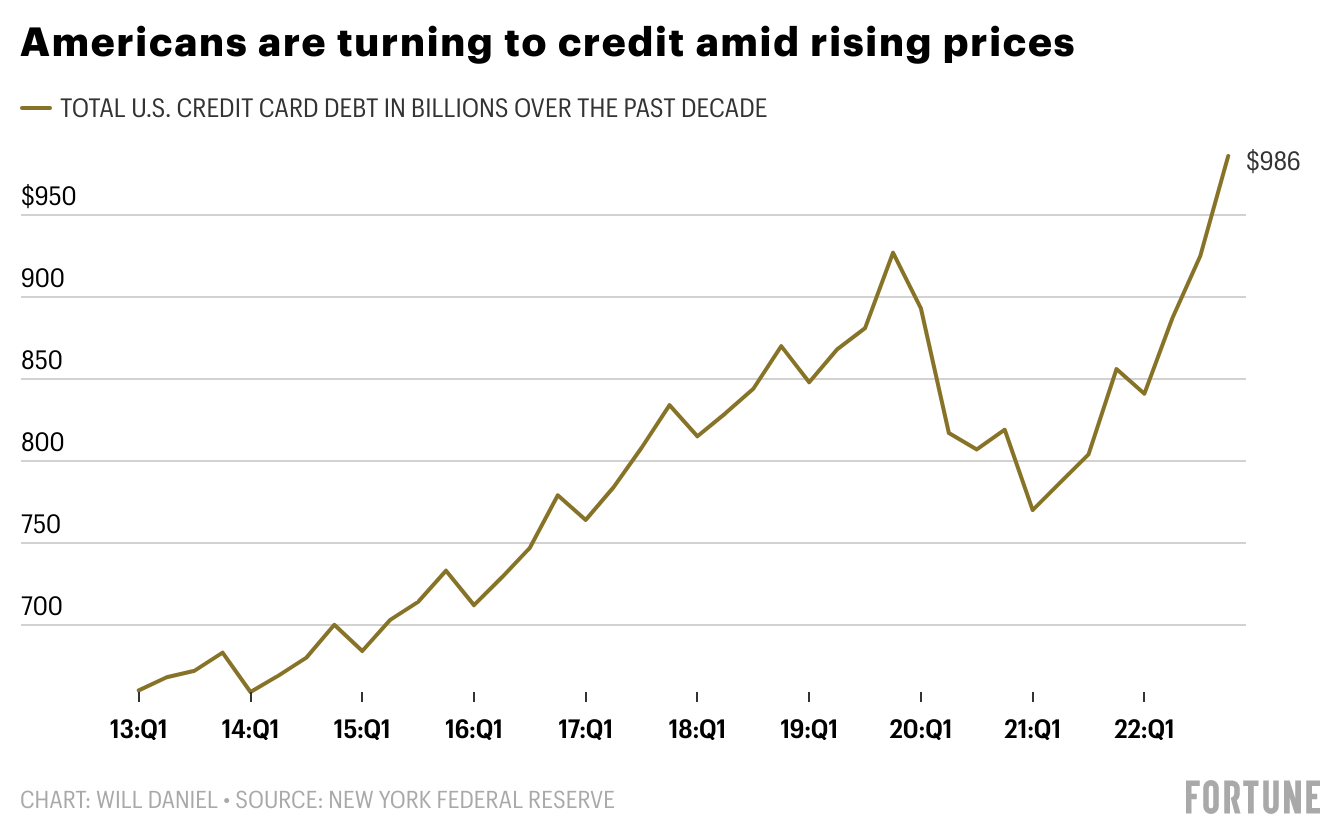

U.S. consumers’ credit card balances jumped 7% in the fourth quarter of 2022 to a new record high of $986 billion, a New York Federal Reserve report showed this week. And Morgan Stanley estimates that last year alone consumers spent roughly 30% of the $2.7 trillion in excess savings they built up during the pandemic, with lower-income consumers tapping closer to 50%.

“At the pace of spending we anticipate, savings are on track to dwindle rapidly,” the investment bank’s economists wrote in a Jan. 24 note, arguing consumers will spend another $500 billion of their pandemic savings in 2023.

Americans’ ailing savings accounts and increasing reliance on credit cards is likely to cause consumer spending—which represents 70% of U.S. GDP—to slow this year. And with leading economic indicators like manufacturing orders and credit conditions deteriorating as well, some economists like Ataman Ozyildirim, senior director of economics at The Conference Board, a non-profit research organization, believe a recession is inevitable.

“Indicators related to the labor market—including employment and personal income—remain robust so far. Nonetheless, The Conference Board still expects high inflation, rising interest rates, and contracting consumer spending to tip the U.S. economy into recession in 2023,” he wrote Friday.

Conflicting data and recession fears

Conflicting data about the health of the U.S. consumer has created confusion among even the most experienced economists this year.

After falling for two consecutive months, retail sales rebounded sharply in January. And Bank of America Institute researchers said they found “signs of a strengthening in consumer spending at the start of this year” in a new report, noting that credit and debit card spending per household rose 5.1% year-over-year in January.

The U.S. economy also added 517,000 jobs last month, pushing the unemployment rate to a 53-year low of 3.4%; social security payments have risen dramatically since last year; and the minimum wage has jumped in various parts of the country.

“The still-strong position of the labor market in January confirms that households and the broader economy are still in relatively firm standing,” Cailin Birch, global economist at the Economist Intelligence Unit (EIC), the research and analysis division of the Economist Group, told Fortune.

Year-over-year inflation, as measured by the consumer price index, fell from its June high of 9.1% to just 6.4% in January as well, the Bureau of Labor Statistics reported Tuesday. With ample available jobs and fading inflation, Goldman Sachs cut its forecast for the odds of a U.S. recession from 35% to 25% last week.

But recent positive economic data clashes with a number of other statistics that indicate consumers’ ability to keep spending at elevated levels is waning.

Although inflation is coming down, high prices are still impacting Americans at every income level. Over 80% of middle-income households cut down on their savings or pulled money from existing savings to make ends meet in the last three months of 2022, the financial services company Primerica found in a new study. And Gregory Daco, chief economist at EY-Parthenon, told the Financial Times this week that lower-income families have spent all their pandemic savings and begun “dipping into” regular savings.

Overall, nearly 65% of Americans were living paycheck to paycheck at the end of 2022, 9.3 million more than the year before, according to a new report from PYMNTS and LendingClub. And the personal savings rate—which measures Americans savings as a percentage of disposable income—has fallen from 9.3% in February 2020 before the pandemic, to just 3.4% in December.

On top of that, Ted Rossman, senior industry analyst at Bankrate, warned that Americans are financing much of their spending with credit card debt. Total household debt increased 2.4% in the fourth quarter to a record $16.9 trillion, driven by rising a 15% year-over-year jump in credit card debt, according to the New York Federal Reserve.

“Robust consumer spending, the hottest inflation readings in 40 years and sharply higher credit card rates have combined to push credit card balances to a new record high,” he told Fortune Thursday, noting that 46% of credit cardholders now carry credit card debt compared to 39% a year ago.

The ECI’s Birch warned that rising interest rates and high inflation are causing “increasing financial strain on households” as well, and she argues the trend won’t end anytime soon.

“As interest rates rise further in the coming months…this will cause consumer spending to slow considerably over the course of 2023,” she said.

That’s not great news, because consumer spending represents 70% of U.S. GDP, which makes it critical to economic growth.

Jennifer Timmerman, investment strategy analyst at Wells Fargo Investment Institute, even wrote a note this week titled “What weakening consumer spending may be foreshadowing,” warning that she is already seeing fading spending and signs of “financial stress” in households that have historically pointed towards a downturn.

“We believe that pressure on inflation-adjusted wages, along with the impact of Federal Reserve rate increases, will trigger an economic slowdown in coming months. Traditional recession signposts already are signaling as much,” she wrote in a Tuesday note.

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.