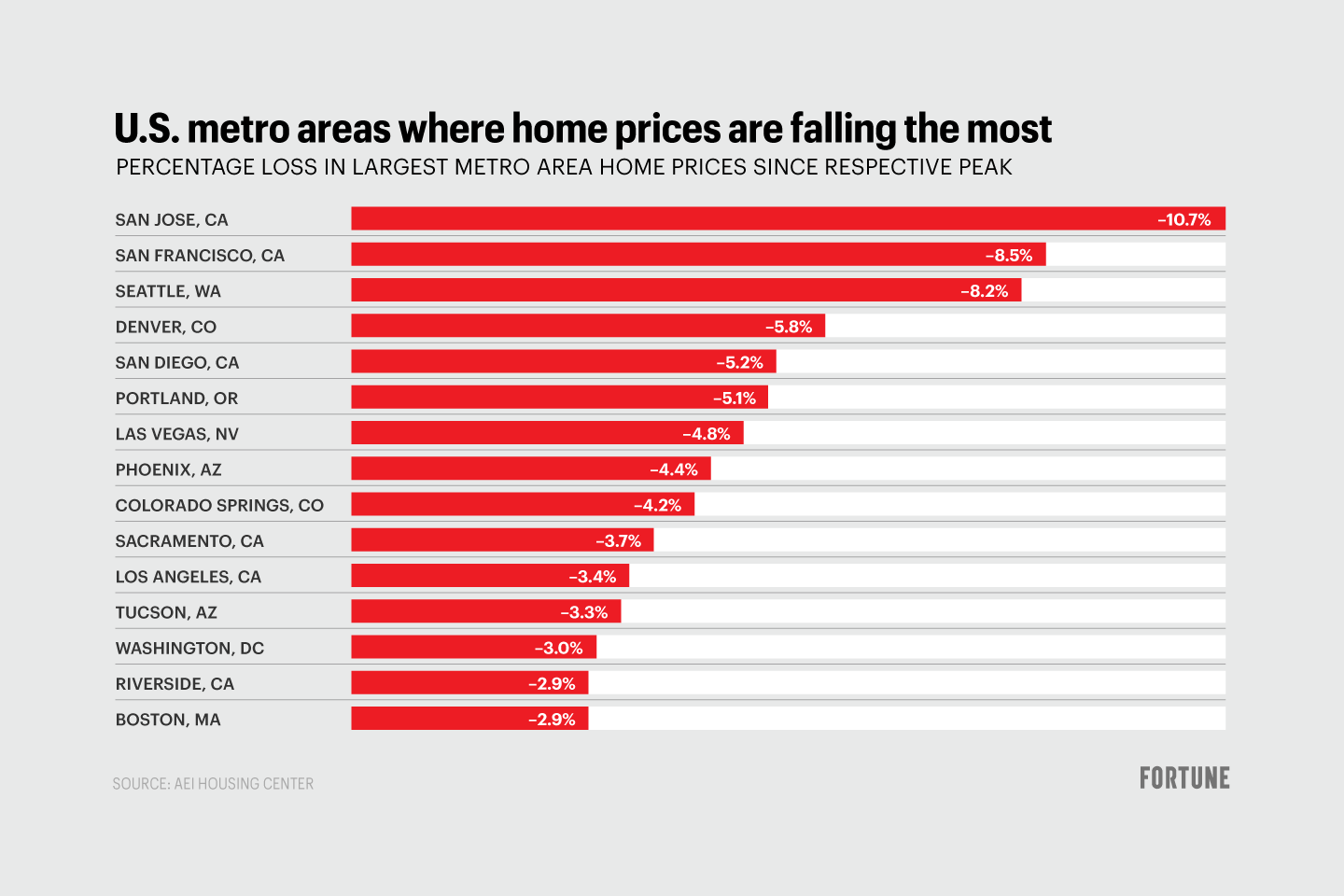

On October 20, Ed Pinto—director of the American Enterprise Institute’s Housing Center and one of the nation’s top experts on residential real estate—emailed me a new custom chart showing the price changes in America’s 60 largest metros, measured from their peaks through September. The column displaying those numbers is almost uniformly red. More than 50 of the cities registered decreases, and many of the drops are already deep.

Hardest hit is the nation’s Western tier, the cities that already ranked as the nation’s most expensive markets before the post-COVID boom rendered them far pricier and especially vulnerable to the doubling this year of 30-year mortgage rates to over 7%. Remarkably, all of the big decliners were rocking as recently as April and May, the two months when every one of them reached their summit in a synchronized climb.

San Jose suffered the biggest fall, tumbling 10.8% through September from its apex in April. The next top losers from their record highs are San Francisco (-8.5%), Seattle (-8.2%), Denver (-5.8%), San Diego (-5.2%), Portland (-5.1%), Las Vegas (-4.8%) and Phoenix (-4.4%). In Seattle, for example, median prices stood at roughly $710,000 in April of 2021, then jumped 18% to crest at $840,000 in April of this year. Phoenix vaulted even faster, rising 24% from $430,000 to $535,000 in the 12 months from May to May.

Most of the sunbelt markets including Dallas, Houston, Orlando, Atlanta, Raleigh and North Port and Palm Bay, Florida, fared better, retreating between 0.5% and 1.6% from their highs. In those locales, prices also exploded over the year ending in April or May. But they started the post-COVID boom at far lower price points than the California and other hot west coast markets due mainly to ample new construction. Even after takeoff, they remained more affordable than the likes of even Phoenix or Las Vegas: Atlanta's average prices peaked at around $430,000, and Houston maxed out at around $390,000. Only two of the sixty cities, Milwaukee and Greenville (SC) increased their prices from their formerly all-time tops in the spring, and three others including Memphis and Orlando are flat.

On October 19, Pinto also updated his chart for month-over-month price trends to present the change from August to September. The same pattern of virtually universal pullbacks shown in the highs-through-September numbers is persisting. Of the 58 markets for which the AEI provided figures, 40 were down or flat. But of the 18 that rose in September, all but two suffered falls in August that either erased the September bump, or put them in negative territory over the past two months. Only two markets secured meaningful gains from July to September, the lone pair still setting new highs, Milwaukee and Greenville.

From the start of the downturn in July, prices have fallen 2.1% through September for the nation overall. Pinto deploys data from mortgage marketplace platform Optimal Blue to forecast where housing's headed over the next two months. Optimal Blue collects prices for newly-signed contracts on sales that will close in around 45 days. The Optimal Blue numbers augur losses of 0.6% in October and 0.8% in November. Taking the mid-point of 0.7%, prices are now falling at an annualized rate of roughly 8%.

Pinto predicts that the damage will spread from the West Coast to the low and middle markets, especially in the Northeast

In a phone interview, Pinto warned that the downshift that first struck the super-expensive Western markets will soon shift to states harboring a high proportion of lower-priced homes. "The expensive parts of the market are the first to decline because they suffer most when the Fed takes away the punchbowl and rates rise," he says. "That's because high-income buyers borrow in the private markets, and when rates increase, they have a harder time qualifying for home loans than lower and middle income borrowers who get Fannie Mae, Freddie Mac and FHA loans." He notes that in the "high" price quintile, the months required to sell all listings at the current rate of demand has already tripled from a record low of 1.5 months to 4.5 months, presaging more drops to come.

So far, the low and low-medium priced categories are showing much more resilience than the high end, in part because Fannie and the FHA require less stringent income standards than the banks that serve mainly high-income purchasers. "The West had the earliest corrections and those corrections will continue and then spread to the rest of the country," Pinto told me. He sees two trends that could pressure prices in mainstream housing. "First, unemployment isn't a story yet, but it will be. We're still at record lows. If joblessness increases substantially to say 6% or 7%, we'll have more foreclosures and distressed sales. Inventories will go up. That process is only in the early days now," cautions Pinto.

The second is the risk of a rise in gasoline prices, and or simply the continuation of wallet-draining cost energy in states where it's super-expensive right now. "Rising gasoline prices are often the canary in the coal mine for a drop in housing prices," he says. "People who drive a long way to work because they moved far from a city to find an affordable house will say, 'I can't afford to live out this far anymore.' They will put their homes on the market and move to a rental. That trend increases inventories and decreases demand, further depressing prices." The combination of rising unemployment and gas prices that will either wax, or stay at their current levels in states where they're already extremely high (such as California and Illinois) would send low-priced FHA homes on a sharper downwards trajectory, Pinto predicts.

In Pinto's view, it's the northeast and Illinois that will take the brunt of the coming storm targeting the low-end. "New York, New Jersey, Connecticut, Rhode Island, and Massachusetts have seen huge outflows of people to the Sunbelt, and so has Illinois," he says. "That's already reducing demand. Heating oil prices are extremely high in New England. Throw in higher gas prices on top of regular inflation. Plus, these are states are in the rust and frost belts. If unemployment rises substantially, their lower priced markets will be hit especially hard." On the other hand, Pinto predicts that places such as Florida, the Carolinas and Texas will suffer smaller declines because they'll keep benefiting from relatively strong job growth and from just the phenomenon that will pound the Northeast and Illinois, the continuing exodus to the Sunbelt. For Pinto, the high end's travails are a harbinger for what's to come. The states losing people and jobs could soon lead declines at the low end that's so far proven most resilient from the stunning downfall in housing.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.