After a series of days in utter and complete COVID-positive isolation, yesterday was my re-introduction into the modern world. I put on a nice shirt and slipped on a pair of loafers and grabbed my car keys.

Let me tell you: Nothing greets you in that moment quite like a flat tire. After muttering a series of obscenities that were, regrettably, overheard by my neighbor, I pivoted: I could still attend my meeting, after all—on my bike. Perhaps others can relate to this, but when you never go into an office, and when you have gone long stretches of time without looking another human being in the (real, not virtual) face, you do whatever is necessary to show up in the flesh when possible—even if you arrive slightly disheveled, a little sweaty, and with your hair shoved up into a helmet.

I digress from the point I’m trying to make, which is this: I should have bought a new set of front tires yesterday, or perhaps in Nov. 2020—when I first purchased my vehicle. And, for some venture-backed companies, they probably should have gotten profitable right along there with me.

We’ll circle back to the whole profitability thing, but let’s keep talking about tires. Here’s my confession: My two front tires have had a slow (but steady) leak since I purchased the truck. It’s been getting worse the past six months or so. Up until today, you could find me at the gas station about every other week, pumping them up for $1.50 or so—a temporary solution to a more long-lasting, and expensive, problem I have been avoiding.

If I had just done the damn thing and bought a new couple of front tires, I’d be much better off. That’s because tire manufacturers upped their prices about three of four times last year—lifting the price of tires by some 20% in a year. And they’re expected to keep rising. This is bad news for Jessica who, not only has spent approximately $3 (give or take) a month to re-inflate her tires, but is now likely shoveling some 20% more than I would have needed to a year ago.

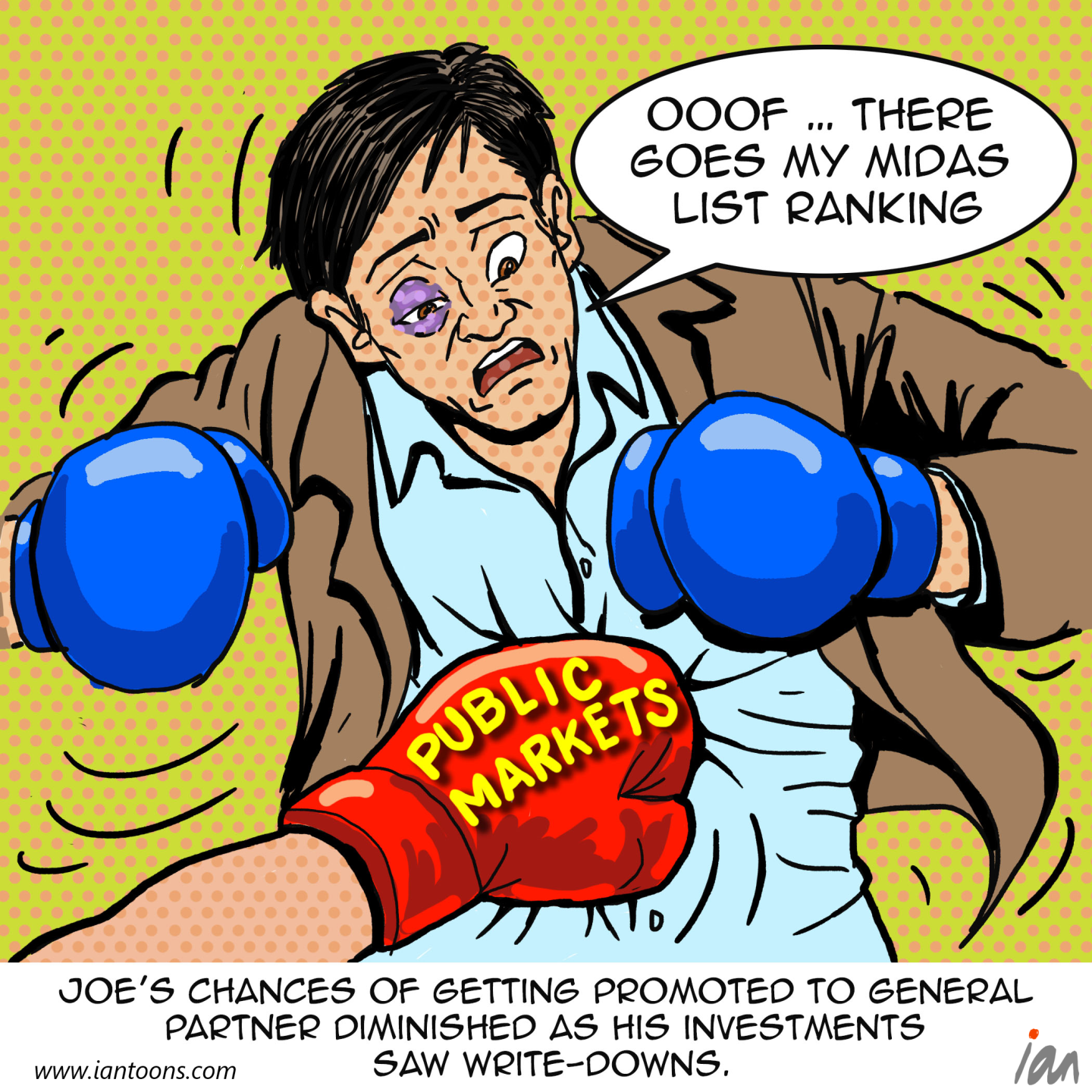

Back to companies. It’s always nice to be profitable. But last year, it really wasn’t too bad if you weren’t. In fact, a Goldman Sachs index that specifically tracks a basket of unprofitable tech rose enormously in early 2021—from just over 100 points to more than 400, per Bloomberg. But that index started nosediving at the end of last year and has now lost around two-thirds of its value since then (Yikes!). By comparison, Morgan Stanley’s similar index—the Morgan Stanley Unprofitable Tech Index—was down 64% earlier this month, according to Sequoia Capital’s pitch deck it offered portfolio companies a couple weeks back. (I would show you these indices; however, neither of them are publicly available, and Goldman Sachs and Morgan Stanley didn’t respond to requests for the underlying data)

All of this makes sense if you think about it. If you didn’t have cash in 2021, that’s OK. Go borrow some for free. Interest rates were zero. No profit, no problem. Now it, well, does seem to be somewhat of a problem. It’s more expensive now, and relying on third-party cash doesn’t seem to be as sustainable, or at least, that’s what the market performance of these public companies seems to indicate.

“With the cost of capital (both debt and equity) rising, the market is signaling a strong preference for companies who can generate cash today,” Sequoia wrote in its pitch deck from earlier this month, which you can read in full here.

Venture capitalists are telling founders this left and right: Have cash on the balance sheet—to the point that founders are already tiring of hearing about it. (“No shit. Thanks for the advice,” one recently told me.)

And hey—they do have a point. By now, the tires are already more expensive. So is borrowing money to run a business. So are a lot of other things: Like gas, food, and labor. In hindsight, yesterday looked like a pretty good time to get a few things done.

But I, for one, didn’t. You can find me at the car mechanic down the road later today paying for it.

Snip, snip… SEC filings show that Fidelity is marking down its valuations of Reddit, Stripe, TikTok owner ByteDance, and Instacart—at least for reporting purposes, according to a new Bloomberg story. It’s the latest indication of how late-stage private companies are following the public herd, even if they are lagging behind a few months. As a reminder, around half of Fidelity’s mutual funds hold at least one private company, I wrote in a recent feature.

See you tomorrow,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- Acrisure, a Grand Rapids, Mich.-based insurance services provider, raised $725 million in Series B-2 funding. A subsidiary of the Abu Dhabi Investment Authority led the round and was joined by investors including Guggenheim Investments on behalf of certain clients and Oak Hill Advisors.

- Hint Health, a San Francisco-based health care membership management and billing software company, raised $45 million in Series B funding. Banneker Partners and Frist Cressey Ventures led the round.

- Solv, a San Francisco-based doctor visitation booking platform, raised $45 million in Series C funding. Acrew Capital and Corner Ventures co-led the round and were joined by investors including Benchmark and Greylock.

- Ordr, a Santa Clara, Calif.-based software security developer for devices, raised $40 million in Series C funding. Battery Ventures and Ten Eleven Ventures co-led the round and were joined by investors including Northgate Capital, Wing Venture Capital, Unusual Ventures, Kaiser Permanente Ventures, Mayo Clinic, and other angels.

- Florence, a London-based social care staffing company, raised $35 million in Series B funding. Axa Venture Partners led the round and was joined by investors including Roo Capital and SEEK Investments.

- Vendia, a San Francisco-based data and code sharing platform, raised $30 million in Series B funding. NewView Capital led the round and was joined by investors including the Neythri Futures Fund, Operator Partners, Lux Capital, Neotribe Ventures, Aspenwood Ventures, Sorenson Capital, Canvas Ventures, and BMW iVentures.

- Air Doctor, a Beit Nekofa, Israel-based health care platform connecting travelers and doctors, raised $20 million in a funding round. Lightspeed Venture Partners led the round and was joined by investors including Vintage Investment Partners, Munich Re Ventures, The Phoenix, and Kamet Ventures.

- Clubbi, a Rio de Janeiro-based online commerce platform for small grocers, raised $12 million in Series A funding. NFX and ALLVP co-led the round and were joined by investors including Valor Capital Group, ONEVC, and Better Tomorrow Ventures.

- Mazen, an Ames, Iowa-based animal health company developing oral vaccines, raised $11.2 million in Series A funding. Fall Line Capital led the round and was joined by investors including Next Level Ventures, Kent Corporation, Ag Startup Engine, Ag Ventures Alliance, ISAV, Summit Ag, AgFunder, 1330 Investments, Addison Laboratories, SLO Seeds Ventures, and Cal Poly Ventures.

- Inne, a Berlin-based women’s healthtech startup, raised $10 million in Series A extension funding. DSM Venturing led the round and was joined by investors including Borski Fund, Calm Storm Ventures, and other angels.

- JUNOCO, a San Francisco-based skincare and beauty brand, raised $6.3 million in Series A funding. Vision Plus Capital led the round and was joined by FREES FUND.

- OMORPHO, a Portland-based weighted training gear fitness company, raised $6 million in a seed funding round. KB Partners led the round and was joined by investors including Greenchain Capital and Madison Square Garden Sports Corp.

- Altan Insights, a New York-based alternative asset intelligence platform, raised $4 million in a seed funding round led by Slow Ventures’ Kevin Colleran.

- Lively Root, a San Diego-based plant lifestyle brand, raised $4 million in seed funding from angels including former Jack In the Box CEO Jake Goodall, investor CJ Stos, and McKenzie Farms founder Ken Cook.

- Digiphy, a Los Angeles-based QR marketing and commerce platform, raised $1.5 million in funding from investors including Gaingels, M13, Builders & Backers, EYRIR Ventures, Sify Ventures, and others.

PRIVATE EQUITY

- Peninsula Capital agreed to acquire ISEM Bramucci, a Vigevano, Italy-based packaging company. A deal is worth around €90 million ($97 million).

- Crest Rock Partners acquired a majority stake in Pitcher, a Zurich-based sales enablement software platform. Financial terms were not disclosed.

- EW Healthcare Partners agreed to acquire and take private TherapeuticsMD, a Boca Raton, Fla.-based women’s health care company. Financial terms were not disclosed.

- H.I.G. Capital agreed to acquire Terra Millennium, a Salt Lake City, Utah-based industrial maintenance services provider. Financial terms were not disclosed.

- Longshore Capital Partners conducted a majority recapitalization of MetaSource, a Draper, Utah-based business process outsourcing and digital transformation solutions provider, with Eos Partners. Financial terms were not disclosed.

EXITS

- Advent International and Lanxess acquired the engineering materials company of DSM, a Netherlands-based health and biosciences company, for $4.13 billion.

OTHER

- GSK agreed to acquire Affinivax, a Cambridge, Mass.-based biopharmaceutical company, for as much as $3.3 billion.

- Saint-Gobain agreed to acquire Kaycan, a Pointe-Claire, Canada-based building products manufacturer, for $928 million.

- Damac Group acquired De Grisogono, a Geneva-based luxury jeweler. Financial terms were not disclosed.

- Lookout acquired SaferPass, a Bratislava, Slovakia-based password management company. Financial terms were not disclosed.

- Thayer Infrastructure Services acquired J. Lee Associates, a Marlborough, Mass.-based wireless communications construction company. Financial terms were not disclosed.

IPOS

- FWD Group, a Hong Kong-based insurance provider, decided to postpone its Hong Kong initial public offering due to market volatility, according to Bloomberg. The company is backed by Richard Li.

FUNDS + FUNDS OF FUNDS

- Binance Labs, the venture arm of crypto exchange Binance, raised $500 million for a fund focused on cryptocurrency projects.

PEOPLE

- 500 Global, a San Francisco-based venture capital firm, promoted Amal Dokhan to general partner.

- Blackford Capital, a Grand Rapids, Mich.-based private equity firm, hired Ken Wagner as CFO. Formerly, he was with Coastal Group.

- Menlo Ventures, a Menlo Park, Calif.-based venture capital firm, hired Aunkur Arya as venture partner.

- Palladium Equity Partners, a New York-based private equity firm, promoted Deborah Gallegos and Carlos Reyes to co-heads of ESG & sustainability.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.