Good morning,

It’s no secret that many CFOs are hesitant to put Bitcoin on the balance sheet due to its volatility. But being accountable for an employee’s decision to use their 401(k) to invest in crypto is a new level of risk.

I recently had a conversation with Timothy S. Klimpl, counsel at Carmody Torrance Sandak & Hennessey LLP, about the U.S. Department of Labor’s compliance assistance released in March that addresses 401(k) plan investments in crypto.

“The agency has taken a position (without regulation) that employers should exercise what they say is extreme caution in offering cryptocurrency as an investment option in 401(k),” Klimpl told me. “They didn’t say that it cannot be done or that there’s anything in of itself improper by doing it.” But it raises some concerns for employers, he said.

A new report by Fortune’s Shawn Tully, Workers want crypto 401(k) options but companies that offer them will face a wave of lawsuits, provides a strong dose of caution to anyone considering adding them.

Tully writes: “Prospective employers that don’t offer Bitcoin and Ether choices could well lose great job candidates to rivals that make those new-age picks available. ‘Companies are damned if they do and damned if they don’t,'” an attorney told Fortune. “401(k) plans are already one of the most litigious areas in the business world. If cryptocurrencies become common in those plans, the cost to employers will be heavy litigation. The plaintiffs’ bar is looking over the next hill to see where the money is, and they’re thinking it’s all about winning class action settlements when employees take losses on, say, the Bitcoin in their 401(k).”

Late last month, Fidelity Investments, the nation’s largest retirement plan provider, announced that by mid-2022, 401(k) plan participants will have the option to invest in Bitcoin via their retirement plan, up to 20%. A week later, the Securities and Exchange Commission announced its adding 20 additional jobs to the unit responsible for protecting investors in crypto markets.

It may seem exciting to some investors to shake up their traditional 401(k) with volatile, unregulated digital assets. But Tully points out in his piece why traditional 401(k) investments have become so basic—companies don’t want to get sued.

“Last year, the top ten ERISA settlements paid by corporations amounted to $837 million,” Tully writes. “That’s double the number in 2020, and a fraction of total damages from sundry suits. Insurer John Hancock and retailer Lowe’s paid $10 million and $12.5 million respectively to settle an 401(k) cases last year.”

To learn more about the great retirement crypto debate, read Tully’s piece here. Let me know what you think about crypto and retirement savings.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

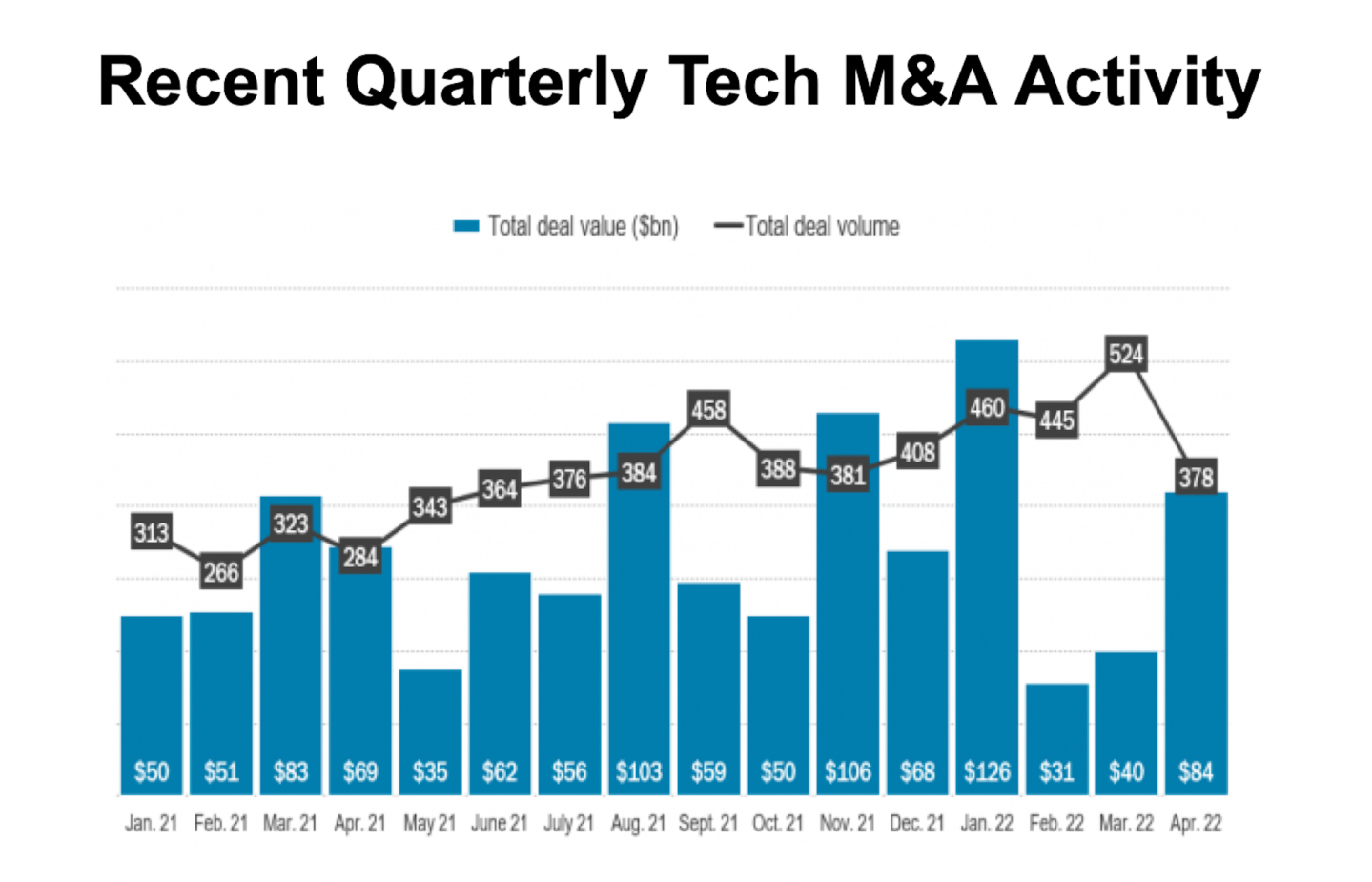

In regard to M&A, there was $84 billion worth of tech transactions globally in April, a new report by 451 Research's M&A KnowledgeBase, part of S&P Global Market Intelligence found. However, the bump from March is entirely due to Tesla CEO Elon Musk's $44 billion acquisition of Twitter Inc. The "blockbuster deal" snapped a "two-month slide in the tech M&A market," according to the report. But Musk's transaction is not representative of the broader market. "There was a notable absence that kept last month's spending at relatively muted levels: publicly-traded acquirers," the report found.

Going deeper

The Best Leaders Have a Contagious Positive Energy, a report in Harvard Business Review, explores why superficial demonstrations of false positivity don't work. Positive relational energy —"the energy exchanged between people that helps uplift, enthuse, and renew them"—is the active demonstration of values, according to the report. The authors provide an analysis of what leaders need to know about this type of positive energy.

Leaderboard

Kate Gulliver was promoted to CFO and chief administrative officer at Wayfair (NYSE:W), effective in November. Current CFO Michael Fleisher has announced his retirement. Gulliver currently serves as VP and chief people officer at Wayfair. She joined the company as head of investor relations after a career at Bain Capital as an investor and at McKinsey as a consultant. Gulliver was a core part of Wayfair’s IPO. She then built up the company’s talent organization, and she has been responsible for global human capital management including recruiting, organizational design, talent management, talent analytics, compensation and learning and development.

Craig Yan Zeng was named CFO at Autohome Inc. (NYSE: ATHM; HKEX: 2518), an online destination for automobile consumers in China, effective immediately. Zeng previously served as CFO of LexinFintech from November 2016 to June 2021. Prior to joining LexinFintech, he was CFO at YeePay, an e-payment service provider in China. Before that, Zeng served as the VP of Hop Hing Group Holdings Limited, and as the EVP of VanceInfo Technologies Inc. Prior to 2010, he served as a financial director of Microsoft (Greater China) from 2008 to 2009, and worked for Venustech Group Inc. from 2006 to 2008 in positions including CFO and COO. Zeng also worked for General Electric in the U.S.

Overheard

"Listen, when we started this effort over three and a half years ago, we were sort of begging to talk to anybody who would be interested in having a conversation. Now we're very much triaging requests that are coming in and trying to make sure that we're being a resource."

—Kristin Smith, executive director of a cryptocurrency trade group called the Blockchain Association, as told to Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.