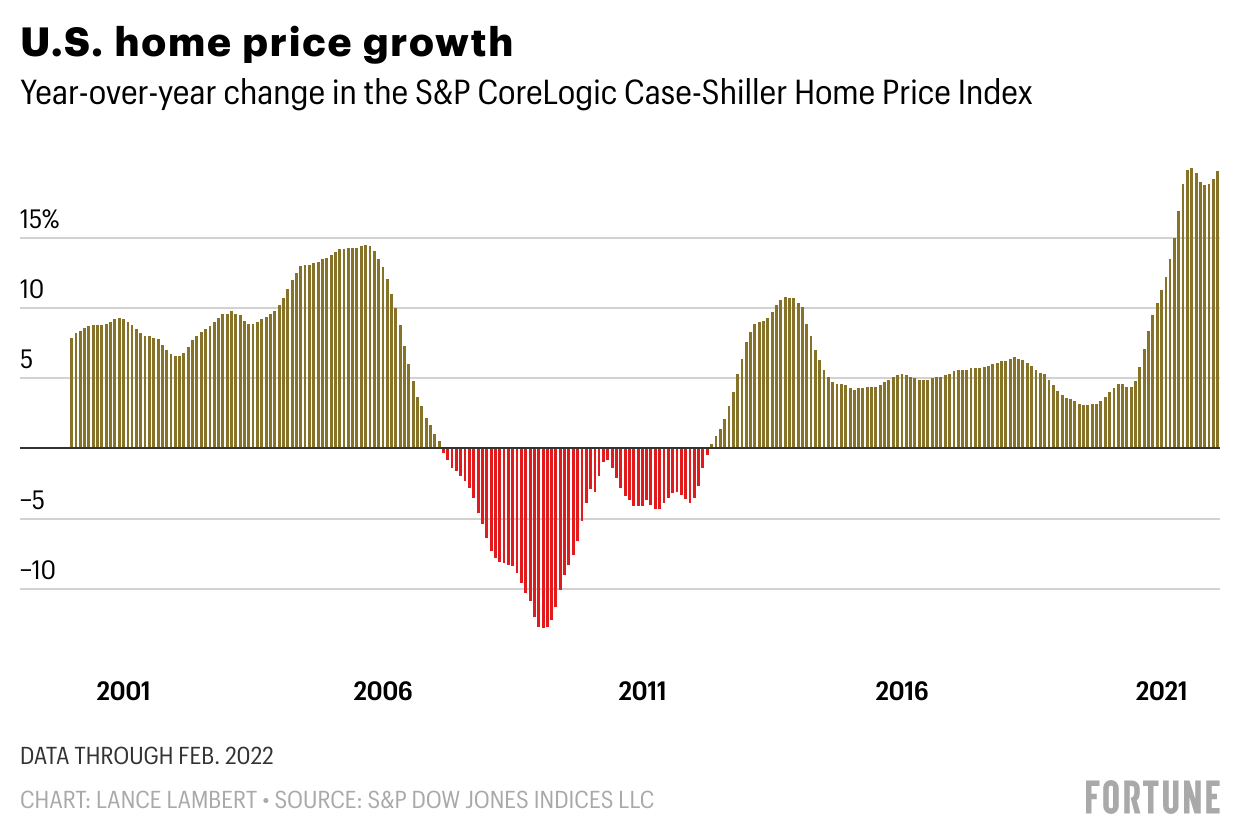

U.S. home prices soared 19.8% year-over-year in February, the third highest monthly increase in the past 35 years, according to the S&P CoreLogic Case-Shiller national home price index.

The rise dwarfs any of the price increases seen in the years leading up to the 2008 housing bust, in which the biggest 12-month jump was just 14.5%. It has some experts arguing the housing market is “skating close” to bubble territory.

But with mortgage rates climbing faster than at any time since the early 1980s, other industry leaders say the housing market is beginning to show signs of slowing.

“The macroeconomic environment is evolving rapidly and may not support extraordinary home price growth for much longer,” Craig J. Lazzara, the managing director at S&P DJI, said on Tuesday. “The post-COVID resumption of general economic activity has stoked inflation, and the Federal Reserve has begun to increase interest rates in response. We may soon begin to see the impact of increasing mortgage rates on home prices.”

The average 30-year fixed mortgage rate has climbed 2 percentage points over the past four months, rising from 3.11% in December to 5.11% as of last week.

Still, in February, U.S. home prices continued to rise at a staggering pace, especially in cities. S&P’s 10-City Composite index saw an 18.6% annual jump, while the 20-City Composite posted a 20.2% year-over-year gain.

Sunbelt cities including Phoenix, Tampa, and Miami reported the highest annual home price gains, with Phoenix leading the way posting a 32.9% year-over-year price increase in February.

Indraneel Karlekar, global head of research and strategy at Principal Real Estate Investors, said February’s nearly 20% gain in home prices will only serve to further exacerbate the substantial shortage of housing in the U.S. and heighten affordability concerns.

That’s bad news for struggling first-time homebuyers.

“Many potential first-time homebuyers are facing lofty home prices and the prospect of rising interest rates, forcing them to move to cities with a lower cost of living or to become renters by necessity,” Karlekar told Fortune.

Rising mortgage rates have some housing market experts cutting their lofty forecasts for U.S. home price growth over the next year, but homebuyers shouldn’t expect to see bargains anytime soon.

Fannie Mae trimmed its March prediction for an 11.2% jump in home prices through the end of 2022 down to 10.8% this week, but that still represents more than double the average annual home price appreciation seen since 1987.

Double-digit home price increases are hardly anything for homebuyers to celebrate, but there are other signs the housing market may be cooling. Redfin data shows there’s been a recent spike in sellers cutting prices, which could be an indicator of falling demand—and represents a stark departure from the record number of bidding wars seen in January.

Still, Bill Adams, the chief economist at Comerica Bank, told Fortune he expects home prices will only continue to rise in the near term. Despite rising mortgage rates, homebuyers should expect double-digit home price increases through the end of the year.

“The reluctance of homeowners to list their homes, construction supply-chain turmoil, and a shortage of construction workers means that housing supply is a bigger constraint on home sales than housing demand; that will keep housing prices rising rapidly near-term,” Adam said.

“But that will change as more buyers are priced out of the market. Housing demand will cool over the rest of 2022, and home price increases will slow. Even so, national average home prices will still be up by double digits at the end of 2022 from the end of 2021.”