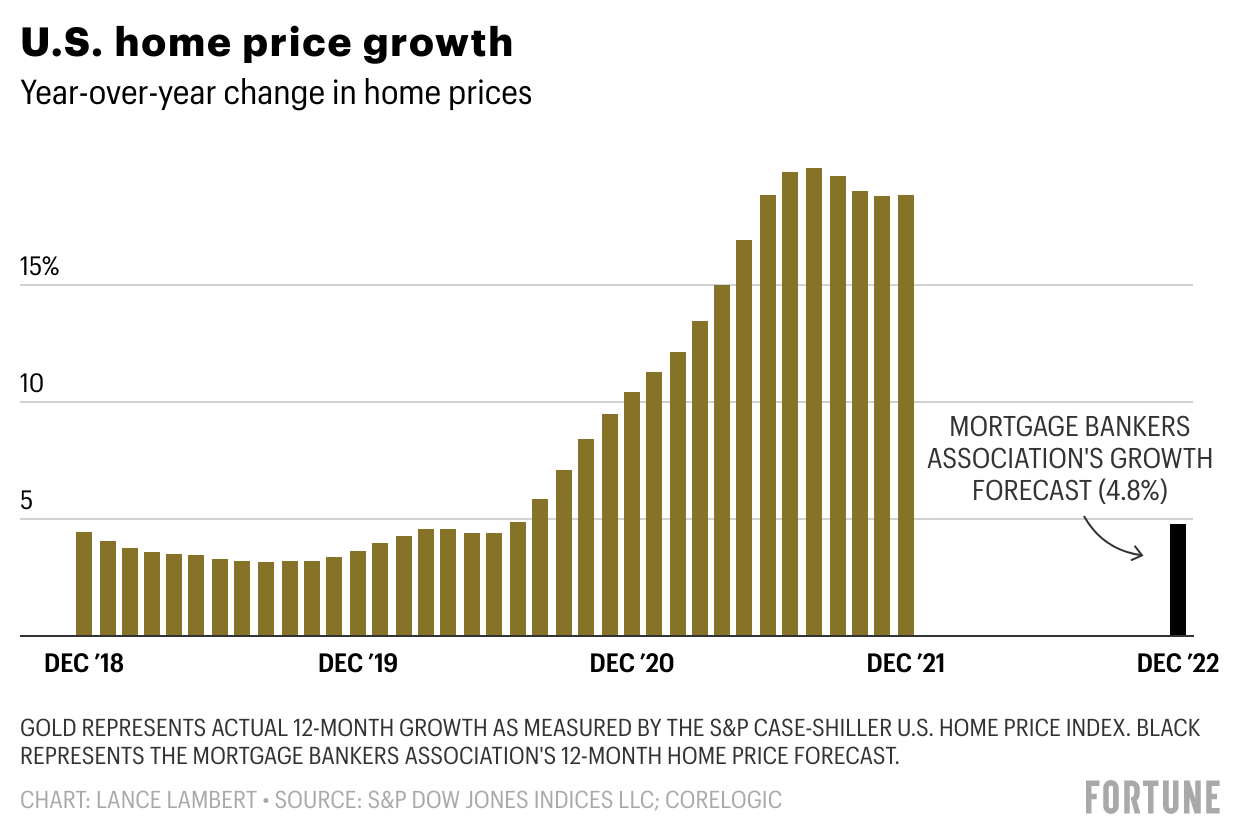

Housing economists are concerned. As they see it, if home price growth doesn’t slow down, it could ultimately put prices so far out of reach for homebuyers that the housing market overheats. They’d like to see the market return to normal rates of growth—not risk a housing bust.

The latest forecast put out this week by the Mortgage Bankers Association should give them some peace of mind: This year, the trade group predicts that U.S. existing home prices will jump just 4.8%.

If the Mortgage Bankers Association’s forecast comes to fruition, it would represent a significant deceleration from the current rate of U.S. home price growth. At its latest reading, home prices were up 18.8% year-over-year (for perspective, during that same period, the typical raise doled by Corporate America was just 3%).

If home prices rise just 4.8% this year, it would mean the housing market would have normalized back to its historic rate of growth. Since 1989, the average annual uptick in U.S. home prices is 4.6%.

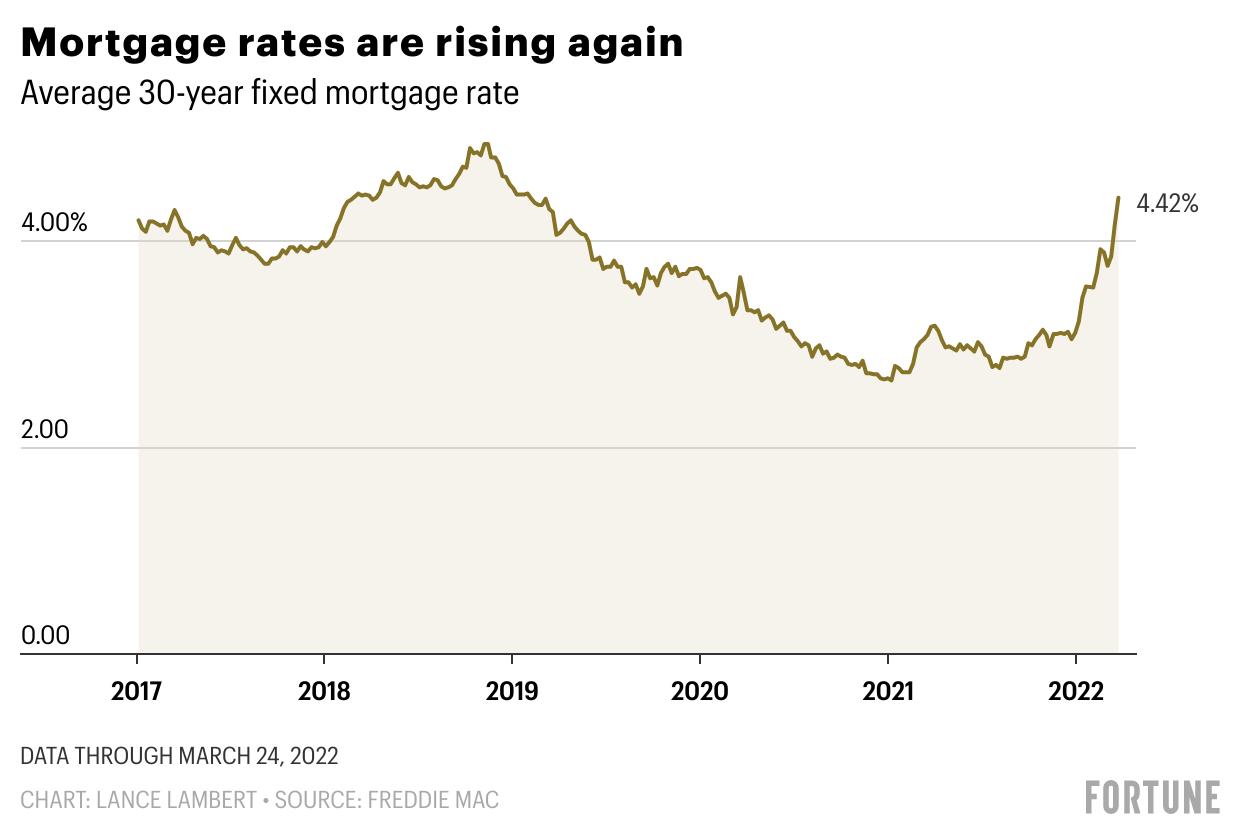

Why does the Mortgage Bankers Association expect home price growth to slow down? It boils down to soaring mortgage rates. This year, the group forecasts that the 30-year fixed mortgage rate will average 4.5%—up from 3.1% in 2021. As of Thursday, we’re already up to an average 30-year fixed mortgage rate of 4.42%, according to Freddie Mac.

That swift move up in mortgage rates amounts to an economic shock. As Fortune explained earlier this week, soaring mortgage rates should put downward pressure on the housing market. As rates rise, some buyers (who must meet banks’ strict debt-to-income ratios) lose their loan eligibility. Additionally, higher rates will price out some home shoppers. If a borrower took out a $400,000 mortgage at a 3.1% rate, their monthly principal and interest payment would come out to $1,708. At a 4.5% rate, that payment jumps to $2,027. Over the course of the 30-year loan, that would add up to an additional $114,700.

“The housing market has gone into a savagely unhealthy stage. Everyone should embrace higher rates to cool off this madness and hope inventory rises,” Logan Mohtashami, lead analyst at HousingWire, tells Fortune. “If inventory doesn’t show year-over-year growth while going into the inventory seasonality period, we should be talking about credit controls. Such as abolishing all arm products while inventory is this low, letting higher rates do their thing.”

So far, the red-hot housing market hasn’t shown signs of cooling. If cooling comes, industry insiders tell Fortune we would first see it through increasing levels of inventory. Right now, the opposite is happening: Last month inventory levels on Zillow.com were 47.7% below February 2020, and 26.1% below February 2021.

When it comes to forecasting home price growth, the Mortgage Bankers Association’s prediction is on the lower side. Over the coming year, Zillow predicts that U.S. home prices will spike another 17.8%. The home listing site sees the mismatch between low inventory and strong buyer demand continuing to push up prices through the year.

“The robust long-term outlook is driven by our expectations for tight market conditions to persist, with demand for housing exceeding the supply of available homes,” wrote Zillow researchers.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.