America’s cryptocurrency capital may become the next Wall Street.

That is, if the title doesn’t go to the home of Wall Street itself.

For years, government officials from such disparate places as the Wyoming state capitol to city hall in Miami have been jockeying to lure the crypto and blockchain industries to their communities. With the potential to become a major port of passage for the ever-growing digital assets space, just as Silicon Valley has been for big tech and New York has been for big banking, the allure of creating a crypto capital in the U.S. is obvious. So, mayors, governors, and lawmakers have all taken to making their pitches: Lower taxes, friendlier regulations, warmer temperatures. The list goes on.

But there’s evidence that New York City, the epicenter of old finance since the days of the Buttonwood Agreement, may be starting to pull ahead.

Home to Tyler and Cameron Winklevoss’ Gemini, NFT marketplace OpenSea, and blockchain analytics firm Chainalysis, New York City already has a well-established crypto community. But a swell of activity has started to take place as of late. Private market investors are pouring gobs of money into New York’s crypto startups; the Wall Street banking and money management mammoths that populate the isle of Manhattan are wading into the markets; and the newly elected mayor, Eric Adams, has gone so far as to vow to make New York City “the center of the cryptocurrency industry”—all of which has seemingly put the city on a trajectory to eventually become non fungible to the crypto industry’s evolution, executives and investors say.

“It’s kind of like a person who’s got a 100-yard dash, and he gets to start at the 50-yard line,” Ava Labs President John Wu says. “It’s for New York to lose.”

Crypto bites into the Big Apple

Globally, the U.S. has taken on newfound importance in the crypto economy in recent years. The market has matured stateside at the same time that other countries like China have cracked down on the crypto industry, which has, in the case of Hong Kong, once widely seen as a crypto stronghold, led to an exodus of firms. In the U.S., the pitch to make New York the crypto capital is unique from many of the other jurisdictions on a similar conquest.

Miami and Austin can offer better tax incentives, considering both cities are in states where there is no income tax. Wyoming has a suite of friendly crypto laws on the books. And in fact, companies operating in the digital asset space in the state of New York need to do so with a BitLicense, which for some, like crypto exchange Kraken, has proven to be a regulatory step too far. (Kraken has a special purpose banking charter in Wyoming.)

What New York brings is access—to finance, to tech, and to culture—that no other city can offer, Andreessen Horowitz General Partner Ali Yahya tells Fortune. “There’s a burgeoning scene of crypto and Web 3 people in New York, and in particular, Brooklyn,” Yahya says. “It’s just in the air, it’s part of the zeitgeist of the place.”

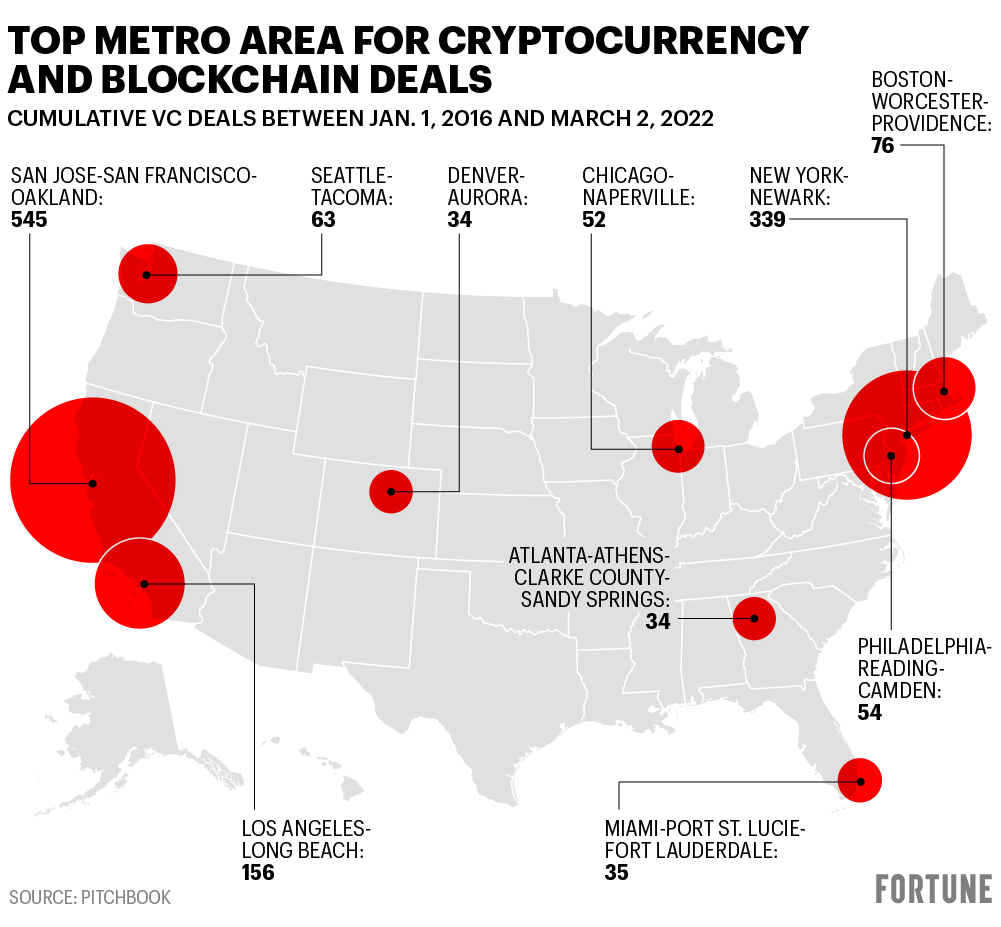

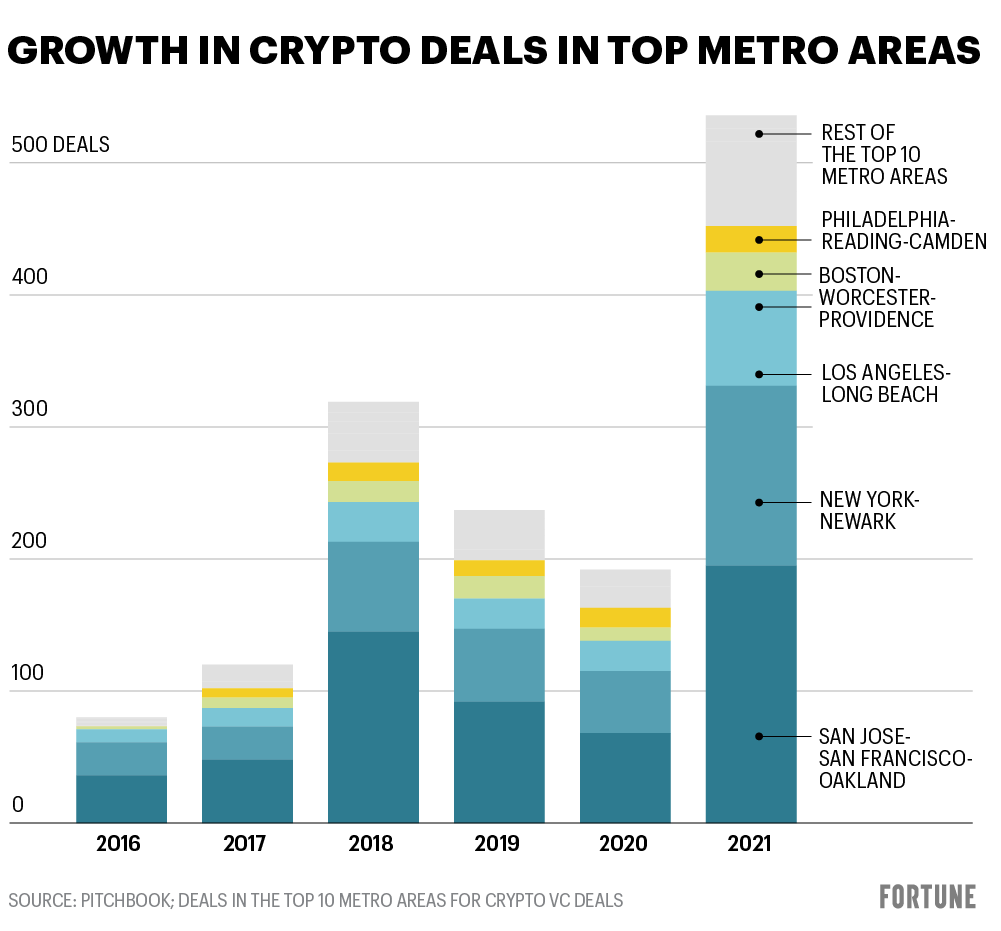

Silicon Valley has the lead, both in the U.S. and likely in the world, based on crypto venture capital funding alone. VCs have injected nearly $14 billion into the Bay Area’s crypto industry through 545 deals since the start of 2016, more than any other market in the U.S. as well as other notable ones around the world like London, Hong Kong, and Singapore, according to PitchBook data. New York trails closely behind, with 339 deals taking place in the greater area that carried a value of more than $7 billion.

But the Valley’s numbers are not the whole picture. Long home to mature crypto giants like Robinhood and Coinbase, the Bay Area’s numbers have been padded by a few massive deals that have helped lift its numbers over the years. (Coinbase became a remote-first company in 2021.) Take 2021, for instance. VCs invested $7.45 billion through 195 deals into crypto companies in San Jose, San Francisco, and Oakland, according to PitchBook. Of that, Robinhood, based in Menlo Park, accounted for $3.4 billion in a single emergency raise.

Eliminate that deal from the Bay Area’s totals and the New York market, where VCs put some $4.74 billion into crypto and blockchain companies in 2021, becomes the top funding spot for the space.

Old finance, meet new finance

Ava Labs, a blockchain development company, wanted to pick New York from the get go in its recent search for a new headquarters.

Born out of Cornell University, where CEO Emin Gun Sirer taught for two decades, the company, which counts Andreessen Horowitz as a backer, has been rooted in the city for years, Wu says. But it had plenty of suitors in its search, including Miami Mayor Francis Suarez who has been pushing to transform south Florida into a crypto hub by recruiting companies like Blockchain.com, eToro, and FTX.US. (The home stadium of the Miami Heat is now even known as FTX Arena.)

On a recent visit to Miami, Wu says Suarez “rolled out the red carpet,” promising “white-glove services” to help the Ava Labs president not just get the company set up in the city but also personally, including by helping answer questions on everything from where to live to where to send your kids to school to how to get a driver’s license.

Ultimately, Ava Labs signed a lease in the Williamsburg neighborhood of Brooklyn—though Wu adds the company has an office in Miami, too. By staying in New York, Ava Labs can remain close to traditional finance, a space ripe with recruiting and fundraising opportunities for crypto companies, Wu says. “If we’re trying to change the world through and how financial services are done,” Wu says, “you have to do it in the center of it.”’

The decision was helped along too by the bullish stance that the city’s newly elected mayor has taken toward crypto, Wu says.

A former cop turned state lawmaker turned Brooklyn borough president, Adams, whose office did not respond to a request for comment, has become an unlikely champion for crypto since taking over city hall. The mayor hasn’t officially pursued any pathways toward making crypto more accessible or available for use in New York, but Adams has been an outspoken proponent for crypto—just like Suarez in Miami. He has even floated the idea of putting crypto on New York City school curriculums, and took his first three paychecks in Bitcoin and Ether.

“Showing enthusiasm and wanting New York to be a hub for technology development and crypto is what really gave us more confidence to stay,” Wu says of Adams.

It’s not just new age finance that’s building out New York’s crypto scene, either. Over the course of the COVID-19 pandemic, as crypto markets have undergone a dizzying explosion of interest, legacy institutions ranging from big banks like Goldman Sachs to asset managers like VanEck—many of which had previously expressed hesitations about digital assets—have been wading further and further into the space. Even the New York Stock Exchange is working on reported plans to build a non-fungible token market.

To centralize or not to centralize

While the race to become the crypto capital of the U.S. has broken out into a full sprint, there are still doubts about whether crypto—a space built on the premise of decentralization—even needs one at all.

The industry, like every other corner of the business world, has been largely distributed around the world for much of the last two years thanks to the COVID-19 pandemic. At San Francisco-headquartered Anchorage, for instance, some 90% of its 65 employees were based in the Bay Area before the pandemic, Diogo Mónica, the digital assets bank’s cofounder and president, tells Fortune. Less than 30% of its now 250-person staff are in the San Francisco area today.

New York is, in fact, Anchorage’s largest consolidation of employees, followed by those based in Portugal.

“It doesn’t make sense to centralize again,” says Mónica, who relocated to Seattle during the pandemic. “Nobody wants to do it.”

Still, Anchorage is considering a move. There’s no burning desire to relocate its headquarters out of San Francisco, Mónica says, but the company’s executive team has given it a thought.

Among the cities it would consider? Miami and New York, Mónica says

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.