Entering into 2020, the nation already didn’t have enough homes built to satisfy millennials who were entering into their peak first-time homebuying years. Then the COVID-19 crisis struck. The ensuing record-low mortgage rates and flexible work from home policies—which allowed buyers to expand their home search further into the burbs—only attracted more buyers into an already tight and competitive market. Simply put: The pandemic created a perfect storm in the housing market.

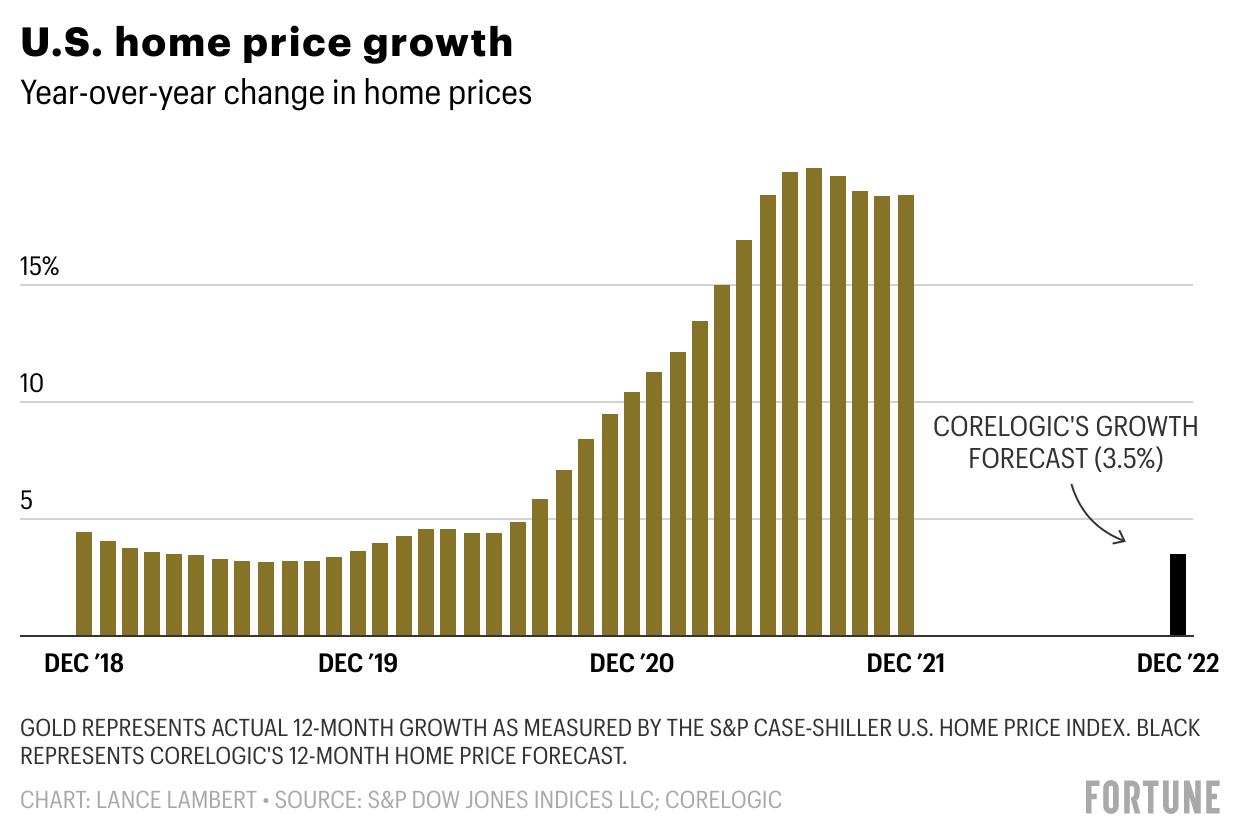

But the historic run on prices could soon begin to wind down. At least that’s according to CoreLogic’s latest forecast. Between December 2020 and December 2021, the S&P CoreLogic Case-Shiller index finds U.S. home prices rose 18.8%—which is more than four times as great as the nation’s average annual rate (4.2%) posted since 1989. Going forward, CoreLogic says we should expect home price growth closer to the historical average. Between December 2021 and December 2022, CoreLogic forecasts home prices will rise 3.5%.

Already, we’re starting to see home prices decelerate a bit. Between August 2020 and August 2021, U.S. home prices climbed a record 20%. But over the following four months that 12-month growth rate has decelerated to 18.8%, as of December.

“Much of what we’ve seen in the run-up of home prices over the last year has been the result of a perfect storm of supply and demand pressures. As we move further into 2022, economic factors—such as new home building and a rise in mortgage rates—are in motion to help relieve some of this pressure and steadily temper the rapid home price acceleration seen in 2021,” writes Frank Nothaft, chief economist for CoreLogic.

In recent weeks, mortgage rates are already starting to move upward as financial markets price in future rate hikes by the inflation-concerned Federal Reserve. Last week, the average 30-year fixed mortgage rate hit 3.92%, according to Freddie Mac. That’s up from 3.11% in December. Of course, rising mortgage rates puts downward pressure on price growth—given that each uptick in mortgage rates prices out some would-be buyers.

But if rising mortgage rates do lead to decelerating home price growth, it doesn’t mean it will benefit home shoppers. After all, the sting of soaring home prices over the past two years has been lessened to a degree by pandemic-induced low mortgage rates. Now that rates are spiking, so will mortgage payments for new borrowers.

But not everyone in the real estate world agrees with CoreLogic’s deceleration prediction.

Look no further than Zillow. Just last week, the home listing site once again upped its home price forecast. Zillow now predicts the year-over-year rate of home price growth to peak at 21.6% in May, and to finish 2022 at 17.3%. That’s not a deceleration—it’s an acceleration.

Why is Zillow so bullish? It says there simply aren’t enough homes on the market. Entering into the spring housing market, inventory levels in the U.S. are down 42% below pre-pandemic levels. That supply (a.k.a. inventory) and demand (a.k.a. home shoppers) mismatch is set to push prices higher even in an environment of rising mortgage rates.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.