Tech bulls, the big number to watch today is: 51.

If the Nasdaq were to close lower on Wednesday by about 51 points, the tech-heavy index would officially be in correction territory. And oh, what a fall it’s been. On Nov. 19, the Nasdaq closed at 16,057.44, an all-time high, only to tumble 9.65% over the past two months. (A market correction amounts to a 10% drop.)

How likely are investors to see the dreaded C-word flash across the screen today? It’s not looking good.

At 4 a.m. ET, the Nasdaq was off roughly 0.8%, and investors in Europe were selling their tech shares yet again. Dutch semiconductor equipment maker ASML, a bellwether for chips stocks, was off nearly 4% in early trading despite reporting a big Q4 profit-beat and a rosy full-year sales forecast. Investors dumped shares on fears ASML cannot meet runaway customer demand.

There’s a confluence of factors buffeting tech stocks. Supply-chain bottlenecks are likely to weigh on the chips sector in the near term. Elsewhere, investor jitters over more hawkish central bank policy, plus higher bond yields and rising inflation, will be like a gut-punch for cash-tight high-growth tech firms.

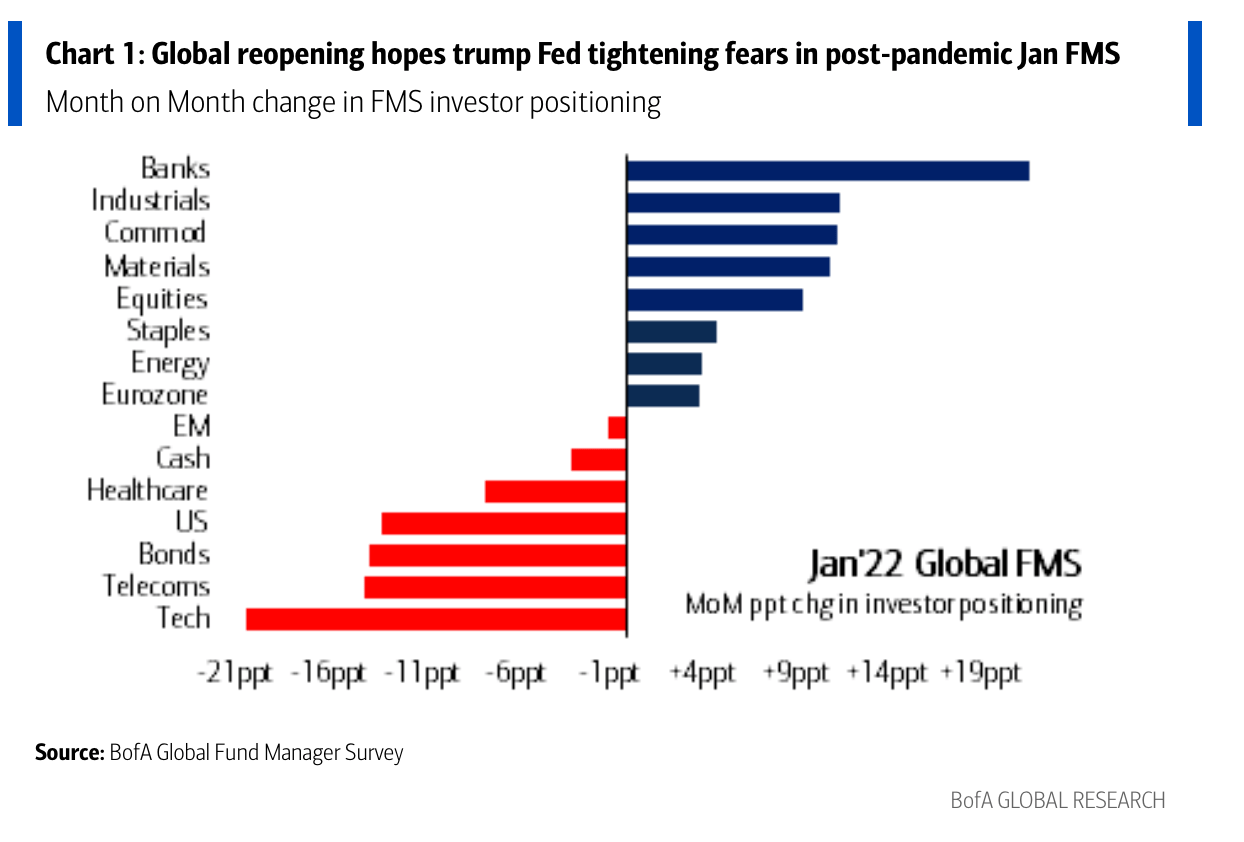

In the latest BofA Securities fund manager survey, the bank found that big money managers are pulling out of tech at a rate last seen in 2008, during the height of the global financial crisis. In the past month, they loaded up on banks, industrials, and energy stocks while they bailed on tech, the investor equivalent of waving the white flag on growth stocks.

If history is any judge, the tech selloff may not hit bottom for a while.

According to Goldman Sachs chief U.S. equity strategist David J. Kostin, in cycles like the one we’re about to enter—that is, with the Federal Reserve expected to hike interest rates multiple times in 2022—cyclical sectors (materials, industrials, energy) tend to do well. “At the factor level,” he continues in a recent investor note, “value stocks tend to outperform in the months before and after the first hike…Growth is the worst performing factor in the six months around the first hike.”

This is not to say equities are a bad bet in period of rising rates. Dating back to 2004, the S&P 500 has delivered, on average, a 9% return even as rates rise, Goldman found. “However,” Kostin writes, “the current inflation-led hiking cycle may prove more challenging for equities.”

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.