This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

You can exhale. For now.

It appears as if Congress has a deal in place to avoid a government shutdown. The clinching Senate vote could happen in a matter of hours. That’s enough of a reassurance to lift U.S. futures this morning.

Across the Atlantic, there’s a risk-on mood in the European markets, too. Alas, U.S. and European stocks are on track for their worst monthly performance of the year.

Meanwhile, Bitcoin trades higher, too, this morning. But September was a rough one for crypto bulls.

Let’s see what else is moving the markets.

Markets update

Asia

- The major Asia indexes are mixed with the Shanghai Composite up 0.9% in afternoon trading.

- Chinese stocks are holding their own despite lousy PMI manufacturing data out this morning showing the country’s factory owners aren’t all bullish on near term business outlook.

- Sports fans, here’s some more bad news. The 2022 Winter Games, to be held in and around Beijing, will be closed to foreign spectators.

Europe

- The European bourses were jumping out of the gates this morning, the last trading day of Q3. The Stoxx Europe 600 was up 0.8% at the open with tech stocks, actually, atop the leader board.

- The euro hit a 52-week low against the dollar yesterday. King dollar is living up to its name in recent weeks as investors ditch risk-assets, and bid up the safe-haven dollar. The pound sterling has fallen even further.

- Clothing retail giant H&M reported a Q3 bottom-line beat this morning, sending shares in Stockholm 2% higher at the open.

U.S.

- The U.S. futures are gaining this morning. I said the same thing yesterday at this time, and then all three major averages sunk in afternoon trading. The Nasdaq fared the worst, closing down by 34.24 points, extending its losing streak to three days.

- Stock futures jumped overnight following Chuck Schumer’s announcement there’s a possible deal to avert a government shutdown.

- No profits? No problem. Loss-making eyeglasses vendor Warby Parker went public via a direct listing yesterday, and its shares took off, valuing the company at $6.8 billion.

Elsewhere

- After Wednesday’s sell-off, Gold is up a tad. It now trades below $1,730/ounce.

- The dollar is flat.

- Crude is down with Brent trading around $78/barrel.

- Bitcoin is up 2% in the past day, trading around $43,000.

***

Buzzworthy

Quick programming note before I get into the latest buzzy chatter: I got a lot of great reader responses to my question yesterday about your outlook on the markets. I will share those responses on Monday. (Spoiler: there are more bearish calls than I had expected). Tomorrow, I will cover the big winners and losers for September in this space.

Now, let’s get back to Buzzworthy:

On understanding the value of a Dollar Tree

💰💰💰

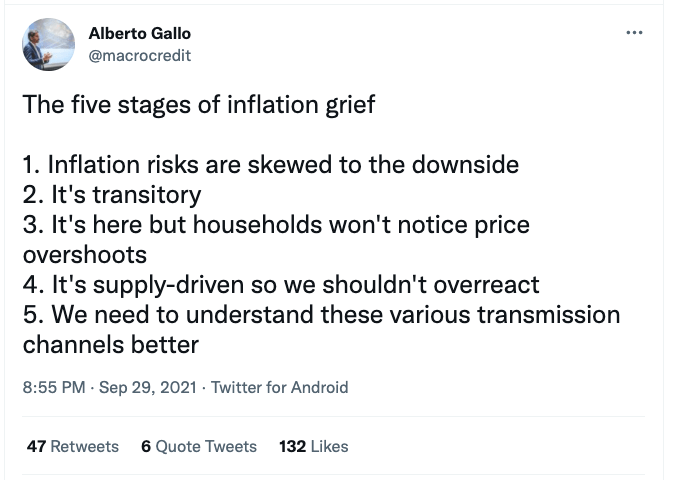

A reminder: inflation memes are transitory

🙄🙄🙄

Bond villain

Gotta give credit to the Wall Street Journal “Heard on the Street” headline writers: “Bond villain” was theirs from yesterday evening. <3

🧨💥🧨

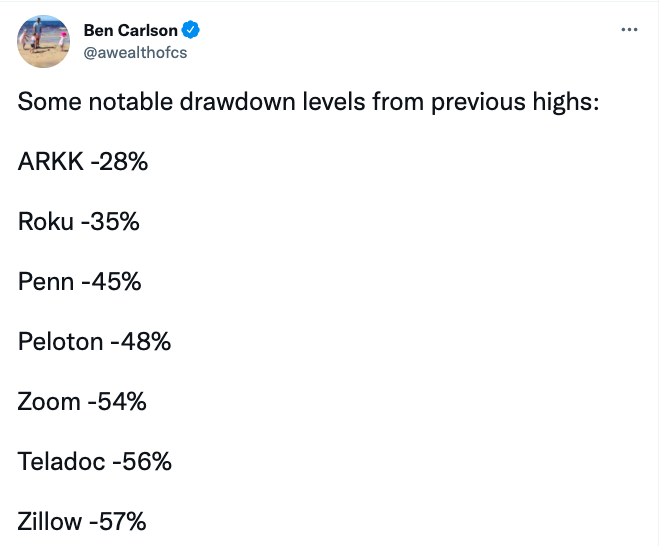

No sign of inflation here

😬😬😬

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Biden’s $3.5 trillion package is ‘too big to fail’ but also ‘too big to describe’—Fortune

Why aren’t interest rates going up? There are 3 possible reasons—Fortune

The investors most likely to ‘freak out’ during a downturn are older men—Fortune

131 Federal Judges Broke the Law by Hearing Cases Where They Had a Financial Interest—Wall Street Journal

Bond-Yield Surge Challenges Investor Confidence in Big Tech Companies—Wall Street Journal

Bull Sheet readers, we have a special offer: 50% off your subscription to Fortune. Just click here, and use the promo code: BULLSHEET . . . Thank you for supporting our journalism.

Market candy

-5.99%

That's the one-month performance for NYSE FANG+, a bellwether big-cap tech ETF. It includes FAANG-stock bluechips, plus the likes of Nvidia, Tesla and Alibaba. It's fallen as bond yields have taken off.

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.