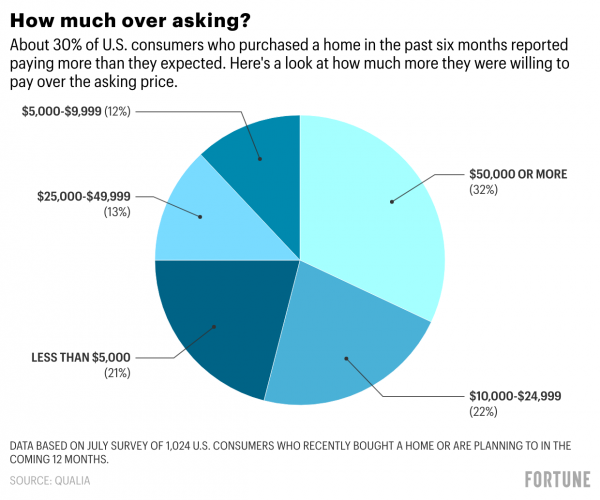

As the red-hot housing market continues on its epic run, many homebuyers are finding themselves shelling out well above asking prices. Nearly a third of Americans who bought a home in the past six months paid more than they anticipated owing to increased competition, according to a new report from digital closing platform Qualia. Many of them—about 32%—reported paying $50,000 or more over the asking price to seal the deal.

In contrast, about 24% of homebuyers who completed their purchase between September 2019 and March 2020 reported spending more than expected, according to the survey of over 1,000 U.S. recent and future homebuyers who plan to purchase a home in the next year.

Many Americans have been looking to buy a home amid the pandemic, thanks to low interest rates and a desire for more space. Yet housing inventory has been stagnant over the past year, causing increased competition and rising prices. Last week, the national median home sale price increased 16% year over year to $361,225, according to the latest data from real estate site Redfin.

In addition to spending more, some buyers are also making other compromises to secure their home sales. Nearly one in four homebuyers bought their house sight unseen, while 19% agreed to remove inspections from the contract, and 29% compromised on the location.

“Acting quickly and making calculated concessions to remove inspections or pay all cash may be necessary for consumers to win in a competitive bidding process; however, these concessions shouldn’t be made if a homebuyer doesn’t understand the implications,” Nate Baker, Qualia CEO, told Fortune.

These compromises and increased home costs may be leading some homeowners to feel less satisfied after the deal is done. About 39% of recent buyers said they were very confident about their decision to purchase a home, compared with 53% of pre-pandemic homebuyers.

“Regardless of whether housing competition and the need to act quickly persist, it’s important for homebuyers to understand the process during one of the largest transactions of their lifetimes,” Baker said.

That’s especially true when it comes to understanding the financing and closing costs. For instance, only about 20% of homebuyers said they understood all of the closing documents they signed. And while consumers don’t necessarily need to become experts when it comes to real estate closings, Baker said it’s important to speak up when something’s not clear.

“If you’re looking to buy a home, know that you have more control than you may think,” Baker said. If things aren’t as transparent as you were expecting during the homebuying process, make sure to ask for clarification. Don’t settle for a complicated and stressful process that makes you feel less confident in your purchase, he added.

More must-read business news and analysis from Fortune:

- These are the most overvalued housing markets in the U.S.

- This one chart puts Biden’s student loan cancellation into perspective

- Is “Big Day Care” the solution to America’s childcare woes—or is it risky to mix profits and toddlers?

- What’s fueling “The Great Resignation” among younger generations?

- All the major companies requiring vaccines for workers

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.