Good morning,

DEI had a huge year. But despite the focus on diversity, equity, and inclusion, reported workplace and societal incidents of discrimination linked to companies increased globally, compromising employees and increasing investing risk, according to new research.

“We find that companies that disclose more diversity and anti-discrimination initiatives tend to be involved in more incidents related to race and ethnicity,” says Martin Vezér, manager of thematic research at Sustainalytics, an ESG research company owned by Morningstar, an American financial services firm. “This pattern holds across different categories of market capitalization and in relation to both internal workforce controversies and broader societal incidents.”

“One interpretation of this finding is that companies may be establishing new policies and programs in response to being embroiled in related controversies,” Vezér says.

Sustainalytics released its ESG Spotlight Series report Race, Ethnicity and Public Equity: A Global Snapshot on July 20. Vezér explains the findings based on an assessment of 3,343 firms listed on the Morningstar Global Markets Large-Mid index.

“We are looking at the relationship between two sets of data—initiatives and incidents—to see whether high exposure to incidents coincides with more or fewer related initiatives,” says Vezér, one of the authors of the report. “We find they tend to coincide with more incidents. We can say that the findings suggest that to mitigate ESG risks related to racial and ethnic controversies, companies need to do more than come up with more initiatives. They have to implement these initiatives in a more meaningful way.”

Many companies are doing the minimum. For example, just 15% of firms sampled from this index go beyond legal compliance needs for diversity initiatives, according to the report. Less than 30% have managerial or board-level responsibility for diversity initiatives. And just under half of the firms have initiatives to support a diverse workforce.

Over the past six years, from 2015 to the first quarter of 2021, Sustainalytics tracked 605 incidents related to race and ethnicity involving internal and external issues at 206 companies globally. The majority of the incidents (483) were related to societal issues, including actions that have adverse impacts on underrepresented ethnic communities and discriminatory marketing practices, researchers found. The remainder of incidents were based on internal issues. For example, some employees in the U.S. and U.K. alleged they experienced racial discrimination by co-workers.

The financial sector actually accounted for 63% of incidents sampled in 2020, Sustainalytics found. Approximately 163 of these incidents stemmed from financial institutions and banks named in non-governmental organization (NGO) reports due to financing companies that have “allegedly negatively impacted Indigenous communities,” in Latin America, according to the report.

Overall, nearly half of the reported incidents tracked by Sustainalytics occurred in 2020. This represented a “175% increase in internal incidents, and a 510% increase in social incidents compared to 2019,” the report found.

“Companies can take several steps to improve their transparency with regard to diversity and discrimination issues,” Vezér says. “They can compare their public disclosures to those of their market and industry peers with the aim of emulating and advancing best practices. Underexplored initiatives that we highlight in the report include mentorship programs and assigning managerial responsibility for promoting corporate diversity. They can also disclose quantitative targets to improve the representation of minorities at different levels of an organization, especially in their senior ranks.”

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

****

Fortune’s CFO Collaborative in partnership with Workday, “The Promise and Pressure of ESG Measures,” takes place on Wednesday, August 11. The event, created just for CFOs, will feature Brian T. Moynihan, chairman and CEO, Bank of America; Claus Aagaard, CFO, Mars Inc.; Ann Dennison, CFO, Nasdaq; Giulia Siccardo, associate partner, McKinsey & Company; and Emma Stewart, sustainability officer, Netflix. CFOs can join their peers in learning more about embracing ESG while attracting new investors and cutting borrowing costs and operating expenses. CFOs can apply here. For more information, email CFOCollaborative@Fortune.com.

Big deal

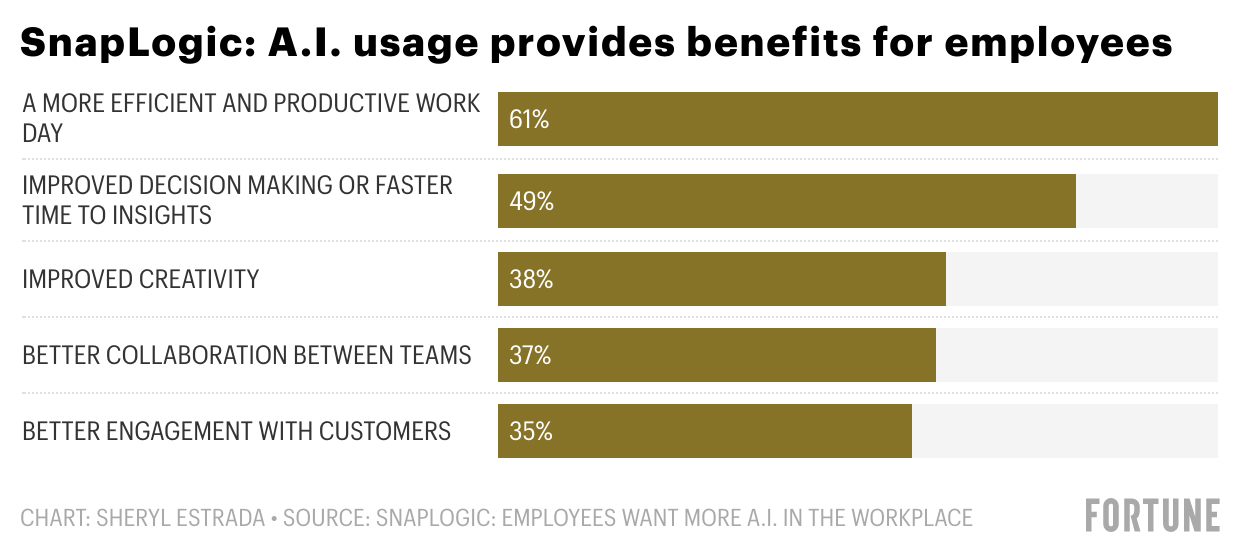

A report by SnapLogic, an intelligent integration platform provider, found that 81% of employees surveyed said artificial intelligence (A.I.) improves their overall performance at work. The survey asked workers in the U.S. (200) and U.K. (200), across various lines of business, including finance, marketing, and HR, their perspectives on A.I. More than half (61%) of respondents said the technology boosts efficiency and productivity.

Going deeper

ISACA, a professional association focused on IT governance, in partnership with HCL Technologies, released the State of Cybersecurity 2021 Part 2 survey report on July 27. The majority (77%) of respondents said they are confident in the ability of their cybersecurity teams to detect and respond to cyberthreats, which is a 3% increase from last year. And 32% said their cybersecurity training and awareness programs have a strong positive impact on overall cybersecurity awareness, up from 28% in 2020.

Leaderboard

Kristian Humer was named chief business officer and CFO at Viridian Therapeutics, Inc., a biopharmaceutical company. Humer spent 20 years on Wall Street, and has experience in capital raising, mergers and acquisitions. Most recently, he served as managing director of banking, capital markets & advisory for the global healthcare team at Citigroup, Inc.

Bob Scopinich was named CFO at Huntington Learning Center, a national tutoring and test prep provider. Scopinich joins Huntington after serving as CFO at the Goddard Systems, Inc. for 18 years. He succeeds Jim Emmerson, who is retiring and served as tHuntington Learning Center's CFO for 24 years.

Overheard

"I truly believe we will not be going back to the 5-days-a week in the office" routine. "That era has stopped."

—Andrei Postoaca, chief executive of Ipsos Digital, on the company's survey of workers across nine countries that found more than a third would quit if forced to return to the office full time, as reported by Fortune.