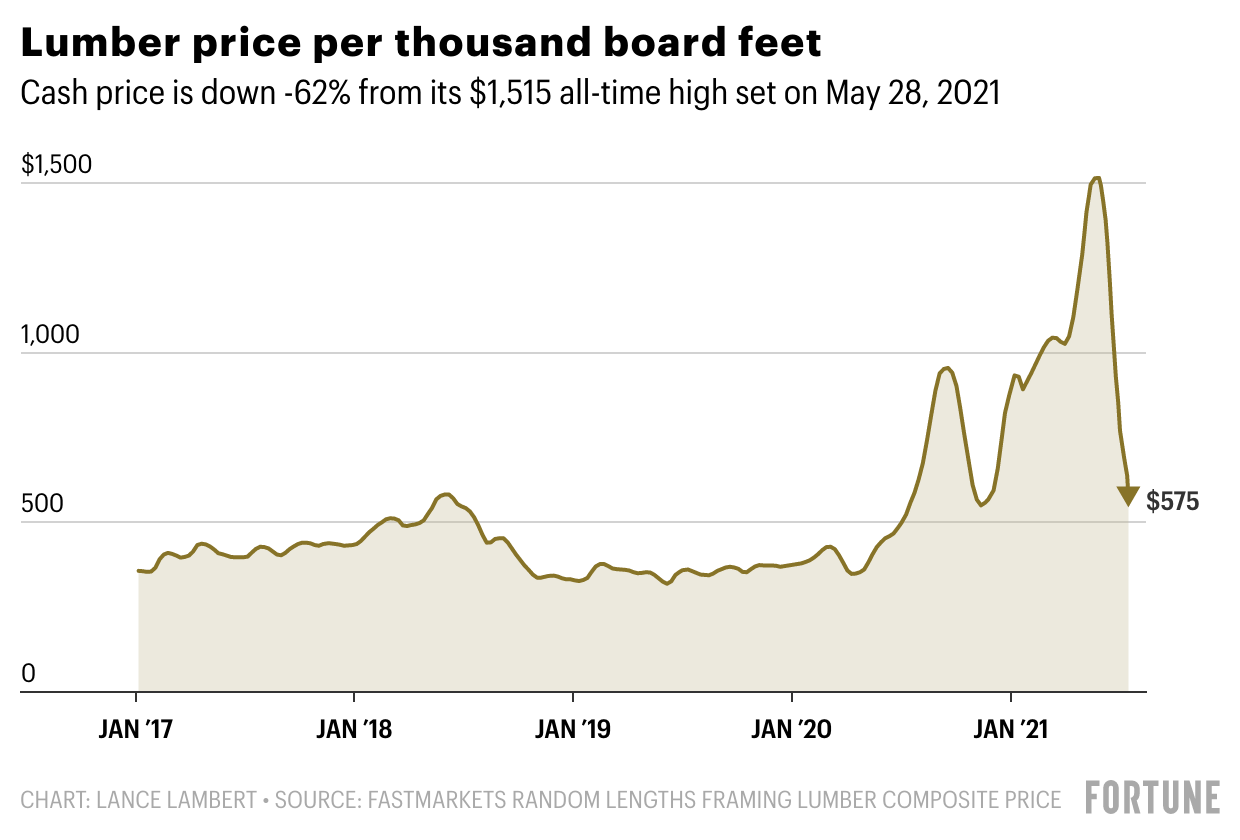

Lumber prices came down nearly as fast as they soared up to record-breaking levels this spring.

For the seventh consecutive week, the “cash market” lumber price, what sawmills charge distributors and wholesalers, is down. Last week, the cash price of lumber fell $114, to $575 per thousand board feet, according to data provided to Fortune by Fastmarkets’ Random Lengths, an industry trade publication.

That represents not just a pullback, but a massive correction. The price is down 62% from its $1,515 all-time high set on May 28. In fact, it has completely erased all of its 2021 gains. The price of lumber is still above its pre-pandemic range, when it usually traded between $350 to $500, however, it’s lower now than the $582 peak price hit during its 2018 run.

Why are lumber prices falling? Exorbitant price levels reached in the spring corrected as homebuilders and do-it-yourselfers backed off a bit. In June, home improvement sales and new home construction were down 9.8% and 5%, respectively, from their March highs. That cooling has given sawmills and the lumber supply chain breathing room to catch up on the supply side.

While prices are coming down at big box retailers, like Lowe’s and Home Depot, the decline isn’t as quick as the decline on the wholesale side. But they will catch up. Michael Goodman, director of specialty products at Sherwood Lumber, recently told Fortune that each wholesale dip will take “about 60 to 90 days to get into the market.”

The lumber pullback wasn’t a huge surprise in the industry. It was really basic economic theory: Elevated demand—from DIY projects and homebuilding—at some point would cool as the price for limited supply soared. Which it did. Only now that lumber has erased all of its 2021 gains, industry insiders are surprised buyers aren’t returning faster to scoop up the discounts.

“I’m not surprised by a correction…But it is remarkable we are not seeing more buyers step in at these levels. Brings into question how strong demand actually is,” Dustin Jalbert, a senior economist at Fastmarkets RISI, where he covers the lumber market, told Fortune.

But that doesn’t mean prices are going to fall back to their pre-pandemic levels. Prices could even tick up again. Many homebuilders are sitting on the sidelines as prices drop, but if they all rush back in, it could drive another surge. Industry insiders also point to hurricane and wildfire seasons as potential disruptions.

“I think over the next 30 days it goes back up again…Two hurricanes, back to back, and next thing you know it’s over $600. That’s okay, though—the market is fine with that; it’s $1,000 wood the market isn’t okay with,” said Chip Setzer, director of trading and growth for Mickey Group, a commodity trading platform.

As Fortune has previously reported, this historic lumber shortage was spurred by a perfect storm of factors set off during the pandemic. When COVID-19 broke out in spring 2020, sawmills cut production and unloaded inventory in fears of a looming housing crash. The crash didn’t happen; instead, the opposite occurred. Americans rushed to Home Depot and Lowe’s to buy up materials for do-it-yourself projects, while recession-induced interest rates helped spur a housing boom. That boom, which was exacerbated by a large cohort of millennials starting to hit their peak homebuying years, dried up housing inventory and sent buyers in search of new construction. Home improvements and construction require a lot of lumber, and mills just couldn’t keep up.

More must-read finance coverage from Fortune:

- Female migrant workers and the families they support are being abandoned by the money-transfer industry

- This Trump appointee bet big on the markets after Biden’s win

- IRS child tax credits could be an unexpected burden for some taxpayers

- Is China’s Bitcoin crackdown cutting mining’s emissions—or shifting them somewhere else?

- Social Security payments could rise over 6% next year

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.