Nearly a quarter of parents with dependent children still don’t know if they’re eligible for the expanded child tax credit payments worth up to $300 per child that are set to start this week.

Although the IRS previously reported that about 39 million U.S. households qualify for the child tax credit payments, a recent survey finds that many parents still lack information or are misinformed about these payments.

About 14% of parents believe they’re completely ineligible to receive the child tax credit payments, according to a survey of 498 U.S. adults with dependent children fielded by the Economic Security Project and non-profit SaverLife during June 17 through 24, 2021.

Among those who believe they’re not eligible, the survey found that some parents incorrectly believe receiving federal benefits such as SNAP disqualifies them from receiving the advanced child tax credit payments. That is not the case.

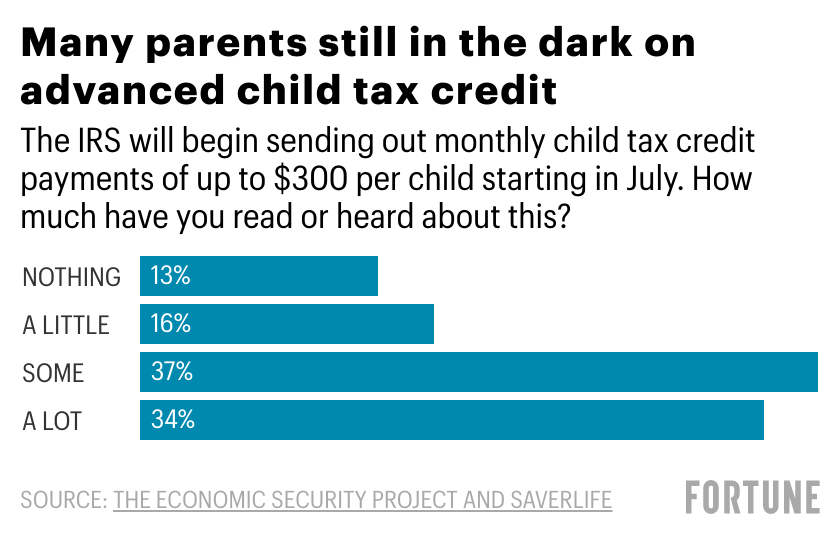

Moreover, nearly 30% of parents surveyed report they’ve heard only “a little” or “nothing” about the child tax credit. And that knowledge gap is much higher among families who didn’t file taxes. Roughly 8 out of 10 non-filers report they haven’t heard a lot about the expanded child tax credit.

For those who are unsure if they’re set to receive these payments, the IRS has a site where families can verify their eligibility. Most families won’t have to do anything extra to receive these payments.

But parents who didn’t file taxes in 2020 or 2019 and also did not register for the stimulus payments, do need to sign up for the Child Tax Credit payments. The IRS has a separate online portal where parents can provide their information to the IRS to help the agency correctly direct their payments and even expedite the process.

Parents can also use the IRS website to manage their upcoming payments and even opt out of future advances if they’re worried about owing money to the IRS when filing taxes next year. Remember, the IRS is essentially prepaying a tax credit, so if you typically owe money on your taxes, then you may want to forgo these payments in order to bring down your total tax bill when filing next year. The deadline to opt out of the July payment has passed, but parents can still forgo payments starting in August.

Eligible families will receive up to half of their enhanced 2021 child tax credit in the form of monthly payments, which are set to start arriving in bank accounts and mailboxes on July 15 and continue through December 2021.

The enhanced credit is set to pay families up to $3,000 per child for those between the ages of 6 and 17 years old and up to $3,600 per child under the age of 6. The amount of the credit is based on a family’s modified adjusted gross income, with payments starting to phase out for single parents (filing as head of household) earning $112,500 a year or $150,000 among those who are married and filing jointly.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.