This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good evening, Bull Sheeters. Finance reporter Anne Sraders here again, filling in for Bernhard.

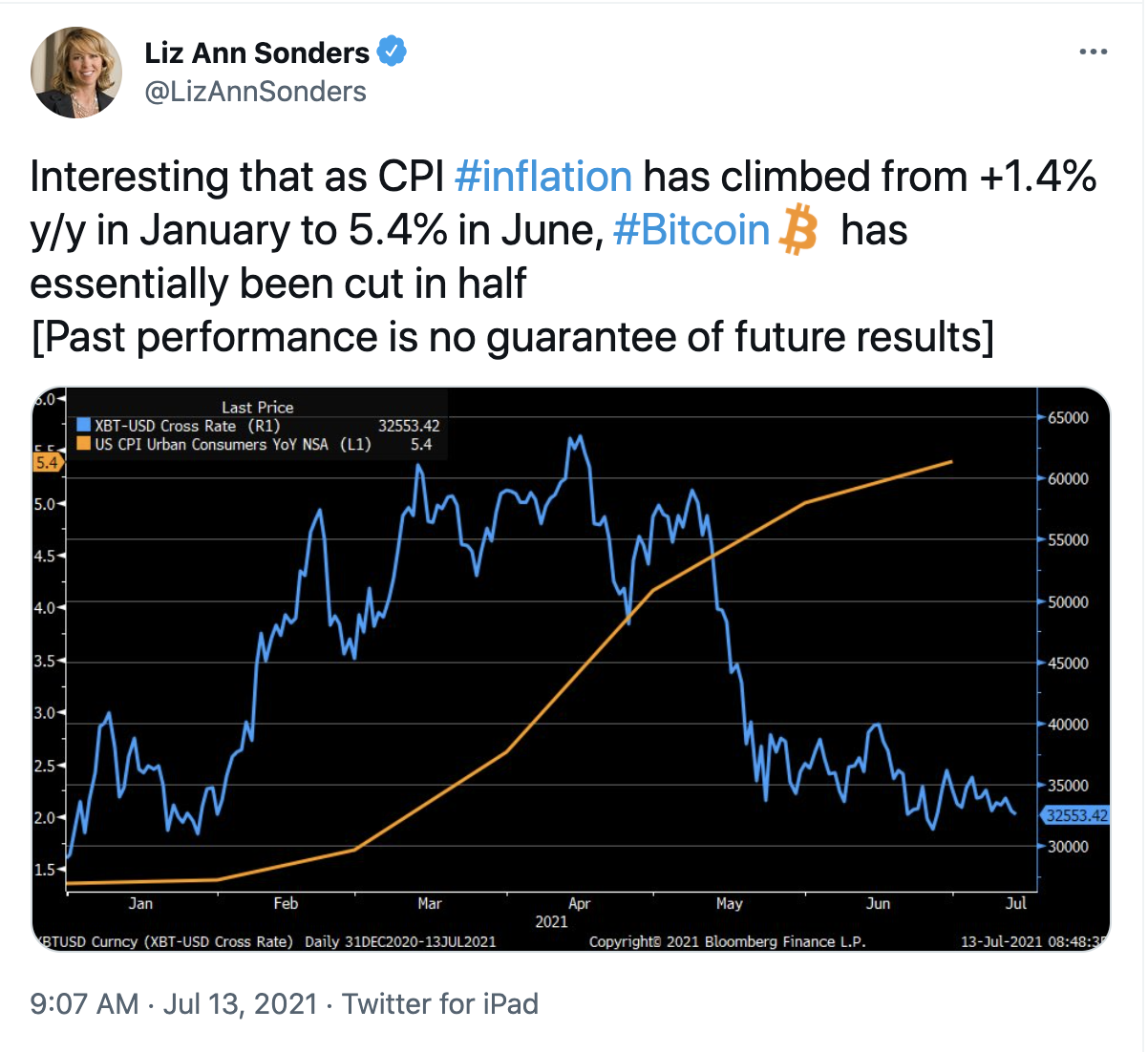

U.S. inflation data out Tuesday, which showed piping hot prices, didn’t cause full-on panic in the U.S. markets, but stocks still closed in the red. Bitcoin and Ethereum still can’t catch a break, slumping on Tuesday even though they’ve been touted as a hedge against inflation. I dig a bit more into the CPI print in today’s essay, especially one line item that’s getting the Street buzzing.

But now, let’s check in on the markets today.

Markets update

Asia

- Asia was in the green, with the Hang Seng up over 1.6%, the Nikkei up 0.5%, and the Shanghai Composite 0.5% higher.

- The Biden administration will reportedly warn U.S. companies this week of the difficulties of operating in Hong Kong, focusing on concerns including China accessing company data, per the Financial Times.

- Japan’s Daiichi Sankyo is planning to start Phase 3 clinical trials of its COVID-19 vaccine in the fall in hopes of using it in Japan in 2022.

Europe

- The European bourses were off, with the Stoxx Europe 600 slightly lower, and France’s CAC 40, London’s FTSE, and the DAX in Germany all barely in the red.

- France slapped Alphabet’s Google with a 500 million euro ($593 million) fine, saying that Google failed to fairly negotiate with publishers in a deal to show news stories on its platform.

- U.K. police seized a record £180 million ($250 million) worth of cryptocurrency as part of a money laundering investigation.

U.S.

- U.S. stocks slumped from earlier highs, with the S&P 500 closing down roughly 0.4%, the Dow off 0.3%, and the tech-heavy Nasdaq nearly 0.4% lower.

- The U.S. 10-year Treasury yield rose later in the day to around 1.4%, following the release of the higher-than-expected inflation data.

- Planemaker Boeing cut its 787 Dreamliner production due to manufacturing flaws. The company’s stock closed over 4% down.

- Big Four bank JPMorgan Chase saw its profits beat estimates in the second quarter as it released loan loss reserves, but revenues slumped about 8% from a year ago, to $30.5 billion. The firm’s stock closed roughly 1.5% lower.

Elsewhere

- Gold is up slightly, trading over $1,800.

- The dollar is up.

- Crude is up, with Brent trading around $76/barrel.

- Despite the high inflation reading, crypto continued to slump, with Bitcoin trading around $32,500 as of Tuesday afternoon, while Ethereum and Dogecoin are also still in the red.

***

Let’s talk about used cars

There’s no denying it: Tuesday’s CPI inflation data was hotter than my morning coffee.

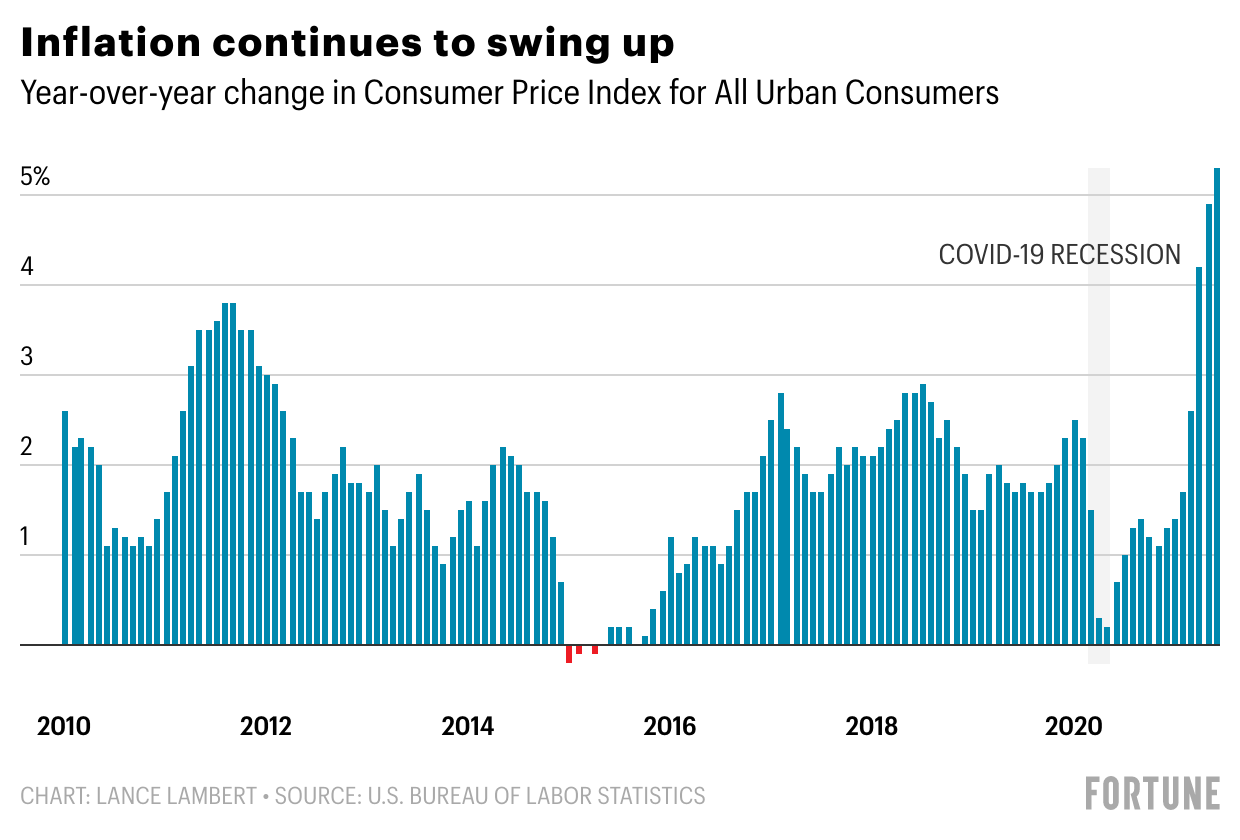

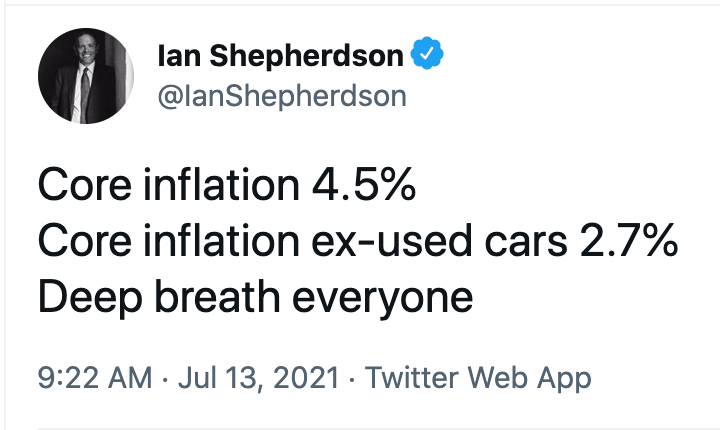

The CPI, or consumer price index, rose 5.4% in June from a year ago, marking the biggest jump since 2008, while core CPI (which excludes food and energy) leaped the most since the early 1990s, at 4.5%.

Big caveat: The numbers look especially dramatic in part because of base effects. In other words, they look big compared to how low they were during the pandemic last year. But we’re also in the midst of a heated debate over that other inflation-related word: “transitory.”

You’ll hear plenty of arguments on both sides for whether or not this period of higher inflation is short-lived or here to stay. Prices were up more than anticipated in June, and some economists predict higher inflation is bound to stick around for years. Others (including, as we all know by now, the Federal Reserve) believe the price spikes are expected and should prove temporary.

But there’s one item that’s been drawing a lot of attention recently: used cars.

Used car prices accounted for one-third of the CPI print, with their prices jumping the most on record, up 45% year-over-year in June and 10.5% from the previous month. And at least for some market watchers, that’s a sign that this level of inflation isn’t sticking around.

“The headline CPI numbers have shock value, for sure; however, once you realize that a third of the increase is used car prices, the transitory picture becomes more clear,” Jamie Cox, managing partner for Harris Financial Group, argued in a Tuesday note. “Inflation is rising, but things are well behaved and have not changed materially.”

NPR also had an interesting piece today about how recently declining wholesale prices for used cars (those paid by dealers) might support a transitory-inflation argument, and that retail prices may follow suit.

“The used car market is really just the inevitable outcome of this semiconductor shortage that we have,” Charles Schwab’s vice president of trading and derivatives Randy Frederick told me. “That actually explains exactly why [inflation] is transitory,” he argues. “Prices aren’t just going up for no reason, they’re going up because there’s a supply constraint and the demand has definitely risen.”

Not everyone is so optimistic that this hot print is a blip.

“The ‘inflation is transitory’ argument is starting to wobble,” Bankrate.com’s chief financial analyst Greg McBride wrote in a Tuesday note. “Even looking past the skewed year-over-year comparisons and measuring from June 2019, the CPI is up at a 3% annualized pace over the past two years. That’s up from 2.55% last month.”

He added that while the pop in prices for things like used cars might be “dismissed” as “unsustainable, … they’ve sustained for several months already. The debate about temporary or problematic inflation will continue for months and will grow more heated.”

Looking at the conflicting comments and takes, one thing is clear: Inflation data can fit more than one story—and the side of the story that perhaps matters most for investors is the Fed’s. (We’ll hear more from Fed chair Jerome Powell at his Wednesday testimony before Congress.)

But higher inflation or not, those like Schwab’s Frederick argue that, with U.S. indexes recently booking records, stocks “are definitely a little high and things are expensive and P/Es are high.”

Side note: Crypto as an inflation hedge? To be sure, the comparisons aren’t perfect, but take a look at this chart tweeted by Charles Schwab’s Liz Ann Sonders on rising inflation and the performance of Bitcoin.

***

Anne Sraders

@AnneSraders

Anne.Sraders@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Conflict of interest? The SEC is reportedly upping the ante on its inquiry into possible conflicts of interest involving ever-buzzy SPACs, or special purpose acquisition companies, Reuters reported. The regulator is reportedly looking into fee structures and whether there's a conflict of interest involved with banks acting as both underwriters and advisors on SPAC deals. Among those who have reportedly been contacted? Heavy hitters like Goldman Sachs, Morgan Stanley, and Citigroup. Read more here.

"Buy now, pay later." Tech giant Apple is reportedly jumping into the "buy now, pay later" craze employed by the likes of Affirm and PayPal, Bloomberg reported on Tuesday. Apple's upcoming service, dubbed Apple Pay Later, is partnering up with Goldman Sachs, per the report. Shares of Affirm plunged over 10% on the news. Read more details here.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

$15.39 billion

That's how much Goldman Sachs posted in revenues in the second quarter this year. That figure crushed estimates but didn't seem to impress investors, with the stock closing down over 1% on Tuesday.