On June 8, Hong Kong’s de-facto central bank, the Hong Kong Monetary Authority (HKMA), signaled it is pushing forward in its drive to develop a usable digital currency for consumers. The regulator announced that an in-depth study on the ‘e-HKD’ will be released next year.

“It is the right time… to explore if we should have an e-HKD. Hong Kong people nowadays, are more willing to use digital banking services [and] many central banks [worldwide] have studied digital currencies,” said Eddie Yue, CEO of the HKMA.

Two weeks earlier in South Korea, the Bank of Korea (BOK), moved one step closer to the creation of its own CBDC. It launched a search for a technology partner to help develop its digital currency.

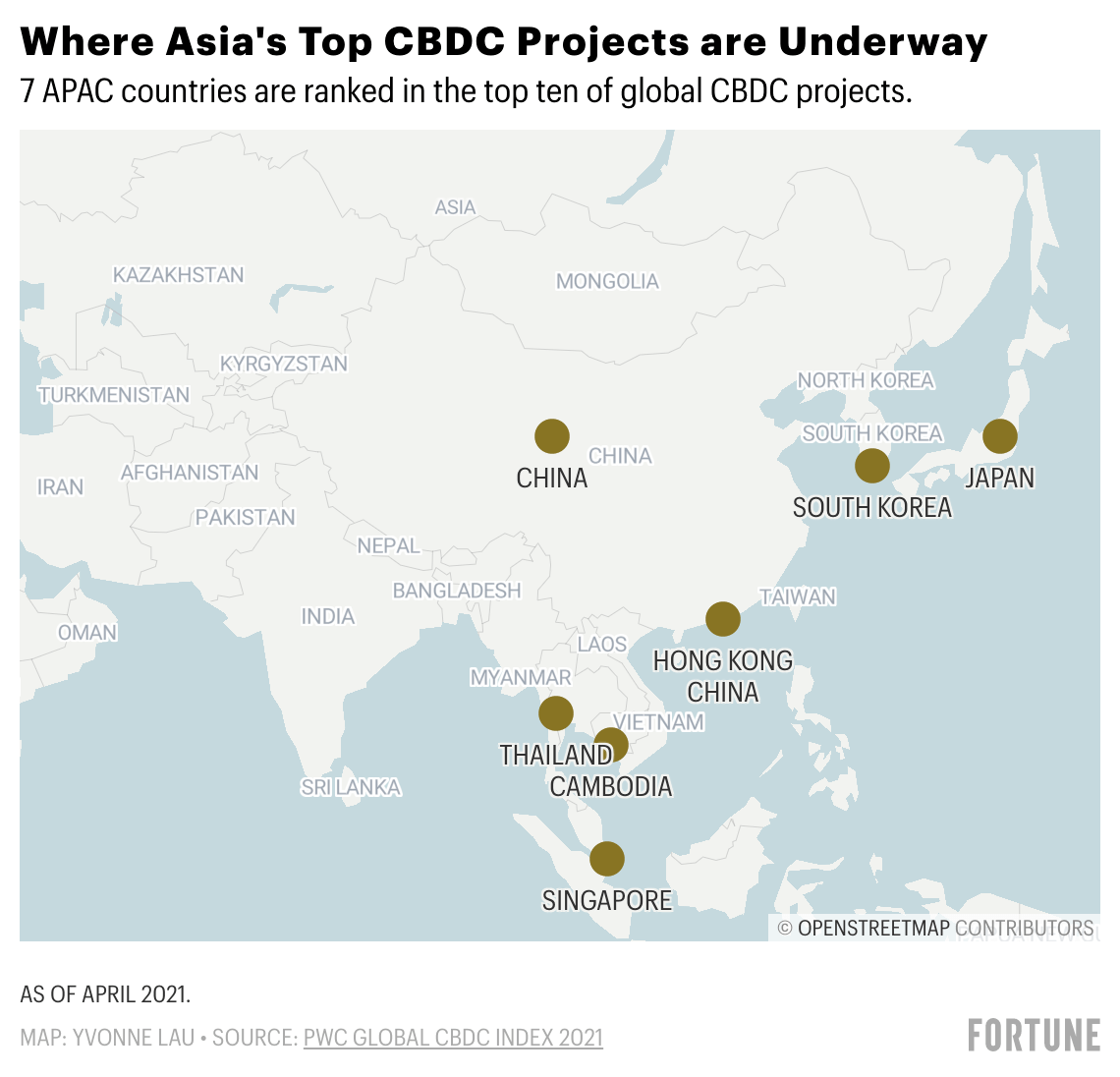

The two announcements, in quick succession, underscore how Asia has pulled ahead in the global race to develop digital currencies that are backed by central banks.

Asia is “by far the most advanced region when it comes to both retail and wholesale CBDCs,” says Henri Arslanian, PwC crypto leader and partner. He says that Asia “probably has the perfect mix of size, resources and knowledge, combined with a willingness to improve the status quo.”

Based on project maturity, three of the world’s top ten retail projects—aimed at creating a digital currency that individuals and companies can use as digital cash—are located in Cambodia, China and South Korea, according to PwC’s first-ever CBDC Global Index. China especially is a standout; its People’s Bank of China (PBoC) became the first major central bank to launch a retail CBDC in April.

Four of the globe’s top ten interbank and wholesale projects to develop a digital currency for financial institutions have launched in Hong Kong, Thailand, Singapore and Japan, according to PwC.

Across the globe, central banks are throwing more and more resources at exploring and trialing CBDC implementation, particularly as cryptocurrencies boom and blockchain technology matures.

In a January survey of 65 central banks by BIS, 86% of respondents said they are exploring the use of digital cash. The BIS says that CBDCs could be used in 20% of the world by 2024.

CBDCs will fundamentally be a “game changer,” says Benoit Sureau, partner, financial risk services and blockchain at PwC France & Maghreb. State-supported digital cash will provide access to alternative payment solutions for both citizens and corporations and reinvent financial market settlement and interbank monetary transactions, he said.

Here’s where the top CBDC players in Asia stand:

Cambodia

Apart from the Bahamas’ ‘Sand Dollar,’ the National Bank of Cambodia’s (NBC) ‘Project Bakong’ is the only live retail CBDC project in the world. Launched in October 2020, Bakong is a blockchain payments platform backed by central bank-held fiat currency. It isn’t a purely ‘native’ digital currency, but one where users use their own cash reserves of Cambodian riels or U.S. dollars to make payments in ‘e-cash.’

Japanese firm Soramitsu developed Hyperledger Iroha, the platform that Bakong runs on. It connects mobile phone users to financial institutions and payment providers, allowing for instant mobile payments without a centralized clearing house. Consumers store their digital cash in a virtual wallet.

The Cambodian government says Bakong is a crucial step to modernize the country’s financial system and boost financial inclusion in a sorely underbanked country that has a strong base of mobile phone users. The implementation of Bakong will also promote payments in Cambodian riels, rather than in the dominant U.S. dollar. As of January, Bakong had transacted over $20 million via 50,000 users and 20 banks.

China

In April, China became the first major economy worldwide to launch a digital currency known as the ‘digital yuan’ or ‘e-CNY.’ It’s the most advanced CBDC project by a major economy. The electronic currency is issued by the PBoC, but distributed by commercial banks and digital payments platforms run by China’s Big Tech firms. In May, Alipay—the country’s largest mobile payments platform with over 1.3 billion users—added the e-CNY to its platform. However, the digital yuan is only enabled for some users since the currency is still in a pilot phase.

The world’s second-largest economy was the first to begin exploring CBDCs in 2014.

“If you want to know what the future of money looks like, don’t waste your time in Silicon Valley or London,” says Arslanian. “All eyes should be on China—they are easily four to five years ahead of every major country when it comes to retail CBDC.”

China hasn’t yet rolled out the digital yuan nationwide but has conducted trials in four major cities—Shenzhen, Chengdu, Suzhou and Xiong’an—by giving away free digital cash via lotteries. During the Lunar New Year, e-commerce giant JD.com took part in a $3 million lottery trial. Winners received a ‘red packet’ app worth 200 RMB on the JD app, which they could spend on the site.

PBoC vice-governor Li Bo said that testing proved the digital yuan is compatible with China’s financial system, but the PBoC is still working to develop the digital yuan for widespread domestic use, improve functionality and security, and ensure a sound regulatory framework. Li expects physical cash and digital currencies to coexist for some time.

By the end of last year, Chinese citizens had spent more than $300 million using the digital cash in 4 million transactions. The country is now preparing for more widespread use and preparing the digital yuan for use at the 2022 Beijing Winter Olympics.

Hong Kong

Hong Kong unveiled its ‘Fintech 2025’ strategy on June 8, which restated its commitment to developing a usable CBDC. Eddie Yue, CEO of the Hong Kong Monetary Authority (HKMA) said that the regulator will “soon begin a comprehensive study on ‘e-HKD’ to understand its use cases, benefits and risks.”

As China’s PBoC ramps up its multi-jurisdictional efforts, it’s launched joint projects with the HKMA, including a cross-border trial to explore how Hong Kong residents can use and top up their virtual wallets with digital yuan.

HKMA’s chief fintech officer, Nelson Chow, said that the trials will ultimately facilitate easier use of digital yuan for Chinese residents when they cross into Hong Kong.

Roger Xie, an equity analyst at Fosun Group, says it’s likely the “majority of Hong Kong-based retail banks will roll out their own mobile apps with the capability to transact e-HKD and e-CNY in the near-term.”

Hong Kong-Thailand

Project Inthanon-LionRock, a joint project between the HKMA and Bank of Thailand (BOT), is the world’s most mature interbank/wholesale initiative to date. The two countries’ central banks joined forces in 2019 to test the use of CBDC in cross-border payments between financial institutions.

In 2021, the project started its second phase of developing a software prototype to facilitate cross-border CBDC settlements. In this stage, the countries will also explore how to expand use to multiple jurisdictions and currencies.

In February this year, China and the United Arab Emirates joined the project, dubbed ‘m-CBDC Bridge’ or Multiple Central Bank Digital Currency Bridge Project, to explore multi-jurisdictional solutions.

South Korea

On May 23, the Bank of Korea announced that it’s looking for a technology partner to launch its ‘E-won’ pilot program, which will run from August to December this year. It is the latest step in the country’s CBDC effort—and a significant one at that.

Alongside the selected partner, the BOK will operate a CBDC in a limited environment and capacity—via a test platform—to analyze functionality and security. The platform will simulate the services of commercial banks and retail outlets, such as fund deposits, money transfers and mobile payments, to test the functionality and security of its e-Won

A BOK official said in a May press conference that the country’s cash transactions are declining significantly. “The steps we are taking now are to prepare for the changes in the payment settlement system, [which is] changing rapidly.”

Singapore

The Monetary Authority of Singapore (MAS) kickstarted its CBDC initiative ‘Project Ubin,’ in 2016 in partnership with JPMorgan and state investment firm Temasek. Last July, the fifth and final phase of testing was completed. The five phases included a range of tests of blockchain-based payments, conducted with over 40 financial and non-financial institutions.

Piggybacking on Ubin, Singapore began a joint project with the BIS called ‘Project Dunbar,’ which is initially focused on developing a common platform for multi-currency CBDC settlement that works for central banks and financial institutions.

Singapore’s MAS is also seeking greater collaboration with other central banks, particularly China’s PBoC.

Japan

In April, the Bank of Japan (BOJ) announced that it has begun the first phase of trials for a retail-focused ‘digital yen,’ which will run until next March. This initial phase will test the “basic functions…core to CBDC as a payment instrument—such as issuance, distribution and redemption,” said the BOJ in an official statement.

In January last year, parliamentary vice minister for foreign affairs Norihiro Nakayama told Reuters that Japan’s digital currency could be a joint venture between public and private sectors to align Japan with global changes in financial technology.

The BOJ is planning two additional trial phases after March 2022. Still, there are no concrete plans to actually launch the digital yen, yet.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.