Although the U.S. economy is beginning to bounce back, we will be dealing with the blow struck by COVID-19 for a long time. During 2020, U.S. GDP fell by 3.5%, and although growth is predicted to return this year, the pandemic could still result in an estimated $3.2 to $4.8 trillion GDP loss over the next two years.

Our country’s economic recovery will depend on harnessing its deep natural reserves of creativity and talent—especially the potential of our young people. It is the generation now at college who will ultimately rethink the world, come to old problems with fresh eyes, and create the innovations on which tomorrow’s prosperity will depend.

Unfortunately, however, some universities are pursuing policies that are putting the brakes on the careers of graduates, forcing them into low-paid jobs that don’t allow them—or their country—to benefit from their years of hard study. And, if these same graduates were able to get better-paying jobs, they’d be able to pay off their debt.

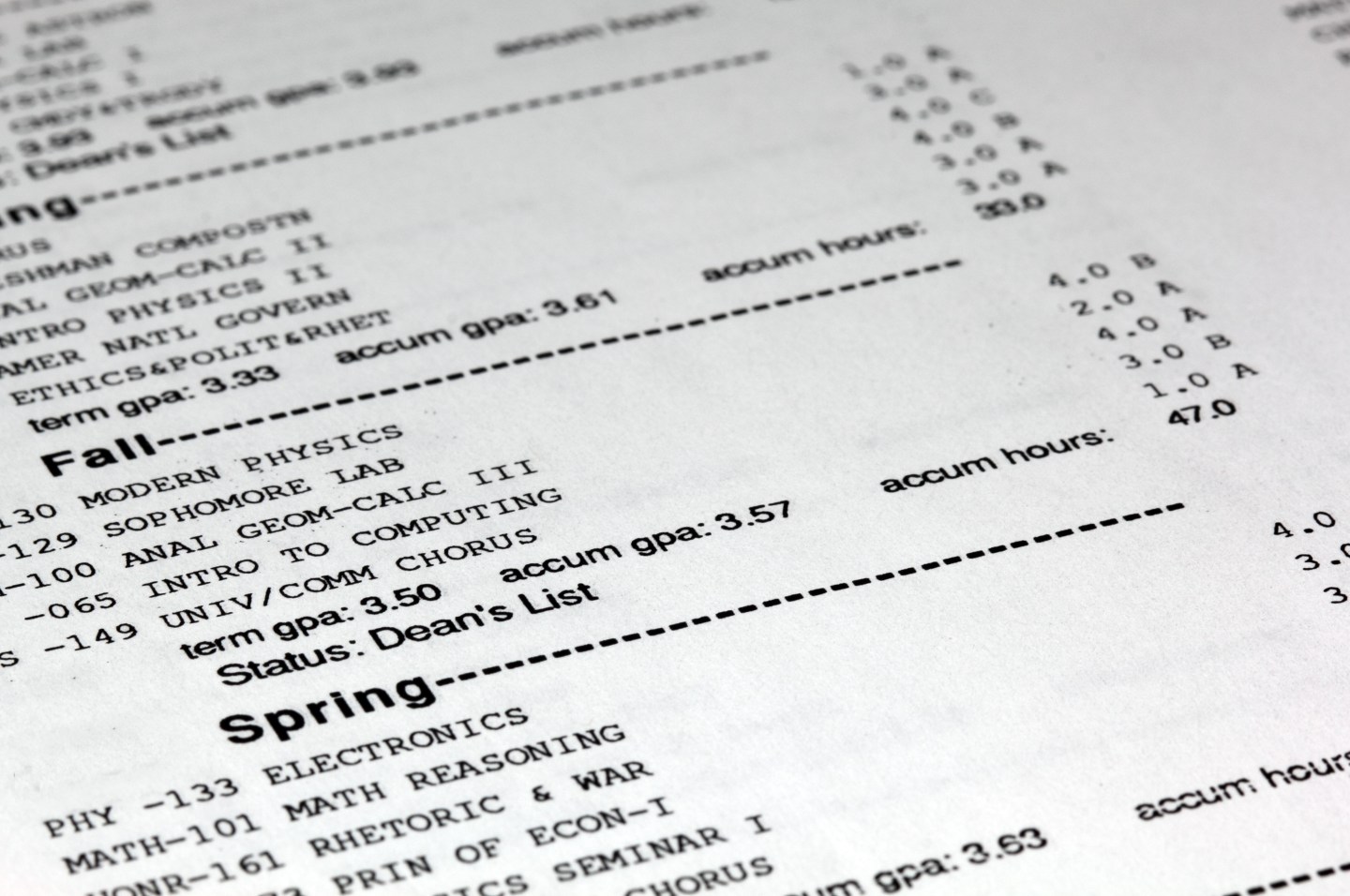

In many states, colleges are enforcing the practice of withholding the transcripts of graduates who have any remaining debt to the college—often for marginal amounts. These policies may be affecting around 6.6 million students in the U.S., hampering them at the starting gate of their careers and potentially affecting them for life.

With undergraduate enrollments down 4.4% this year, COVID-19 has put many American universities under severe financial pressure. Even prestigious statewide institutions such as the University of Arizona are projecting a $250 million revenue loss, and overall, it is estimated that 20% of liberal arts colleges (around 200 institutions) could go out of business.

It’s understandable that universities are anxious to balance their books. But the practice of withholding transcripts ultimately harms everyone involved: graduates, their universities, and the wider economy.

Colleges don’t have to forgive the debt. But, given the awful year students have gone through, what a wonderful time it would be for colleges to show some sensitivity to the student struggle by stopping this terrible practice. When 37% of U.S. college students struggled to afford food over the last year, and nearly one-third were laid off from their jobs due to the pandemic, it is simply unrealistic for universities to expect all remaining debt to be paid before graduates have begun earning.

The opportunity cost for the U.S. economy and society is devastating, at a time we should be using every opportunity to fuel our recovery. According to one study, a growth of just 1% in the number of bachelor’s graduates over the last decade would have boosted U.S. GDP by $130 billion.

And the existing shortage of skilled graduates means we are withholding transcripts at a time when the economy can least cope with it. In the U.S., just 37% of people have a bachelor’s degree or higher qualification—far too few for an increasingly services- and tech-focused economy.

Withholding transcripts is symptomatic of the wider crisis in higher education around tuition and student debt. Currently, 3 million people in the U.S. owe more than $100,000 in student debt alone, and total student debt nationally is now at $1.7 trillion—the second largest form of consumer debt behind mortgages. Over a third of U.S. students don’t believe they’ll ever pay theirs off.

While this problem cries out for solutions, they need to be structural, systemwide remedies rather than unilateral sanctions. Some states, including Washington and California, have passed laws that ban transcript withholding. But the simplest way to restore fairness is to enact a federal law prohibiting these measures.

Now is not the time to withhold the lifeblood that young people can bring to the economy. History will look kindly on those colleges that understand, whatever the financial pressures, that we can’t afford to lose the contributions of college students. And it seems particularly unfair to place further barriers in front of a generation that, over the last year, has already seen its hopes, plans, and dreams indefinitely deferred.

Dan Rosensweig is the CEO and president of Chegg.