Archegos Capital Management imploded last month with all the force of a collapsing star, lopping off billions from the trading profits of some of the world’s biggest investment banks.

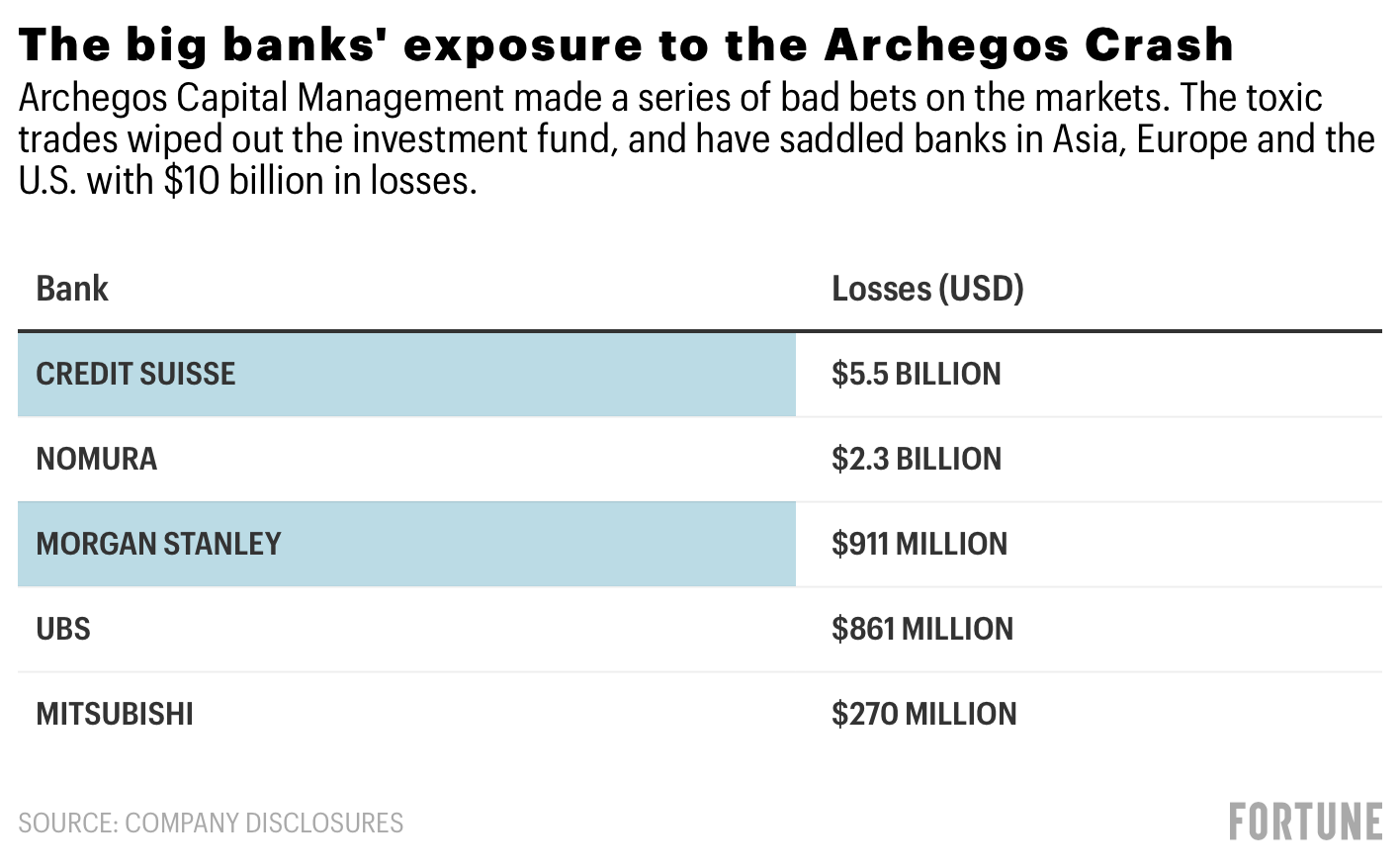

After Tuesday’s disclosures by Swiss giant UBS and Japanese lender Nomura, the hit to banks so far is roughly $10 billion.

Bill Hwang’s hedge fund may have only traded on its own behalf rather than clients, but it was still able to borrow enormous sums of money for high-risk bets with the help of prime brokerage accounts scattered among Wall Street firms.

As the economic losses resulting from one single, solitary client piled up, bank executives were unanimous in calling for greater transparency into the opaque dealings of these so-called “family offices.”

Below is a list of banks that acknowledged having lent on margin to Hwang’s Archegos Capital, and the resulting fallout on their results in the first quarter and, if applicable, also in the second.

Credit Suisse

The Zurich-based lender forecasts first-half losses of 5 billion francs ($5.5 billion), the equivalent of pretax profits over the past five years at its investment banking division. In addition to slashing its dividend to a third, the bank raised 1.7 billion francs ($ 1.9 billion) in loss-absorbing equity to plug holes on its balance sheet. Chief Executive Thomas Gottstein sacked a number of key managers, including two he personally promoted last summer. He also plans to shrink the prime brokerage business by a third. As of last Thursday, Credit Suisse still had 3% exposure to Archegos remaining on its books.

Nomura

The Japanese bank, which acquired Lehman’s European business after the latter went bankrupt in the financial crash of 2008, reported on Tuesday that it would take a $2.3 billion dollar hit from Archegos. Despite being the second biggest casualty after Credit Suisse, Nomura won’t be drawing any immediate lessons from the debacle. “We are not planning to make major changes to our global business strategy,” CEO Kentaro Okuda told a media briefing.

Morgan Stanley

The U.S. investment bank suffered losses of $911 million. CEO James Gorman said he would “certainly be looking hard“ at family office clients such as Hwang’s. “Frankly, the transparency and lack of disclosure relating to those institutions is just different” compared with hedge funds, he told analysts during an earnings call.

UBS

Credit Suisse’s crosstown rival revealed a surprise $774 million trading loss arising from Archegos in its first quarter results on Tuesday, warning a further $87 million was still to be booked for the second quarter as it winds down its exposure. Ralph Hamers, CEO of the bank since November, characterized the loss as “pretty idiosyncratic” in a call with analysts on Tuesday and pledged to protect the business with prime clients — a crucial part of the UBS franchise. Unlike Credit Suisse, finance chief Kirt Gardner said Swiss regulator Finma had not launched enforcement proceedings against UBS.

Mitsubishi UFJ

The Japanese banking house estimated a $300 million hit initially, but came in slightly below with $270 million. The loss seems paltry compared to its peers, but it could still badly dent MUFG’s European securities operations. The firm’s London-based subsidiary, MUFG Securities EMEA, posted a profit of just £84 million ($117 million) in 2019, according to the most recent filing available from the U.K. Companies House.

Goldman Sachs

Probably the world’s most sophisticated player in capital markets, the storied firm has sometimes been on the wrong end of trades, such as in the infamous Abacus deal, yet it never seems to suffer losses of its own. CEO David Solomon told CNBC recently that he was very pleased how his team took “prompt, corrective action” to protect the bank. So far no material losses have been announced.

Deutsche Bank

In recent years it has seemed like every major financial scandal has affected Germany’s largest lender. The Frankfurt firm is set to publish first-quarter results on Wednesday, but so far the bank seems to have dodged any material Archegos-related losses. Reportedly it was swift to unwind its $4 billion exposure.