Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.

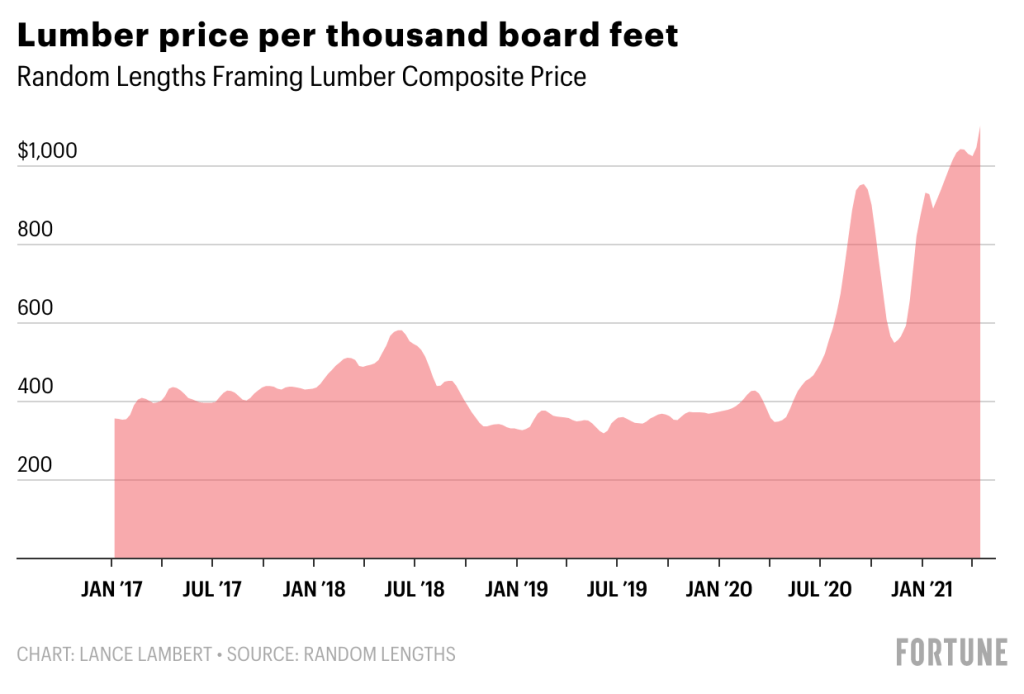

Homebuilders and do-it-yourselfers just can’t catch a break: On Friday, the price per thousand board feet of lumber jumped to an all-time high of $1,104, according to Random Lengths. That’s up a staggering 208% from a year ago.

For months, lumberyards and homebuilders held off on buying lumber in hopes that prices would correct before spring and summer building kicked off. Price relief hasn’t materialized, so now they’re rushing to buy. That frenzy is sending prices further north: On Monday, the May futures contract price per thousand board feet of two-by-fours jumped $32 to $1,326. That uptick once again triggered the circuit breakers and caused lumber trading to halt for the day.

Why haven’t prices corrected back to pre-COVID levels? Simply, backlogged supply can’t catch up to robust demand. But the full story is a perfect economic storm worthy of its own business school case study.

When the pandemic struck last year, shutdowns caused sawmills to halt production at the same time quarantining Americans rushed to Home Depot and Lowe’s to buy up materials for do-it-yourself projects. That supply-and-demand mismatch caused lumber inventory to plummet. It only got worse from there. Aided by recession-induced record low interest rates, the housing market boomed in the summer of 2020. As that market got hotter and existing home inventory fell, buyers turned to new construction. Of course, new homes require a lot of lumber, thus exacerbating the shortage.

On the supply side, production is finally rebounding: Wood production hit a 13-year high in February. But because of limited mill capacity and labor shortages, that alone can’t solve the scarcity. Classic economic theory suggests surging prices should help to dampen demand. That hasn’t happened yet. In fact, the demand for lumber has only gone higher. In March, new housing starts hit its highest levels since 2006.

Tight-budgeted DIYers don’t want to hear this, but pre-pandemic lumber prices might never return.

“I don’t think we ever go back to levels we had prior to this boom,” Michael Goodman, director of specialty products at Sherwood Lumber, told Fortune.

Why? Demographically speaking, we’re going to need a lot more lumber in the years ahead. The five largest years for millennial births occurred between 1989 to 1993. And we’re currently in the five-year window when this seismic group of younger millennials will hit the age of 30—an all-important age for first-time homebuying. A Fortune-Researchscape International poll conducted in April found 54% of these young millennials plan to buy a home in the next five years. But as the result of years of under-building following the 2008 housing bust, the country doesn’t have enough homes to accommodate that level of buying. That’s why we’re already seeing these millennial buyers cause housing inventory to dry up: The total number of homes for sale in the U.S. has dropped over 50% in the past 12 months. That means builders—and lumberyards—should remain plenty busy.

That is, if supply can keep up. Currently, sawmill capacity is too low. And even if capacity grows, it doesn’t fix the limited supply of Canadian softwood lumber, which—unlike abundant Southern yellow pine—is the go-to for framing homes.

“If the production factors remain that are limiting log supply, I find it hard to believe we return to historical price ranges,” Stinson Dean, CEO of Deacon Lumber, told Fortune.

Returning to the April 2020 price of $358 per thousand board feet is a pipe dream. But don’t scratch off the possibility of a mild pullback. If sky-high prices finally cause demand to slow a bit, Goodman says later this year we could get back to around $800.