This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Happy April First.

After the Volkswagen’s joke’s-on-you-ha-ha stunt, I’ve informed the girls that April Fool’s jokes are banned this year. In Italy, anyhow, it’s called Pesce d’aprile, which literally translates to April’s fish!

That, I will wish you all. Happy April’s fish!

Speaking of plenty-of-fish-in-the-sea, the Biden Administration has finally unveiled its infrastructure plan. So far, the markets like what they see. U.S. futures are gaining this morning after a big Nasdaq rebound on Wednesday.

In today’s essay, I detail which stocks, bonds and other financial assets had a good quarter—and which ones didn’t—and what to look for in the quarter ahead.

But first, let’s see what else is moving markets.

Markets update

Asia

- The major Asia indexes are higher in afternoon trading, with the Hang Seng up nearly 2%.

- Remember the name: the mobile ad firm InMobi Pte. That’s India’s first unicorn, and it’s plotting a 10-figure IPO in the U.S. this year.

- The World Trade Organization has revised upwards its 2021 global forecast for the trade in goods, the biggest increase since 2010 when the world was climbing out of the global financial crisis.

Europe

- The European bourses are mostly higher with Paris’ CAC 40 the laggard. It was as flat as a croque monsieur (the train-station variety) at the open, before rebounding.

- With COVID cases rising quickly, France announced on Wednesday night a month-long shutdown of schools and some businesses, a move that puts the increasingly unpopular Emmanuel Macron in further political hot water.

- Deutsche Bank emerged more or less unscathed from the Archegos hedge fund meltdown. How? It sold off $4 billion in quickly souring trades last Friday.

U.S.

- U.S. futures have been gaining throughout the morning, with tech leading the way. That’s after the Nasdaq closed out the quarter on a high note, gaining 1.5% on Wednesday.

- We now have an initial price tag for the Biden Administration infrastructure plan: $2.25 trillion. To pay for it, the president wants to bump up the corporate tax rate to 28%. The Business Roundtable is not a fan.

- Jobless claims numbers come out ahead of the bell today. That’s a precursor to tomorrow’s big non farm payrolls report. A reminder: today is the final trading day of the week. Another reminder: with markets closed, this is the last issue of Bull Sheet this week.

Elsewhere

- Gold is flat, trading below $1,720/ounce.

- The dollar is gaining again even with equities on the upswing.

- Crude is up with Brent trading above $63/barrel.

- Bitcoin is trading above $58,000.

***

Winners and losers: Q1

Q1 is in the books.

For those of you who liquidated your Tesla holdings on New Year’s Eve and sunk it into GameStop, congratulations. The cigars are in the mail.

If you thought 2020 was strange, get a load of what we’ve seen so far in 2021. There are a few surprises in the numbers.

“For equities, both March and Q1 marked a very strong performance, and in a major reversal from 2020, it was European indices which saw the largest advances,” Deutsche Bank investment strategist Jim Reid and research analyst Henry Allen wrote in an investor note this morning. “Over Q1, the DAX (+9.4%), the FTSE MIB (+11.3%) and the STOXX 600 (+8.4%) all saw solid gains in total return terms, while banks led the way thanks to higher yields, with the STOXX 600 Banks up +20.3% over the quarter.”

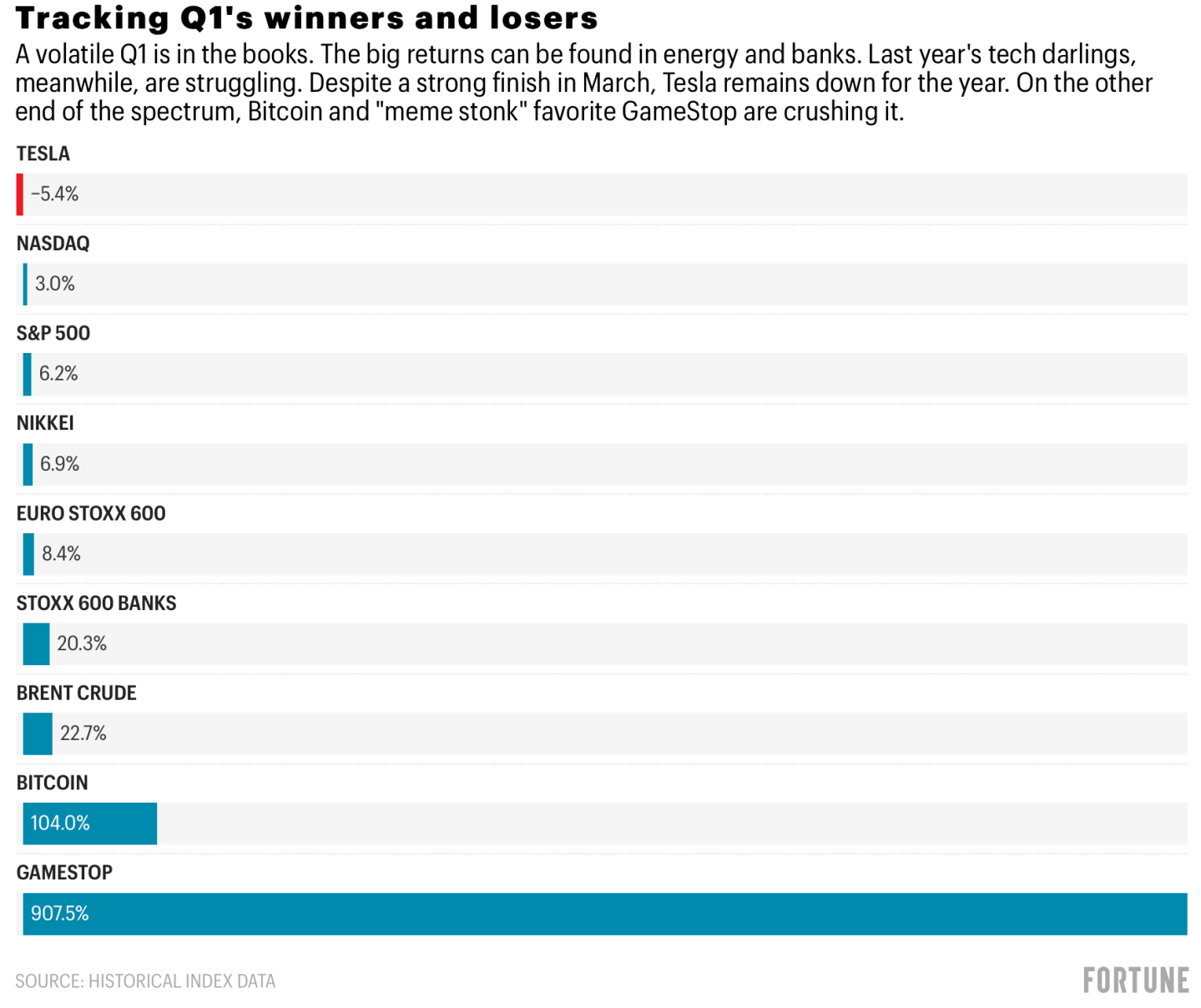

I break out the winners and losers in the following chart:

For our list, the lone asset in the red is TSLA, which is down 5.4% YTD. Incidentally, Tesla closed out the quarter with a bang, gaining 5% yesterday, enough to pull it out of correction territory (on a quarterly basis).

On the other end of the spectrum are Bitcoin (+104%) and GameStop (+907.5%). Energy and banks have had a heck of a run too, as has the dollar.

Some other duds include: gold (-10%), silver (-7.5%) and Chinese equities. The Shanghai Composite fell 0.9% in Q1.

Across the board, bonds had a brutal quarter, including: German bunds (-2.4%), British Gilts (-7.3%) and U.S. Treasuries (-4.5%). As you recall, trouble in the bond markets in Q1 spilled into equities, ratcheting up volatility with stocks. That has the effect of pushing up yields, which weighs down growth stocks. That’s one big thing to watch for in the quarter ahead.

Here’s the good news: April, historically, has been a good month for equities, and the Wall Street pros see reason for optimism as we turn the page on the calendar.

“Weak late March seasonality could offer an opportunity for the bulls ahead of strong early April seasonality,” Stephen Suttmeier, technical research strategist at Bank of America, wrote in a Tuesday report, as “the first 10 sessions of April has an average return of 0.88% (1.12% median),” while the last 10 sessions of March has an average return of negative 0.29%.

In other words, stay tuned.

***

Programming note: I will be off until Tuesday April, 6. But good news, stock bulls. Rey Mashayekhi will take the wheel of Bull Sheet on Monday. Good things happen when Rey is in charge… Have a nice Easter break, everyone.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Wrong delivery. British tech darling Deliveroo is down again this morning in early trade. That's after the meals-delivery specialist had a dreadful stock market debut yesterday. There's a lot riding on the fortunes of the firm that extend well beyond its share price.

Archegos fallout. Now the Feds are getting involved. According to Bloomberg, the SEC will investigate the precarious trades that led to the downfall of Archegos Capital Management.

S&P 4K. As of yesterday's close, the S&P 500 is a mere 27 points from the mighty 4,000 mark (which is pretty amazing seeing as it was well under 3K a year ago at this time). With SPX rising to new heights, Fortune's Shawn Tully takes a fresh look at the benchmark index, and presents five reasons we should be wary of its great gains.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quiz Time

Which global financial asset was the top performer (by total return, in USD) for March? Was it...

- A. Dax (Germany)

- B. Athex (Greece)

- C. DJStoxx 600 Banks

- D. S&P 500

The answer is B, Greece's Athex. According to Deutsche Bank, the Athens Exchange rocked to a 9.2% gain last month. It's up 6.9% YTD, despite a rough January.