This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, and happy Friday, Bull Sheeters.

Do you hear that? It’s the sound of the world’s biggest helicopter all set for take-off, ready to dump piles of cash on the good people down below. Okay, that’s not how helicopter money gets to the masses. But the dough will soon arrive now that President Joe Biden has signed the American Rescue Plan into law.

Alas, investors are being true ingrates. U.S. futures and global equities are faltering with tech leading the way lower. Tesla is off more than 4% in pre-market. Adding to the risk-off mood, the dollar is on the rise, and bond yields are up. Is this a classic case of selling on the news?… In crypto land, Bitcoin is holding up just fine.

Let’s spin the globe, and see what’s happening.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading, with the Nikkei up 1.7%.

- The largest IPO of 2021 belongs to Seoul-based Coupang. The e-commerce giant went public on the NYSE yesterday, raising $4.6 billion. Fortune‘s Lucinda Shen spoke to CEO Bom Kim about the firm’s ambitious plans.

Europe

- The European bourses were lower with the Stoxx Europe 600 off 0.3% at the start.

- Shares in Deutsche Bank were 0.8% higher at the open despite the German lender guiding down its 2021 top-line as it expects trading revenue to drop this year.

- The pound sterling was softer in FX trade this morning even as the latest data showed the U.K. economy has fared a bit better than expected in January.

U.S.

- The U.S. futures have been falling all morning. That’s after the Dow and S&P 500 closed at fresh all-time highs on Thursday, helped by a surge in tech stocks. It’s the opposite story this morning.

- There’s selling in the bond market at the moment, pushing yields higher. That’s after a closely watched 30-year auction went smoothly.

- Speaking of bonds… Verizon yesterday sold $25 billion worth of corporate bonds, the biggest such debt sale of 2021, as it readies an ambitious investment in 5G.

Elsewhere

- Gold is down, trading below $1,700.

- The dollar continues to gain ground as equities and futures falter.

- Crude is off, with Brent trading just below $70/barrel.

- Bitcoin is steady after topping $58,000 overnight. It’s appreciated about 20% since this time last week.

***

By the numbers

675

Last week at this time, things looked pretty dire for tech bulls. The Nasdaq had just fallen into correction territory, off 10.2% from its intraday Feb. 12 all-time high of 14,175. It has since climbed 675 points, or 5.3%. That rebound comes amid a period of calm in the bond markets. The closely watched 10-year Treasury topped 1.60% on Monday afternoon, and then fell. At that point, tech stocks took off. Alas, that same yield has climbed by six basis points overnight and Nasdaq futures are sinking.

Up or down?

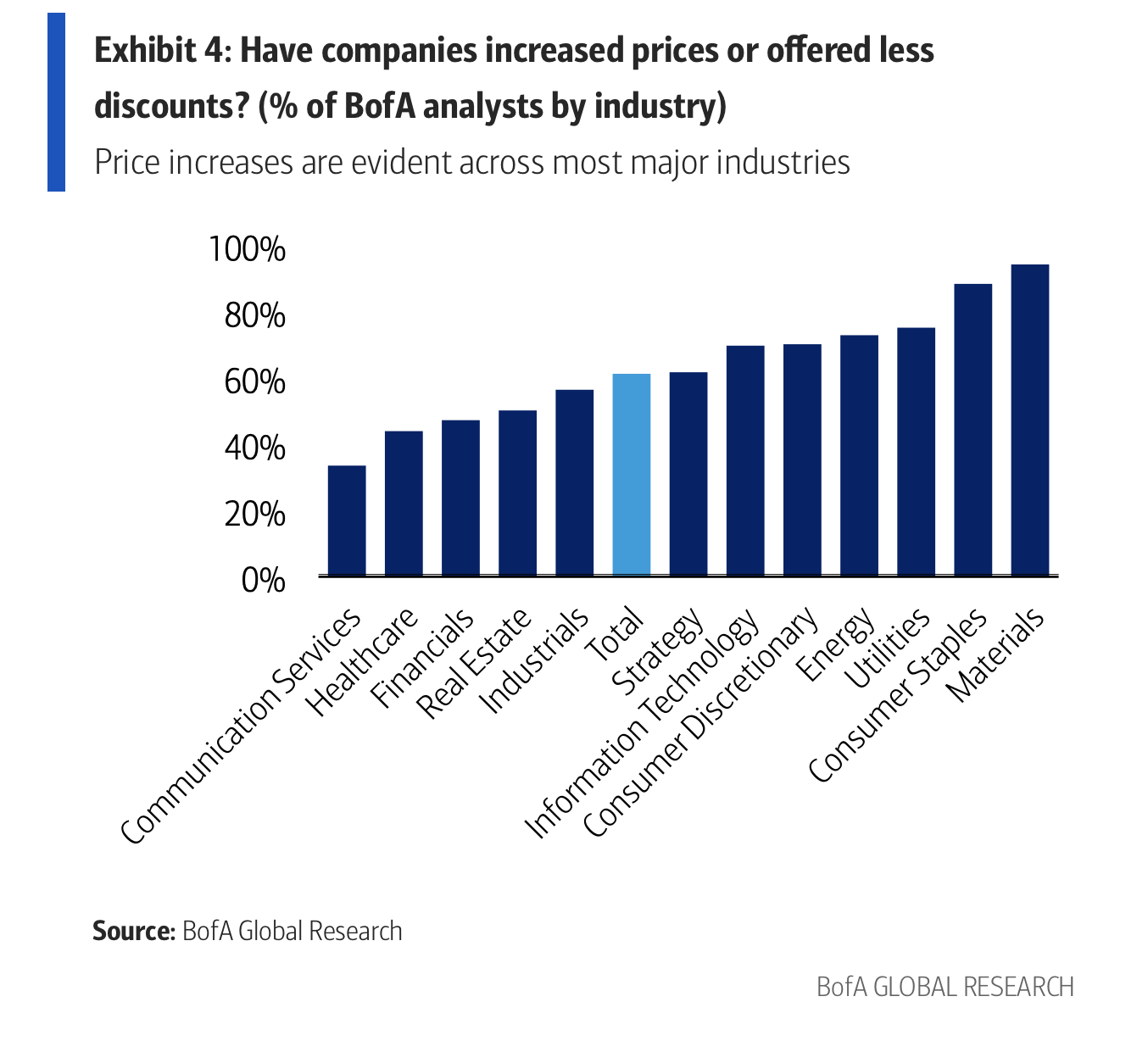

Bond yields are particularly sensitive to rising prices—or even the expectation of higher prices. And there’s a confluence of factors pushing inflation expectations higher: pent-up consumer and business demand, high household savings (more on that below), the presumed reopening of the global economy (we can thank COVID vaccines for that), and trillions in stimulus spending by the world’s biggest economies. If stimulus checks hit bank accounts this weekend, we could see a surge in consumer spending—in what? How about in digital artwork? Against this backdrop, BofA Securities conducted a global survey of analysts to answer the question: are companies planning to boost prices in the near term? The answer: a resounding yes!, led by companies in the materials, consumer staples and energy sectors. Brace yourself for higher gas prices, more expensive shampoo, booze and cigarettes. But you can afford it.

$130.2 trillion

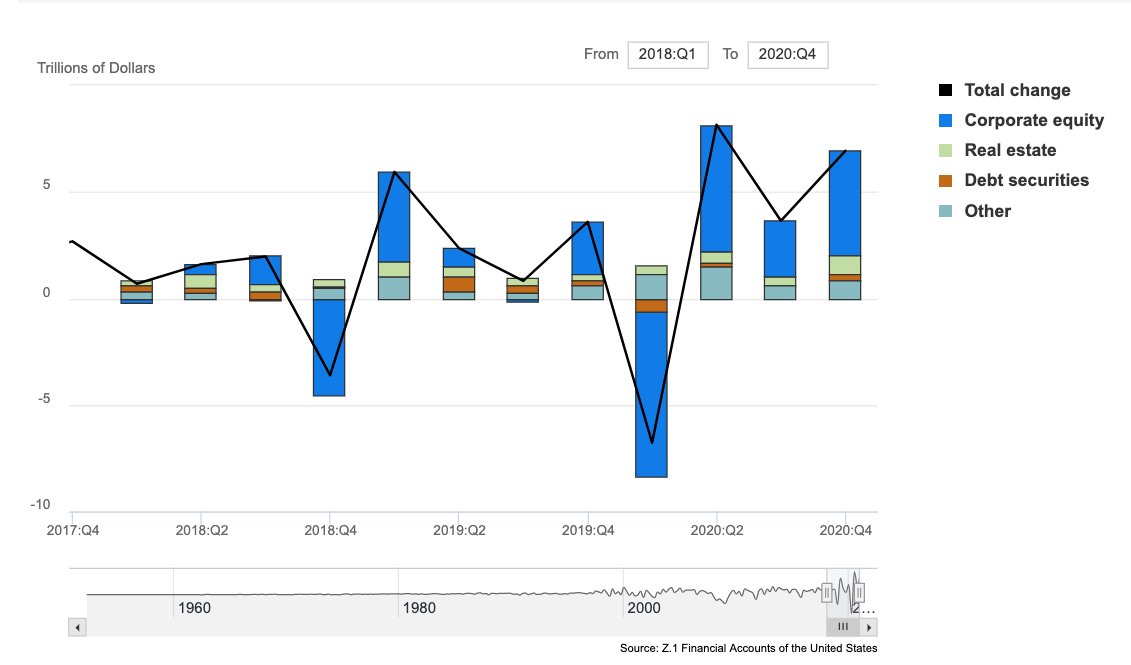

One of my pet questions for economists used to be: What’s better? To live in a country with high sovereign debt, but low household debt? Or, the opposite? A place where household debt is precariously high, but sovereign debt is low? For the former, I was thinking of Italy; for the latter, the United States. But the U.S. has gone more like Italy in recent years—that is, sky-high federal deficits and, somewhat more promisingly, lower household debt. In fact, U.S. households’ net worth, as of the end of Q4 2020, hit an all-time high of $130.2 trillion, the Federal Reserve reported yesterday. That nest egg grew an astonishing 10.1% above the Q4 2019 level. As Berenberg economist Mickey Levy explains, household net worth is “a measure of the value of financial (stocks and bonds, etc.) and nonfinancial (real estate, etc.) assets held by households and nonprofits—and its strong rise following the deep economic contraction in Q2020 is striking.” For some Americans, the pandemic has done wonders for their credit ratings.

Now, what’s the answer to my riddle above? Depends on who you ask. If you have high household debt, you’ve gotta pay up. If your country is running up big debts, everybody pays.

***

Postscript

We hit something of an anniversary this week. A full year ago, I first went off script and started including the occasional postscript at the bottom of Bull Sheet. We had just gone into a strict lockdown back then, and I wanted to communicate from captivity that we in Rome were doing just fine.

Once the lockdown ended, I used this space to riff on things that got further and further off topic: General Patton in Sicily, restaurant recommendations if you’re ever in the Apennines, and Tuscan soup recipes. The feedback on postscript has been a real lift for me, and I want to thank you for that. I got hugely helpful advice from you on puppy rearing. And, a reader even penned an SFW limerick starring the word “impavid.”

I know the postscript has been somewhat sporadic of late. I’ll try my best to correct that.

Just this morning we’re getting news that schools here may close again as soon as next week as COVID cases spike. Those blasted variants! The last time we were all crammed into this apartment, the postscripts became a nice distraction for me. I may need such a therapy yet again. Stay tuned.

***

Have a nice weekend, everyone. I’ll see you back here on Monday… But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Dark money. Unnamed funders poured an estimated $750 million in dark money contributions into last year's U.S. elections. Such murky funding—when done by corporates, anyhow—is becoming a big concern among ESG investors, and now there are fresh efforts to bring it into the light, Fortune's Rey Mashayekhi reports.

Overreach? Cryptocurrency heavyweight Ripple Labs is embroiled in an SEC probe that has now escalated to impact the personal finances of co-founder Christian Larsen and Chief Executive Officer Bradley Garlinghouse. Their response? It's “wholly inappropriate overreach,” they say.

Stimmy update. Direct deposits could hit bank accounts as soon as...this weekend. Party on!

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

38 billion

The big question hanging over markets involves bond yields. When they spike up, equities get hit. That's why Wednesday's auction was so closely watched. But the U.S. succeeded in placing $38 billion worth of 10-year notes, and demand was fairly strong. What happened? Overseas investors stumped up for the notes as U.S. debt is still seen as the best out there, and that could keep the Treasuries market buoyant for the time being—a good sign for stocks.