This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. The checks may not yet be in the mail, but investors are already celebrating. U.S. futures are gaining on Thursday, following Asian and European shares higher after Democratic leaders yesterday hailed, “help is on the way.”

Now that the $1.856 trillion American Rescue Plan has cleared Congressional approval, economists and Wall Street forecasters are busy running the numbers on one of the largest federal aid packages for American families since the Great Depression. They figure all this helicopter money could now boost U.S. GDP by five, six or even 7% this year, and that it will lift the global economy as well.

That should add rocket fuel to the reopening trade—so good news for small caps. Of course, there are tradeoffs. First, there’s the question of who’s going to eventually foot the bill for such a generous bag of goodies. And then there’s inflation.

Rising prices typically accompany huge growth spikes, and that usually means rising rates and further pressure on growth stocks—i.e, tech. Sure enough, the Nasdaq faltered in afternoon trade as some closely watched gauges on tech bearishness climb. But so far this morning, bond yields are fairly subdued, and that’s adding to the risk-on mood in equities.

Let’s see where investors are putting their money.

Markets update

Asia

- The major Asia indexes are solidly higher in afternoon trading, with the Shanghai Composite up 2.4%.

- In an effort to jumpstart tourism, Australia is planning to discount your airfare by as much as half if you can get to the country, a subsidy that will cost the country about $920 million.

- Hello, the Chinese bike-sharing startup, has reportedly filed for an IPO in the U.S., and could be looking to raise up to $1 billion. I’m missing the days of not having to slalom around haphazardly abandoned bicycles in this corner of Rome. With all that dough, I’m sure Hello will figure that out.

Europe

- The European bourses were a lovely shade of green this morning with the Stoxx Europe 600 up nearly 0.2% at the open.

- All eyes will be on Frankfurt today for one of the biggest ECB meetings of the year. The central bank is expected to crank up the printing press to keep rising borrowing costs from spiking. Global yields are a touch lower as I write.

- Shares in Rolls-Royce were 3.2% higher at the open after the COVID-battered engine-maker reported a worse than expected $5.6 billion loss last year.

U.S.

- U.S. futures have been climbing all morning. That’s after the Dow closed in record territory following the Biden Administration’s big victory yesterday on the $1.9 trillion stimulus package.

- The stimulus checks, child-care benefits, unemployment benefits and the like will combine to boost U.S. GDP to China-like growth levels in 2021, economists calculate.

- Watch the “stimmy” check effect on meme stonks. On cue, shares in GameStop soared more than 40% by mid-day yesterday, then crashed into the red, then rebounded.

Elsewhere

- Gold is up, trading around $1,735/ounce.

- The dollar is down.

- Crude is edging higher with Brent trading near $69/barrel.

- Bitcoin is flat at just under $55,000 after surging to just above $57,000 overnight.

***

Buzzworthy

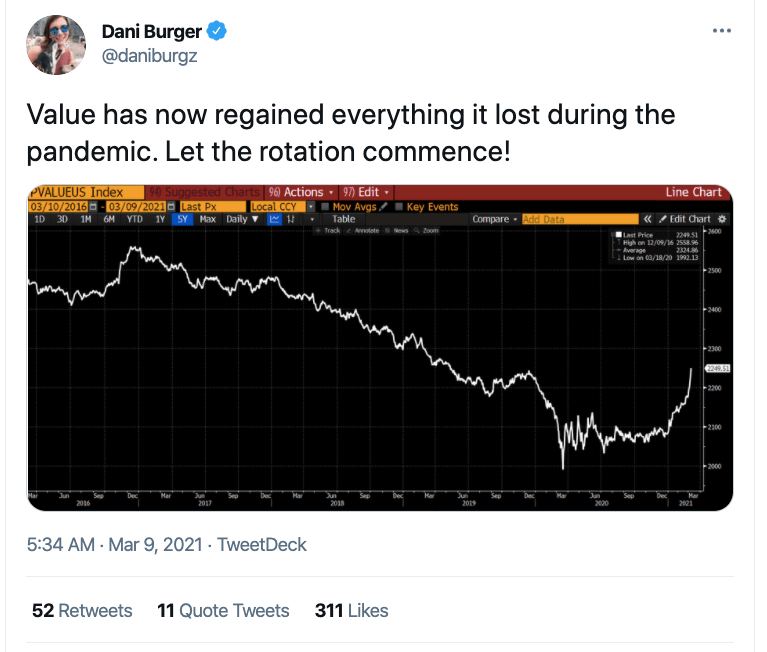

Viva la Rotation

All yield to the king of the stonks

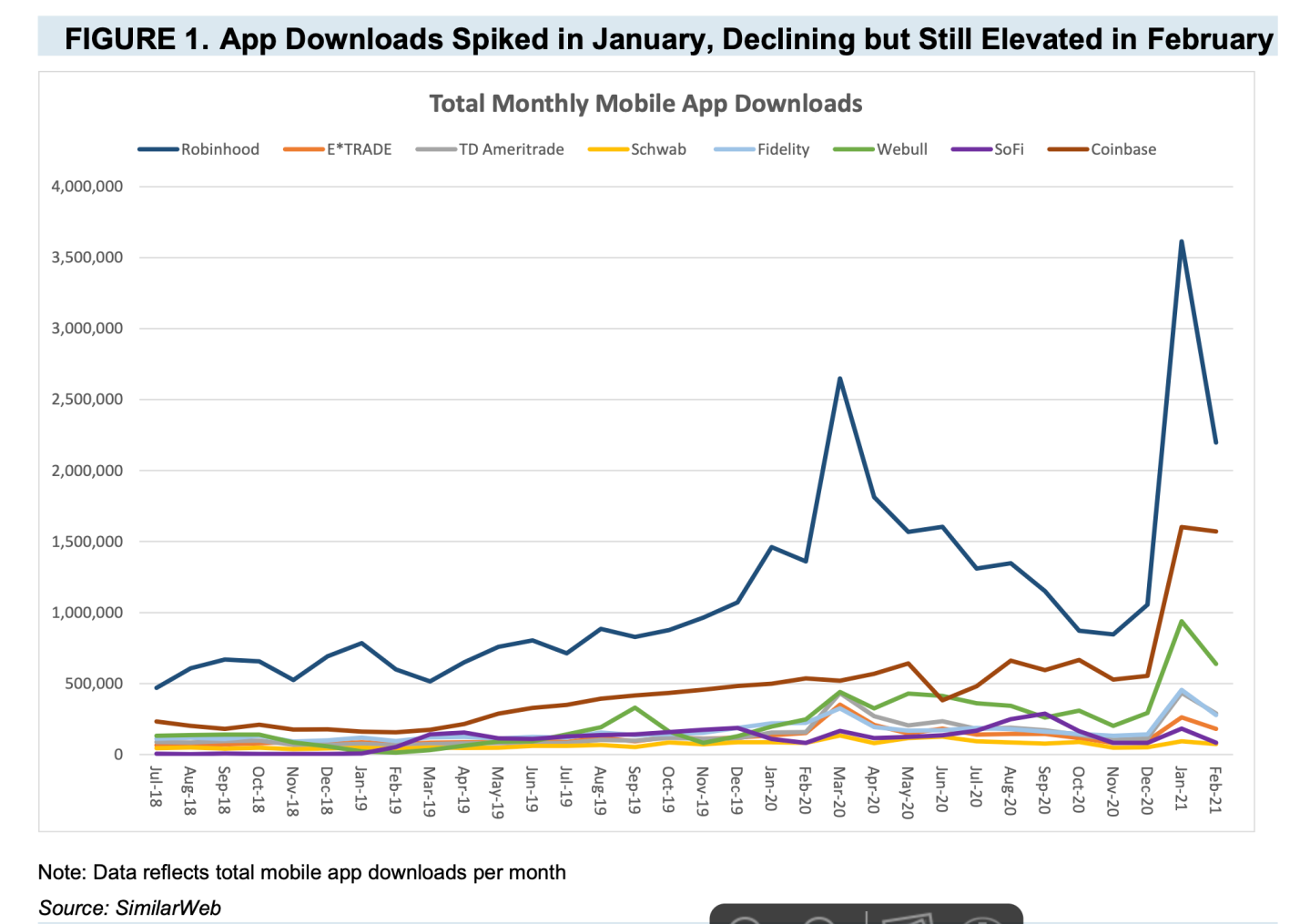

On the apparent tie between free money and spikes in retail investing….

🤔🤔🤔

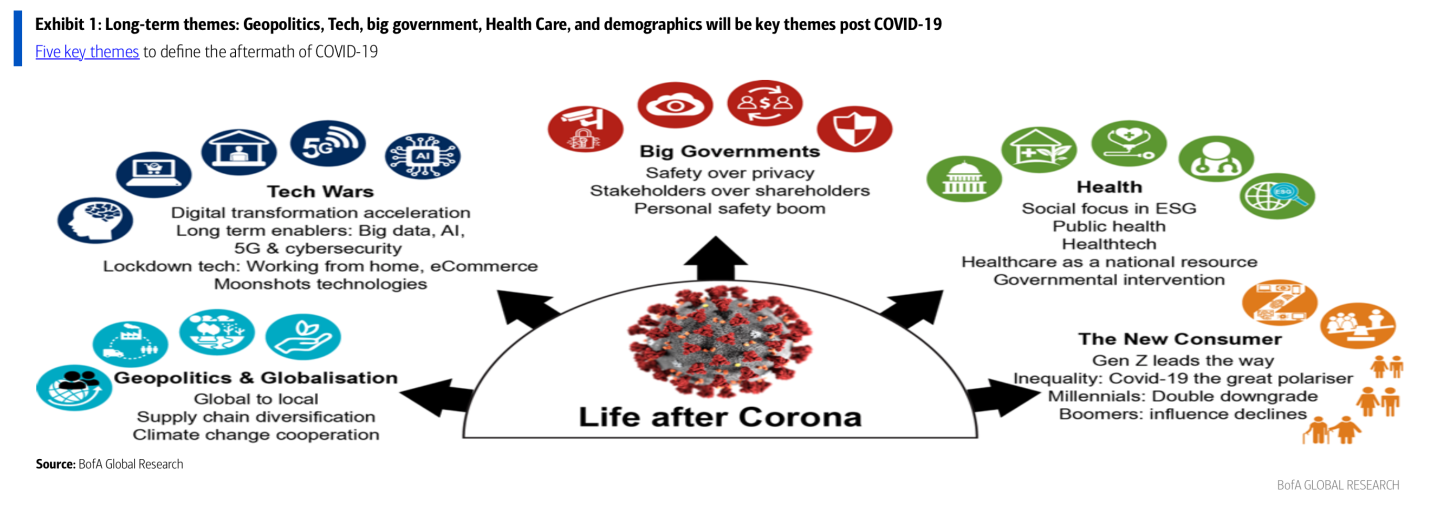

Global-to-local and other big investment themes

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

This week's billionaire. Top of the newly minted list would be Dave Baszucki, CEO of Roblox. The video game service (ticker: RBLX) went public yesterday, and soared more than 50%. You may recall the company delayed its IPO late last year, thinking the market for new issues was too frothy. Apparently, conditions are more palatable these days.

Thank you, short-sellers. The Nasdaq on Tuesday had its best one-day rally since October. The reason? A surge of hedge fund short-sellers covering their positions. "Some analysts say those gains would likely be short-lived," Bloomberg reports.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Who gets the bill?

The roughly $1.9 trillion stimulus package will be signed into law tomorrow and payments will go out shortly afterwards. Even in pandemic politics, there's no such thing as a free lunch. And so, it's never too soon to ask: who the heck is going to pay the bill on this lights-out spending plan? As always, the burden will fall squarely on America's recent college grads. "Even if interest rates stay incredibly low, your household's annual share of the payments will be about $1,750," calculates Fortune's Shawn Tully. "That's not just for one year. Those bills will go on forever and keep growing in size."