The CEO of Robinhood, along with the founder of Citadel and cofounder of Reddit, got hammered during a congressional hearing on Thursday as lawmakers looked into the GameStop fiasco. But did the public learn anything new? Not really.

We all know D.C. is slow to act, and that action happens only after a lot of political theater. So Robinhood’s greatest threat, right now, is likely to be retribution from its own users.

When GameStop shares soared last month—topping $483 at one point—Robinhood announced it would limit retail purchases of GME and other hyped shares, such as AMC. Soon after, GME (along with AMC) lost its upward trajectory. Many traders now blame Robinhood for manipulating GME shares downward. (The company says limits ensured that it could meet its clearinghouse deposit requirements—which rose 10-fold during the frenzy. As of Friday’s open, GME shares are trading at $41.28.)

To find out how the fallout of these events will impact Robinhood, Fortune and Civis Analytics surveyed 2,336 U.S. adults, including 1,378 investors and 238 Robinhood account holders, between Feb. 5 and 7.

The survey has a 3 percentage point margin of error. When broken-down to an investor-level it rises to 3.9 percentage points. When looking solely at Robinhood account holders, the margin of error rises to 9 percentage points.

The takeaway? Robinhood has severely damaged its brand. More than half (56%) of Robinhood account holders are considering leaving the platform as a result of the fiasco. Forty percent of Robinhood investors say they aren’t considering it, and 4% say they’ve already left the platform as a result of its stock limiting. It looks like Robinhood is learning the lesson Warren Buffett preached for years: “It takes 20 years to build a reputation and five minutes to ruin it.”

Before this mess, Wall Street speculated that Robinhood could IPO with a valuation over $20 billion. So the $20 billion question is, Will Robinhood accounts actually close en masse? It’s too early to tell. But there is also reason for skepticism: Switching brokerages does require effort, not to mention Robinhood is unique in offering both fractional and cryptocurrency trading.

After the GameStop episode, people like Barstool Sports founder Dave Portnoy and Tesla CEO Elon Musk piled on Robinhood. “Ironically Robin Hood took from the rich and gave to the poor, even though they do the exact opposite. I was stunned. I think it’s criminal. I think there has to be an investigation. I think people have to go to jail,” Portnoy told Fox News viewers.

All that bad publicity hurt Robinhood with more than just its own traders.

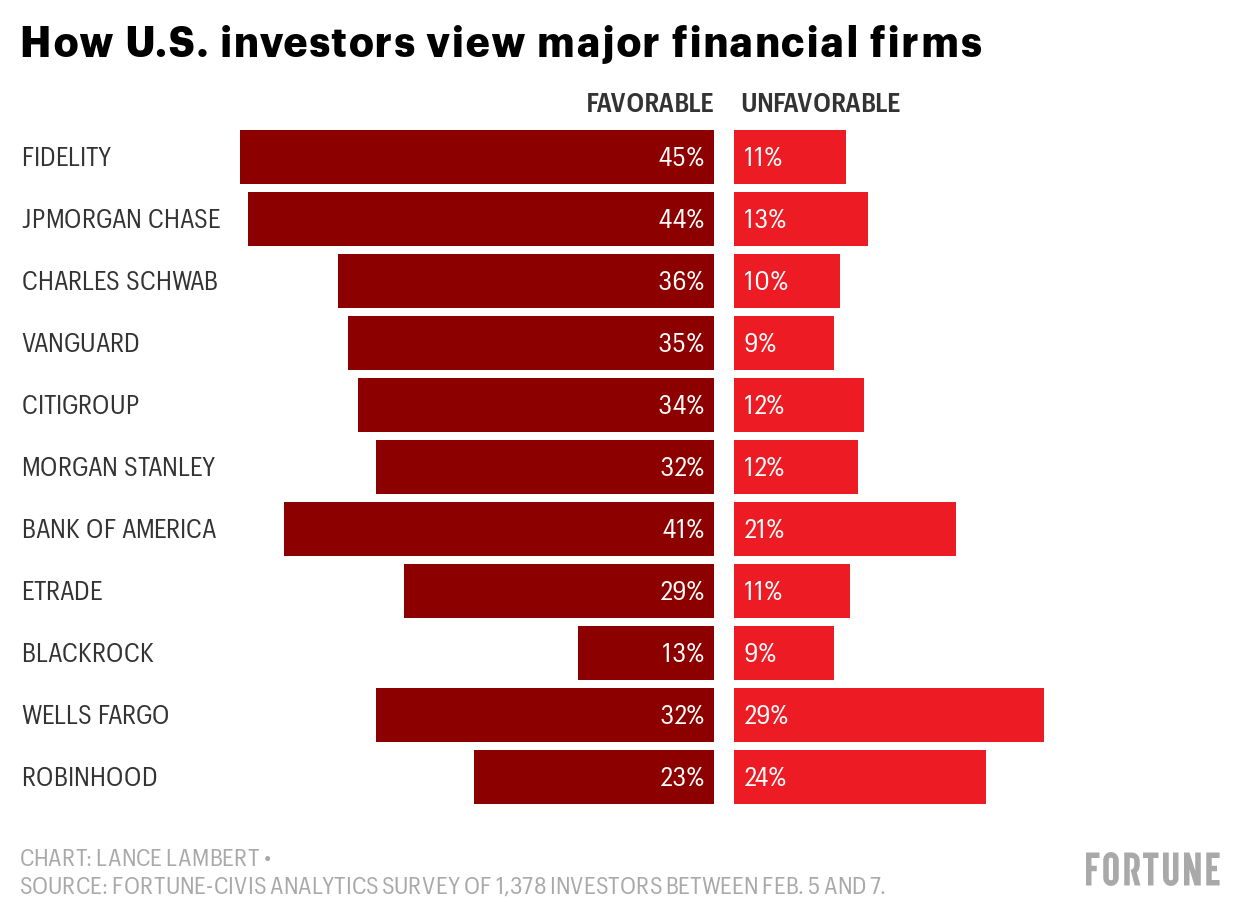

We asked investors to rate their views of 11 financial firms. Among those, Robinhood (–1 points) was the only firm to have a negative favorability score. That’s even worse than Wells Fargo (+3 points), which saw its popularity flounder for years following its fake accounts scandal. Simply put, you’re in trouble when you’re losing a popularity contest to Wells Fargo.

*Methodology: The Fortune–Civis Analytics survey was conducted between Feb. 5 and 7. We surveyed 2,336 U.S. adults, including 1,378 investors. The findings have been weighted for age, race, sex, education, and geography. The survey has a 3 percentage point margin of error. When broken-down to an investor-level it rises to 3.9 percentage points. When looking solely at Robinhood account holders, the margin of error rises to 9 percentage points.

This is an excerpt from Fortune Analytics, an exclusive newsletter that Fortune Premium subscribers receive as a perk of their subscription. The newsletter shares in-depth research on the most discussed topics in the business world right now. Our findings come from special surveys we run and proprietary data we collect and analyze. Sign up to get the full briefing in your inbox.