U.S. stocks have been on a roll.

As of mid-February, the S&P 500 has hit 10 new all-time highs this year, and CFRA’s Sam Stovall is pointing out the obvious: “The U.S. equity markets are off to a good start,” he wrote in a Tuesday note.

He highlights that “only 11 other times since 1929 has the S&P 500 recorded 10 or more new [all time highs] in the first two months of the year,” and following those, the S&P 500 “went on to post a full-year gain averaging nearly 16%, rising in price every year but one (1966), compared with the average annual price rise of 9.2% and 73% frequency of advance for all years.”

In other words, early-year bullishness could beget bullishness—at least in theory.

But while there are plenty of reasons why investors are optimistic about the outlook (to name a few: a $1.9 trillion stimulus package will likely soon be on the table in Congress, the Federal Reserve continues to be accommodative, and the vaccine rollout is gaining steam), some strategists are waving little red flags.

“I continue to think the success of the market, really since early November, has also bred its greatest risk—which is just a very frothy sentiment environment,” Charles Schwab’s chief investment strategist Liz Ann Sonders tells Fortune.

To be sure, there have been bouts of “speculative froth” before, but unlike in the late summer of 2020, Sonders argues “Now, it’s pretty much across every measure of sentiment: Behavioral measures of sentiment, attitudinal measures of sentiment,” like ETF flows, the options market, and some sentiment surveys, she suggests. “There’s a lot of complacency, if not just outright euphoria.”

And while CFRA’s analysis shows that a strong start to the year might bode well for year-end returns, history suggests February can be a more bearish time for the markets.

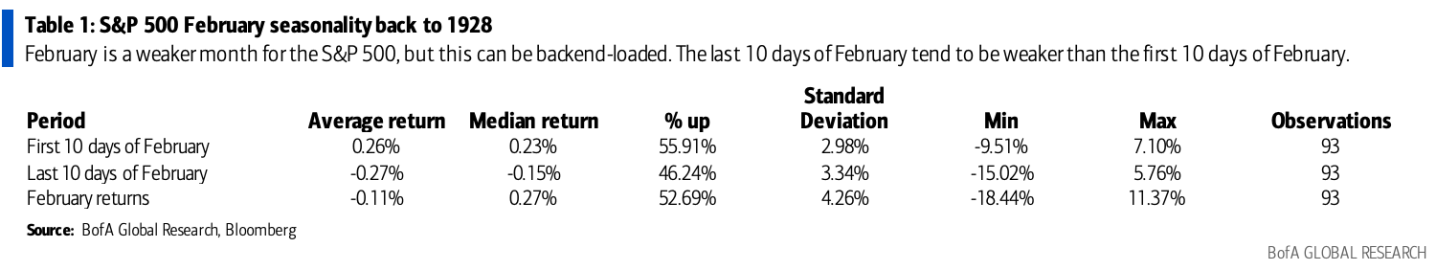

Stephen Suttmeier, technical research strategist at Bank of America, points out that while “February 2021 has proven strong so far,” the “weaker February seasonality tends to be backend-loaded,” he wrote in a Monday report.

Per data going back to 1928, “the first ten sessions of February has been up 56% of the time with an average return of 0.26%,” Suttmeier notes, but “the last ten sessions of February is weaker with the period up 46% of the time with an average return of -0.27%.” (See BofA’s chart.)

What’s more, Suttmeier writes that recently “both the put/calls and the 3-month VIX relative to the VIX were overbought or complacent for the first time since August 2020, which was just before the weak seasonal period for the [S&P 500] in September and October.” That’s on top of “the risk of weaker February seasonality,” he notes, “especially during the second half of the month.”

Despite the historical weakness, BofA’s Suttmeier says his view for stocks “remains a secular bull market,” with upward trends, at least for now, “intact with plenty of confirmation.” Others like Sonders point out the accelerating vaccine rollout, a better earnings outlook, and the prospect of more stimulus are continuing to buoy markets.

On Tuesday, stocks saw some turbulence, dipping in and out of the red before closing with the S&P 500 down about 0.06%, while the Dow managed to close 0.2% higher, a new record.

As for the coming weeks, Brad McMillan, chief investment officer at Commonwealth Financial Network, argues data like jobs numbers and retail spending will need to be top-notch to satiate market expectations. “There’s a lot of potential for disappointment here,” he tells Fortune. “Even good numbers can be disappointing, so I think that’s the immediate headwind for the markets.”

Adds Schwab’s Sonders: “I think there’s a lot of the supports for the market,” she says. “My concern is that a lot of them are already effectively priced in.”