This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Friday, Bull Sheeters. Global stocks are higher, but U.S. futures are in the red as investors contend with a string of worrisome news: coronavirus cases are surging, America’s Thanksgiving travel plans are in doubt, the labor markets have taken a turn for the worse, and the clock ticks down on a federal emergency lending program.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading with the Shanghai Composite the best of the bunch, up 0.4%.

- Embattled Chinese social media firm Joyy Inc. bounced back on Thursday, with shares rising 17% in New York trading. That’s after the company challenged short seller Muddy Waters’ accusations it’s guilty of widespread fraud, including allegations it’s inflating its user numbers.

- Not so fast with the Remdesivir, doc. The WHO has warned against using the drug to treat hospitalized COVID patients on grounds there’s “no evidence that it improves survival or the need for ventilation.” Shares in Remdesivir maker Gilead Sciences were down 1.6% in pre-market trading.

Europe

- The European bourses were largely flat at the open, before climbing. The Europe Stoxx 600 was up 0.3% a half-hour into the trading session.

- The European Union could fork over as much as $10 billion to pay for a massive batch of COVID vaccine doses made by Pfizer-BioNTech and CureVac, Reuters reports in a big scoop. That would assume a €15.50 per dose fee ($18.34) for the Pfizer-BioNTech vaccine.

U.S.

- U.S. futures are down with Dow futures off more than 250 at one point. On Thursday, the three major indexes closed higher after rallying in the final hour of trade.

- A rare public rift has emerged between Treasury Secretary Steven Mnuchin and the Federal Reserve on the future of an ongoing emergency lending program for business and municipalities. The program was introduced in the spring when credit markets all but froze up. The Fed wants to extend it; Mnuchin would prefer to see the program expire at year-end.

- Airline stocks—including Delta Airlines United and Southwest Airlines—were all trading lower in the pre-market on Friday after the CDC issued a health advisory warning yesterday, saying please don’t travel for Thanksgiving this year.

Elsewhere

- Gold is up, trading below $1,870/ounce.

- The dollar is flat.

- Crude is up too with Brent trading around $44/barrel.

- Bitcoin has is up nearly 5%, topped $18,200.

***

By the numbers

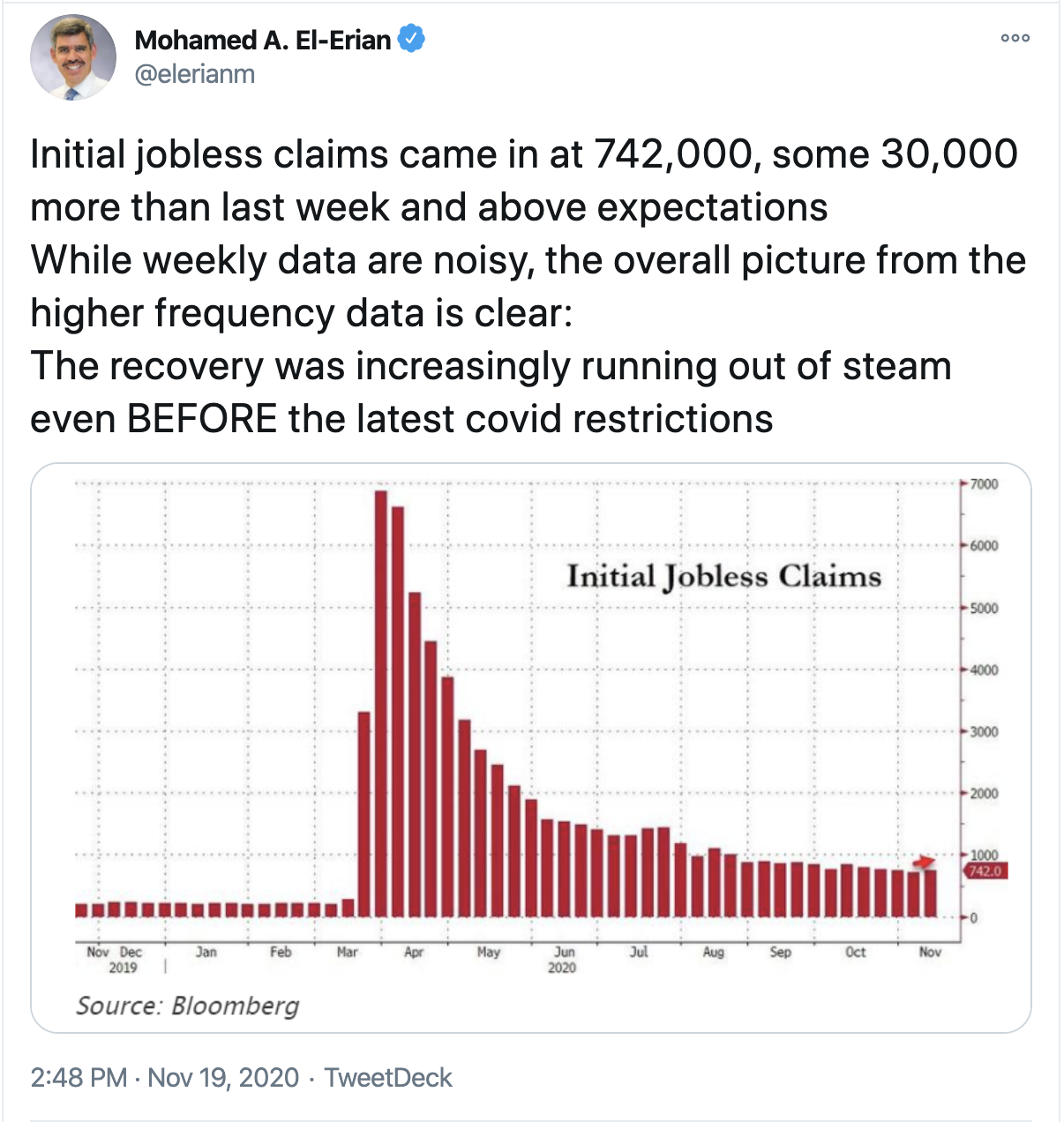

742,000

We haven’t talked a lot about the U.S. labor market in a while. That’s because investors have repeatedly shrugged off the news. As long as a stimulus deal was a possibility they were willing to overlook it. But after yesterday’s worse-than-expected jobless claims numbers—742,000—a number of Wall Street vets are once again sounding the alarm that America’s economic recovery is in jeopardy. That makes the Mnuchin-Fed disagreement so unnerving. Economists see a need for adding stimulus to the U.S. economy, not taking it away. UBS chief economist Paul Donovan sums up that policy conundrum in a note to investors this morning: “Given that there are increased restrictions on the US economy, economists are inclined to side with the Fed. Markets prefer it when policy exhibits joined up thinking—this situation is not joined up and shows limited evidence of thinking.”

1,919.62

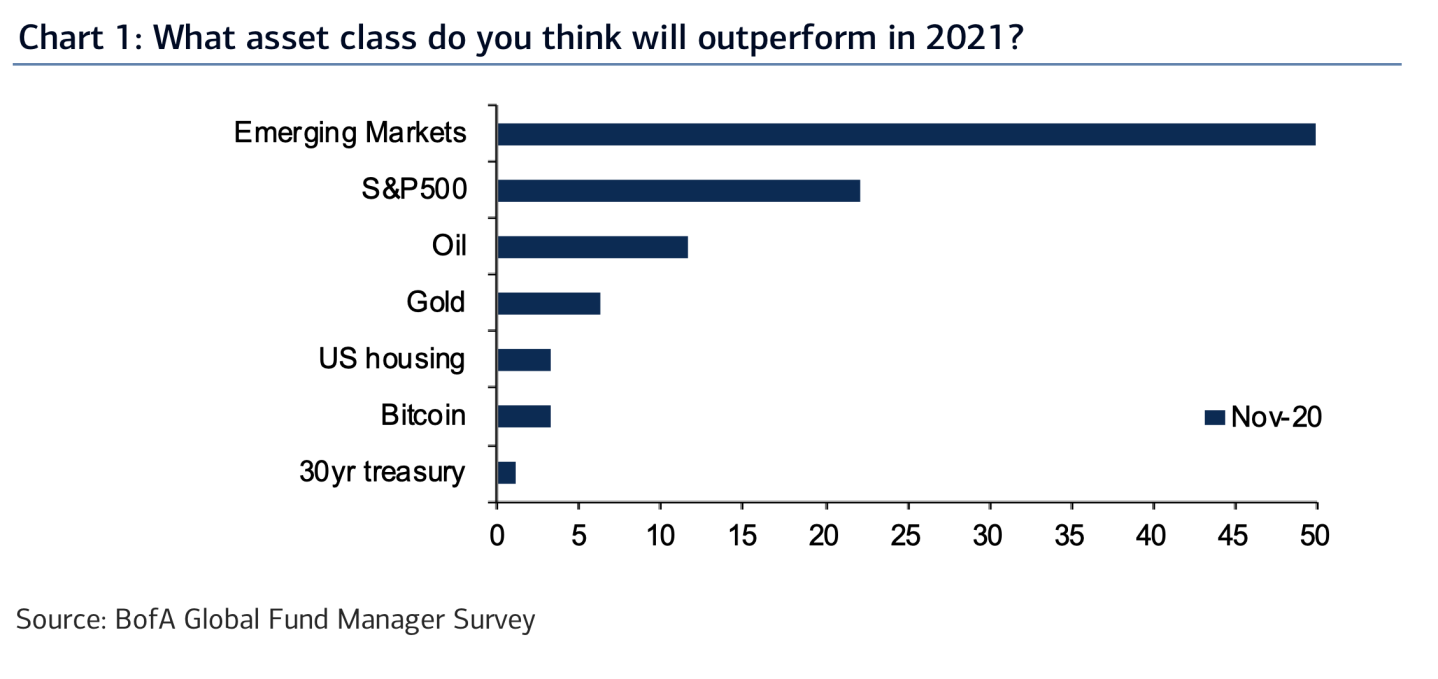

Usually in this spot I look at the trailing five-day performance of one of the big indexes. But they’re all flat as a pancake this week. So, let’s head straight to this week’s big winner, Bitcoin. The crypto currency is up 12.7% since Nov. 13, gaining an impressive $1,919.62. The Bitcoin bulls are out in force, eyeing a $20K handle by year-end. But you know who’s not convinced about the Bitcoin rally? Fund managers. As I detailed earlier this week, fund managers see Bitcoin underperforming the S&P 500, gold and oil next year.

-3.28

S&P 500 futures are in the red, as I type, and the benchmark index is down 3.28 points so far this week. The movement isn’t all that notable, but the backdrop is. Since Joe Biden was declared the winner of the presidential election nearly two weeks ago, money has flowed into the markets at a brisk pace. According to Goldman Sachs, “U.S. equity mutual funds have experienced $34 billion of inflows in November, on pace for the first month of net inflows since September 2019. The recent trend of inflows has occurred alongside rising optimism around a vaccine and expectations of a divided government.” The S&P is up 3.7% in the past month, but has been trading fairly flat over the past two weeks. The fundamentals are there for a breakout. Stay tuned.

***

Postscript

With stocks on the move higher yesterday, Bull Sheeters found themselves in a creative mood. An additional two readers sent me their markets-inspired poems to share. Here they are:

First, from R.E., hailing from the lovely Channel Islands.

The markets were down due to Covid,

And shares could be had for a low bid.

But the bulls have come out since the vaccine

So increasingly yields will wax lean.

There’s a pivot from tech stocks to value

Lifting airlines, hotels and Total too

Elon Musk just sits pretty with Tesla

Making more return than an embezzler!

I’m guessing R.E. prefers to get around in a sailboat.

And here’s one from P.N. in South Africa. It’s untitled.

There once was a writer for Fortune

Who wrote about stocks to exhaustion

His favourite footnotes

Were Italian anecdotes

Which could fetch a fortune on auction

Thanks P.N.!… Ahem, boss. I think R.E. is talking about me.

Okay, you’ve inspired me to pen a knock-knock joke. Warning: it’s pretty awful. But, it’s Friday. So here goes:

Knock, knock!

Who’s there?

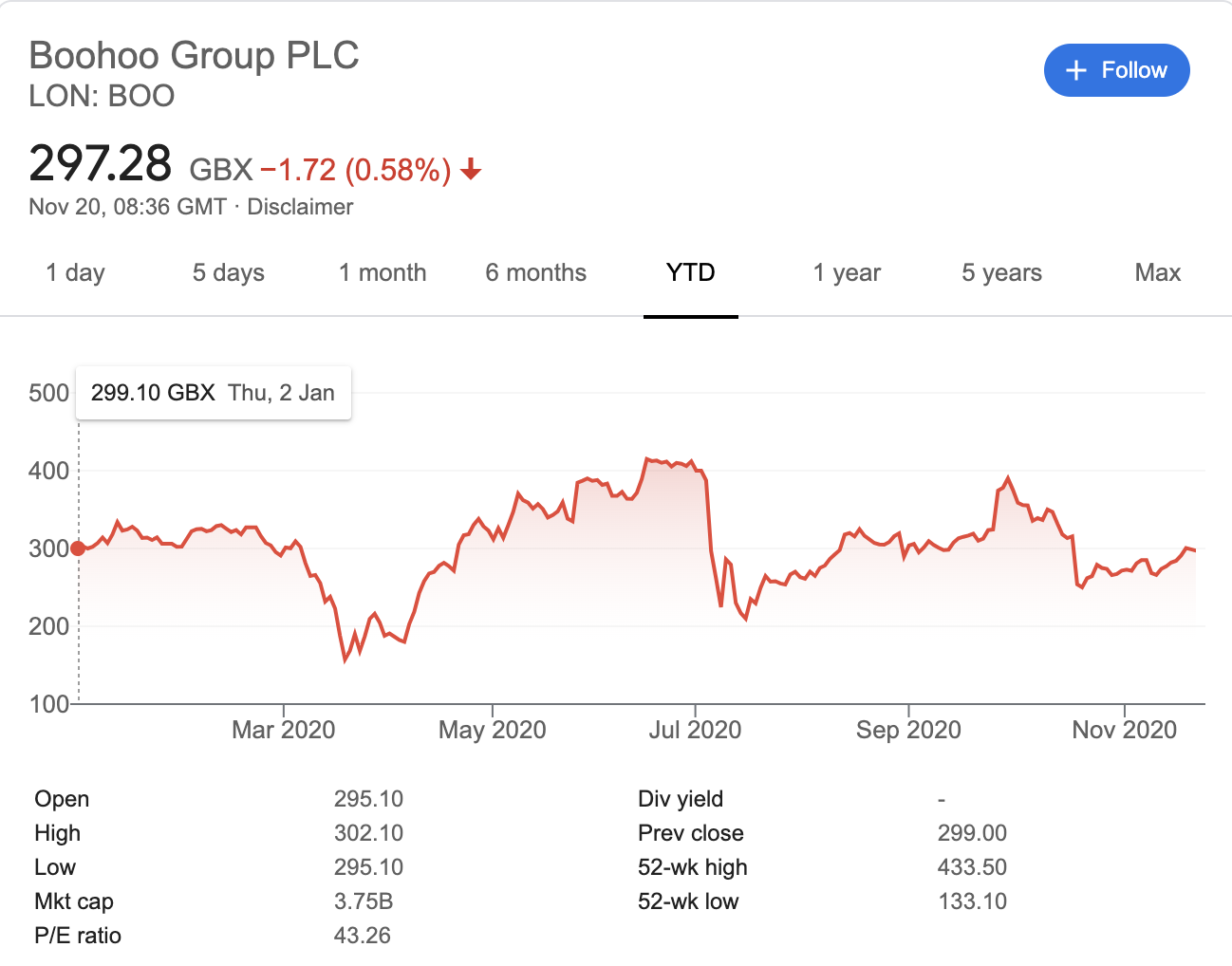

Boohoo Who?

Don’t cry. It’s only down 0.1% YTD.

I tried that one out on my kids first, and they said, go for it, dad! Honest.

I know. After that one the boss is going to mercifully put an end to our impromptu Postscript creative hour.

***

Have a nice weekend, everyone. I’ll see you here on Monday… But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

Won't be home for Christmas. Or Thanksgiving, for that matter. Even before the CDC issued its stay-home advisory yesterday, would-be travelers were abandoning their holiday vacation plans. In recent days, a trio of airlines—United, Southwest and Alaskan Airlines—all reported that bookings have slowed and that cancelations have surged, the Wall Street Journal reports.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Net zero

You've no doubt heard that term a lot lately as some of the world's biggest companies and mightiest economies unveil plans to cut emissions in the coming years and decades. The truth is they won't hit their targets without serious investment in innovative new power sources, none more promising than hydrogen. Hyped for years, the most abundant element in the universe is attracting all kinds of investment. Welcome to the hydrogen economy. Fortune's Katherine Dunn explains why the letter H is such a big deal.