This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. To those of you who decided to dump tech stocks for cruise stocks late last week, complimenti!, as they say around here. The cigars and champagne are in the mail (once I can get management to approve the purchase).

Seriously, if any of you unwound your WFH pandemic portfolio on or around Election Day, drop me a line. I have a lot of questions for you.

The Monday rally in 2020’s misfit stocks—the likes of airlines, banks and energy—was fueled of course by Pfizer’s “game changer” news of a vaccine trial breakthrough. At one point, the Dow was up 1,600 points yesterday before closing the day 3% higher.

Alas, yesterday’s investor euphoria is petering out on Tuesday, with stocks and futures mostly flat. But there are some sectors that are still solidly in the green, including big banks and Big Oil.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading with the Hang Seng up 1.1%.

- Not all vaccines are the same, apparently. China’s frontrunner, Sinovac’s Coronavac, was halted in Brazil after what health officials there are describing as “a serious adverse event.”

- The D-word—deflation—is suddenly being murmured in China as consumer price inflation threatens to go negative. One big culprit: plunging pork prices as the country’s swine stock recovers from African swine fever. (I may have mentioned this before here on Bull Sheet: ASF, or pig ebola as it’s known, is nothing to mess with.)

Europe

- The European bourses are mixed with London and Paris up, and tech-heavy Frankfurt down. That’s after Germany’s DAX closed up nearly 5% on Monday and France’s CAC 40 did even better, closing more than 7.5% higher.

- Here’s something we don’t see every day. Shares in Adidas are down 0.8% after the company reported a bottom-line beat thanks to strong growth in its home market, Europe.

- Norwegian Air was one of the few airline stocks to falter yesterday, plunging more than 11% on news Oslo won’t give them any more pandemic relief dough.

U.S.

- Dow futures are in the green, while S&P and Nasdaq futures are down again in up-and-down trade this morning. That’s after the blue chip Dow scored its best one-day performance since June 5. I get into the big winners and losers below.

- McDonald’s did not make it onto yesterday’s big gainers list (nor was it a big decliner, for that matter). But it did make news as the fast-food giant announced a new plant-based burger, the McPlant… Spoiler: it’s no “royale with cheese.”

- Online trading platforms did not have a great day yesterday. Several “around the world broke down or were unavailable on Monday as individual investors tried to take advantage of heavy trading,” Bloomberg reports.

Elsewhere

- Gold is rebounding modestly, trading around $1,875/ounce.

- The dollar is down.

- Crude is mixed after a stellar Monday when both Brent and WTI soared on the Pfizer news.

- Bitcoin bulls are no fans, it seems, of promising vaccine trials. The cryptocurrency is down nearly 3% at $14,880.

***

The winners and losers, vaccine edition

Investors knew V-day would come. Eventually.

Kudos to those of you who wagered it would land yesterday, the first trading day after a new president is announced. (If you have an angry conspiracy theory about the timing, don’t send them to me… unless they’re really preposterous. You can send me those.)

All kidding aside, we shouldn’t be that surprised by what we saw yesterday. The vaccine trade was something we discussed in this space a few times. A refresher: once there’s legit progress on a vaccine, it’s time to recalibrate (or at least rethink) your long positions, the thinking goes. In are the beaten-down value stocks, the Wall Street pros say; out are inflated growth stocks.

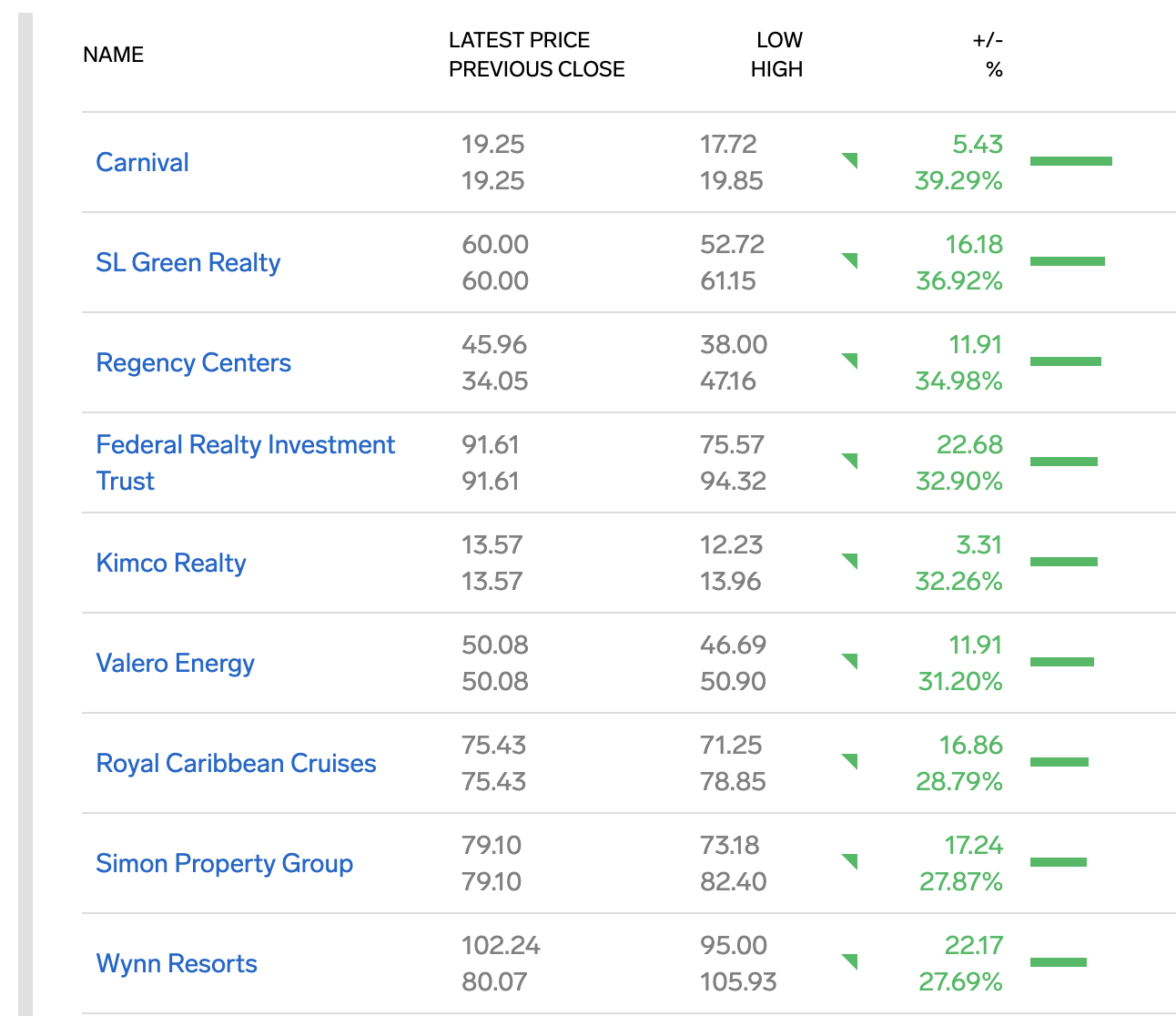

And, on cue, the Europe Stoxx 600 Banks index is up more than 3% in early morning trade again this morning. That makes sense. The banks, a bellwether for the larger economy, have posted decent results this quarter only to get punished by investors. It’s hard to make a similar analysis about the cruise and casino stocks, but there they are topping the list (or near the top) of Monday’s big gainers.

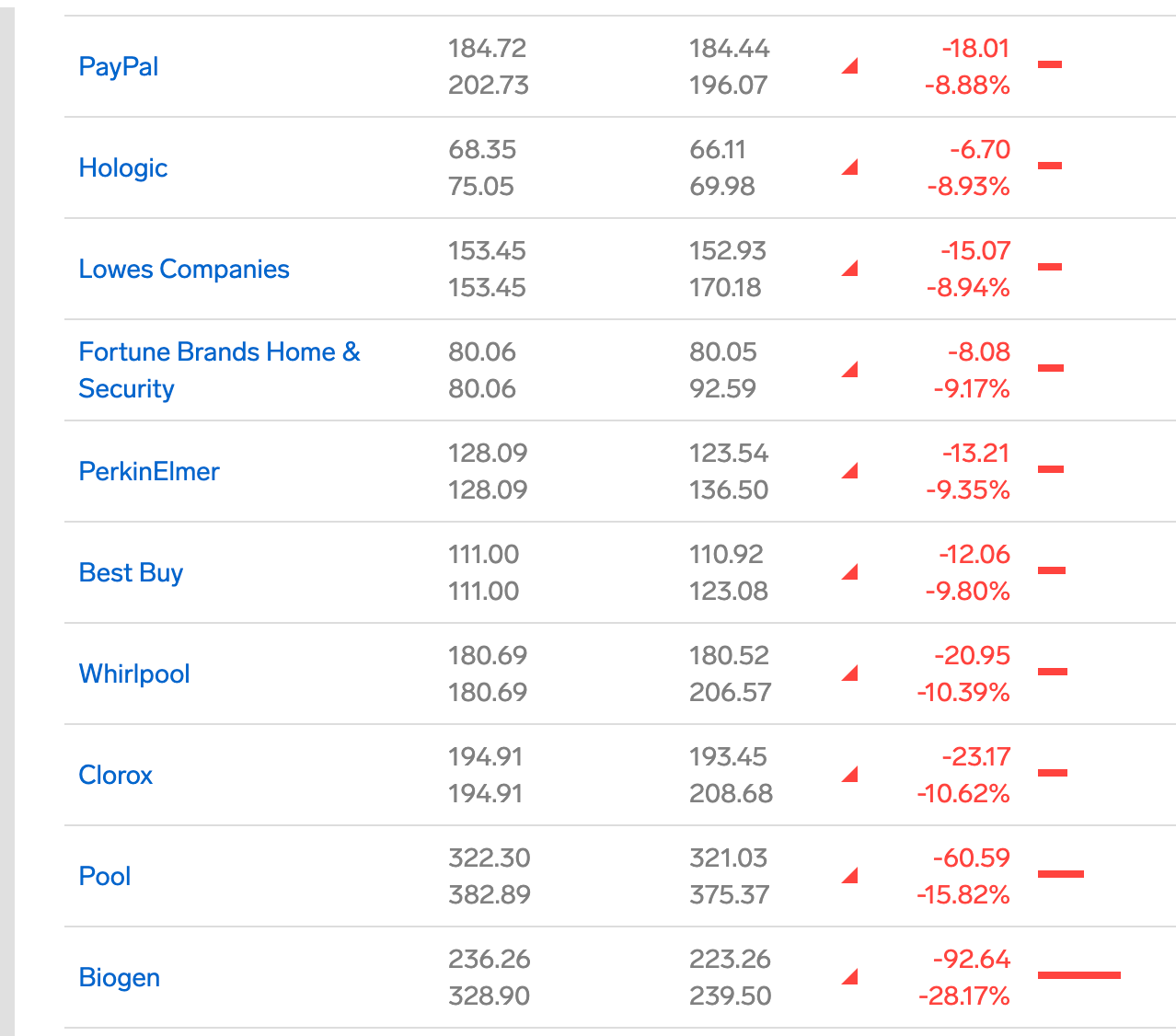

And the losers? They include stay-at-home stocks like Zoom Video, plus DIY retailers such as Lowe’s, plus Clorox and Biogen.

But does this really mean it’s time to ditch the likes of big cap tech and health care stocks? Not so fast, analysts are saying.

Here’s why: Even if these vaccines prove effective—a sizable if—it could take several months to get meaningful distribution. And, more immediately, much of the world faces a deadly second wave that’s getting worse by the day. As such, world leaders are cautioning this is no time to let down our guard.

Alas, the 2020 bull market has been one of FOMO-led rallies. As I glance again at the markets, investors continue to give a thumbs-down to tech and pile into previously unloved value stocks.

***

Postscript

Here’s a touching story from the North of Italy, once again a region rocked by COVID.

81-year-old Stefano Bozzini’s wife has coronavirus. And, of course, he cannot visit her while she’s hospitalized. And so he props his chair in the courtyard outside her window and serenades her, playing his fisarmonica.

The video is really sweet.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Pfizer pfunding. It's inevitable that politicians will want to take credit for promising vaccine breakthroughs. On cue, such self-congratulations came from the White House yesterday after the Pfizer news broke. There's only one problem with such claims: crucial funding came from Berlin, not Washington.

You think your Monday was bad? Zoom founder Eric Yuan saw his personal wealth fall by a cool $5 billion yesterday following the company's stock plunge, according to Bloomberg.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

25

In late October, when Election Day jitters were high, J.P. Morgan shared with investors their list of 25 stocks to follow—or even dive into—in the event of a big vaccine breakthrough. Fortune's Lee Clifford breaks down here the aptly named list of "COVID-19 Vaccine Tactical Short Candidates."