Our mission to help you navigate the new normal is fueled by subscribers. To enjoy unlimited access to our journalism, subscribe today.

Positive news out of the United Kingdom: Retail sales haven’t just rebounded from the horror show of lockdown; they’ve already surpassed the U.K.’s pre-pandemic-lockdown levels.

According to July figures released Friday by the Office for National Statistics (ONS), retail sales volumes grew by 3.6% month on month. That may be small compared with the 13.9% growth seen in June and the 12% growth in May, but those were increases from a very low base, and July’s boost now means volumes are 3% higher than they were in February, before lockdown.

The trend echoes that in the U.S., where retail spending also surpassed pre-lockdown levels in July.

“Retail sales have now regained all the ground lost during the height of the coronavirus restrictions as more stores open for trade and online sales remain at historically high levels,” said the ONS’s deputy national statistician for economic statistics, Jonathan Athow, in a statement.

Indeed, online sales seem to be a prime driver here, up 44% from the start of the year.

“The flip side is sales at many traditional retailers are still well down on pre-virus levels, and in fact the latest footfall data…shows that there has been only a minor, and very steady, improvement in retail traffic since shops reopened back in June,” ING developed markets economist James Smith wrote in a Friday note.

Smith attributed the sluggish return of physical shopping to safety concerns. “Clearly, keeping COVID-19 transmission controlled is going to be a key factor in determining how Britain’s high street recovers through the rest of the year,” he wrote.

The other notable aspect here is that of an uneven retail recovery among sectors. Sales in the clothing sector, which was particularly hard hit by the lockdown—who cares about new clothes when you’re stuck at home, anyway?—were still 25.7% lower in July than in February. Fuel sales are also still 11.7% down, corresponding with decreased car road traffic.

The ONS’s Athow also noted that food sales “fell back from their recent peaks as people started to venture back into pubs and restaurants.” Clearly, the situation remains volatile.

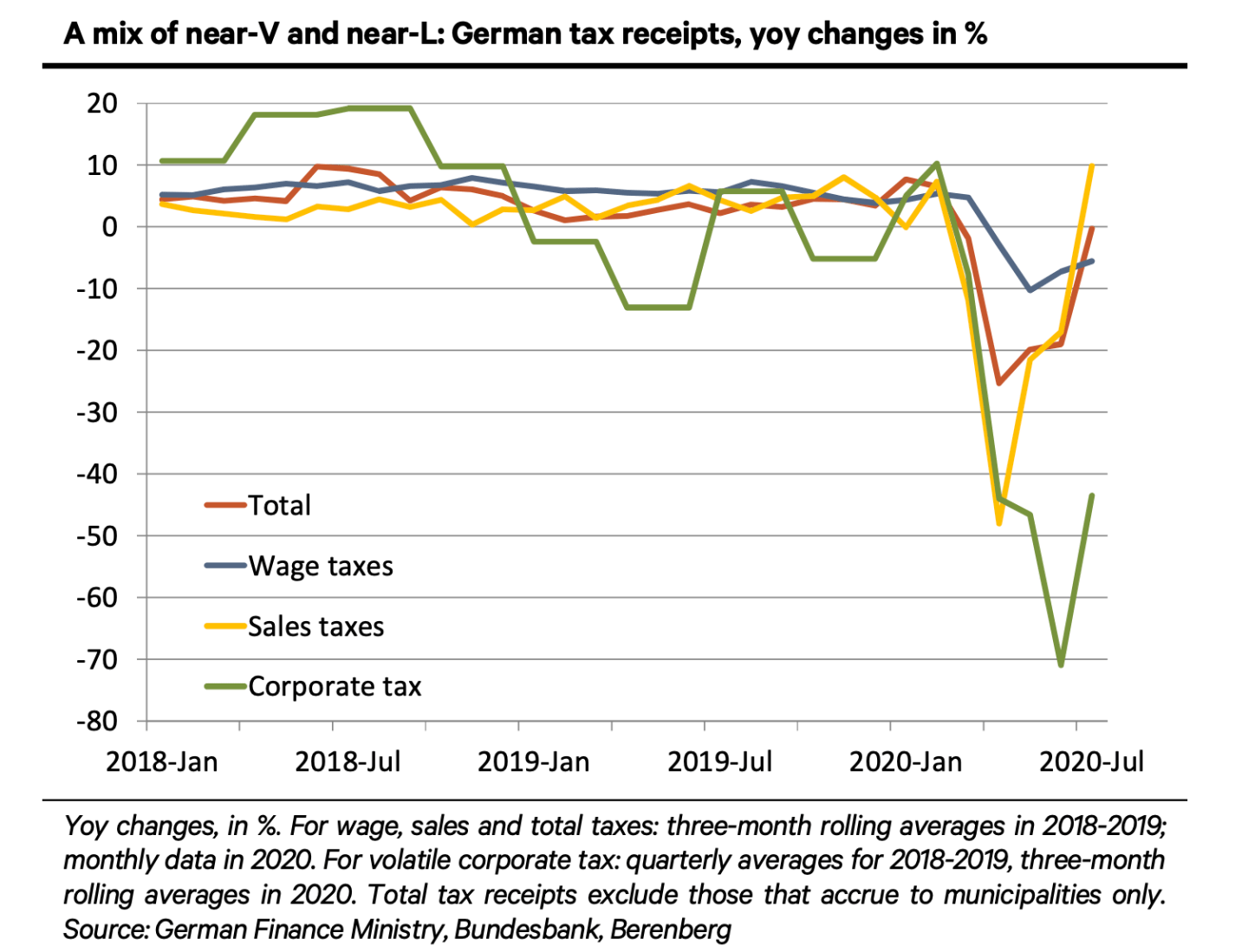

The U.K. isn’t the only European country to see consumption returning in force. As outlined in a Friday Berenberg note, receipts from sales taxes in Germany have “rebounded almost like a V.” Retail sales in that country were already up year on year during May and June, by 5.2% on average.

“After a catch-up effect in these months, we expect retail sales to oscillate around current levels in coming months before embarking again on a gradual uptrend,” Berenberg said.

However, the latest IHS Markit purchasing managers’ indexes for the U.K. and Germany suggest diverging trends when it comes to manufacturing and services.

An early reading of these indexes—which indicate economic output from these sectors, with a score of 50 being the threshold for growth—shows the U.K. at a lofty 60.3. This is almost a seven-year record. In Germany, however, July’s promising score of 55.3 appears to have fallen back to 53.7 this month. France, too, has seen its PMI drop significantly this month.

“There were encouraging signs that customer-facing service providers have started to catch up with the rebound seen earlier this summer across the wider economy,” said IHS Markit economics director Tim Moore, regarding the U.K. figures.

However, employment fears continue to weigh heavily everywhere. In the U.K., where grocery giant Marks & Spencer this week announced 7,000 job cuts, the big crunch will likely come as the government winds down its wage subsidy scheme in the coming months.

And even in Germany, where the government is set to extend its Kurzarbeit furlough scheme for perhaps another two years, IHS associate director Phil Smith noted that “a sustained decline in overall employment…continues to undermine domestic demand.”

Another thing worth noting about the U.K.’s situation is that the country’s national debt has now exceeded 2 trillion pounds ($2.63 trillion) for the first time, the result of all the government borrowing during the pandemic. However, it is likely that this figure would have been even higher, had it not been for the tax revenues from that better-than-expected retail revival.

More coronavirus coverage from Fortune:

- WHO chief warns the world: Don’t fall prey to COVID “vaccine nationalism”

- What makes the latest coronavirus testing process, developed by Yale, so promising

- Commentary: Why empowering frontline workers is a key element to a safe reopening

- Urinals and toilets may spread COVID-19, adding fuel to the mask debate

- Depression symptoms among the employed in the U.K. have more than doubled since the start of the pandemic