Quiz time: Which Nasdaq-listed e-commerce stock has become the clear favorite among tech bulls this year? Amazon? Shopify? Alibaba?

Nope, nope, nope.

The answer is Utah-based Overstock.com, up more than 1,500% year to date. More impressively, the stock has soared roughly 2,000% since the market’s mid-March lows. It’s part of the mighty Russell Microcap Index, which is outperforming the best of the best in Big Tech—the Nasdaq 100—in recent weeks. Overstock’s rocket rise has been generating windfall returns for plenty of investors, with one noteworthy exception: the man who founded the company more than 20 years ago.

On Tuesday, Overstock was down 1.7% in early trading, a day after Piper Sandler equities analyst Peter Keith initiated coverage of Overstock (ticker symbol: OSTK) with an “overweight” rating, saying the new management team and the company’s focus on home furnishings should help propel sales to $2.9 billion this year, more than doubling its year-earlier top line.

Unprofitable a year ago, Overstock is now expected to pull in a decent profit this year, with Keith estimating full-year earnings per share at $0.47.

“There are seismic forces at work that have dramatically improved the sales and profitability outlook for Overstock (OSTK) well into the future,” Keith wrote in a research note to investors.

And as with other e-commerce companies, COVID-19 is the big catalyst.

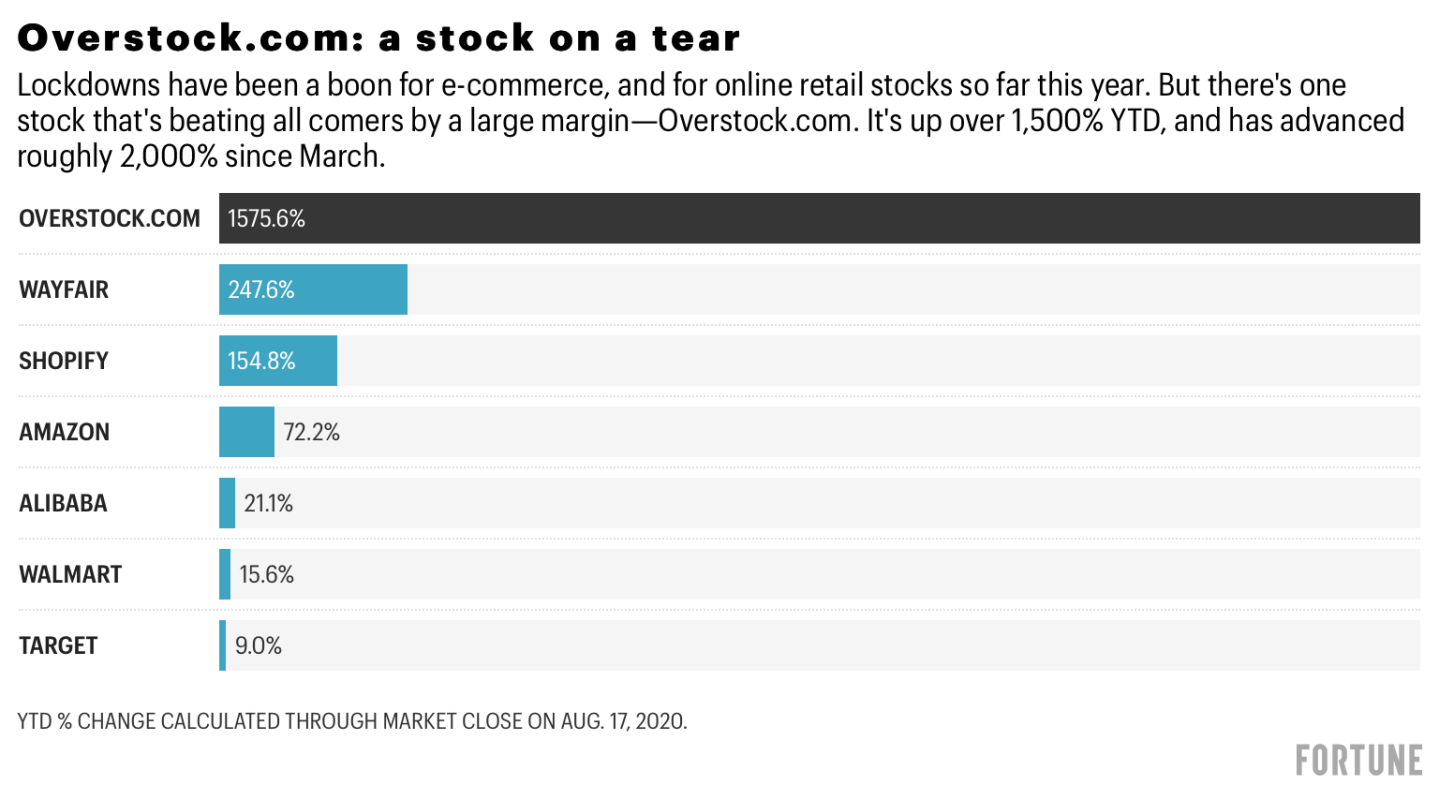

Stay-at-home stocks continue to dominate the wider markets rally as investors bet the digital economy will power the broader economy out of recession. It’s the proverbial clicks vs. bricks trade. But even among that group of high-flying tech stocks, there are clear standouts, as the below chart shows.

Overstock’s share price has grown six times more than Wayfair, which is having a heck of a run itself. Further down the list is Amazon, up a mere 72%, a performance making Amazon bulls very happy. But even they must be getting Overstock envy.

That an online retailer is rallying to record heights should be of little surprise at this stage in the tech-driven equities rally. But veteran Nasdaq watchers may recall how improbable a run this is for Overstock.com, which has had its run-ins with investors over the years.

It was almost exactly one year ago when Patrick Byrne, founder and CEO of Overstock, resigned abruptly. Days earlier, he had admitted to being questioned in a federal investigation related to the 2016 presidential election, blaming the whole affair on “the deep state.” That revelation spooked investors, who sent the shares crashing down by more than one-third over a two-day stretch.

Within weeks, Byrne had dumped all his shares in Overstock.com, public filings showed. That resulted in him missing out on the rally of a lifetime this spring and summer.

According to regulatory filings, he sold 4,790,459 shares in September, a stake that would have been worth roughly $566 million by this morning’s share price.

It’s possible Byrne has since bought back into the stock, though regulatory filings show no such purchases. Overstock itself is unaware of any such buys by its estranged founder. “Overstock doesn’t have information on every individual external investor that holds our shares, but we have no reason to believe Dr. Byrne has bought shares as he has had no involvement with the company since his resignation,” a company spokesperson told Fortune.

But don’t feel too bad for Byrne. Byrne realized about $90 million from the share sale. He penned an open letter last autumn to employees, explaining he was putting the $90 million into gold and silver (the appeal of the two precious metals: Both are stored outside the United States, and therefore “even more out of the reach of the Deep State,” he wrote) as well as in cryptocurrencies.

Gold-and-silver bugs are having an excellent pandemic, as are crypto bulls.

Alas, few assets have had the kind of six-month run that Overstock shares are enjoying.