This article is part of Fortune’s quarterly investment guide for Q3 2020.

As the pandemic devastated New York City in March, schoolteacher Ali Iberraken and her young family rushed to relocate outside the city—way outside the city. They left their two-bedroom Brooklyn brownstone for an Airbnb in the woods of Virginia’s Shenandoah Valley. The Iberrakens had planned to decamp for three weeks but ended up staying for two months, not least because they loved the peace and beauty of the bucolic environment.

“Virginia made me realize that’s exactly the lifestyle I wanted,” Iberraken said. “We tried to stay as long as we could, and upon coming back to New York, it was such a big difference. Now we’re going back to the same old playground in 90-degree heat and horrible humidity.”

She’s not the only one pining for a rural escape during the COVID-19 crisis. A spate of recent headlines such as “Coronavirus may prompt migration out of American cities” and “Americans flee cities for the suburbs” suggest a major demographic shift is underway—a shift that could have profound consequences for housing prices and the broader real estate market.

Tales of Americans fleeing cities in droves, however, are likely overstated. According to Jeff Tucker, an economist at the online real estate service Zillow, 64% of prospective homebuyers on the site are looking at suburban areas—a figure that has barely budged from previous years—while searches for property in rural and urban areas likewise represent about the same percentage as before.

Jonathan Miller, who writes a popular newsletter about New York real estate, is likewise skeptical that America’s cities will empty out.

“There is outbound migration. It’s certainly happening. But the current narrative suggests there will be five people left in Manhattan by September,” he says.

Miller likens what’s happening with COVID-19 to events like the Lehman Brothers collapse in 2008 and the 9/11 attacks. Those events likewise triggered a flight from New York, but only a temporary one; many of those who left returned in a year or two. Miller expects a similar phenomenon to occur with the pandemic.

That doesn’t mean the coronavirus won’t have significant impacts on the real estate market, of course. Respected housing economist Robert Shiller recently warned that urban home prices could decline, while civic boosters in Connecticut say early trends suggest the state could benefit from a long-awaited return to the suburbs.

Meanwhile, real estate experts say the pandemic has created or accelerated several notable shifts in behavior—shifts that could become permanent in the long term.

The ‘Brooklyn effect’ and virtual home tours

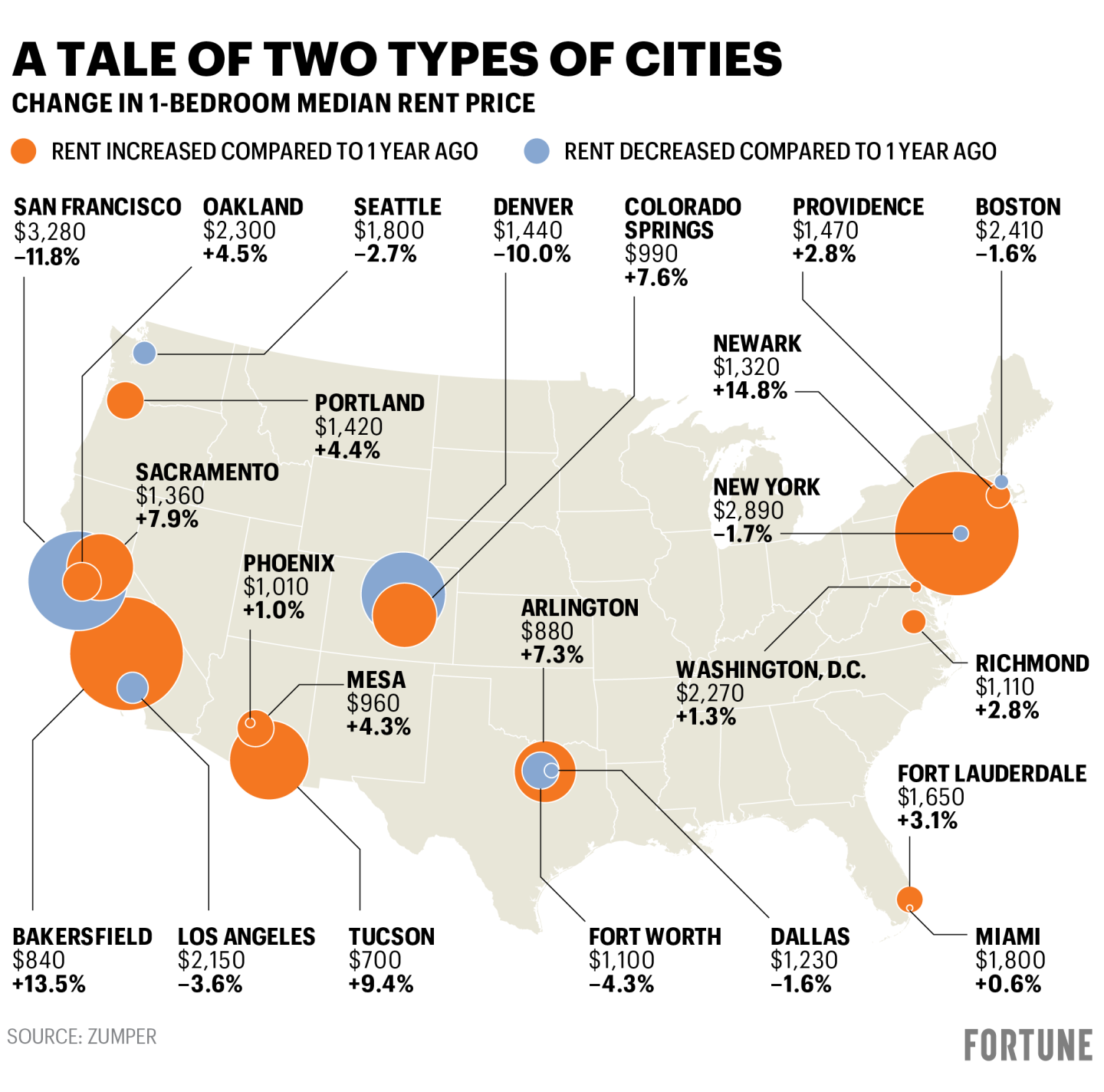

Zumper is a popular site for renters looking for a home. Founded in 2011, the company is also known for parsing housing data and for popularizing the term “Brooklyn effect” to describe the phenomenon of people leaving urban centers like Manhattan for adjacent locations. According to Zumper CEO Anthemos Georgiades, the effect has been especially pronounced during the COVID-19 pandemic.

He notes, for instance, that an outflow from San Francisco has contributed to rents shooting up 4% in nearby Oakland and 7% in Sacramento—a situation he says is unprecedented during a recession. Another example of the Brooklyn effect, says Georgiades, is taking place in Newark, N.J., where rents are up 15% as New Yorkers flock to that state.

For its part, Zillow has detected another COVID-related trend: A surge in virtual home tours. The company’s app has offered sellers the ability to show floor plans or 3D tours for some time, but these features have only taken off in recent months.

“Agents have absolutely upped their game to give people the virtual experience,” says Tucker of Zillow, who says the number of listings that include virtual features increased sixfold with the pandemic. Tucker predicts the popularity of such listings will become permanent as buyers realize it is safer and more efficient to go house-hunting on their phones rather than spending their Saturdays driving around.

And while the number of Americans fleeing cities appears to be more of a trickle than a flood, there is an exception: San Francisco. According to Zumper’s data, the average rent in the city has plunged by 11% this year, a figure that Georgiades describes as “staggering.” He says that the narrative of a flight from the pandemic is more true in the Bay Area than anywhere else in the country. The reason, he claims, is that tech companies are more inclined to embrace remote work both in the short term and long term—leading many workers, including some of the more than 40,000 employees at Facebook—to leave the Bay Area altogether.

If a broader movement to flee cities does take hold, it is this phenomenon—the rise of remote, Zoom-based work culture more than COVID-19 itself—that will be responsible, says Miller, the New York real estate maven.

“Zoom has lengthened the tether between work and home. You can now have fewer commutes but with the average commute getting longer,” he says.

Miller cautions not to overstate the implications, though, especially as remote work will mostly be an option reserved for professional employees. He also adds that the real estate industry simply doesn’t have enough data right now to draw firm conclusions about which changes wrought by the pandemic will be permanent. Meanwhile, housing prices will continue to be determined by the same factors that have informed them for decades.

Millennials and marriage remain a force

While the generation known as the millennials spans about 20 years, the cohort is not evenly spread. There is a large bulge within the generation, says Frank Nothaft, chief economist at data firm CoreLogic, and that bulge is beginning to turn 30. Like those who came before them, that subset of millennials is turning their mind to marriage, and moving to properties that offer more space.

It is macro-factors like this one that will have a major effect in shaping the housing market in the coming years, says Nothaft. Other ones include record low mortgage rates (many banks are offering rates well below 3%) and an ongoing shortage of inventory. Several real estate experts consulted for this story cited the latter factors as important in determining where prices might be headed.

In light of these subtle but significant factors, the more dramatic headlines about Americans “fleeing cities” can amount to noise that can obscure the market’s underlying signals. In light of this, bold predictions about the future of home prices are best taken with a grain of salt.

As for Iberraken, the schoolteacher who is also an app designer, her family’s sojourn in the woods of Virginia kindled a desire to leave New York, but she is discovering a permanent move is complicated. One big reason, she notes, is that the “Internet in rural Virginia is…slow.”

The family plans to be in Brooklyn for the foreseeable future.

More from Fortune’s Q3 investment guide:

- A comprehensive guide for first time homebuyers

- The best and worst places in the U.S. to invest in real estate during the pandemic

- To buy or to rent? Residential real estate calculus in the time of COVID-19

- Where are housing prices heading? Gain, then pain

- What the post-pandemic housing market might look like, according to the CEO of Century 21

- This is what every generation thinks of real estate—and what each has spent on it

- How to hedge your home