This article is part of Fortune’s quarterly investment guide for Q3 2020.

There has long been a generational divide when it comes to music, fashion, and politics…but there’s also a growing generational gap when it comes to real estate.

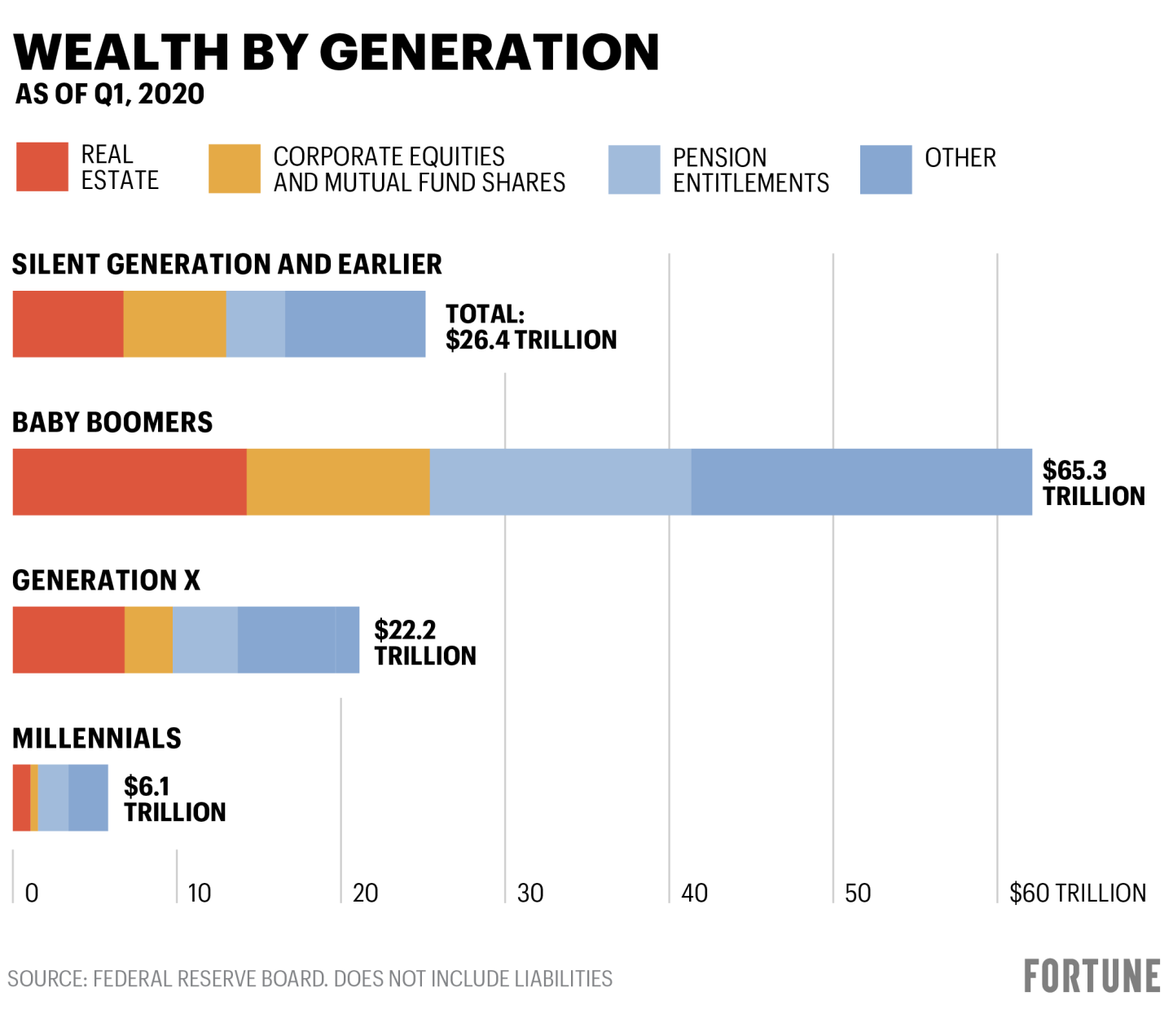

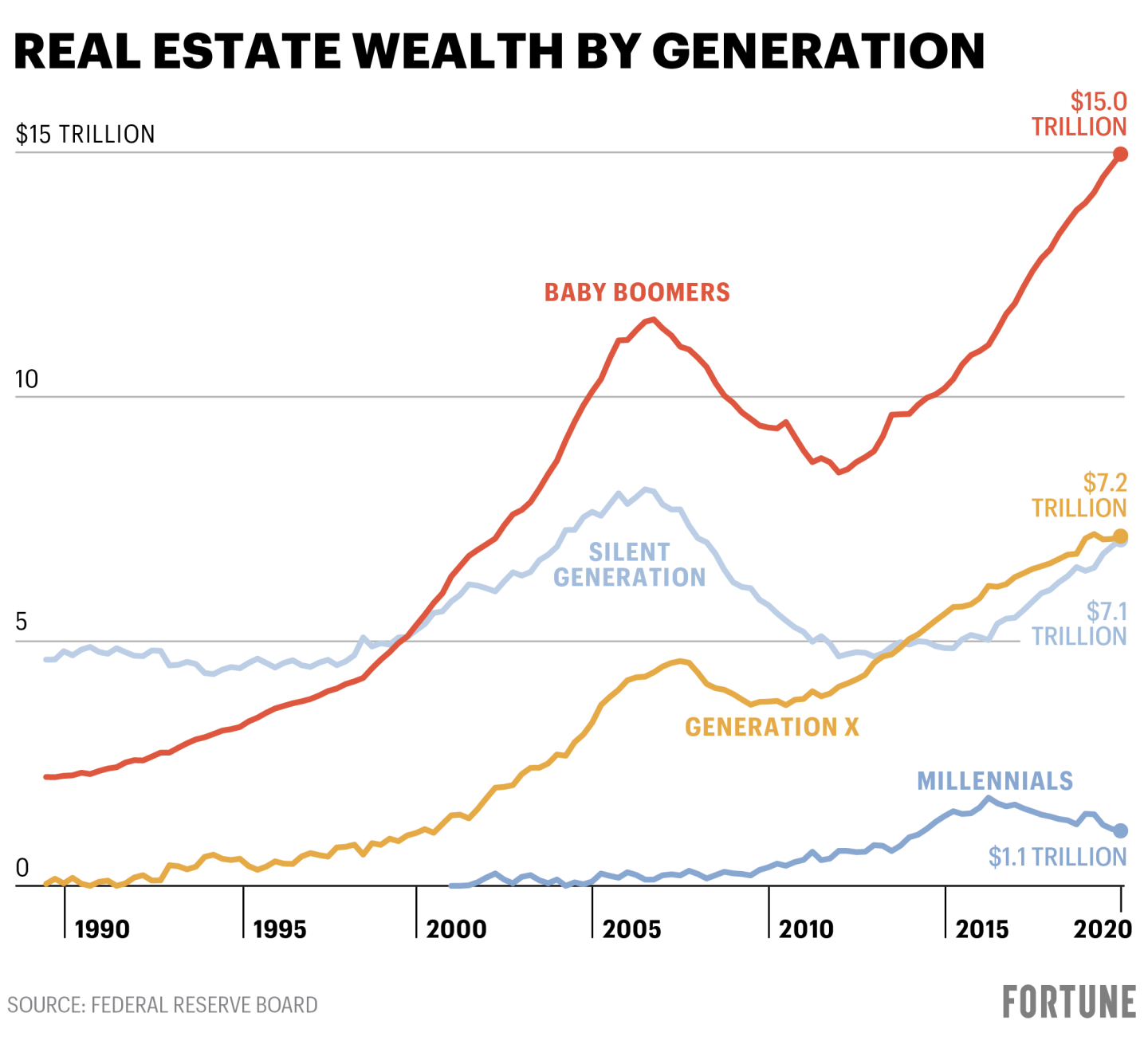

As the charts below show, starting in the 1990s, both the amounts each generation has invested in real estate, as well as the value of those investments, have differed dramatically. And generational experts say that while some of this has to do with luck and timing—those factors have also shaped each generation’s overall feelings about owning a home.

There are a few factors at work here, says Jason Dorsey, president and lead generational researcher at the Center for Generational Kinetics, a research and strategy firm based in Austin. And they affect not just how much each generation has to spend, but what each is spending it on.

- Gen Z: If you think Gen Z is all about gig jobs and the rental economy, you couldn’t be more mistaken. Says Dorsey: “Gen Z was old enough to remember the Great Recession, but young enough to have it change their views. They saw and heard their parents struggle, lose their jobs.” Broadly speaking, Dorsey says, members of Gen Z skew conservative financially and tend to have a more skeptical attitude toward credit and debt, seek jobs with stable benefits, and are much more likely to use apps that encourage saving or improving their credit scores. “We call Gen Z a throwback generation,” Dorsey says. “In many ways they are really like baby boomers.” A recent Freddie Mac survey backs that up, finding that 86% of Gen Z respondents want to own a home someday, and estimating on average that they will “attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).” Compared with previous surveys, Freddie Mac found that “fewer 18- to 23-year-old members of Gen Z see renting as more appealing than buying a home, versus millennials at the same age (19% to 30%); fewer believe renting makes you feel like part of a community (33% to 39%); and fewer perceive that it costs less to rent a home than to own a home (40% to 51%).”

- Millennials: It’s not that millennials don’t want to own homes, but given the economic wallop of the Great Recession, their passage through adulthood has been pushed back. Many emerged from college unable to find jobs, settled for jobs that weren’t ideal, or took lower-paying jobs because of the state of the economy. Not to mention this is a generation carrying very high loads of student loan debt, given the explosion in higher ed costs. According to analysis of Census data by the Pew Research Center, “Millennials trail previous generations at the same age across three typical measures of family life: living in a family unit, marriage rates, and birth rates.” They found that in 2019, 55% of millennials lived in a family unit. This compares with 66% of Gen Xers in 2003, 69% of boomers in 1987, and 85% of members of the Silent Generation in 1968. Though millennials had just started to power a buying boom before COVID-19, they were hit with another blow just as many would have been on the verge of buying their first home.

- Gen X: Meanwhile, when it comes to Gen Xers, their experience with real estate tends to center on whether they are in an area where prices have fully recovered from the Great Recession. If they have, they generally view it as a positive way to build wealth. But if not they hold more negative views. Says Dorsey, “They’ve seen the good and bad—the rapid appreciation and the crash.”

- Boomers: If you’re a boomer, you tend to have an unabashedly positive view of real estate as an investment, thinking of it as a wealth creation vehicle as well as a nest egg. Which leads to another interesting generational twist: Will millennials be able to play financial catch-up via a huge wealth transfer from their boomer parents? Though that has long been what’s predicted, Dorsey isn’t so sure anymore. “Boomers are living so long they may end up spending what they would have given to their kids,” he says.

- The Silent Generation: They have a very different experience than later generations, says Dorsey, “because they were there during the rapid growth of the suburbs post-World War II. As the parents of boomers, they witnessed farmland become master-planned communities. They also saw the fortunes of cities rise and fall and rise again.” He says that this group is increasingly trying to simplify their real estate and homeownership responsibilities—i.e. moving into a smaller place or one that is easier to maintain. They’re also navigating inheritance and estate planning, while figuring out how to “maintain their quality of life, access to healthcare, and proximity to other family members and friends,” says Dorsey.

More from Fortune’s Q3 investment guide:

- A comprehensive guide for first time homebuyers

- The best and worst places in the U.S. to invest in real estate during the pandemic

- To buy or to rent? Residential real estate calculus in the time of COVID-19

- Where are housing prices heading? Gain, then pain

- Are people really fleeing cities because of COVID? Here’s what the data shows

- What the post-pandemic housing market might look like, according to the CEO of Century 21

- How to hedge your home