This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. The global rally in stocks continues this morning. Investors again are pinning their hopes on big fiscal stimulus packages and the further reopening of the global economy.

Let’s see where investors are putting their money.

Markets update

Asia

- The Asian indices are all in the green in afternoon trade, with Japan’s Nikkei and Hong Kong’s Hang Seng leading the way.

- There’s big optimism that Japan and South Korea will unveil new spending plans to launch their economies out of recession.

- Brent is climbing again this morning. All signs are that Saudi Arabia and Russia will agree to further output cuts on a June 9 conference call.

Europe

- European bourses climbed out of the gates again this morning, with London’s FTSE and France’s CAC up roughly 1% at the open.

- Angela Merkel didn’t get the €100 billion stimulus plan she was seeking yesterday to reinvigorate Europe’s biggest economy. Talks resume in the German capital. The Dax is trading as if it’s a done deal.

- Staying with Germany… Volkswagen agreed to invest $2.6 billion in Argo AI, a self-driving car startup backed by Ford Motor Co.

- First-in-first(ish)-out. Italy today lifted the last of its major lockdown restrictions, permitting nationwide travel and flights from abroad. (My in-laws have already called the house twice this morning. They want to know when we’ll cross the border to visit.)

U.S.

- U.S futures are climbing again, looking to extend the equities rally to a fourth straight day. The curfew orders and protests, the coronavirus case load (more than 20,000 American cases were reported yesterday), the huge social divisions and massive unemployment… meh, that’s all occurring on a different planet. Or so it seems to this markets observer.

- You know what the global economy needs about now? A new wave of tariffs. That’s apparently the thinking of the Trump Administration as it prepares a tough policy response against the many European and Asian countries eyeing taxes on digital commerce, a measure that would hit FANG stocks.

- Zoom (ZM) is having a good pandemic. The video conferencing company reported a sales boost of 169% last quarter, led by a surge in business customers.

Elsewhere

- Gold is down. As is the dollar. It’s another risk-off day.

- Crude is gaining. Brent is now up above $40/barrel.

Reopen sesame

The markets are looking forward. COVID-19? That was yesterday’s news. GDP collapse? Depression-era unemployment levels? Ancient history. New trade tensions with China? Okay, not so fast. That could still be a big deal, but for now equities investors are shrugging off the possibility, sending stocks on a rally that, in some places, is greater than 30%.

The global economic rebound is, at best, a U-shaped affair. The global equities rebound though is very a much a V-shaped phenomenon.

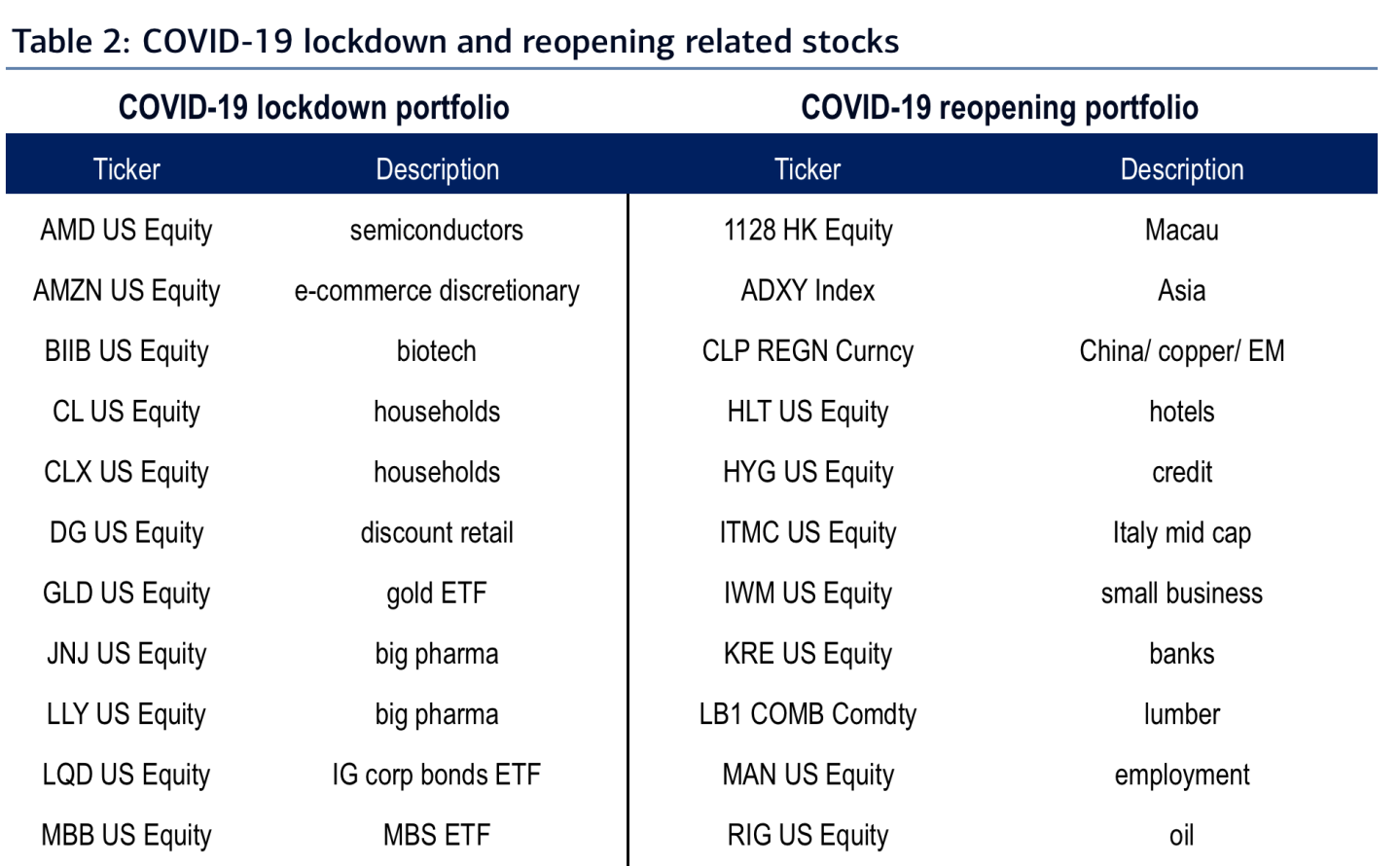

And what’s driving the upward leg of the “V”? Things like oil, copper, banks and Italian mid-cap stocks—what BofA Securities calls its “reopening portfolio.” These beaten-down assets are way off their lows, and driving much of the rally in recent weeks. They should be the first to rebound when lockdown measures ease, and people start to resume something resembling a normal life. You can see some of the “reopening” assets in BofA’s table below (right-hand column).

What’s in the “lockdown portfolio”? Things like gold, discount retail, biotech, Big Pharma and Big Tech. You can see them in the left-hand column above.

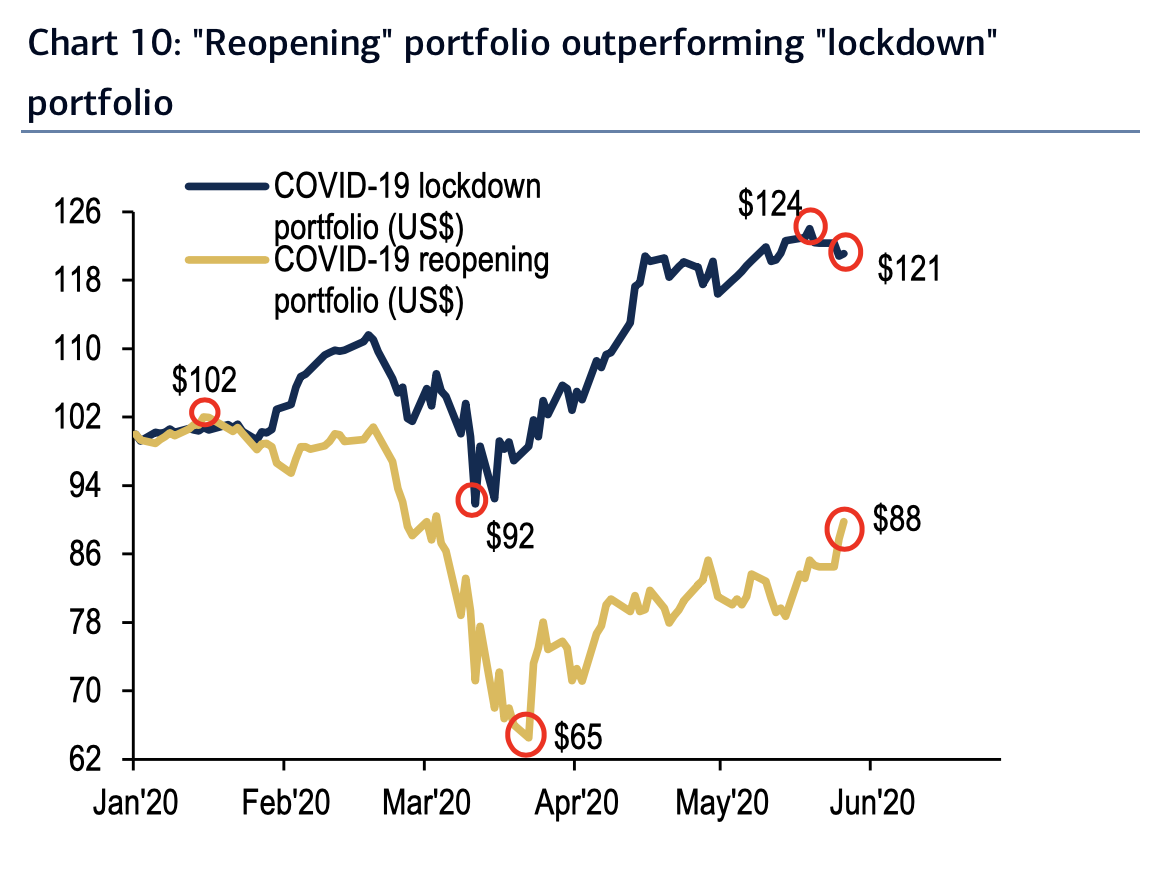

During this current rally, the “lockdown” assets are still holding their own, but the “reopening” assets are beginning to close the gap, as this second BofA chart below shows. (The BofA chart was published at the end of last week; the gap has narrowed further over the past three trading sessions.)

That yellow squiggly line is what’s largely driving the markets higher in recent days. For example, financial stocks yesterday had a good day, led by American Express and Goldman Sachs.

These reopening assets are still far from their February highs, but they’ve been roaring back.

***

Have a nice day everyone. I’ll see you back here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune’s Outbreak newsletter will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Half shares—big deal. The Amazon (AMZN) share price closed yesterday at $2,472.41. Too pricey for your portfolio? A number of Fintechs and brokerages are here to help. Increasingly, they're selling "fractional" shares in the markets' high-fliers. It's a move that's particularly popular with one group of investors in particular, Fortune's Lucinda Shen reports.

IPO watch. After weeks of inactivity, there are a quintet of big initial public offerings scheduled this week, with Warner Music, biopharma firm Applied Molecular Transport and payment processor Shift4 Payments all slated to price. If these debuts go well, "a host of companies are likely to follow in the coming months," the Wall Street Journal reports. That "if" is already being tested as Warner Music was forced to delay pricing its shares yesterday.

(Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.)

Market candy

$16 trillion

So much for a quick recovery. The Congressional Budget Office now forecasts the economic hit from the coronavirus will linger for another decade or so. By 2029, the cost to the U.S. economy could top $16 trillion. That's trillion with a T.