This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. The markets continue on cruise control. That’s despite another night of protests and looting in the U.S., and big doubts as the U.K. and Europe go back to the negotiating table to hammer out a trade deal.

Let’s see where investors are putting their money.

Markets update

Asia

- The Asian indices are all in the green in afternoon trade again on Tuesday, looking to extend yesterday’s gains. Japan’s Nikkei, a high-flyer last month, leads the way.

- Not more than two months ago they were engaged in a bruising oil price war. Now Saudi Arabia and Russia are playing nice, planning to limit crude production through Sept. 1, sending oil prices higher.

- Australia’s central bank says the downturn will be less severe than expected. The country has had a relatively small, manageable batch of COVID-19 cases.

Europe

- European bourses climbed out of the gates again this morning, led by Germany’s DAX, which was 3.5% higher two hours into the session.

- Brexit negotiations resume today. No-deal remains a distinct possibility. Citi thinks such a development would force the BOE to join its European peers in pushing interest rates into negative territory.

- Russia is one of the worst-hit COVID-19 countries on the planet. But that’s not stopping Russian President Vladimir Putin from scheduling a referendum for next month to essentially keep himself in power until 2036.

U.S.

- U.S futures are off their lows as I type. All three indices closed higher on Monday, all but ignoring the turmoil in the streets of America’s cities.

- If you’re confused by the paradoxical markets calm… there’s a long history of America’s stock markets ignoring America’s social upheaval.

- JP Morgan, for one, thinks this rally has legs as there’s still more than a trillion in cash sitting on the sidelines. “There is still plenty of room for investors to raise their equity allocations,” JPMorgan strategists wrote in a note yesterday.

Elsewhere

- Gold is down.

- As is the dollar.

- Crude is gaining. West Texas Intermediate is up above $35/barrel.

The American precariat, revealed

America is suffering. We saw it in the images from April of mass graves and coffins. We saw it in the images from May of protests at state capitols. We’ve seen it in the images from America’s burning cities this past week. And, yes, we will see it again on Thursday when millions more jobless claims are announced.

Who are these suffering Americans? They drive our commuter bus. They clean our office. They operate that small business you frequent every now and then, or maybe they just work there.

In good times, they make up a crucial part of the American economy. In bad times, they are the first to lose their jobs. The difference this time around is that they seem to all be losing their jobs at once, forming the great American precariat. Historians say we haven’t seen such economic upheaval since the Great Depression. Others point out the inevitable: social upheaval is sure to follow. It probably already has.

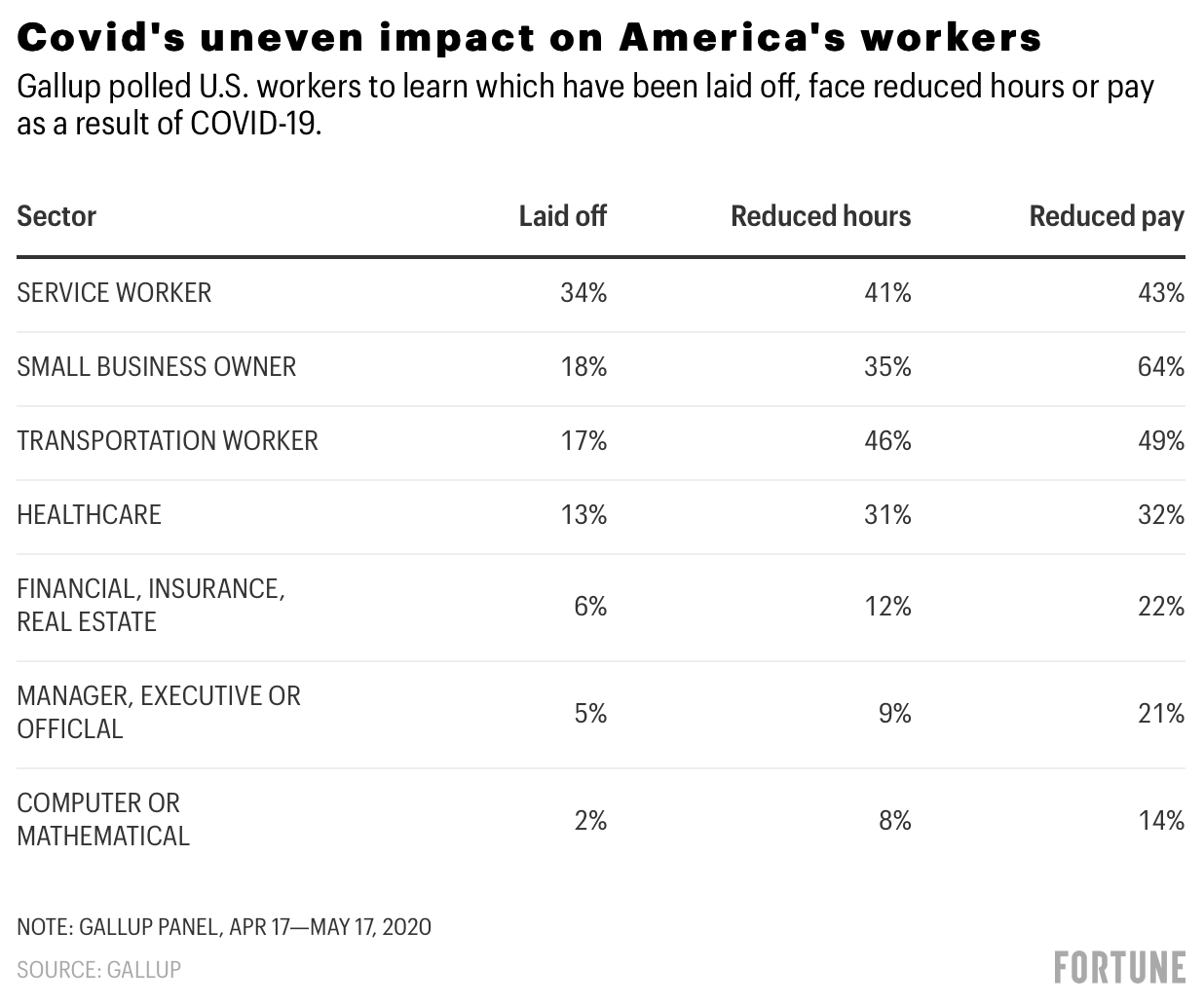

The American precariat is more diverse than you think. Gallup has been doing some great work digging into the numbers to find out who’s out of work, and who’s clinging to a job on reduced hours and reduced pay.

Some jobs (in IT, for example) are more pandemic-proof than others (service workers). We knew that. But even essential staff (transportation and healthcare) cannot avoid the COVID-19 hit. Many have to go to work these days earning reduced pay.

As Gallup researchers point out, the most vulnerable have been hit the hardest in this pandemic. Gallup writes:

A staggering 95% of workers in low-income households—defined as those making less than $36,000 per year—have either been laid off as a result of the coronavirus (37%) or have seen a loss of income (58%). When asked about their current financial situation, 42% in this income group described themselves as spending beyond their income. They are either drawing from savings or taking on debt. Another 37% say they are “just making ends meet,” when asked to describe their current financial situation.

Middle- and upper-income brackets have been hit, too, but not like the lowest-income groups.

It took the better part of a decade for the labor market to recover from the global financial crisis. And that made the larger economic recovery all the more uneven for Americans. This current shock to the labor market has been even more extreme. There’s little reason to think the recovery this time will be any different.

***

I’ll see you back here tomorrow, everyone.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune’s Outbreak newsletter will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Earnings, schm-earnings. So far in 2020, S&P 500 companies have posted dreadful bottom-line results. And yet if you're long the benchmark index, you're pretty happy this morning. What gives? How long can this earnings-don't-matter paradigm last? Fortune's Anne Sraders digs into the numbers.

Bully, bully. Remember when Goldman called a 2400 bottom for the S&P? It was just a few weeks ago. Well, after the May rally, it's had to abandon that position, repricing the floor. And it even sees a further rally in the cards. Here's how high they think the benchmark index has room to climb.

(Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.)

Market candy

Quiz time

In yesterday's chart, I pointed out that one of the winners for May was German equities. The Dax is up 12% since its mid-May low. It has company.

Which of its European peers is the second-best performer over that period?

- a) London's FTSE

- b) Spain's IBEX

- c) Milan's FTSE MIB

- d) Paris' CAC

The answer: The IBEX, up an impressive 11.5% since May 14 as the country comes out of lockdown with a much-reduced coronavirus caseload. The FTSE is the relative laggard (+7.4%)