This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. We’re stuck in a “W” cycle—up yesterday, down today.

On the calendar today is another wave of bank earnings and a much-watched energy industry report. Let’s see where investors are putting their money.

Markets update

In Asia, the major indices are trading slightly lower even after China’s central bank decided to pump more liquidity into the banking system and cut the main lending rate 20 basis points. Meanwhile, all eyes will be on South Korea today, where, as Fortune‘s Grady McGregor writes, the country is holding the world’s first-nationwide election of the coronavirus era.

The IMF’s report from yesterday is still weighing on global markets. It warned the “Great Lockdown” recession will shrink the global economy by 3% this year, a decline not seen since the Great Depression.

***

Speaking of depressing… Europe is trading sharply lower on Wednesday with Germany’s Dax down about 2%. The prospect of European countries easing coronavirus lockdown measures lifted markets yesterday. But that’s fading today, despite another round of reports that Germany, Spain and Italy are making progress in their fight against the coronavirus pandemic.

With earning season underway, investors’ focus is squarely on corporates. Today, Dutch chip maker ASML declined to provide a Q2 outlook, like so many companies. CEO Peter Wennink says demand remains strong. What’s less certain is “how the current COVID-19 crisis will impact the global GDP development, end markets, our manufacturing capability and supply chain,” he tells Bloomberg.

***

The U.S. futures are pointing to a weak open. The Dow, S&P 500 and Nasdaq are poised to open down by more than 1% after impressive gains yesterday.

The banks may be our best window into how deep a recession we can expect. JPMorgan Chase and Wells Fargo yesterday told investors they’ve set aside a combined $10 billion to cushion against a flood of insolvencies and loan defaults.

Up today are Bank of America, Goldman Sachs and Citigroup, giving us further data on the fragile U.S. economy.

In bailout news, U.S. airlines apparently struck a deal to get $25 billion in federal funding to ride out the worst of the crisis. Shares of American Airlines, United Airlines, Delta Air Lines, and Southwest Airlines initially rose on the news in after-hours trading.

***

Elsewhere, the dollar is up. Gold and crude are down. Brent is again trading below $30 per barrel, wiping out much of the gains it hit in the run-up to last weekend’s OPEC+ deal to cut output. There could be more turmoil after the International Energy Agency publishes its annual outlook today.

***

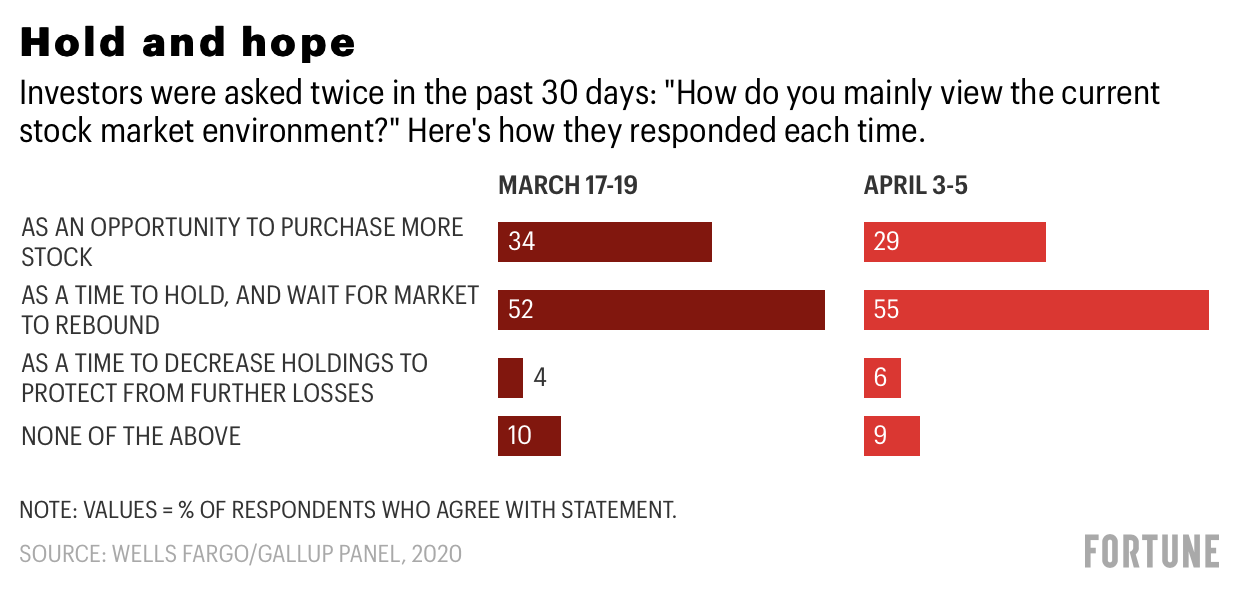

Tuesday’s rally notwithstanding, investors are still approaching the markets with caution. That’s one of the few constants during these volatile times.

Yesterday, a new piece of investor survey data came out showing risk-off sentiment rules the day. That’s the subject of today’s chart.

***

Wait and see

The data is part of a Gallup/Wells Fargo survey which found that the majority of investors (55% as of April 3-5) view the current market as a time to sit on the sidelines until prices recover and a calmer pattern emerges. That bearish view among investors has increased since the tumultuous trading days in mid-March just before the S&P 500 hit its 2020 low.

“As the COVID-19 crisis stretches into a second month with no end in sight to current business closures and sweeping social distancing recommendations, investors have grown less optimistic about how soon the market will recover once the coronavirus crisis ends,” the report’s authors note.

Now here’s some good news. As you extend the timeline, those polled begin to feel more comfortable about the future of their portfolio. Eight in 10 investors “are confident they can weather the current market downturn.” That data point resembles one we saw in another recent investor poll by Allianz. As I noted in Bull Sheet last week, 70% of investors surveyed by Allianz felt there was still plenty of time to recoup portfolio losses.

Postscript

Let’s leave it there on that upbeat note. I’ll be back here tomorrow with new insights and observations from lockdown land.

Have a good day. And stay safe and sane.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Behind the mask. With America's hospitals desperate for medical masks to treat coronavirus patients, the “mask economy” has turned surreal, with price-gouging, bidding wars and armed guards protecting warehouses. Long-time suppliers in China are now charging seven times more for masks than they did in December and that, coupled with soaring freight costs, has driven the price hospitals are paying through the roof, reports Fortune’s Shawn Tully.

Depression-era bad. The coronavirus recession will likely be the worst since the Great Depression almost a century ago, the IMF predicts. The cumulative loss in global GDP this year and next could be about $9 trillion—bigger than the economies of Japan and Germany combined. IMF chief economist Gita Gopinath called it a crisis “like no other”.

Banks squeezed. First-quarter profit at JPMorgan Chase plunged by nearly 70% to the lowest in more than six years, giving investors a first taste of the damage the COVID-19 pandemic is inflicting on bank results. The bank set aside $8.29 billion for bad loans, the biggest provision in at least a decade and more than double what some analysts had expected. Shares were down nearly 3% on Tuesday.

Market candy

This date in history

What's regarded as the first franchised McDonald’s restaurant opened in Des Plaines, Ill., on this date 65 years ago—on April 15, 1955—under an agreement between the founding McDonald brothers and Ray Kroc, who saw the potential to expand the brothers’ stripped-down Speedee Service System hamburger restaurant concept nationwide. Today, the company is the world’s best-known fast-food chain with over 36,000 restaurants in over 100 nations.