This article is part of Fortune‘s quarterly investment guide for Q2 2020.

Remember early February? The stock market was notching new highs, the unemployment rate was at a 50-year low, and the coronavirus was an emerging strain of disease halfway around the world.

The world couldn’t look more different now.

Now the question isn’t just how deep a recession will be, it’s whether we’re heading for the dirtiest word in all of economics: a depression.

To best judge which way the economy is going, Fortune canvassed seven top economic indicators. Because things are changing so rapidly during this pandemic, we looked only at indicators that include data as of mid-March, when the pandemic was substantially affecting the U.S. economy. (Some indicators like the unemployment rate and home construction are lagging, so we won’t see the full effects of the coronavirus on those till later this spring.)

More than 6.6 million Americans filed for unemployment benefits in the week ending March 28. That is the highest number ever, topping the previous all-time record of almost 3.3 million unemployment claims, which was set the week ending March 21. Combined, that’s 10 million jobless claims in two weeks.

This surge in unemployment claims is so great that states are struggling to process everyone—meaning the total number of claims is actually higher.

Before these unemployment claims, a total of 7.1 million Americans were unemployed in the most recent jobs report through mid-March. But if you combine the number of Americans unemployed in the jobs report and the following two weeks of unemployment claims, then the country’s jobless amounts to above 17 million—which would be the highest in American history.

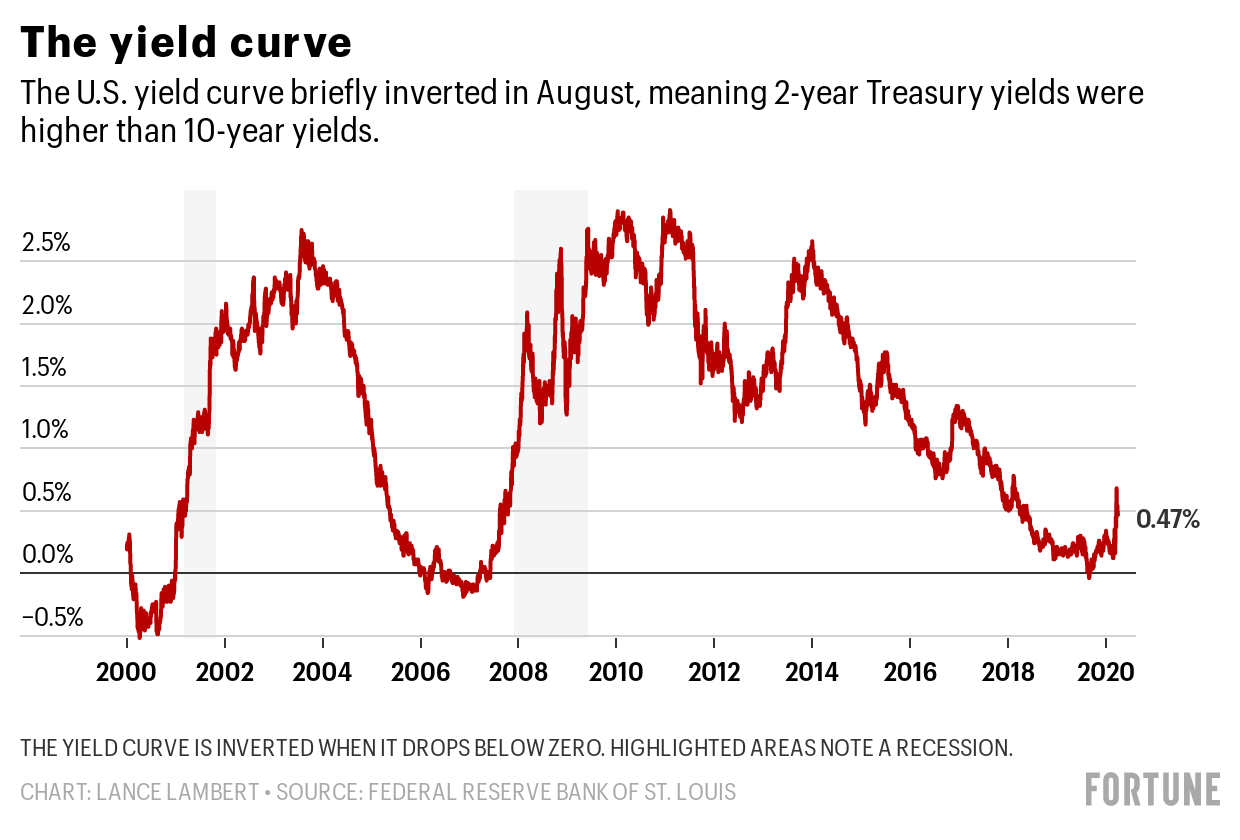

Back in August 2019 the yield curve inverted, which means long-term rates were temporarily lower than short-term rates. Historically, this usually happens before a recession. Since then, the inversion has receded. But the fact it inverted means there was already some concern in the economy even before COVID-19.

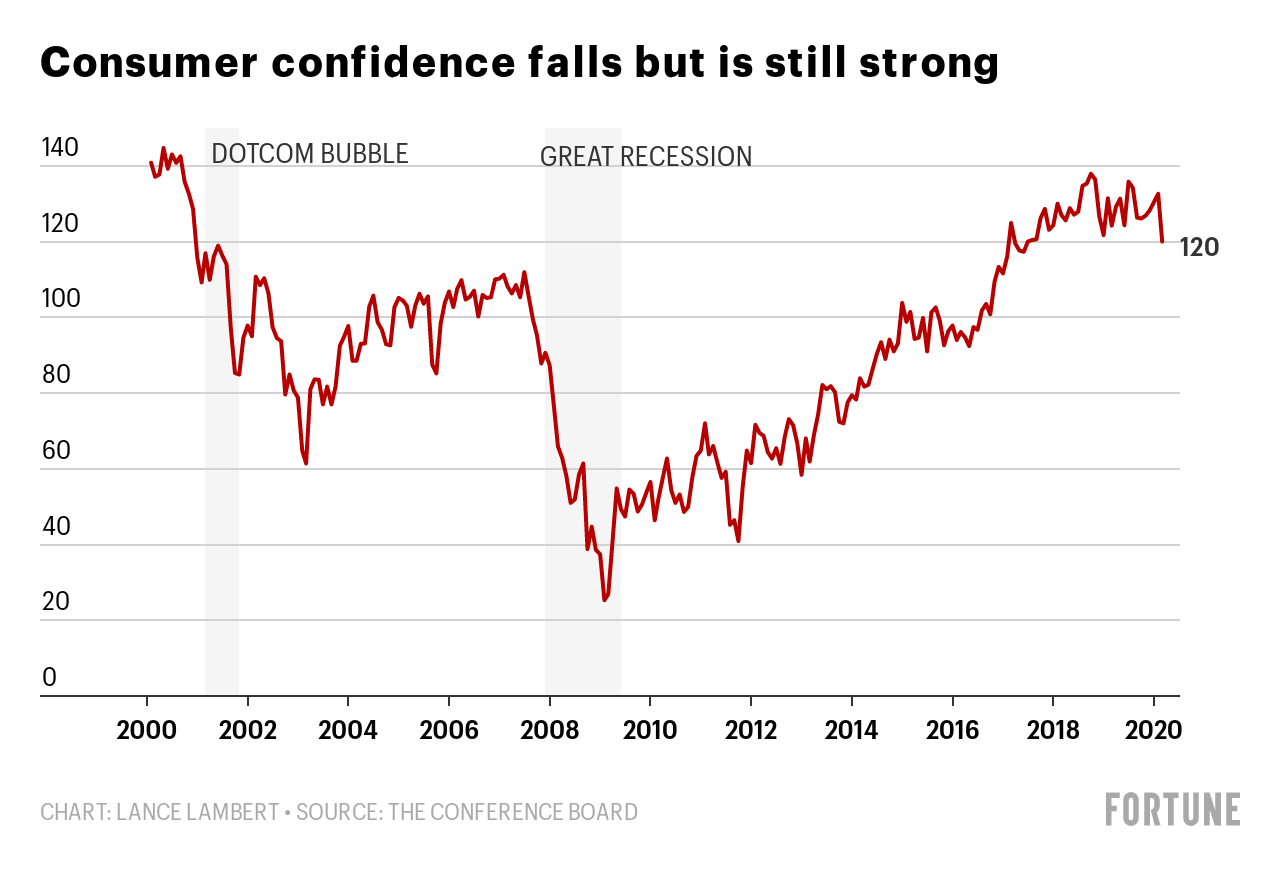

Consumer confidence dropped in March, according to the Conference Board’s Consumer Confidence Index. The index was at 120, down from 132.6 in February. While this drop moves consumer confidence back to 2017 levels, it is still far above where it was during the Great Recession.

“March’s decline in confidence is more in line with a severe contraction—rather than a temporary shock—and further declines are sure to follow,” said Lynn Franco, senior director of economic indicators at the Conference Board in its press release.

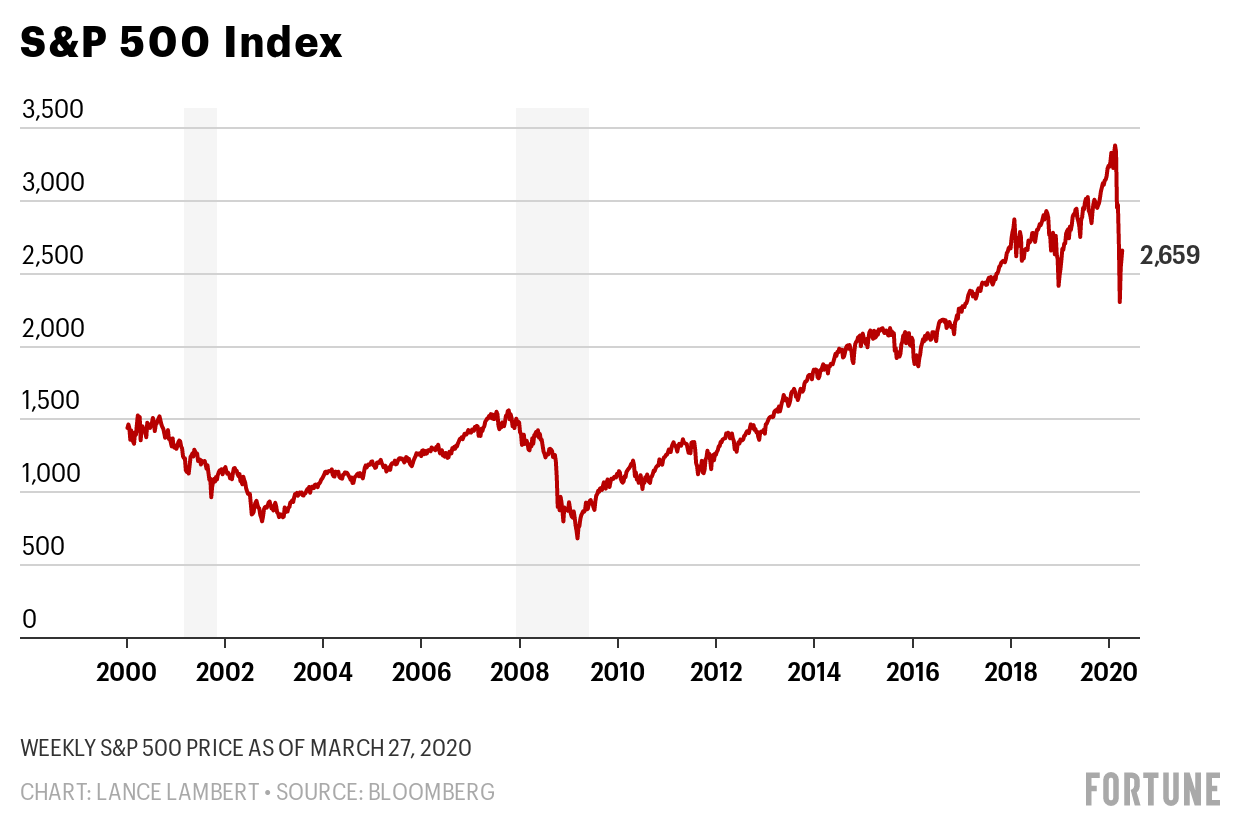

Earlier this year the Shiller P/E ratio was starting to get historically high, indicating an overvalued stock market. Since then, we’ve entered into a bear market, and the index has dropped. But this drop might be less than it appears, considering earnings will be down significantly once we get earning reports—so current P/E ratios look lower since they’re based on previous higher profits. Either way, the P/E ratio is still above that of 2009, meaning the market still has room for bigger losses if the downturn deepens.

The past month has been brutal on Wall Street, as an 11-year bull run turned into a bear market. The S&P 500 dropped 34% from its February high of 3,386 to 2,237 in March. It has since recovered a bit, but this drop is a bad omen. In recent history, similar-size drops have usually been followed by recessions. One of the best examples is the Russell 2000 and other indexes that crashed in 2000 and were the red flag leading up to the 2001 recession.

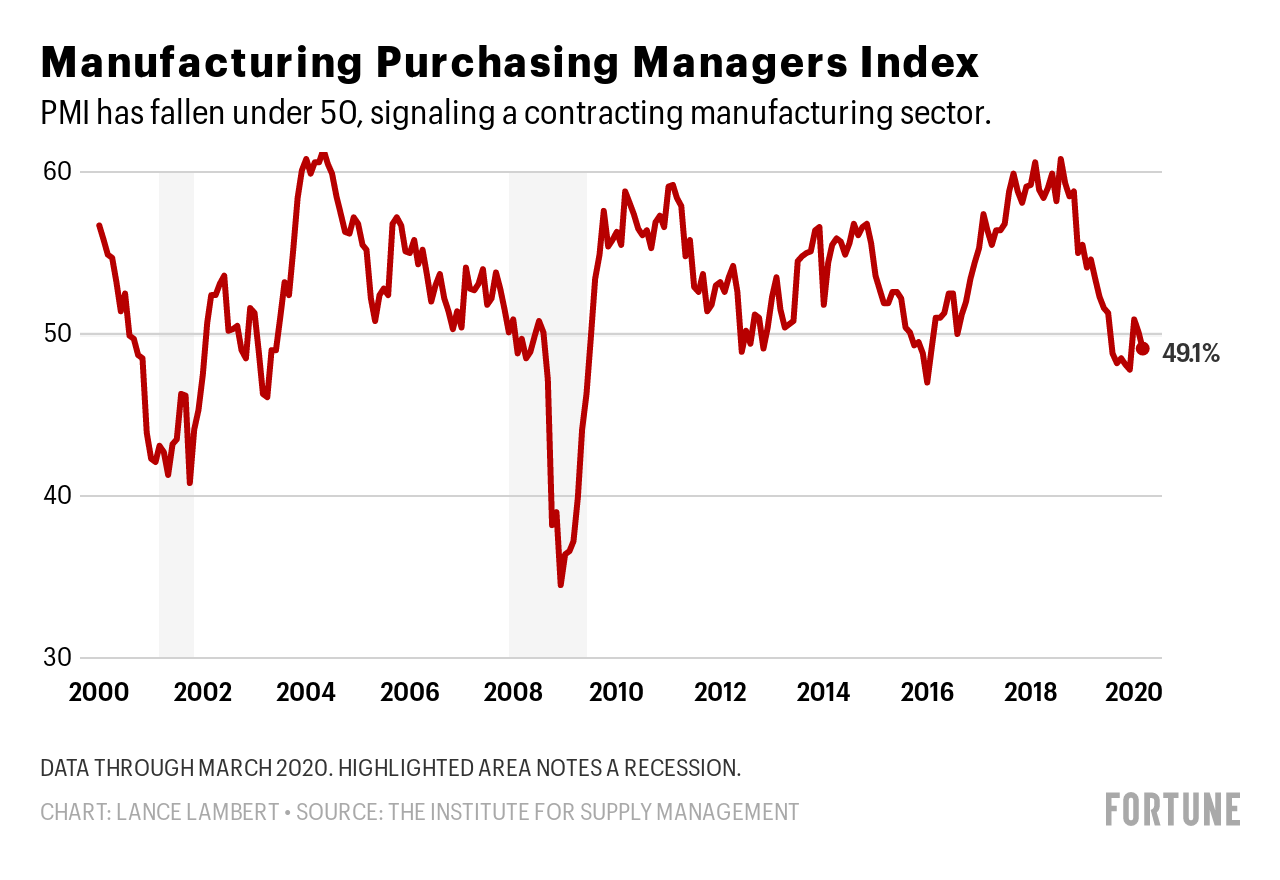

Even before the coronavirus outbreaks, U.S. manufacturing was already lethargic, contracting several times late last year. The Institute for Supply Management’s Purchasing Managers Index (PMI) came in at 49.1% in March, down from 50.1% in February. A PMI below 50% signals a contracting manufacturing sector—something that has happened six times over the past year. But that mild dip isn’t as bad as many other industries. The reason is that states like Ohio and Pennsylvania have deemed manufacturers essential and allowed them to stay open. And some manufacturers with ties to the health care industry are as busy as ever, as they ramp up production of items like masks.

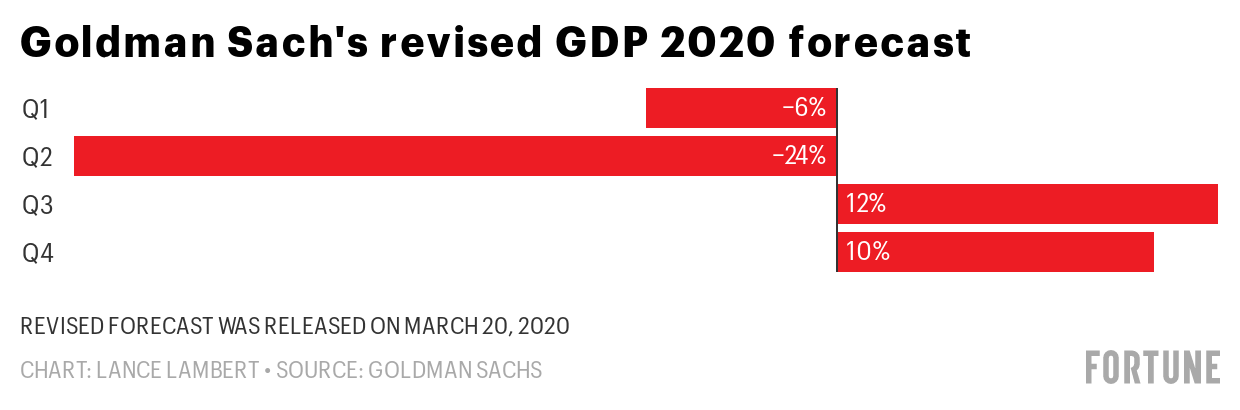

The U.S. grew at 2.1%. in the final quarter of 2019. That modest growth could soon be upended by sharp decreases, according to Goldman Sach’s GDP forecast released March 20. And given the 10 million Americans who’ve claimed unemployment in the weeks since, that forecast might be too conservative.

Last quarter we provided a scorecard for the economic indicators (green=signaling growth, yellow=steady, and red=forewarning trouble). This quarter the data scream only one color: red or trending red.

The trajectory of the economy in 2020 is clearly pointing toward a recession. The specifics—how deep, how long—will dictate the damage done to the U.S. economy once the pandemic recedes.

More from Fortune’s Q2 investment guide:

—5 rules to guide your investing decisions during the coronavirus pandemic

—Market preview: What to remember as we move past a quarter to forget

—Chasing returns: Why ‘inside the tent’ assets like corporate debt may be poised to outperform

—Q&A: State Street’s Lori Heinel on where she sees beaten-down buying opportunities during coronavirus

—Best stocks to buy now: These 5 names will weather the coronavirus pandemic

—Why a bear market is the best time to ‘convert’ to a Roth IRA

—How to adjust your 401(k) during a bear market

Subscribe to Fortune’s Bull Sheet newsletter for no-nonsense finance news and analysis daily.