This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. Q1 comes to a close today, and there’s green on the screens.

Let’s check in where investors are putting their spare cash.

Markets update

We begin in Asia. The Hang Sang and Shanghai Composite are both trading higher, helped by a wave of new data showing the Chinese economy is bouncing back. The country’s manufacturing sector, in particular, is showing signs of renewed strength.

***

Next stop: Europe. The major bourses in Frankfurt, London and Paris all opened higher. Investors are relieved that Italy, still the worst coronavirus hotspot in Europe, is making steady progress in finally containing the outbreak.

The mini-rally is happening despite fresh pressure on dividends and buybacks. The ECB is putting the squeeze on European lenders to cancel dividends over the next six months. Germany is doing something similar, insisting a dividend ban be placed on companies requesting state aid.

Other companies have arrived at the conclusion on their own. Advertising giant WPP is halting all buybacks and dividends for the time being.

Let’s finish with some good news: Sweden’s Ericsson reports business is actually strong at the moment, and that 5G demand is soaring. Shares in the telecoms equipment supplier are up nearly 3% at the open.

***

As I type, the Dow and S&P 500 futures are ticking higher. The indices are looking to add to yesterday’s impressive gains.

Wall Street is giving mixed signals about whether or not we’ve already hit a bottom. JPMorgan Chase says most risk assets have seen their low point, suggesting equities will begin a rocky return higher. Goldman Sachs though warns it’s still too early to declare the worst is behind us, my colleague Anne Sraders writes.

There’s a big asterisk put on all these calls. It all depends on whether the U.S. can keep the coronavirus contagion numbers to a relatively manageable number. The situation in New York City looks dire.

***

A first big test will come later this week when the latest jobs numbers are reported. James Bullard, Federal Reserve Bank of St. Louis president, made a remarkably bearish call on the U.S. jobs picture yesterday, warning the unemployment rate could hit as high as 42%. That may not seem so farfetched after U.S. retailers announced yesterday they’ll be furloughing workers in record numbers.

***

Elsewhere, the dollar is climbing for a second straight day. Gold is flat, and oil is rebounding. The improved factory data out of China, plus the White House’s latest intervention in the Saudi-Russian price war, are lifting futures prices. WTI crude had hit a low on Monday last seen in 2002, and that’s showing up at the pump. A Bull Sheet reader yesterday told me he’s seen the price of gasoline in the Dallas-Fort Worth area sink below $1.50 per gallon.

***

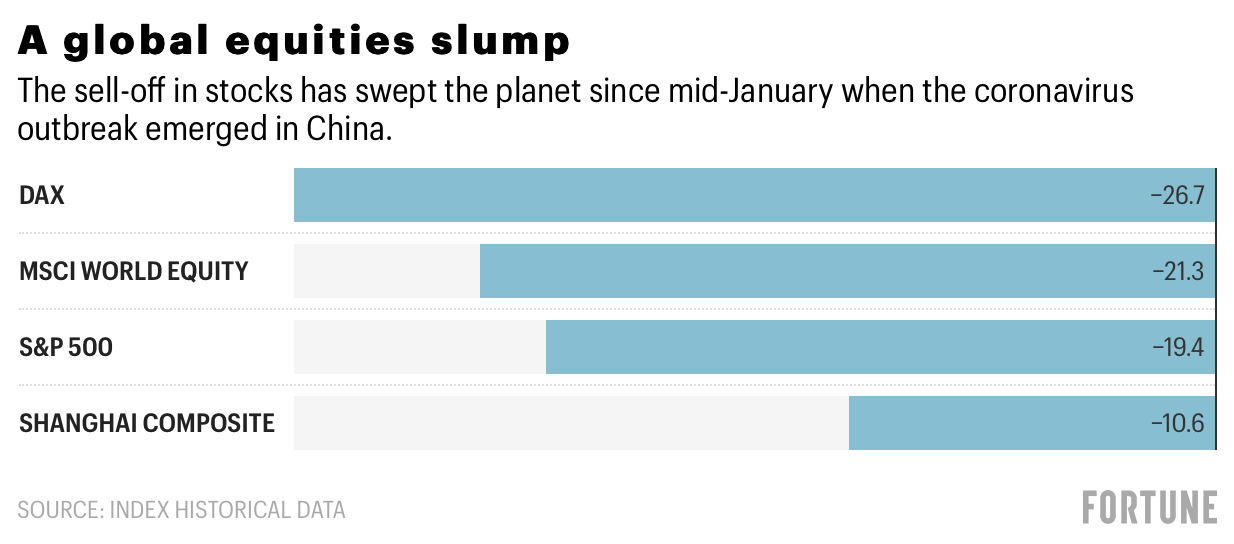

Today is the final day of the quarter. It’s been a quarter to forget. Finding any kind of return on equities has been a global problem. As the Wall Street Journal notes, citing FactSet data, the MSCI All Country World Index was, as of yesterday, on pace to record its worst quarter since 2008.

Here’s how that compares to other benchmark indices around the world.

***

World beating

Let’s start with Germany’s Dax. It saw a nice rebound last week, but it’s still down 26.7% for the quarter, worse than the MSCI World Equity index. The S&P 500, thanks to a stellar seven-day stretch, is down a dreadful 19.4%. The best of the bunch is the Shanghai Composite, which is solidly outperforming the MSCI over the past quarter.

Postscript

Day 22 (23?) in lockdown here in Rome.

Last night’s coronavirus bollettino (bulletin) gave us reason for guarded optimism. The increase in new confirmed cases had hit a new low in the previous 24 hours; Italy’s growth rate has now halved over the past week. The numbers in the ICU are down too, and the ranks of “recovered” is climbing. But still the overall numbers are growing.

The World Health Organization says Italy and other European countries may be nearing a peak. And yet Italian officials warn they won’t even consider relaxing the stay-at-home measures until after Easter, and that we’ll likely be stuck in lockdown for another month.

Sit tight, everyone, and stay healthy. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Insider trading rocks D.C. The Justice Department will formally investigate Congressional at least one lawmaker who dumped shares in recent weeks ahead of the markets nosedive, the Wall Street Journal reports. Investigators will seek to determine whether Sen. Richard Burr (R., N.C.) was acting on confidential information gleaned from closed-door coronavirus intelligence briefings. He's not the only one under suspicion.

Daily bread. The price of wheat and rice futures has soared 15% and 17%, respectively, in the past two weeks, according to the Wall Street Journal. Staples like these are expected to be in high demand as the lockdown continues, driving up food prices.

Learning from Lehman. Why do we need bailouts when we have Chapter 11 bankruptcy protection? Fortune's Jeff John Roberts details what we've learned since the 2008 financial crisis, in which the likes of Lehman Bros. collapsed in spectacular fashion. We're unlikely to see that kind of corporate carnage this time round, policymakers seem to be saying. We'll see.

Market candy

$8 trillion

Social distancing is a hassle. No argument there. It's also a big life-saver. And, researchers at the University of Chicago say all those saved lives will have a huge added value to the U.S. economy. They tallied it up and arrived at the sum of $8 trillion. The numbers may seem fuzzy, but kudos for trying to find a silver lining in this awful coronavirus pandemic.