This article is part of a Fortune Special Report: Business Faces the Climate Crisis.

Capturing carbon dioxide and storing it underground seems a no-brainer, according to the new calculus of a changing climate. But it has a dirty downside: It burns a lot of energy, which typically means it spews a lot of other pollutants.

New technology proposed for commercial deployment in the West Texas oil patch aims to address that problem, providing cleaner fossil-fueled power optimized for the carbon-capture process. And that technology’s wider development, including in a separate proposed project in Louisiana, could expand and prolong the use of fossil fuels in an increasingly carbon-averse world.

Combusting fossil fuel with air, whether in a power plant generating electricity or in a car cranking out motion, yields a witch’s brew of pollutants. One is CO₂, a colorless, odorless gas that’s warming the planet and that society, until recently, much cared to curb. Others, such as nitrogen oxides, contribute to local pollution such as acid rain and smog.

Governments long have regulated those local pollutants, which is why fossil-fueled power plants have elaborate exhaust-cleaning equipment and why cars and trucks have catalytic converters. In limiting pollution, though, those devices typically lessen power, making the electricity plant less efficient and—as generations of teenage drivers know—the car less throaty off the line.

Capturing CO₂, too, requires energy. How much depends on how concentrated the supply of CO₂ is. In the waste gas coming out of a typical coal-fired power-plant smokestack, the concentration of CO₂ is about 15%. In ambient air—whose CO₂ a technology called “direct air capture” proposes to hoover up, often using giant fans—the concentration of CO₂ is radically, dauntingly, lower: 0.04%.

Once the CO₂ is captured, moreover, compressing it and injecting it into underground formations also requires a lot of juice.

For more on carbon-capture technology, read “Big Oil’s Hail Mary.”

But what if fossil fuel could be burned in a way that produced no pollutant other than CO₂—which itself could be captured? Presto: Fossil fuels would be green.

That, at least, is the theory. It’s also the stated promise of a newfangled natural-gas-fired power plant developed by North Carolina-based Net Power. Its investors include Houston-based oil producer Occidental Petroleum and Chicago-based power producer Exelon. Both see Net Power as a potential economic savior—one that could make fossil-fuel-powered electricity newly competitive amid mounting pressure to curb CO2 emissions..

Oxygen in, cleaner gas out

The Net Power process burns natural gas not with air, about 80% of which is nitrogen, but with oxygen. As a result, according to the company and its investors, the combustion produces only CO₂ and water. Because that CO₂ is highly pure—it constitutes about 98% of what comes out of the Net Power machine—it can be captured relatively easily and then, rather than being sent skyward, shot underground.

So far, no full-scale Net Power plant has been built. A small one exists at the end of a gravel road in an industrial part of La Porte, Texas, on the southeast fringe of Houston. (On the day I visited the plant in February, power generation was down for an inspection, and as of mid-March it remained down for an upgrade of a key part.)

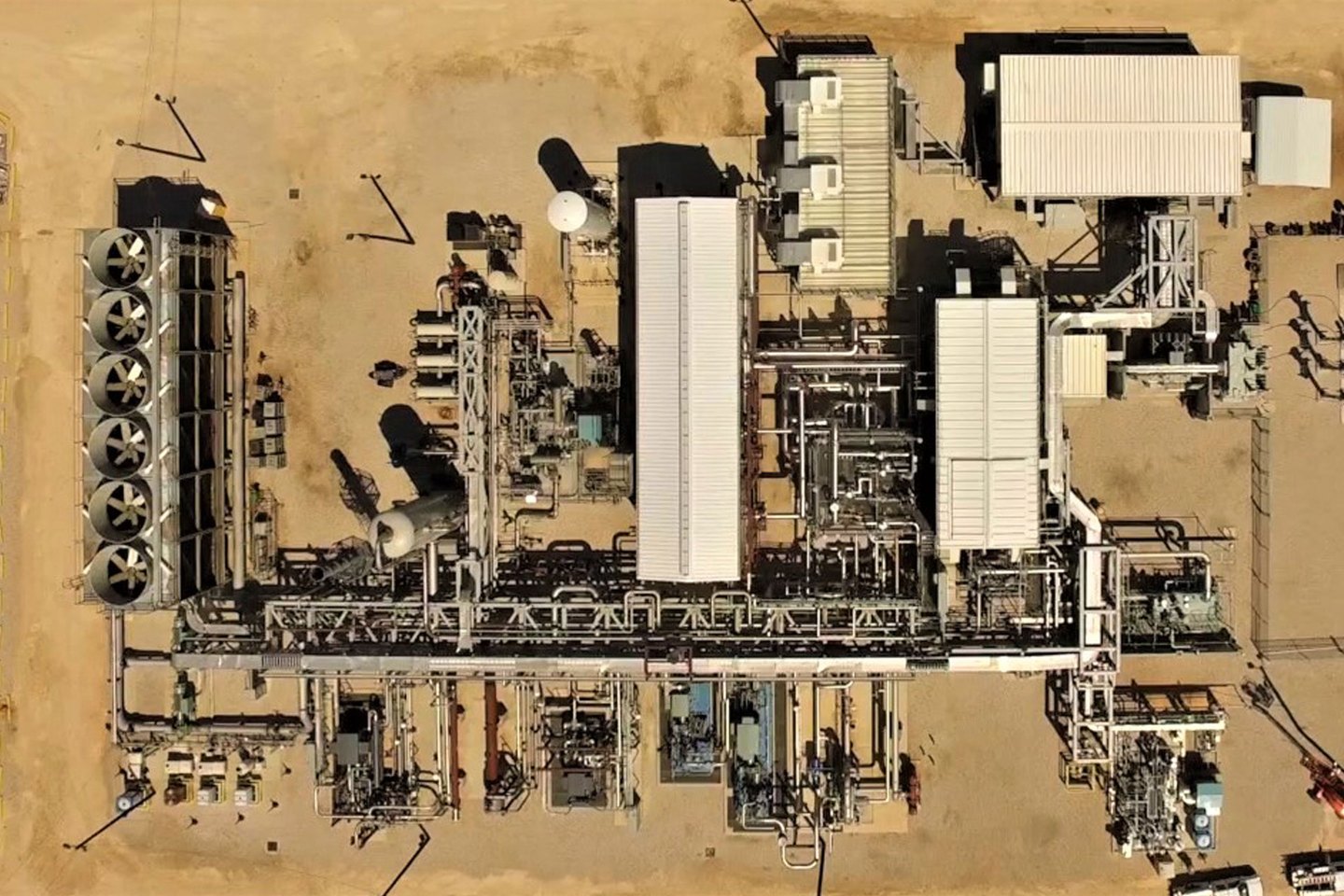

Occidental, known as Oxy, says it will build a commercial-scale Net Power plant by 2023 in the Permian Basin, a vast stretch of western Texas and eastern New Mexico in which Oxy long has shot CO₂ into aging oilfields to loosen oil in the rock and coax more of it up to the surface. The project will be located on an Oxy oilfield not far from Odessa, Texas, says Bill Brown, chief executive of Net Power, which refers to the initiative internally as “Project Odessa.” Odessa is the quintessential Permian oil town immortalized in the book, film, and TV series “Friday Night Lights.”

If the Net Power machinery could be rolled out affordably and at scale—still a big “if”—it could boost demand for natural gas, a glut of which is flooding the Permian and the U.S.

At the Texas oilfield, Oxy intends the Net Power contraption to power a machine to capture CO₂ from the air, a technology developed by Carbon Engineering, a Canadian firm in which Oxy also has invested. Together, Oxy says, the two machines, which Oxy intends to perch atop a number of its Permian oilfields, would sequester enough CO₂ to render the oil Oxy pulls up there “carbon-neutral.” Additional electricity from the Net Power device would, Brown says, be sold into the power grid.

The endgame for Oxy is to boost the profitability of its oil output. Electricity and CO₂ are its two biggest costs in the Permian, and so, to fatten margins, it needs cheaper supplies of both. Vicki Hollub, Oxy’s CEO, tells me she anticipates the Net Power machinery will slash Oxy’s power costs by at least 25% over the next several years. And she predicts Oxy’s CO₂ costs will fall by perhaps 30% as Oxy shifts to getting its CO2 from increasingly cheap man-made sources rather than, as it now does, buying CO₂ that’s been drilled up from natural underground formations in the American West.

On the drawing board in Louisiana

Another Net Power project is on the drawing board near Louisiana’s Gulf of Mexico coast. Two entities led by Charles “Chas” Roemer IV, whose father is former Louisiana governor Charles “Buddy” Roemer III, are working with Net Power and with Siemens, the German industrial-equipment giant, to cobble together the money and the government approvals necessary to build a massive liquefied-natural-gas facility that they say would be essentially carbon-neutral.

LNG plants use massive amounts of energy in compressing natural gas into liquid form for shipment around the world. Typically, the energy burned to produce that compression emits prodigious quantities of CO₂ and other pollutants. Using Net Power equipment to generate that electricity, say those assembling the Louisiana deal, would allow them to avoid emitting those pollutants and to capture essentially all the project’s CO₂—and then send the CO₂ underground.

The advancement of the project, which would be located on the Calcasieu Ship Channel south of Lake Charles, La., is far from certain. The backers still need federal approval, including on the environmental front, and they have in hand only a tiny slice of the $8.75 billion that the project is expected to cost, says Kyle Simpson, chief strategy officer of G2 Net Zero LNG, the project developer. Chas Roemer chairs G2 and heads the investment group that, Simpson says, has put an initial $32 million into the project.

The idea is that the project ultimately would crank out about 13 million metric tons of liquefied natural gas annually, with production starting in 2026. It would capture basically all the 3.9 million metric tons of CO₂ the process produced. The initial plan is to send that CO₂ through a pipeline and ultimately to an oilfield where it would be injected underground – a process that would qualify the project for what Simpson estimates would be $172 million per year, for 12 years, in federal carbon-capture tax credits.

As soon as 2024, Simpson says, G2 hopes to have one of the project’s four planned Net Power machines operating, which would provide early revenue from the sale of electricity, from tax credits, and from the sale of nitrogen and argon, substances contained in air that the project would separate from the oxygen used to feed the Net Power machines.

Siemens would build motors and compressors to liquify the natural gas, among other potential roles in the project, says Matthew Russell, Siemens’ executive vice president for LNG. The project is strategically intriguing to Siemens, which has to find a future in a warming world for a business that makes equipment for the fossil-fuel industry. “We’ve got a really, really difficult challenge ahead of us, in terms of continuing to support what is the existing fossil business” amid intensifying societal constraints on CO₂ emissions, Russell says. “There are going to be tremendous pressures for those fossil projects to be as green as possible, knowing that there is a transition period between conventional and renewables that is going to be many decades long.”

Net Power, for its part, is talking with additional companies about deploying its fossil-fuel-burning power plant, says Brown, its CEO. He knows he’s straddling a fine line. On the one hand, he says, his technology offers the potential to upend “the keep-it-in-the-ground challenge,” the argument that the only way to avoid disastrous climate change is to stop burning fossil fuels. On the other hand, it would upend that argument only if the CO₂ his machine emitted really were captured and kept out of the atmosphere. That’s why, Brown tells me, Net Power won’t sell its kit to any company that doesn’t agree to capture the CO₂. “Basically,” he says, “we’re not going to sell opioids to addicts.”

More from Fortune’s Special Report on the Climate Crisis

—Business is finally starting to reckon with climate change

—Wall Street’s pressure on the fossil fuel industry is not aggressive enough

—Plastic that travels 8,000 miles: The global crisis in recycling

—5 charts projecting the cost of climate change by 2100

—Big Oil’s Hail Mary

Subscribe to The Loop, a weekly look at the revolutions in energy, tech, and sustainability.