This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Monday, everyone. A historic plunge in oil prices along with coronavirus contagion fallout are taking just about everything down. Let’s dig into the numbers.

But first we have a language advisory—today’s newsletter will contain that other B-word. You may want to refrain from reading this one aloud.

Markets update

Asia, Europe and the U.S. future are a blur of red with the S&P futures, as I write, down close to 5%. Within the first 10 minutes of European trading today, the benchmark Stoxx Europe 600 had entered—hold your ears—bear territory. We haven’t seen drops like these since the fall of Lehman Brothers in September 2008.

The picture is even worse in the oil markets where Brent futures tanked at the open by more than 30%. THIRTY. Royal Dutch Shell opened down over 20%, before recovering some, underscoring the carnage in energy stocks.

These falls appear to be no blip. Goldman Sachs slashed its Q2-Q3 crude price outlook to $30 a barrel and warned that price shocks could take it closer to $20. CitiGroup analysts, hours later, reached a similar conclusion. The latest culprit is the Saudi-Russia price war. A breakdown in talks over the weekend between OPEC-plus producers could trigger market and political turmoil from Riyadh to Moscow to U.S. shale country.

Elsewhere, the euro and the yen are surging against the dollar, and just about all commodities are collapsing.

Yes, it’s a risk-off day. Investors are barging into safe-havens. Gold climbed above $1,700 an ounce and the entire U.S. Treasury yield curve sunk below 1%. Don’t look now but yields are getting scarily close to zero.

I had planned to talk more about coronavirus today, living as I do in a country where one-quarter of the population is in lockdown, but then I woke up to the crude sell-off. So, let’s head there right now.

Crude collapse

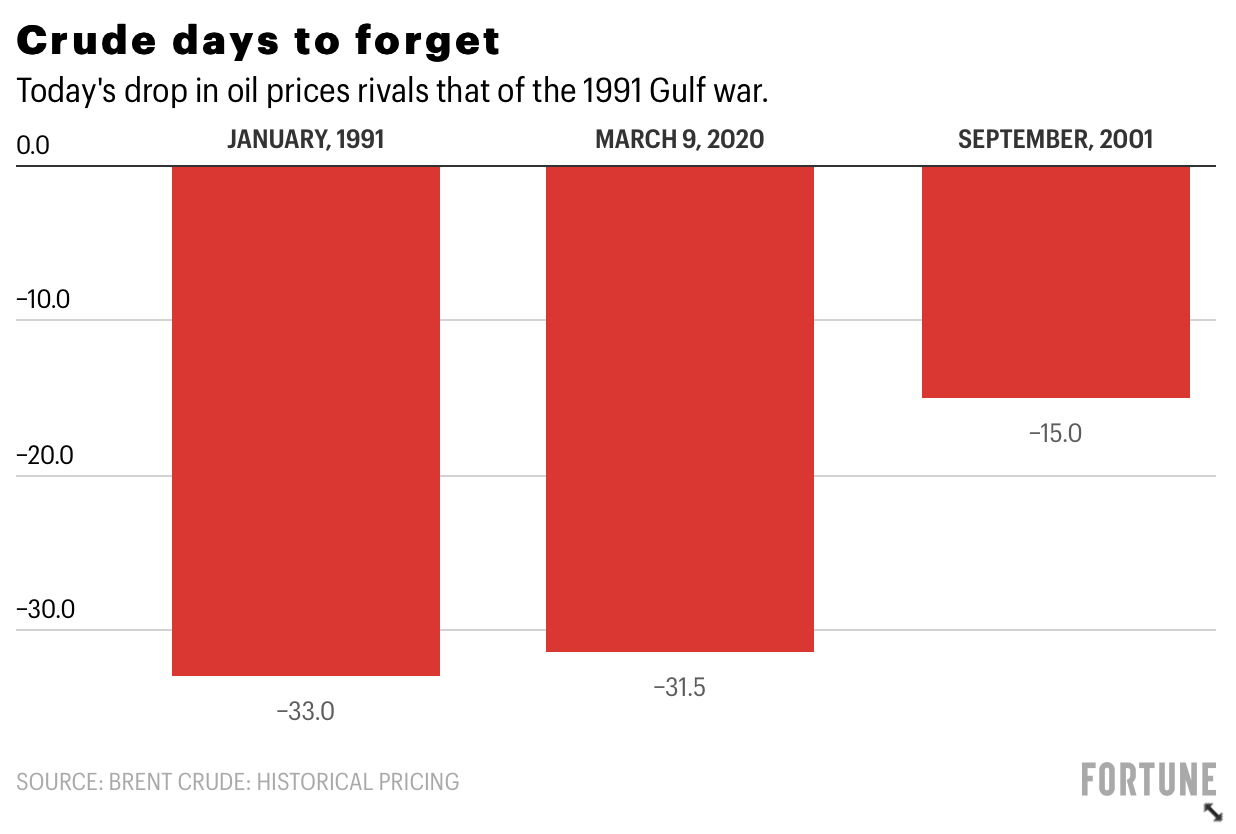

You have to travel back in time 29 years, to January 1991, to find a worse day for the oil markets.

The start of the Gulf War that day sunk the price of oil by roughly one-third. Today was nearly as bad—worse, it should be noted, than in the days following the Sept. 11 attacks.

***

As the chart above shows, Brent crude dropped 31.5% at the Asian open today. As I write, it’s clawed back some of those losses, but it’s still down more than 20%, and down 45% year-to-date.

Unless you have some crazy hedge position on oil, a precipitous drop like that is bad news.

Coronavirus is a global health crisis that’s roiling every corner of the global markets. And so while the Goldman and Citi oil forecasts look dramatic, there’s a very likely chance those analysts will need to come back soon to revisit the numbers. Traders will be holding their breath.

That’s it from me, everybody. Before I go, I want to give a big shout-out to my colleague Rey Mashayekhi who took the wheel last week in my absence. Chapeau!

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

Today's reads

Throttled. Employees working from home to curb the spread of coronavirus could find they are swapping the traffic jams of their daily commute for congestion on the Internet. With 42 million Americans able to work from home, there’s a risk of overload on the home broadband network. “People will hit congestion, just like a highway, where the speed goes from 60 miles an hour to 20,” says Lisa Pierce, a network expert with Gartner.

On a roll. Gold briefly surged above $1,700 an ounce for the first time since 2012 as investors scrambled for a safe haven amid turmoil in the oil and equities markets, the spreading coronavirus and expectations of easier monetary policy. Goldman Sachs has predicted prices could top $1,800 while UBS Group’s wealth management unit has said gold could rally toward that level within weeks.

German aid. Germany, known for its resistance to loosening the purse strings to boost growth, plans to spend more than the United States—so far—to help the economy weather the coronavirus outbreak. German Chancellor Angela Merkel’s government will invest an additional $14 billion between 2021 and 2024, Bloomberg reports. The U.S. House of Representatives last week passed an $8.3 billion bill to counter the spread of the virus but there has so far been no major U.S. package to help business.

Market candy

Quote of the day. “We are headed to closer to $3 a barrel than $30.”

That’s Bob McNally, president of market research firm Rapidan Energy Group, talking to Bloomberg TV about the outlook for oil prices after Saudi Arabia and Russia failed to agree on a new production-limiting agreement, sending prices into freefall.