This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. The markets are clearly rattled after five straight days of declines. Today looks little better.

The latest brutal stretch puts all the major indices in Asia, Europe and the United States in negative territory for the year.

Here’s what’s moving markets today.

Markets update

Asia and Europe both opened solidly lower today, following on yesterday’s bruising sell-off in the United States. Here’s a bleak stat for you: in the past seven days the S&P 500 is down 7.6%. The Nasdaq looks worse. It’s off 8.7% in that period.

What’s more worrying to some is the scene in the bond markets. Yesterday, the 10-year Treasury plumbed a record low as investors have poured in to a safe haven that’s delivering a pitiful return of 1.34% (it was $1.31% yesterday). Analysts are now saying the benchmark could be headed to a very European-like 1% or below, a sign of extreme investor pessimism. That’s a measure to watch.

Elsewhere, the dollar is up slightly. Crude is down. And, hey, what’s this? The U.S. futures were positive when I began the morning, but are now down, and falling.

Yesterday’s equities momentum was dashed by a coronavirus warning from the Centers for Disease Control, which spelled out for the first time the Covid-19 outbreak risk to Americans. All major U.S. indices sunk on the news.

Medical professionals were not mincing their words.

“We are asking the American public to work with us to prepare, in the expectation that this could be bad,” Dr. Dr. Nancy Messonnier, director of the National Center for Immunization and Respiratory Diseases, said at a news conference yesterday.

Let’s look back and see just how bad it’s been in recent days.

A week to forget

***

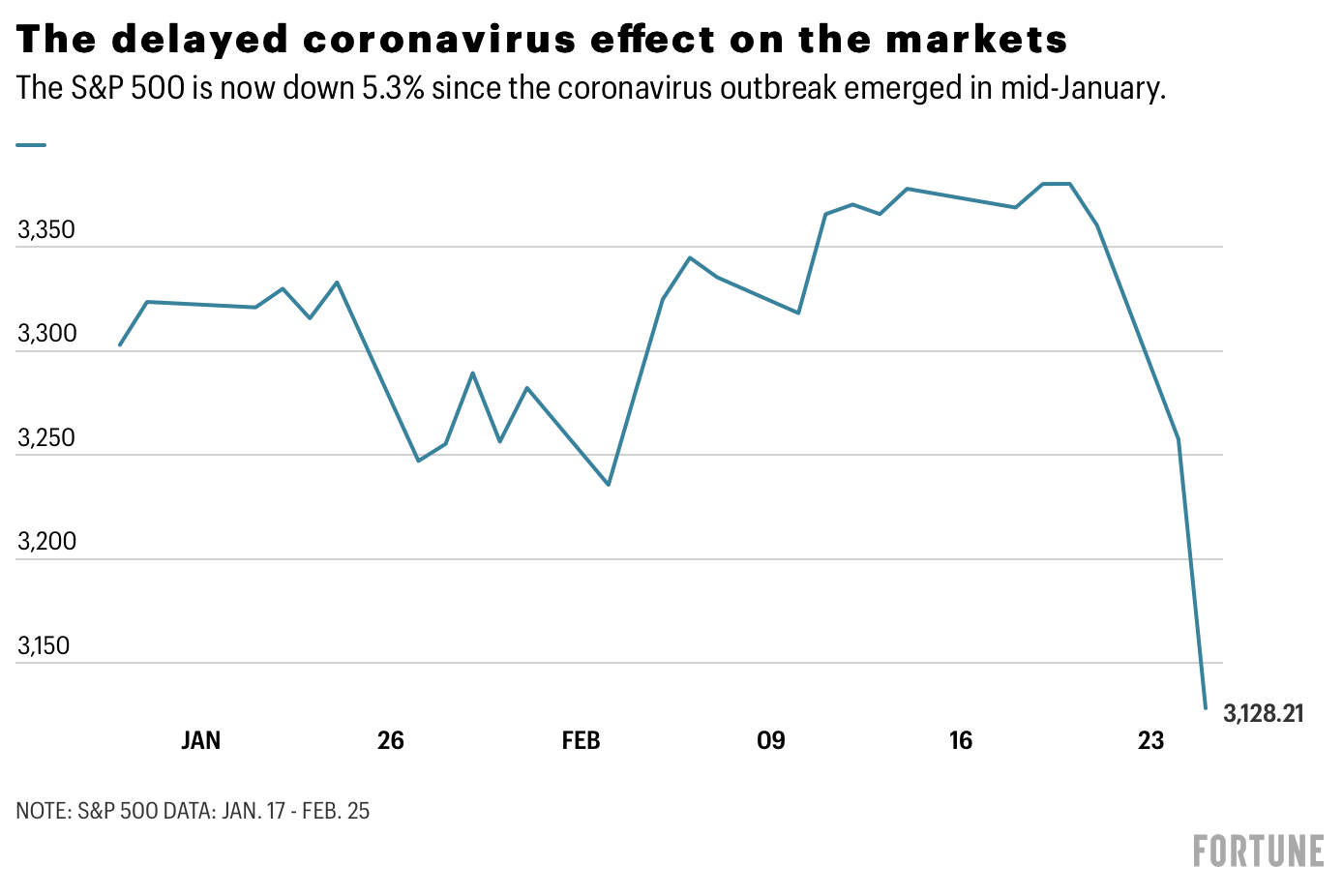

If you like rollercoasters, you’ll appreciate today’s chart. That’s the S&P 500 performance over the past six weeks, which is how long the markets have been dealing with the coronavirus outbreak.

Even after a few modest dips in January and early February, the S&P 500 was in the green as of this time last week. But the spread of the contagion to Europe in recent days, combined with a spate of profit and sales warnings by a slew of Fortune 500 giants, has sunk investor confidence. And now we’re surfing a stomach-churning fall.

The benchmark S&P 500 is down more than 5% since the coronavirus outbreak emerged in mid-January. Tucked in there is the index’s worst two-day decline (Monday and Tuesday of this week) since 2015.

Ouch.

We’ll see you here tomorrow. Have a nice day.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Today's reads

Overpaid CEOs. Business software maker Oracle tops a new list of America’s most overpaid chief executives, with co-CEOs Safra Catz and Mark Hurd (who died in October 2019) bringing home a cool $216 million between them last year. Non-profit As You Sow works out how overpaid CEOs are compared with shareholder returns, measured against the gap with average company employee pay. That resulted in a CEO-to-worker pay ratio at Oracle of 1,205 to 1, Fortune’s Chris Morris reports.

Speaking of the boss. In a surprise move, Walt Disney Co’s long-serving CEO Bob Iger is stepping down immediately, replaced by Disney theme parks chief Bob Chapek. Iger will stay on as executive chairman through the end of 2021. “With the successful launch of Disney’s direct-to-consumer businesses and the integration of Twenty-First Century Fox well under way, I believe this is the optimal time to transition to a new CEO,” Iger said in an announcement.

Olympics outage. What if the unthinkable happened, and the coronavirus outbreak forced the cancellation of the summer Olympics in Tokyo, now just five months away? At least the International Olympic Committee would have something to cushion the blow: a $897 million reserve fund to help finance global sports. Cancellation of the jewel in the sporting calendar is an improbable scenario, but one drawing more consideration as the coronavirus spreads around the world.

Market candy

4,137. As in 4,137%. If you'd been shrewd enough to invest in Sun Communities Inc in March, 2009, that would be the return you'd be seeing on your investment today. The mobile-home park owner has outperformed the S&P 500 by a staggering eight times since the 2009 stock-market bottom. That includes both share rise and dividend payments, The Wall Street Journal reports. By comparison, the S&P 500’s return has been a paltry 499%. Trailer parks have been one of the best-performing investments since last decade’s housing crash.