FORTUNE Analytics brings readers business insights from proprietary data and exclusive surveys. It will launch as a premium newsletter in the coming weeks. Sign up for the debut below:

The merger of T-Mobile and Sprint is proceeding. On Tuesday, a federal judge ruled against states trying to block the deal on the grounds of harm to competition. This was the final roadblock for the $26.5 billion agreement, first announced in 2018. It already has Federal Communications Commission approval.

Verizon Wireless, AT&T, and T-Mobile take in 79% of wireless revenue, according to Bloomberg. After this merger, these three companies would control over 90% of wireless revenue on the continent—and an even higher share in just the U.S.

“We’ve said it all along: the New T-Mobile will be a supercharged un-carrier that is great for consumers and great for competition. The broad and deep 5G network that only our combined companies will be able to bring to life is going to change wireless,” wrote T-Mobile’s CEO John Legere in a joint release with Sprint following the announcement.

The courts and companies have made their stances clear. But how do Americans feel about having fewer mobile carriers? What do Sprint and T-Mobile customers in particular think? To get a pulse on public opinion towards this merger and the current state of wireless, Fortune-SurveyMonkey polled nearly 2,500 Americans.*

Quick numbers you should know:

45%

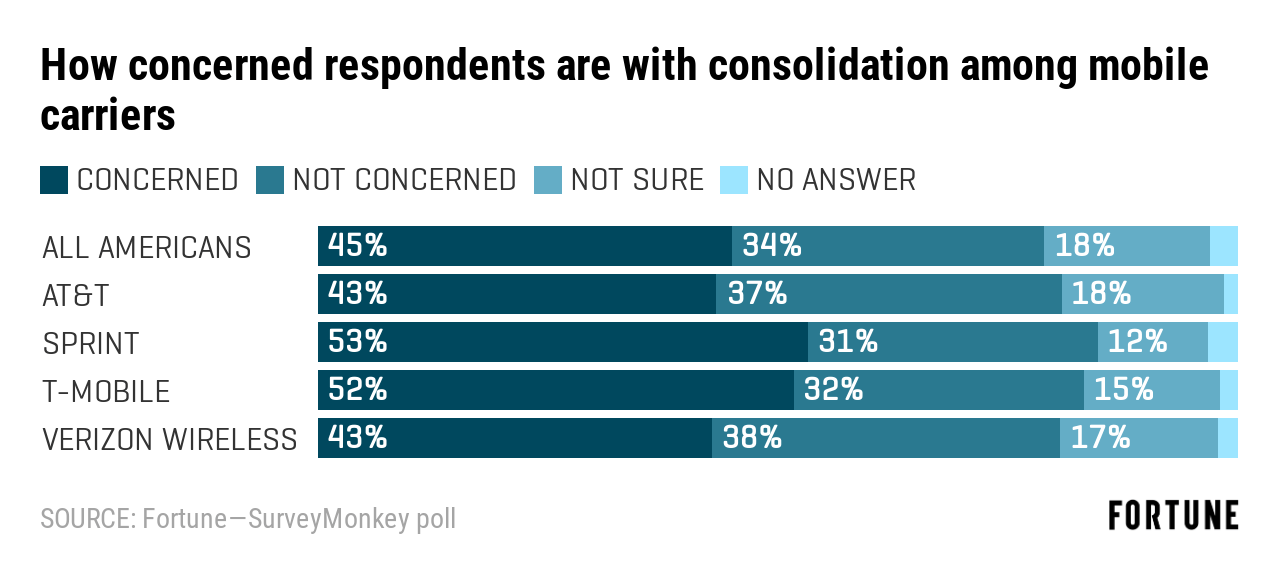

- … of Americans are concerned about consolidation among mobile carriers, while 34% say they are not concerned.

34%

- … of T-Mobile customers say the planned merger is mostly positive for them, compared to the 13% who say it’s mostly negative.

21%

- … of Sprint customers say the planned merger is mostly positive for them, while 19% think it’s mostly negative.

-8 points

- … is the net favorably rating of Sprint, the lowest among the four largest carriers, including AT&T (+13), T-Mobile (+13), and Verizon Wireless (+30).

Big picture takeaway:

Sprint and T-Mobile customers have very different beliefs on the benefits of the merger. Many more T-Mobile customers think it will positively than negatively impact them—the ratio is 3 to 1. Meanwhile, Sprint customers are pretty much split down the middle.

But many Americans are concerned with the prospect of having fewer cell phone carrier options. Americans concerned with consolidation among mobile carriers outnumber those not concerned by 11%.

Deeper takeaways:

Sprint is at the industry low for customer satisfaction

Sprint and T-Mobile have head in opposite directions for much of the past decade. In 2013, T-Mobile took in 9.4% of mobile carrier revenue while Sprint totaled 14.4% of the market. But they flipped by the end of 2018: T-Mobile sat at 16.9% of the market compared to Sprint’s 11.5%.

That difference in trajectory might be explained by national image and customer satisfaction. Sprint struggles the most with its national image, with only 22% of Americans viewing it favorably versus 30% viewing it unfavorably. Meanwhile, 33% of Americans view T-Mobile favorably versus 20% unfavorably. And Sprint users have the highest level of dissatisfaction while T-Mobile users have the lowest.

Sprint and T-Mobile users are the most concerned with this kind of merger

The consumers directly impacted by the Sprint and T-Mobile merger are also the most likely to say they’re concerned with increased mobile carrier concentration. But even among AT&T and Verizon Wireless customers, the share of those concerned outnumbers that of those unconcerned.

One more interesting number:

47%

- … of Americans say their mobile payment is higher than it should be. And 44% of Americans say they spend more on their mobile carrier plan than their car payment.

*Methodology: The Fortune-SurveyMonkey poll was conducted among a national sample of 2,455 adults in the U.S. between December 21 to 30. This survey’s modeled error estimate is plus or minus 3 percentage points. The findings have been weighted for age, race, sex, education, and geography.