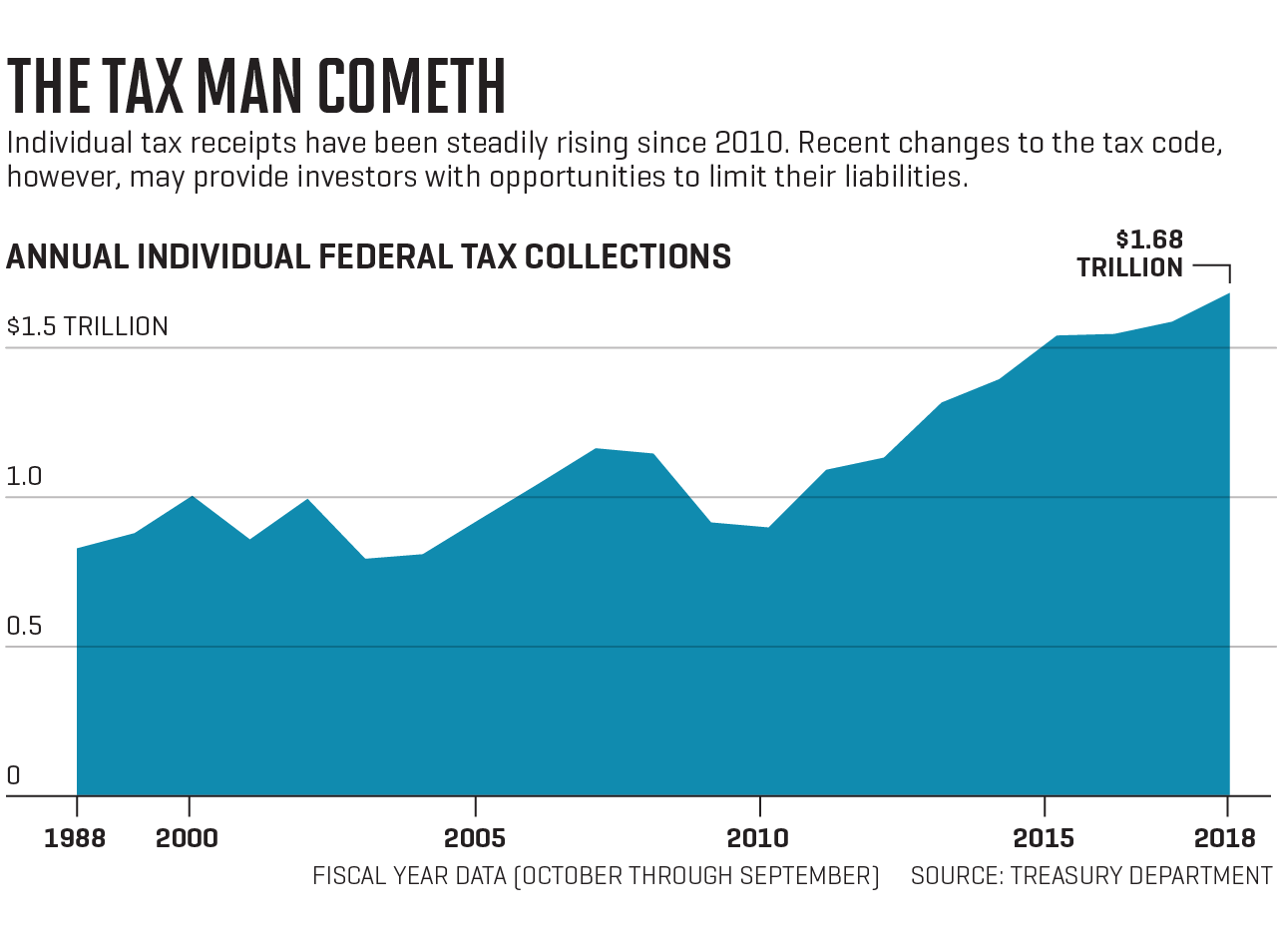

Tax Day has come and gone, along with appreciable amounts of your money. Given the huge changes enacted under the Tax Cuts and Jobs Act of 2017, tax pros were still trying to figure out what worked (and what didn’t) right up to the filing deadline. To decode the code, we talked to top tax experts to find strategies you can implement now—that just might pay big dividends next April.

Revisit REITs

Pass-through businesses like partnerships, LLPs, and sole proprietorships are the big tax-change winners. If they meet certain standards, they get to deduct 20% of their profits before calculating taxes. “It was intended for small businesses, but it also applies to REITs [real estate investment trusts] if they have the right structure,” says Cal Brown, a financial adviser with Savant Capital Management. With REITs looking at lower tax bills, that can mean more profit to divvy up among investors like you.

Go Local

Many have been hampered by the 2017 tax changes’ $10,000 limitations on state and local tax (SALT) deductions. One way to save on state taxes? Move some of your portfolio to Treasuries and municipal bonds issued in your state, which would be tax exempt at the state level, says Eric Bronnenkant, head of tax at online financial adviser Betterment. The savings may outweigh the additional interest you’d earn on taxable higher-yield bonds.

Ask to Pay Commissions

In recent years, that advice would have sounded crazy, as clients gravitated toward fee-based advisers. However, with the deduction for adviser fees gone, paying commissions might make sense, says Paul Gevertzman, a partner at accounting firm Anchin Block & Anchin. Say that your investments earn $10, and you get charged $2 in fees. “If they pay you the whole amount, and you pay an advisory fee [separately], that fee is taxable,” Gevertzman says. But commissions charged as you trade, and deducted from the money you net, don’t get taxed.

Get Educated

One group that will benefit in a big way from the 2017 changes are parents and grandparents of school-age kids, thanks to an expansion of 529 plans. In these state plans, earnings aren’t taxable, and when you take money out to pay for such things as tuition, room, board, and textbooks, there’s no tax implication either. Though 529s were originally designed as higher-ed savings vehicles, “in the new tax law, tax-free withdrawals are now allowed for private school, from elementary through high school,” Brown says. But be aware, gift tax exclusions (now $15,000 a year) may apply.

A version of this article appears in the May 2019 issue of Fortune with the headline “Pain-Proof Your Portfolio—for Next Time.”